Let’s learn about Marketing Research, its types, processes, steps, and models.

Meaning of Marketing Research

Marketing research specifies the information, manages and implements the data collection process, analyzes the results, and communicates the findings and implications. To offset unpredictable consumer behavior, companies invest in marketing research.

Increased customer focus, resource productivity demands, and domestic and international competition have prompted an increased emphasis on marketing research.

Managers cannot always wait for information to arrive in bits and pieces from marketing departments. They often require formal studies of specific situations. This official study is called marketing research, whether performed internally or externally.

As stated earlier, marketing research is generally considered part of an MIS.

Marketing research is the systematic and scientifically unbiased data collection and analysis, preparing information relevant to a particular problem or opportunity.

It may also be defined as the systematic collection of information for decision-making. A firm gets and tests ideas through marketing research.

You should know that marketing research is not a part of the marketing mix but rather an aid to management in making decisions about the company’s marketing mix and the target market.

It is a process, not an institution; as such, it is a part of virtually all aspects of the research process, from data collection to information transmission.

Marketing research processes are almost always used to collect data for recurring and unique decision-making.

For data evaluation, research methods are commonly used to determine the error factors in collected data when certain sampling techniques ( e.g., purposive samples) are used.

Similarly, data transformation occurs mostly through statistical testing methods normally used in marketing research.

We first define and discuss what marketing research refers to.

Marketing Research Definition

Marketing research is the systematic and objective identification, collection, analysis, and dissemination of information about issues relating to marketing products and services for the sole purpose of assisting management in decision-making related to the identification and solution of problems and opportunities in marketing.

Marketing research aims to identify and assess how changing elements of the marketing mix impact customer behavior.

The term is commonly interchanged with market research; however, expert practitioners sometimes draw a distinction.

Market research is concerned specifically with markets, while marketing research is concerned with marketing processes.

Marketing research is partitioned into two sets of categorical pairs:

- Consumer marketing research

- Business-to-business (B2B) marketing research

Consumer Marketing Research

Consumer marketing research is a form of applied sociology that concentrates on understanding consumers’ preferences, attitudes, and behaviors in a market-based economy. It aims to understand the effects and relative success of marketing campaigns.

Arthur Nielsen pioneered consumer marketing research as a statistical science by founding the AC Nielsen Company in 1923.

Marketing managers make numerous strategic and tactical decisions in identifying and satisfying customer needs.

They make decisions about potential opportunities, target market selection, market segmentation, planning and implementing marketing programs, marketing performance, and control.

Traditionally, marketing researchers provided relevant information, and the managers made marketing decisions.

However, the roles are changing, marketing researchers are becoming more involved in decision-making, and marketing managers are becoming more involved with research.

DECIDE Model in Marketing Research

The role of marketing research in managerial decision-making is explained further using the framework of what is known as the DECIDE model. The structure of the model is as follows:

- D: Define the marketing problem;

- E: Enumerate the decision factors;

- C: Collect relevant information;

- I: Identify the best alternative;

- D: Develop (and implement) a marketing plan;

- E: Evaluate the decision and the decision-making process.

The DECIDE model conceptualizes managerial decision-making as a set of six steps. The decision process begins by defining the problem, opportunity, objectives, and constraints.

Next, the possible decision factors that make up the alternative courses of action (controllable factors) and uncertainties (uncontrollable factors) are enumerated.

Then, relevant information on the alternatives and possible outcomes is collected. The next step is to select the best option based on chosen criteria or measures of success.

Then a detailed plan to implement the alternative selected is developed and put into effect. Lastly, the outcome of the decision and the decision process itself is evaluated.

A specialized form of marketing research is the so-called advertising research. The sole purpose of conducting this research is to improve the efficacy of advertising.

It may focus on a specific ad or campaign or be directed at a more general understanding of how advertising works or how consumers use the information in advertising.

It can entail various research approaches, including psychological, sociological, economic, and other perspectives.

