Asset liquidity depends on the case with which the asset can be converted into cash to meet funds needs. Let’s understand liquidity management.

What is Liquidity?

In the ordinary sense, generally, liquid assets mean cash in hands. Though assets and establishments can be purchased in cash, these assets are not easy to convert into cash. According to the convertibility into cash, assets can be divided into;

- Near cash assets;

- Convertible within short notice financial assets;

- Convertible within reasonable longer time non-financial movable & immovable property;

- Unconvertible into cash (preliminary expenses).

So, by the term liquidity, we mean the ability of the bank to maintain the necessary cash amount for fulfilling the promise and the ability to satisfy the clients’ withdrawal requests whenever they demand.

Definition of Liquidity

Liquidity means the bank has the right amount of immediately spendable funds (i.e., in every account) or can raise the necessary fund by borrowing or selling assets. Assets are liquid if quickly converted into immediately available funds with limited price depreciation.

According to Grady and Spencer, “The ability to convert an asset into cash with little risk of loss of principal value.”

The liquid assets include the cash in the tills and those assets which can be turned into gold (cash) almost immediately. Non-liquid assets are those not readily available to meet liabilities and are termed non-liquid.

The quality that renders an asset convertible into cash on short notice, by sale in the open market, or by rediscount, usually at a minimum loss.

The ability of a bank to meet its current obligations for cash outflow and respond to changes in customer demand for loans and cash withdrawals without selling assets is a substantial loss. Bank assets are liquid to the extent that they may be easily converted into cash without loss.

An individual bank’s liquidity is the ability to pay depositors on demand, disburse loan installments as committed and make other payments as and when due.

Why Liquidity is Important

One of the most important tasks the management of any bank or other financial service provider faces is ensuring adequate liquidity at all times, no matter what emergencies may suddenly appear. A bank is considered “liquid” if it has access to immediately spendable funds at reasonable costs when needed.

Funds may be needed now, tomorrow, next week, or next year to meet promises to depositors, borrowers, and other customers. When the promises for depositors as and when presented) come due, and the bank must make payments in cash or equivalent funds.

Indeed, a lack of adequate liquidity can be one of the first signs of real trouble. The cash shortage that banks in trouble often experience make clear that liquidity needs can not be met on time.

A bank may be closed if it can not raise sufficient liquidity even though, technically, it may still be solvent. The bank must always be ready to honor the clients’ withdrawal requests whenever they need it.

So, this is the client’s minimum expectation to be met by the bank. Any delay or inability to fulfill this expectation creates enough grounds for the clients to switch to other banks. This may create panic and loss of public confidence, which is a consequence of the bank failing or facing punitive measures by the regulatory authorities.

Liquid Assets of Bank

The following assets are considered liquid assets for a bank;

- Cash in the vault.

- Items in the process of collection.

- Balance lying in the central bank.

- Balance with the sister bank

Nature of Bank Liquidity

A bank can hold liquid assets in three manners as under:

- Cash assets equal to its required liquidity on demands and or

- Easily convertible near-cash assets into cash enable to meet the liquidity gap and or

- Creation of liabilities by selling open market instruments to meet the liquidity gap.

Alternatives Sources:

- The first alternative nature of liquidity indicates that banks need to hold enough cash based on experience and demand forecasting. The bank needs to hold a major portion of its funds in non-earning cash assets in this alternative.

- The second alternative nature refers mainly to holding selected blue chips that are actually not in cash but immediately encashable without any material loss. These are earning assets, but the yield rate is not that lucrative.

- The first two are based on assets, but the third one is a liability approach. Depending on the mature level of the money market, a bank can sell securities of various natures and maturities to raise funds for meeting liquidity needs. This approach is known as the liability approach. But this approach is popular in countries with developed money markets.

A bank can use one or more of these three alternative sources of liquidity depending on its situation and the available banking environment.