Another component of marketing research is product research

Product research looks at what products can be produced with available technology and what new product innovations near-future technology can develop.

Business-to-business (B2B) Marketing Research

There are several ways in which a company can obtain marketing research. The company may have a marketing research department.

The person in charge of this department plays a multidimensional role, such as a study director, administrator, company consultant, and advocate who usually reports to the company’s marketing head.

If the company cannot afford to maintain a separate marketing research department or the services of marketing research firms, it has other affordable options.

They are as follows:

- It can engage students and professors to design and carry out marketing research projects in their favor. This is the most cost-effective way of marketing research activities, and even small companies may afford it.

- The other option is to use online information services where business information may be collected at a meager cost. There are many online services available nowadays on the internet. Browsing the internet may help a company get much-needed information quickly and economically.

- Checking out competitors is another option that small companies may exploit nicely. A regular visit to competitors’ business premises may help the company get many important tips that may be utilized later.

- Taking help from Syndicated Service Research firms is another good option. This type of firm gathers different information on trade and consumers and offers them for sale to interested companies. Information may be gathered at a relatively low cost from syndicated research firms.

- Custom marketing research firms may be hired for some specific projects. This type of firm, if given responsibility, designs the study, conducts it, and reports to the clients on findings. But, it is interesting to note that the study results become the property of the appointing firm.

- Specialty-line marketing research firms may also be hired to get some specialized research services. One of the example of such firms is a field interviewing service firm. This type of firm only provides field interviewers.

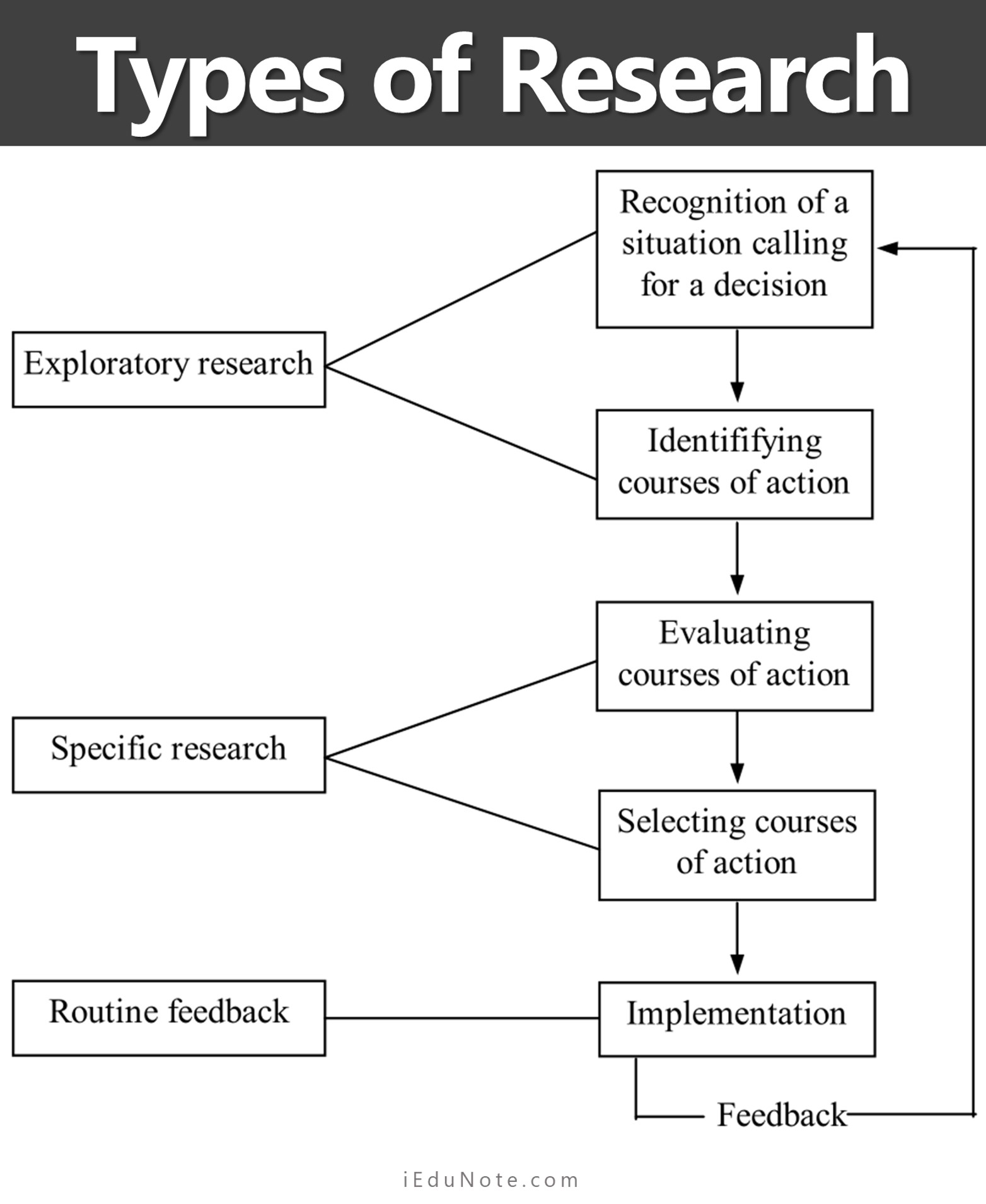

Types of Marketing Research

All marketing research activities are not the same and are different in many respects. They may differ in objectives, research design, covered area, depth, data analysis method, presentation, etc.

Research activities may be classified as exploratory, aimed at a specific problem, or used to provide routine feedback. Now let us look at each of them in the following section.

Exploratory Research

Exploratory research is conducted when the problem is generally known, but its nature and causes are not or partially known.

For example, if a company experiences no change in sales even after aggressive promotion, it may conduct exploratory research in this situation.

Because the problem is known here, but its nature and causes are unidentified. What is the problem here?

The problem is sales have not increased despite aggressive sales promotion activities.

Specific Research

This is another type of research. When a problem has been defined, a different type of information input is needed to enable management to make decisions concerning alternative ways of solving the problem.

Specific questions that might be posed include:

- What changes should be made in the marketing mix?

- Is the product positioned properly?

Questions such as these lead to specific research. Specific research generally involves larger samples and is more costly than exploratory research.

While exploratory research aims to suggest hypotheses, specific research enables management to accept or reject hypotheses with a predetermined confidence level.

Routine Feedback

It attempts to continuously monitor certain development variables such as sales, market share, or consumer sentiment.

Firms with well-operating marketing information systems would receive such information through the marketing intelligence subsystem. Firms without such sophisticated means of conducting routine feedback research have two options.

The first is to utilize the marketing research department to gather and assess routine feedback. Companies without the necessary internal resources may avail themselves of commercial services offered by the different outside research organizations.

What is the primary purpose of marketing research?

Marketing research is the systematic and objective identification, collection, analysis, and dissemination of information about issues relating to marketing products and services to assist management in decision-making related to problems and opportunities in marketing.

How is marketing research different from market research?

Market research is specifically concerned with markets, while marketing research is concerned with marketing processes.

What are the two main categories of marketing research?

The two main categories of marketing research are Consumer marketing research and Business-to-business (B2B) marketing research.

What is the difference between secondary and primary data in research?

Secondary data are data that have already been collected for some other purpose, while primary data are collected by the researcher from the source specifically for the particular purpose of the study.