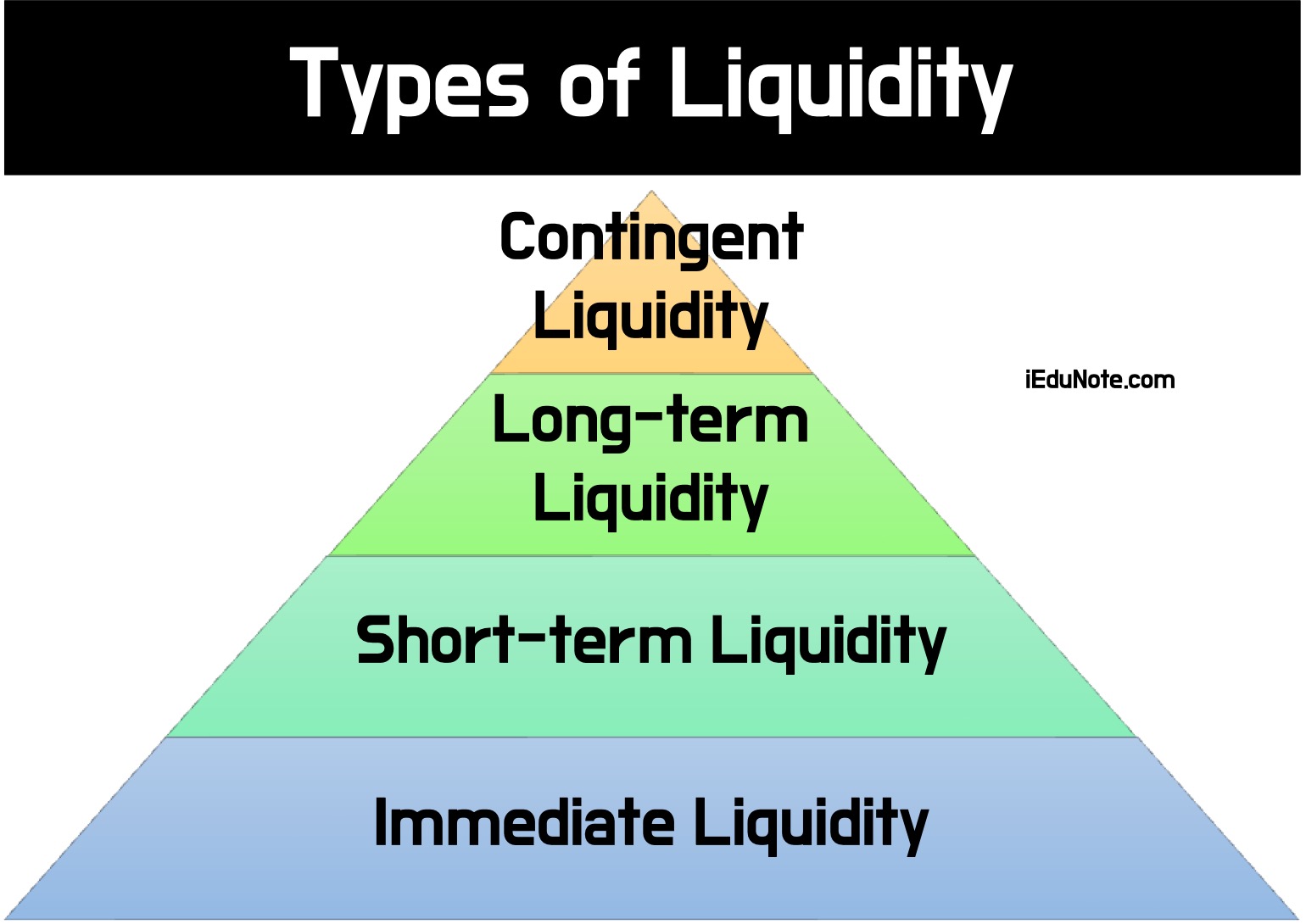

Types of Liquidity

Different liquidity analysts and bank managers classify the types of liquidity in different ways. Generally, there are four types of liquidity;

- Immediate Liquidity.

- Short-term Liquidity.

- Long-term Liquidity.

- Contingent Liquidity

- Economic Cyclical Liquidity.

Let’s discuss all these types in the following order.

1. Immediate Liquidity

Immediate liquidity is necessary for the payment of the cheques written by the depositors for withdrawals. This liquidity is also required to meet the other daily payables.

2. Short-Term Liquidity

Short-term liquidity is utilized to meet the monthly liquidity requirements. Based on the types of clients and the seasonal variability, the necessity of these types of liquidity can vary.

For example, the season of seed sowing by farmers, the condition of the export-import business, and cultural and religious festivals affect this amount of liquidity. The ranges of such liquidity vary from three to four months.

3. Long-term Liquidity

Generally, the necessity of this type of liquidity arises for some specific projects. The demand for this liquidity can be forecasted some months or some years ago.

Long-term liquidity is required to meet the cash demand for replacing fixed assets, retiring the redeemable preferred shares/ debentures, and acquiring new fixed assets and technical know-how.

4. Contingent Liquidity

Contingent Liquidity arises depending on the happening of some unexpected events. It is difficult to guess the unexpected situation but not impossible though the amount can not be predicted.

This type of liquidity often arises to compensate any loss consequent upon the adverse verdict of any pending lawsuits, to meet the gap due to sudden transfer of large-sized deposits and unexpected large amounts of loan demand, or in case of a large volume of deposit withdrawals due to panic for loss of public confidence and the like.

Contingent liquidity is also required to face the adverse situations created by a big bank robbery, fraud, arson, or other accidents.

Besides the above four types of liquidity, two additional types of liquidity are Economic Cyclical Liquidity and

5. Economic Cyclical Liquidity

Based on a good or bad economic situation, the supply of bank deposits and the demand for loans varies. Due to this variation, the liquidity demand also varies. But it is tough to identify the extent of such variation.

Generally, different national and international events, e.g., political instability, war, and the pressure created by the different interest groups relating to banking activities, are the causes of economic cyclical liquidity needs.

The economic cycles, e.g., trough, expansion, peak, and contraction resulting for whatever reasons, create needs for liquidity of various degrees to cope with the situation.

Whatever the determinants are, variable interest rates cause the variable size of liquidity demands at various stages.

From the above figure, it can be found that in bad economic conditions and squeezed monetary policy, interest rate decreases. This eventually increases the supply of money. As a result, liquidity requirement increases, and bank deposit decreases.

On the other hand, when the economic conditions expand and get strong enough, the supply of money will decrease, and the interest rate will increase. Eventually, the liquidity demand will decrease, thereby increasing bank deposits.

Liquidity Management Theories

Liquidity policy is The plans for meeting the bank’s funding needs. Funds may be needed tomorrow, next week, or next year to meet promises to depositors, insured persons, borrowers, and other customers. When the promises come due, the bank must make payment in cash or equivalent funds; a default on its commitment nearly always causes a punishing response.