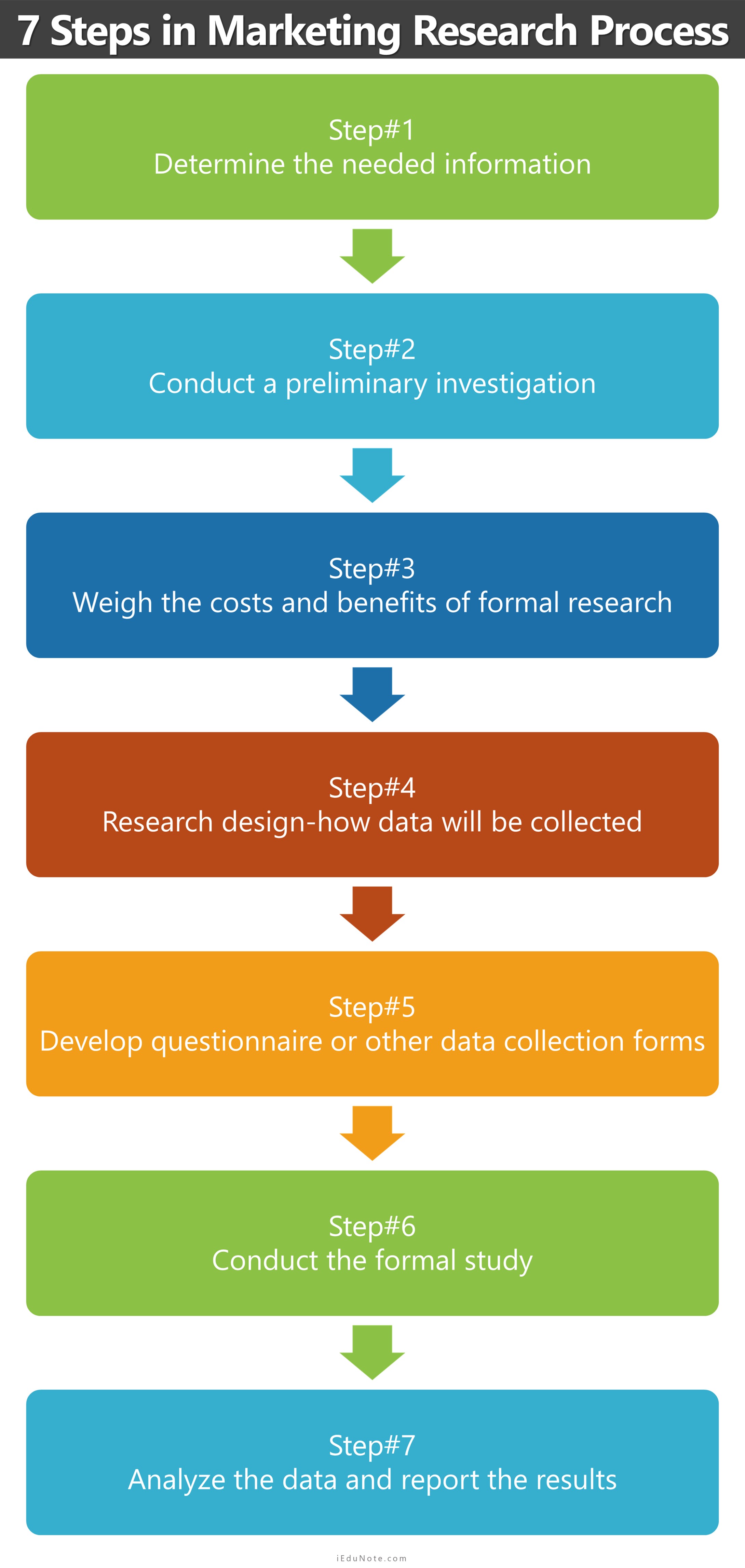

7 Steps of Marketing Research Process

Most marketing managers delegate the detailed design and implementation of research projects to specialists either within or outside their organizations.

The principal reason for such delegation is that most marketing managers do not have the time or the expertise to engage in market research activities. They must, to a greater or lesser extent, depend on the efforts of others.

Therefore, it is most important that managers know enough about the research process, design, and methods of implementing research to be effective in commissioning research and appraising the quality and cost-effectiveness of its results.

Because marketing research is an element vital in an MIS, it must be conducted systematically and unbiasedly. The information it generates is too important to be haphazardly collected, analyzed, and disseminated.

The methodology can be elaborate and comprehensive, depending on the significance of the problem or opportunity needing study.

Underlying any research study, then, is the need to obtain the best information possible, given environmental and company limitations (e.g., time and money).

But the more scientifically based, the more expensive and time-consuming the marketing research process will be.

Although there is always a risk of collecting and processing useless data, the seven-step research process described below and in the following exhibit will minimize these risks:

- Determine the needed information.

- Conduct a preliminary investigation.

- Weigh the costs and benefits of formal research.

- The research design-how data will be collected.

- Develop the questionnaire or other data collection forms.

- Conduct a formal study.

- Analyze the data and report the results.

| Steps | Details |

|---|---|

| Step#1 | Determine the needed information. |

| Step#2 | Conduct a preliminary investigation. Secondary data sources: Internal company records, Government documents, Marketing research firms, trade and professional associations, Advertising agencies and media firms, University research centers, Published sources Primary data sources: Interviews with people inside the firm, Interviews with people outside the firm, |

| Step#3 | Weigh the costs and benefits of formal research. |

| Step#4 | The research design-how data will be collected: Survey method, Observation method, Experimental method, Sample size determination. Sample selection: Probability samples, Non-probability samples. |

| Step#5 | Develop the questionnaire or other data collection forms. Question design: Open-ended, Multiple choice, Dichotomous choice, Question sequencing Questionnaire design |

| Step#6 | Conduct the formal study |

| Step#7 | Analyze the data and report the results |

Step-1: Determining the Needed Information/Problem Definition

The best research on the wrong study is as useless as conducting the worst research on the right study. If we fail to do a thorough job at this stage, no sophisticated research will save us.

Often, the rush for answers leads to research based on vaguely defined objectives and unspecified information needs. When this happens, decision-makers typically receive only part of the information they actually must have. The research tends to take longer and costs more to collect than is necessary.

The process begins with clearly defined objectives.

- What is the research supposed to accomplish?

- Why is a study going to be made?

Although research studies are conducted for various reasons, the most common ones determine if a problem or opportunity exists or obtain information pertinent to a problem or opportunity.

Whatever the reason, there must be a purpose involved – research is too costly to conduct for idle curiosity. When objectives are clearly defined, specific informational needs can be determined.

Step-2: Conduct a Preliminary Investigation

A preliminary investigation is necessary before any formal data collection is actually undertaken. This investigation tends to be informal, relatively inexpensive, and beneficial for three reasons.

First, the activities in step two define the objectives of the study and the informational needs.

Second, a preliminary investigation sometimes provides the decision-maker with enough information, making further study necessary.

Third, preliminary investigations help familiarize the researchers with the issues involved.

Researchers often are not experts in the fields they study, and they need to develop a feel for the problems or opportunities if they are to prepare and conduct a useful study.

Whatever the reasons, researchers frequently make preliminary investigations, using various sources to obtain the data they need.

The most likely sources used in this particular collection process are secondary data sources, interviews with people inside the firm, and observations of, or interviews with, people outside the firm.

Sources of data

Public institutions and private agencies collect a tremendous amount of data that can frequently prove useful to a researcher. Data that have already been collected for some other purpose are known as secondary data.

That which is collected by the researcher from the source for the particular purpose of the study is called primary data. Quite obviously, secondary data are usually easier, quicker, and cheaper to obtain than primary data.

Unfortunately, secondary data are not always readily available and desirable. Data may be free or for sale, handily indexed and in a useable form, or buried within volumes of other extraneous data.

The accuracy of secondary data frequently cannot be assessed. Information on how they were collected might not be available, so the researcher will never really know if they were obtained systematically and unbiasedly.

Despite these problems, secondary data are still generally preferred because of time, trouble, and cost savings. Among the more important and useful sources of secondary data are:

Internal Company Records

The company’s own records are one of the best sources. Data on sales volume, market shares, competitive tactics, etc., are nearly always maintained.