Unlike a grocery store, which may have a “stock-out” of peanuts or frozen orange juice, a bank cannot run out of money to meet its customers’ claims.

As commercial banking is the oldest financial institution, predating savings and loans, insurance companies, and pension funds, the historical approaches were developed primarily for banking.

However, these approaches’ concepts apply equally well to all financial institutions. Four important concepts are:

Commercial loan theory 18-19th century (until 1920)

Under the traditional commercial loan theory, the ideal assets are short-term, self-liquidating loans granted for working capital purposes. These assets are considered the only type appropriate for banks because of their large proportion of demand and near-demand liabilities.

If deposits decrease, the maturing loans are not renewed, and the funds are applied to depositors’ withdrawals.

Shift-ability theory in the 1920s

Broadened security markets in the 1920s and the desire of banks to make long-term loans fostered this theory.

Holding secondary reserves composed of relatively short-term, high-grade, readily marketable securities satisfies its liquidity needs. Secondary reserves can be sold (shifted) to meet deposit outflows without loss.

The bank can make other loans without liquidity or maturity gave the good quality and marketable securities.

Anticipated-income theory 1940s

A growing proportion of amortized loans and the development of realistic repayment schedules for working capital loans provided the basis for forecasting flows of funds. The massive flow of funds could be committed to reserve deficiencies or new loan demand, as circumstances dictated.

Liabilities-management theory 1960s

Rapidly developed and accepted by medium-and large-size banks, this theory holds that liquidity can be obtained through the issuance of liabilities rather than the sale of assets.

Banks in need of funds can borrow Federal funds, issue negotiable certificates of deposit, sell consumer-type certificates of deposits, borrow from the Federal Reserve, issue capital notes and common stock, and raise funds in the Eurodollar market.

To avoid the conflict between liquidity and profit, many conventions and rules were adopted from time to time. These rules and conventions were accepted as theories in later periods.

Many renowned theorists believe that adjustment between liquidity and profitability will be possible by investing funds inappropriate assets. Some theories relating to liquidity management have been discussed below:

1. Commercial Loan Theory

The Commercial loan theory, originating in England during the 18th century, acquired widespread acceptance. According to this doctrine, a commercial bank should provide short-term self-liquidating loans to business firms to meet their working capital requirements.

The logical basis for the doctrine was that commercial bank deposits are demand or near-demand liabilities and should, therefore, be committed to obligations that are self-liquidating within a short period in the normal course of business operations.

Thus, self-liquidating loans are, besides earning in character, liquidating themselves automatically in due course.

Criticism of Commercial Loan Theory

The doctrine came in for criticism for several reasons.

First, suppose a bank decides to grant a new loan only after the repayment of the old loan. In that case, production and trade will suffer since the disappointed borrowers for want of accommodation would be compelled to cut down production and trade.

In this regard, it is worthwhile to recall the observations of Professor Sayers; “If bankers in a misguided attempt to liquidate their assets were to refuse to take up any new bills and do simply sit back in their parlors and wait for the maturities of the bills in their portfolios, there is a catastrophic fall in the supply of purchasing power and the catastrophic fall in prices which make it impossible for debtors to meet bills out of the proceeds of their operations.”

The country’s economic situation also conditions the liquidity character of self-liquidating loans. In periods of economic depression, goods do not move speedily into normal trade channels or move at a meager price.

Even at losses to sellers in such adverse circumstances, there is no guarantee, even though the transaction for which the loan was provided was genuine, that the debtor will be able to repay the debt at maturity.

Another charge leveled against the doctrine is that it has failed to take cognizance that banks can ensure liquidity in their assets only when these are readily convertible into cash without any loss and not because loans are made against real trade bills.

2. Shift ability Theory

The shift ability theory of bank liquidity originated in the U.S.A. in 1918 by H G. Moulton. According to this theory, the problem of liquidity is not so much a problem of the maturity of loans but one of shifting assets to others for cash without material loss.

In the words of Moulton. “The way to attain the minimum in Jie matter of reserves is not by relying on maturities but by maintaining a considerable quantity of assets that can be shifted to other banks before maturity as necessity may require.”

According to shift ability theorists, an asset to be perfectly shiftable must fulfill the attributes of immediate transferability to others and without an appreciable capital loss for the purpose of meeting a temporary liquidity crisis caused by the sudden demand of customers.

The opportunity of shifting assets has expanded considerably in the recent past, owing mainly to the relaxation of eligibility rules. The soundness of assets and their acceptability as distinct from mere eligibility has now become accepted as the standards of liquidity.

Criticism of the Shiftability Theory

With the development of the corporate form of organization, commercial loan theory lost its ground in favor of shift ability theory.

However, in periods of acute depression when the whole industrial community is caught in crisis, shares and debentures of even well-reputed concerns would fail to attract buyers, and the cost of shifting would be prohibitively high.

Both the commercial loan theory and the shift ability theory failed to distinguish clearly between the liquidity of an individual bank and that of the banking system as a whole.

3. Anticipated Income Theory

One of the most striking banking developments noticed in the recent past is the commercial banks, increasing participation in term lending.

A term loan is granted for a period extending more than one year but not exceeding five years. Such loans are usually accompanied by agreements between the bank and the borrower containing restrictive covenants for the financial activities of the latter.

Banks grant these loans against the hypothecation of stocks, machinery, etc., but security is not the basic consideration.

The ‘Anticipated Income Theory’ was developed in 1944 by Herbert V. Prochnow.

In his own words, In every instance, regardless of the nature and character of the borrower’s business, the banker planned the liquidation of the term loan from the anticipated earnings of the borrower (liquidation), not by the sale of assets of the borrower as in the commercial credit or traditional theory of liquidity, nor by shifting the term loan to some other lender as in the shift ability theory of liquidity, but by the anticipated income of the borrower.

Criticism of Anticipated Income Theory

According to this theory, loan repayment schedules have to be adapted to the borrower’s anticipated income or cash receipts. All loans, including short-term loans and long-term loans, become liquid if the borrowers have the capacity to repay the sum.

Therefore, a loan officer must continuously estimate future earnings or net cash inflows of the borrowing firm for the amortization of loans.

4. Liability Management Theory

During the 1960s, a new theory of bank liquidity emerged, which may be labeled as the “Liabilities Management Theory.

According to the liabilities management view, an individual bank may acquire reserves from several different sources by creating additional liabilities against itself. These sources include some items, some of which are listed below.

- Issuance of time certificates of deposit.

- Borrowing from other commercial banks.

- Borrowing al Central Bank.

- Raising capital funds by issue of shares and employing retained earnings.

We shall now discuss each of these sources and their potential as sources of liquidity briefly.

Time Certificates of Deposit

The major liability source of reserve money for individual commercial banks in the U.S.A. since the early 1960s is time certificates of deposit.

These certificates bear different maturities ranging from ninety days to one year and are offered with interest rates competitive with treasury bills and other similar money market instruments. Time certificates are negotiable and can be sold by the holder in the market.

During boom conditions, the central bank, in its bid to control inflationary pressure, will very likely impose a maximum interest rate that may be paid.

Another limitation of certificate deposits as a dependable source of reserves is the- fact that commercial banks compete strongly among themselves for existing reserve money.

Borrowing from other commercial banks

The second way individual commercial banks may create additional liabilities to acquire reserves is by borrowing from other banks. Thus, commercial banks with different legal reserves borrow from other banks with excess reserves.

Borrowing at Central Bank

Another source of reserves through the creation of liabilities is borrowing from the country’s central bank. Central bank credit facilities are generally available through discounting or advances to meet the day-to-day and seasonal liquidity needs of commercial banks registered with the central bank.

Raising of Capital Funds

Commercial banks can acquire reserves by the issue of shares carrying different features to this source would depend on public response to bank shares, which is essentially conditioned by the current dividend rate and growth prospects associated with it.

Since the dividend rate offered by banks on their shares is not competitive with that of manufacturing and trading concerns, banks generally find it difficult to raise a substantial amount of funds through the sale of shares.

Funds can also be built up by plowing back earnings. The magnitude of this source of funds will depend upon the profitability of the commercial bank and its dividend policy.

Criticism of Liability Management Theory

This theory is relatively more acceptable than the other three previous theories, but it is still not beyond criticism.

In this theory, more emphasis is given to earning profit by utilizing more of the collected deposits as loans and/or investments rather than maintaining a portion of the same liquidity. One can try to predict the future very scrupulously.

Still, it might prove wrong with the lapse of time.

For reasons beyond control, the market rate of interest, when abnormally goes up, the cost of raising funds for meeting liquidity needs by creating liabilities may unnecessarily rise, which may shrink the possible earning of the bank.

Besides, regulatory agencies may restrict using such a source, jeopardizing the bank financially.

Mixing Asset and Liability Liquidity Sources

The blend of asset and liability sources of liquidity depends largely on the ability of the bank to manage liquidity and the acceptance by the market of the bank’s securities.

Greater management planning and economic expertise are required with liability management than with asset management because the bank must always place itself to tap the marker.

For example, A.B.C. and its banking subsidiary. A.B.C. bank has access to many sources of funds by borrowing from wide & diversified markets. A.B.C. bank maintains its position as a preferred borrower to tap sources of liquidity at the most favorable rates available.

Likewise, finance companies maintain expert staff to deal with commercial banks, corporate cash managers, and commercial paper dealers to provide immediate and continuing access to numerous sources of funds.

With a strong liabilities liquidity position, the need for asset liquidity is reduced, and a greater proportion of assets can be invested in higher-yielding direct loans.

On the other hand, a relatively unknown bank without an active money-market manager has few opportunities to borrow for liquidity purposes and is disfavored under tight money-market conditions.

The smaller banks cannot issue sufficient volumes of negotiable money market instruments in the local money market or outside the Eurodollar market. Titus, the smaller and unknown institutions, must rely primarily on asset sources of liquidity.

Demand for and Supply of Bank Liquidity

Demand for cash first arises with the withdrawal notice of depositors. In addition to this, the bank has to pay various kinds of other clients frequently. Bank docs do not create money but perform multifaceted monetary transactions with money originating from other sources.

Demand for Liquidity can be defined as the client’s willingness and the usage of money. On the other hand, ‘Supply of Liquidity’ can be defined as the various processes of the sources of cash generation.

The nature of demand for and supply of liquidity of banks is as follows;

Supply of Liquid Assets

- Increase in deposits,

- Income from services other than deposits,

- Recovery of loan/ loan installment/ interest income from the borrowers,

- Proceeds from the sale of assets, if any;

- Borrowings from the money market,

- Borrowings from the central bank.

Demand for Liquid Assets

- Withdrawals of deposits.

- Disbursement of Ioan installments.

- Repayment of the borrowings.