Government Documents

Certainly, the largest single source of secondary data is the government.

Marketing Research Firms

Several private businesses collect and analyze market data and sell them to other firms. Also, several firms known for their public opinion surveys can provide specialized types of market data.

Trade and Professional Associations

Local and national associations frequently collect and publish data about their particular trades and professions. Since these associations so closely match their industries, they are usually good sources of information.

Advertising Agencies and Media Firms

Advertising agencies, television stations, and large newspapers and radio stations often collect data on the market areas they serve. Researchers may take help from such data in the course of their research.

University Research Centers

Many of the larger universities have developed research bureaus providing published data useful to marketing researchers.

Published Sources

Various business and trade publications are accessible, inexpensive, and usually very timely.

The primary data can be obtained mainly from two sources. Now we shall mention these two sources/ways of collecting primary data:

Interviews with People Inside the Firm

Marketing researchers frequently turn to knowledgeable people within the firm during a preliminary investigation. Salespeople and sales managers, brand managers, senior marketing executives, and other top marketing and nonmarketing personnel have considerable experience and vast amounts of expertise.

Interviews with People Outside the Firm

Researchers prefer not to go outside the firm to conduct interviews unless they find it necessary. This process is more time-consuming and expensive, but these interviews can alert customers and competitors to problems and opportunities within the firm.

Despite these drawbacks, present and potential customers, suppliers, and even competitors undoubtedly can provide valuable data for the preliminary investigation. The most frequently used methods to collect these data are informal interviews and observation.

Informal interviews are more popular because they are simpler. They are used like interviews conducted with people inside the firm to obtain various people’s attitudes and opinions. The other method, observation, will be discussed later in this lesson.

Step-3: Weigh the Costs and Benefits of Formal Research

Very few issues are destined to be the subject of formal data collection. The researcher must determine whether further research is necessary or justified.

Step two may yield enough information for the executive to make the decisions without more formal research.

When enough information is not available, the researcher must determine whether the added study’s benefits would justify the costs.

A formal study’s costs must be determined, including data collection, data analysis, data interpretation, and report preparation and presentation. If the researcher believes that decision-makers could use additional information, the value of better information must be estimated.

Admittedly, the process of weighing the costs and benefits is somewhat subjective. It depends heavily on the estimates of the executive and researcher.

Step-4: Develop the Research Design

Once it has been decided that a formal research study is needed, detailed plans can be developed.

Among the most important questions are the following;

- How will the data be collected?

- How will respondents be selected? How many respondents will data be collected from?

Answers to these questions form the research design – the formal plans for the conduct of the study.

How will data be collected?

The initial decision in the development of a research design is the choice of a data collection method. Researchers usually use the survey, observational, or experimental method. Each approach has unique strengths and weaknesses.

Survey Method

Here researcher gathers data from only a portion of all the people it would be appropriate to collect data from. Those included in the survey are known as the sample, and the entire group is called the population.

Three specific techniques are used to collect data – personal, telephone, and mail interviews. Personal interviews involve a direct interface between the researcher and the interviewee or respondent.

Telephone interviews are another technique providing direct interaction between the researcher and the respondent, although telephone contact is only vocal.

Although rapport is harder to build over the telephone, it is still better than a mail survey. It also tends to be fairly inexpensive to administer since no travel is involved, and even long-distance calls are relatively cheap compared to personal interviews.

Finally, the telephone survey has the special advantage of speed, making it most appropriate when short.

Mail surveys are also popular in business research. Researchers send respondents printed questionnaires to complete and return within a specified period of time.

This technique is very efficient when respondents are dispersed geographically, as in a national survey.

Observation Method

This method allows the researcher to watch the actions (or listen to the words) of people or events to obtain the desired data. Normally, this is done within the people’s own environment without their knowledge.