- Repayment of other short-term liabilities.

- Payment of expenses for preparing and delivering bank services.

- Cash dividends are paid to the bank owners.

Operational processes of the demand for supply of liquidity are determined by;

- Net liquidity (N)

- Deficit Liquidity (D)

- Surplus Liquidity (S)

If the supply of liquidity is denoted as ‘S’ and the demand for liquidity is denoted as ‘D,’ then the determinants of liquidity stand as follows:

| Liquidity Situation | Condition of S&D |

|---|---|

| N | S-D=N |

| D | S<D |

| S | S>D |

Pros and Cons of the three liquidity situations:

- If the net liquidity becomes balanced, there is no reason for the bank to be apprehended. The bank will have to take no action concerning liquidity;

- But if a liquidity deficit situation arises, banks have to be cautious and take appropriate, timely steps to collect additional cash to meet the liquidity gap: and

- On the other hand, in case of a surplus liquidity situation, banks will have to find out relatively most profitable sources of investment to avoid idle cash remaining in the banks’ vault.

Traditional Measures of Liquidity

Bank liquidity can be arranged by creating liquid assets and creating liabilities by selling instruments in the money market. Due to having a negligible influence on the money market, relatively Smaller banks depend more on near-cash assets than selling securities in the money market.

The reverse is the case for larger banks with better access to the money market and relatively depend more on arranging needed liquidity than maintaining near-cash assets.

The following table presents liquidity indicators based on assets and liabilities-

Asset-based Liquidity Sources

- Cash in hand above daily requirements.

- Current deposit balance with other sister banks.

- Short-term deposits with other sister banks.

- Immediately encashable treasury notes/ bills.

- Government Securities of one-year maturity.

- Securities of Govt, organizations/agencies of a one-year maturity.

- High-quality corporate securities.

- High-quality municipal securities.

- Convertible loans into securities/ debentures

Liability-based Liquidity Sources

- The ratio of equity capital to total assets.

- The ratio of risky assets to total assets.

- The ratio of loan loss to the total loss.

- The ratio of loan loss provision to problem loans.

- Percentage of current and term deposits.

- The ratio of total deposits to total liabilities.

- The ratio of core deposits to total assets.

- The ratio of borrowings from the central bank to total liabilities.

- The ratio of short-term liabilities and commercial securities to total liabilities.

Assets-based liquidity sources largely depend on the extent of minimum loss on converting these assets into cash. The quality of assets-based liquid assets is judged by how quickly these assets can be -marketed and turned into cash.

On the other hand, liability-based liquidity sources mean selling and collecting cash through selling money market instruments. The quality & efficiency of such source of creating liability mostly depends on the costs and quickness of marketization of such instruments.

Liquidity Management Strategies for Banks

From the very beginning, the banking industry has more or less been suffering from a liquidity crisis. Over the years, experienced liquidity managers have developed several broad strategies for dealing with liquidity problems:

- Assets conversion strategies.

- Liabilities management strategies.

- Balanced liquidity management strategies.

1. Assets Conversion Strategies

Among the bank liquidity management strategies, this is the oldest one. In its purest sense, this strategy calls for storing liquidity in the form of holdings of liquid assets, predominantly in cash and in marketable securities. This strategy is often called asset liquidity management.

Some bank specialists called this strategy to store liquidity in bank assets. Among such assets, cash is the main source. Other near-cash assets can be classified as follows according to their conversion period and other characteristics:

- Such near-cash assets are convertible to cash within short notice.

- Such near-cash assets have reasonably stable prices so that, no matter how quickly the asset must be sold or how large the volume of sale is, the market is deep enough to absorb the sale without a significant price decline.

- Such near-cash assets, which the seller can repurchase with little risk of loss and inconvenience.

The most popular convertible assets, which can be used for liquidity management, are:-

- Treasury bills.

- Government funds are received through other institutions.

- Securities on repurchased assets.

- Deposits held with other banks.

- Municipal bonds/notes.

- Govt, agency securities.

- Bankers acceptances.

- Short-term commercial papers.

- Eurocurrency loans.

Asset liability management strategy is used mainly by smaller banks and thrifts that find it a less risky approach to liquidity management than relying on borrowings.

But asset conversion is not a costless approach to liquidity management. First, selling assets means losing the future earnings those would have generated had these not been sold off. Thus, there is an opportunity cost to storing liquidity in assets when those assets must be sold.

This apart, there may be declining prices resulting in substantial capital losses. Selling those assets to raise liquidity tends to weaken the appearance of the balance sheet.

Finally, investing heavily in liquid assets means forgoing higher returns on other assets that might be acquired.

2. Liability Management Strategy

The liability management strategy is modern and relatively recent in comparison to the asset conversion strategy.

In the U.S.A., this strategy was viral from 1960 to 1970 due to its greater reliability in liquidity management. This strategy is often called borrowed liquidity or purchased liquidity by bank specialists. In this case, borrowings are made only when the liquidity requirement is imminent.

The bank doesn’t need to hold unproductive idle/low-yield funds like the asset conversion strategy in the liability management strategy. The principal sources of borrowed liquidity include:

- Govt funds borrowings in different instruments.

- Borrowing reserves from the discount window of the central bank.

- Selling liquid, low-risk securities under a repurchase agreement.

- Issuing large negotiable certificates of deposit to major corporations, governmental units, and wealthy individuals.

- Issuance of foreign currency certificates of deposits, for example- Euro/ petro currency deposits.