Trained observers are needed here to ensure that the data is collected accurately and that people’s actions are properly interpreted. Additionally, the events they monitor have to occur with sufficient frequency to make this method feasible.

Finally, there are some ethical considerations for monitoring people without their knowledge or consent.

Experimental Method

Historically, this method has been used mostly in the natural sciences and not in business. With this method, the researcher tries to determine causes and effect relationships. By controlling some variables and varying others, the results can be measured and relationships identified.

Sample Size Determination

Deciding on sample size is one of the more important issues in the research design.

Although a census – interviewing all population members – is always preferable from an accurate viewpoint, it is usually not feasible. The costs involved and the difficulty in reaching everybody are just too great. Executives and researchers must trade accuracy for cost savings.

Most nonresearchers mistakenly believe that the sample size depends on the size of the sample population. Actually, the main determinant of sample size is how the sample population varies on the issues under study. The more they vary, the greater the sample size needed to obtain accurate data.

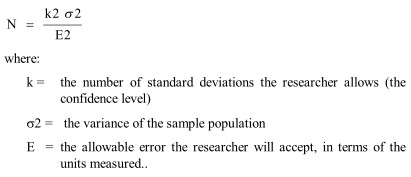

There are several formulas researchers use to determine sample size. One of the simplest is:

Sample Selection

Once the sample size has been determined, the researcher can plan for the sample selection.

This is an especially important element in the research design since the people selected might significantly impact the research results. The researcher’s objective is to make the sample just like the sample population in terms of its mean, median, and mode.

However, it is tough to obtain a sample that is a perfect miniature of the sample population.

The researcher has to select a sample that is as close as possible, given time and cost limitations. The researcher must decide between probability or nonprobability sampling plans as a method in selecting the sample.

Probability Samples

In a probability sampling plan, chance determines whether an individual member of the population is included or excluded from the sample.

The basic probability sampling plan is known as the simple random sample. Here, each sample population member has a known and equal chance of being included in the sample.

This plan is called simple, but it is not always so.

In fact, researchers frequently find it very difficult or expensive to obtain a full list of the population from where the sample is drawn. To reduce some of the problems associated with a simple random sample, an area cluster sample is often used, where a population is grouped into smaller units (clusters).

Then, some of those units are selected in a purely random manner. Finally, some of the members of the selected units are also chosen in a purely random fashion.

Although both the simple random and area cluster sampling plans are commonly used, neither can assure the researcher that the sample selected will represent the population.

To maximize the likelihood of obtaining a representative sample, a stratified sampling plan should be used.

In a stratified sampling plan, the population is grouped based on characteristics relevant to the study. Based on the size of each group, specified numbers will be randomly selected from each.

Nonprobability Samples

Although probability samples can be more exact because they eliminate interviewer bias in selecting respondents, they frequently are either too costly or impossible to use.

In those instances, researchers turn to nonprobability sampling plans, where they or others select the final sample instead of it being done on a random-chance basis.

The easiest nonprobability sampling plan for a researcher to use is a convenience sample. The researcher may choose people closest to each other or a group gathered in one place. No consideration is given to whether the sample group reflects the entire sample population.

To refine this method, a researcher will sometimes use a judgment sample, choosing respondents who are thought to match the population.

The most sophisticated nonprobability plan is the quota sample, similar to the stratified sample. The researcher identifies the population’s relevant characteristics and tries to select a roughly proportional sample.

If, for example, it is known that 51 percent of the population are men, the researcher would make sure that 51 percent of the sample selected are men.

Step-5: Develop the Questionnaire or Other Data Form

Although not all marketing research involves surveys, much of it does. Accordingly, the process of survey research will be described here. Developing a good data collection instrument or questionnaire is one of the more difficult tasks.

There are many different types of questionnaires. Initially, the researcher must decide whether to use one that is structured or unstructured.

If a personal or telephone interview is used, the most common is the structured questionnaire, where every question is worded and sequenced, and the interviewer does not depart from it at all. No other questions can be asked, nor different sequences be used.