Borrowing liquidity is the riskiest approach to solving liquidity problems because of the volatility of money market interest rates and the rapidity with which credit availability can change. The borrowing costs are always uncertain, which adds greater uncertainty to the bank’s net earnings.

Moreover, a bank that goes into financial trouble usually needs borrowed liquidity, particularly because information about the bank’s difficulties spreads and depositors begin to withdraw their funds.

3. Balanced liquidity management strategy:

Due to the inherent risks & limitations of the previous two strategies, bank specialists and officers have devised a balanced liquidity management strategy. The cost of storing liquidity in non-earning or small-earning assets is huge, which can be treated as keeping idle money.

On the other hand, interest expense is not small enough in borrowed liquidity strategy. The combined and rational use of asset management and liability management is called a balanced liquidity management strategy. The amount by which assets and liabilities manage liquidity depends on the bank officers’ experience, banking practice, and intuition.

Under a balanced liquidity management strategy, some of the expected demands for liquidity are stored in assets. Unexpected cash needs are typically met from near-term borrowings. In contrast, other anticipated liquidity needs are backstopped by advanced arrangements for lines of credit from other banks or other suppliers of funds.

Longer-term liquidity needs can be planned for, and the funds to meet these needs can be parked in short-term and medium-term loans and securities that will provide cash as and when those liquidity needs arise.

Best Liquidity vs. Worst Liquidity

| Liquidity Management Issue | Indicators of Best Liquidity | Indicators of Worst Liquidity |

|---|---|---|

| Deposits | The level of collected deposits is more than those forecasted by efficient and knowledgeable fund managers. | The efficient and knowledgeable fund managers are far short of the deposits forecast of the level of collected deposits. |

| Loans | Actual loan applications and demand for loans are smaller than the amount predicted by efficient loan managers. | Actual loan applications and demand for loans are much greater than the amount predicted by efficient loan managers. |

| Steps Taken | – After assessing the amount of surplus liquidity, which can manage a handsome yield, necessary steps are taken as early as possible for profitable investments. – If known well ahead, necessary arrangements are made to face the predicted deficit liquidity condition by arranging the cheapest and easily available sources of funds in advance. | – As the information could not know much earlier, no arrangement for taking necessary steps to use the surplus liquidity is possible in profitable investments. Therefore, it remains idle- no yield becomes possible. – If known just when the liquidity crisis is on, there is no arrangement for predicting and taking necessary steps to collect additional funds at a competitively lower cost. Banks may resort to any source on any adverse terms and conditions to overcome the liquidity crisis. |

Considerations in Selecting the Liquidity Sources

Liquidity needs can be met by selling the assets or by increasing the liabilities. Whatever sources are used, the costs of collecting the money should be tried to be kept to a minimum.

To control the collection costs following factors are to be considered.

Considerations while selling assets for liquidity

- Brokerage commission.

- Possible loss of profit from selling securities at market price.

- The amount of loss of interest receivable on securities

- The extent of increase/ decrease in tax liabilities from the gains from the sale of securities,

- Increase/Decrease in interest income from interest receivable

Considerations while creating liabilities for liquidity

- Brokerage commission.

- Amount of reserve required for created liabilities for liquidity purposes.

- The amount of deposit insurance premium (if any).

- The expense for the development and maintenance of concerned liabilities.

- Interest payables.

Estimating a Bank’s Liquidity Needs

Over the decades, various experiments were made to estimate the quantum of liquidity for a particular period. Each method is based on different assumptions, and none of the methods could be identified as perfect one. For that reason, bank fund managers estimate liquidity demand based on their past experiences and knowledge.

Among various methods, the following three are mostly used;

- The sources and uses of the fund approach.

- The structure of the fund approach.

- Liquidity indicator approach.

1. The sources and uses of the Fund Approach

This approach is based on the following two simple but practical situations –

- The more the deposits are, the more liquidity will be. In other words, deposits will increase if loans decrease.

- The fewer the deposits are, the less liquidity will be. In other words, liquidity decreases with the increase in loans.

If the uses of funds are greater than the actual collection of funds, a liquidity gap arises. This liquidity gap can be large in volume or the reverse depending on the size of operations. Such liquidity deficit is also called negative liquidity.

On the other hand, if the uses of funds are lower than the actual collection of funds, it creates a liquidity surplus, or positive liquidity will be generated.

The following table shows the imaginary sources and uses of funds:

| Period of Liquidity | Bank’s estimated deposit level | The bank’s permitted loan level | Estimated Change in deposit | Estimated Change in Loans | Estimated Liquidity Surplus(+) /Deficit (-) |

|---|---|---|---|---|---|

| Running week | 1200 | 800 | – | – | – |

| Next week | 1100 | 850 | -100 | +50 | -150 |

| 3rd week | 1000 | 950 | -100 | +100 | -200 |

| 4th week | 950 | 1000 | -50 | +50 | -100 |

| 5th week | 1250 | 750 | +300 | -250 | +550 |

| 6th week | 1200 | 900 | -50 | +150 | -200 |

Except for the estimation in the 5th week, all the remaining weeks have a negative liquidity balance.

Thus, the manager must employ a 5th weak s balance in profitable investments. On the other hand, the liquidity manager will manage the cheapest source to fulfill the deficit liquidity in the 2nd, 3rd, 4th, and 6th weeks.

G.W. Walter Wood Worth gave an alternative to the fund approach’s sources and uses, called the ten-level Liquidity Forecasting Method. The levels are:

- Level-1: Tabulate the Monthly series for total deposits and total loans for a selected period.

- Level-2: Chart the series for total net deposits and total loans using either a ratio arithmetic scale.

- Level-3: Subtract total loans from total net deposits for each month in the period to derive the difference series.

- Level-4: Calculate seasonal indices for total net deposits and total loans.

- Level-5: Fit a trend line to the total net deposits series and forecast it over the next I2(twelve) months.

- Level-6: Using the trend ordinates derived in Level-5 as a basic measure of secular trend, estimate the cyclical and secular variation of both total net deposits and total loans for a period such as 12(twelve) months.

- Level-7: Multiply projected total net deposit and total loans by their respective projected seasonal indices generated in Level-4.

- Level-8: Subtract projected total loans from projected total net deposits as calculated in Level-7.

- Level-9: Express the projected differences series as a percentage of projected total net deposits.

- Level-10: Chart the historical difference series expressed as a percentage of total net deposits

2. The structure of the Fund Approach

Deposit is the main source of liquidity. Depending on the usage of the

clients, deposits can be of three types –

- Hot money deposits.

- Vulnerable deposits.

- Stable or Core deposits.

Liquidity requirements vary from one to another among the above three types of deposits, for example. Hot Money deposits require the highest liquidity. Stable or Core deposits require comparatively lower liquidity.

On the other hand, vulnerable deposits require a moderate amount of liquidity.

The case will be clear from the following illustration:

A.B.C. Bank has estimated its deposits as follows;

- Hot Money Deposit: $25 Crore.

- Vulnerable Deposit: $24 Crore.

- Stable or Core Deposit: $100 Crore.

Then what will be the liquidity needs in the next week?

It is assumed from experience that depending on the types of deposits and required liquidity rates are 95%, 30%, and 15%.

Statement showing the estimated liquidity requirements of the ‘A.B.C.’ Bank :

| Structure of Deposit | Amount of Deposits (Millions) | Amount of Reserves (Millions) | Probability of Liquidity | Estimated Liquidity Amount (Millions) |

|---|---|---|---|---|

| Hot Money Deposit | 25 | 3% | 95% | 23.04 |

| Vulnerable Deposit | 24 | 3% | 30% | 6.98 |

| Stable Core Deposit | 100 | 3% | 15% | 14.55 |

| TOTAL | 149 | 4.47 | 44.57 |

Estimated reserve conies to $4.47 million while liquidity comes to $44.57 million. Finally, it appears that for the three types of deposits of $149 million in the next week, the estimated liquidity amount for A.B.C. bank is $49.04 million (Reserve $4.47 crore+ Liquidity $44.57 million).

3. Liquidity Indicator Approach

Many banks estimate their liquidity needs to be based on experience and industry averages. These often mean using certain financial ratios or liquidity indicators. Examples of some of such liquidity indicators are:

Cash position indicator, liquid securities indicators, central bank funds and repurchase agreement position, capacity ratio, pledge security ratio, hot money ratio, deposit brokerage index, core deposit ratio, deposit composition ratio, etc.

Most indicators seem to show a gradual decline in bank liquidity, particularly in liquid assets. One reason is a gradual shift in bank deposits towards longer maturity instruments that are most able and have fewer unexpected withdrawals.

There are also more wages to raise liquidity today, and advancing technology has made it easier to anticipate and prepare liquidity needs.

Most banks estimate liquidity based on the ratios on a specific date. There are two types of liquidity indicators;

- Asset-based or Stored liquidity ratios.

- Liquidity-based or Purchased liquidity ratios.

The indicators, along with the formulas, are given below:

Asset-based Indicators

| Ratio or Index | Calculating Formula |

|---|---|

| Cash Position Indicators | Cash + Deposits Total Assets |

| Liquid Securities Indicators | Govt. Securities / Total Assets |

| Riskless Assets Position | (Cash + Deposits + Govt Securities) / Total Assets |

| Net Treasury Funds Position | Balance of the Reserve With The Central Bank / Total Assets |

| Liquidity Assets Ratio | (Cash + Government Securities + Reserve) / Total Assets |

| Capacity Ratio | (Net Loan + Lease or Rent) / Total Assets |

| Pledged Securities Ratio | Pledged Securities / Total Securities Holdings |

Liability Based Indicators

| Ratio or Index | Calculating Formula |

|---|---|

| Hot Money Deposit | Withdrawable Hot Money Deposit / Total Hot Money Deposit |

| Short-Term Deposits to Assets Ratio | Short-Term Deposit / Total Assets |

| Short Time Investment To Sensitive Liabilities Ratio | Short-Term Investment / Sensitive Liability |

| Deposit Brokerage Index | Brokerage Deposits / Total Assets |

| Core Deposit Ratio | Core Deposits / Total Assets |

| Deposit Composition Ratio | Current Deposits / Terms Deposit |

| Transaction Deposit Ratio | Transactional Deposit / Non- transactional Deposit |

Above mentioned ratios of a bank are compared with the whole banking industry to estimate the liquidity needs. In addition to this, banks may estimate the future liquidity requirement by analyzing specific ratios’ past trends and movements.

Banks can efficiently estimate future liquidity requirements by making necessary adjustments to the above-mentioned ratios by considering the seasonal fluctuations of the economy, like recession or expansion.