An unstructured questionnaire contains a limited number of questions allowing the interviewer to vary the wording after the sequence or probe for more data based on the respondent’s answers.

The advantage is that the additional questions may obtain some valuable data.

Now we shall present some of the important issues in this regard;

Question Design

Each question must be carefully prepared, whether it is in a structured or unstructured questionnaire.

Most importantly, questions must be appropriately formed and worded for the specific data being sought. The researcher can use open-ended, dichotomous choice, or multiple-choice questions.

Open-ended questions allow the respondent to answer in their own words so that exact data can be collected. Dichotomous choice questions limit respondents to two choices – yes or no, agree or disagree, etc.

Multiple-choice questions force respondents to select one of several pre-established answers.

Question Sequencing

A questionnaire is not simply an assortment of questions that happened to be grouped. If they are improperly ordered, respondents may not answer any of the questions or not answer them accurately.

The questions are interrelated but must be sequenced logically to flow together, assisting the respondent in answering correctly and truthfully.

In general, questions should be ordered in the following manner :

- from easy to difficult

- from general to specific

- from insensitive to sensitive (or confidential)

- in groups by topical area

- with demographic questions toward the end

Questionnaire Design

A questionnaire consists of four parts: the introduction, the set of instructions to the interviewer and respondent, the set of questions, and the closing.

The introduction is especially important because it helps the interviewer gain rapport with the respondent. It also gives the respondent some general information on what the study is about and why it is being conducted.

Inexperienced researchers often ignore instructions. Interviewers and respondents need to know how the interview will proceed and how responses are recorded on the questionnaire.

The questions were discussed earlier, but a courteous closing is called for in deference to the respondent’s cooperation after the questions.

The physical layout is a final consideration in the questionnaire design. Proper use of white space, quality printing, and paper are all important.

Location and spaces for responses to the questions are also a concern and should be arranged to simplify transferring the data to punch cards or tape.

Step-6: Conduct the Formal Study

The formal study is a three-phase process.

- First, the questionnaire must be pre-tested to ensure that it is defect-free.

- Second, trained interviewers are needed to collect the data properly.

- Finally, the formal study can be conducted, but only after the first two phases have been completed.

Even the most experienced researcher pretests the questionnaire before using it in a formal study.

Omitting an important question, wording a question ambiguously, or making some other mistake is very easy. As a safeguard, the questionnaire is tested on a relatively small group of people.

When the questionnaire has been finalized, the interviewers – if they are using a personal or telephone survey – must be familiarized with the questionnaire and the overall study.

Interviewers need to know the type of people they will meet and the questionnaire they will use.

Finally, the beginning and end dates for the study must be established and adhered to.

Step-7: Analyze the Data and Report the Results

Once the data has been collected, the researcher can begin making an analysis. For relatively large studies, the data will be transferred from the questionnaires directly into a computer or recorded on punch cards or tape.

With small studies, it is common for the data to be tallied by hand, although this method is becoming less frequent.

The particular analysis conducted on the data depends on the study’s objectives.

The analysis will most often begin with a simple tabulation of the mean, median, mode, and frequencies. Although this is certainly the least sophisticated step, it frequently provides valuable information.

If a probability sampling plan has been used, further analysis through some of the higher-level statistical tests can be conducted, such as regression analysis, chi-square, correlation analysis, and analysis of variance.

Most of the quantitative analyses have been computerized to complete the actual computations quickly and easily.

Before the information obtained from the data analysis is sent to an executive, it is usually translated into a more useful form for decisionmaking purposes. The value of the entire project depends on how well the executive understands and uses the results.

Reports are usually prepared to describe the purpose, methodology, limitations, analysis, and study findings. Many executives demand the full report and an “Executive Summary” capsulizing the study in one or two pages.

Final Words

From time to time, marketers may be required to undertake marketing research to collect information on the market.

Source

Provided by iedunote: https://www.iedunote.com/