Liquidity Vs. Profitability

Liquidity and profitability are two contradictory concepts. One can not be effective without the other. But excess of one may slow down the other. Too much squeezing of any of the two can also aggravate the situation.

Consideration for profitability

Depositors are the mam sources of banks’ funds. By safekeeping their deposits, banks can not make a profit other than earning service charges. But banks must spend a huge amount as transaction costs to maintain these deposits.

If a bank only maintains deposits, profitability can not be achieved. So banks grant credits at a higher rate of interest from the borrowers than the interest banks pay off depositors.

The difference between interest received from the borrowers and the interest given to the depositors is known as the spread. The higher the spread, the higher the profit banks can cam after meeting expenses about transactions and other related expenses.

Other than loan activities, banks invest a portion of their funds in the money market or capital market instruments and earn interest or dividend income. The more a bank could extend as loans and invest through money and capital market instruments, the more profit it can earn.

Consideration for liquidity

Banks have to keep a portion of bank funds as liquidity to fulfill short-term liabilities. Otherwise, in a time of liquidity crisis, any delay in making payments, when required, can dissatisfy the depositors or potential receivers of loan installments.

If a bank faces an unavoidable crisis in meeting liquidity, clients most likely will react negatively. If the liquidity crisis repeatedly occurs, clients will switch their deposits to other banks. Clients, other than depositors, also search for new banks.

Finally, the bank will be considered a “Problem Bank.” Maintaining adequate liquidity is of foremost importance to keep the confidence of people at a satisfactory level.

What do the banks need to do?

Holding a reasonable portion of the deposit is necessary for liquidity. But banks can not set aside a large portion of their funds as cash. Because if doing so, less amount will remain to be invested as loans or investments to earn profit.

On the other side, if banks invest the largest portion of their funds without maintaining needed adequate liquidity, depositors and other creditors will become impatient and react adversely, which creates panic among the public members.

So, banks should maintain the required and necessary liquidity first and then invest the rest of the amount for profit either as a loan and/or as an investment through open markets.

If they fail to do so, the banks will surely face either a liquidity crisis or a profitability crisis. Maintaining judicious trade-off between liquidity and investment sine qua non for profitability and successful survival of the bank.

Since a bank can realize higher profits from relatively illiquid assets, there is a natural tradeoff between profitability and liquidity.

Commercial banks must invest as profitably as possible within reasonable limits of liquidity. Because of this potential conflict, regulators in some countries have established certain minimum liquidity requirements.

How Banks Manage Liquidity Crisis

Two different notions of liquidity risk have evolved in the banking sector. Each has some validity. The first, and the easiest in most regards, is liquidity risk as a need for continued funding.

The counterpart of standard cash management, this liquidity need is forecastable and easily analyzed. Yet, the result is not worth much. Banks of the sort considered here have ample resources for growth and recourse to additional liabilities for unexpectedly high asset growth in today’s capital market.

Accordingly, attempts to analyze liquidity risk as a need for resources to facilitate growth or honor outstanding credit lines are of little relevance to the risk management agenda pursued here.

The liquidity risk that does present a real challenge is the need for funding when and if a crisis arises.

In this case, the issues are very different from those addressed above.

Standard reports on liquid assets and open lines of credit, which are germane to the first type of liquidity need, are substantially less relevant to the second. Rather, what is required is an analysis of funding demands under a series of “worst-case” scenarios.

These include the liquidity needs associated with a bank-specific shock, such as a severe loss and a system-wide crisis.

In each case, the bank examines the extent to which it can be self-supporting in the event of a crisis and tries to estimate the speed with which the shock will result in a funding crisis.

Reports center on both features of the crisis.

Other institutions attempt to measure the speed with which assets can be liquidated to respond to the situation using a report that indicates the speed with which the bank can acquire needed liquidity in a crisis.

Response strategies considered include the extent to which the bank can accomplish substantial balance sheet shrinkage and estimates of the sources of funds that will remain available to the institution in a crisis.

Results of such simulated crises are usually expressed in days of exposure or days to the funding crisis.

Such studies are, by their nature, imprecise but essential to efficient operation in the event of a substantial change in the firm’s financial conditions.

As a result, regulatory authorities have increasingly mandated that industry members develop a liquidity risk plan. Yet, there is a clear distinction among institutions as to the value of this type of exercise.

Some attempt to develop careful funding plans and estimate their vulnerability to the crisis with considerable precision.

They contend that, either from prior experience or attempts at verification, they could and would use the proposed plan in a time of crisis. Others view this planning document as little more than a regulatory hurdle.

While some actually invest in backup lines without “material adverse conditions” clauses, others have little faith in their ability to access them in a time of need.

Conclusion

Bank profitability, liquidity, and liability management are very much interrelated. There is a trade-off between bank profitability and liquidity. Efficient handling of bank liquidity provides sufficient loanable funds.

On the other hand, mismanagement of liquidity causes dissatisfied customers, thereby incurring the loss.

In addition to this, any punitive action by the bank regulators due to faulty liquidity management and non-compliance with statutory liquidity requirements causes a severe adverse impact on the bank’s goodwill.

Access to money markets has become important in accommodating liquidity needs. Especially for larger banks, liquidity is now less a function of the existing balance sheet and more a function of issuing large-denomination time deposits, purchasing Govt bills/notes and reports, and issuing commercial paper.

Banks, in general, in countries with developed money markets, may rely more on liability creation. Still, this option is found to be not at all encouraging in those countries where money markets are yet to be developed.