The main objective of bank management is to build an organic and optimal interaction system between the elements of banking mechanisms with a view to profit.

Every successful banker has to perform managerial responsibilities along with technical banking activities. Although a bank is a financial institution like other businesses, its main objective is to maximize its wealth by earning profit. Bank business is different from other types of businesses.

Other businesses can transfer/shift their goods or services from factory to office or other far places even can export to foreign countries. But banks can transfer funds or extend services only after fulfilling the demand for a loan of the area where the office or branch of that bank is situated.

Efficient management can offer high-quality service, and efficient management can be ensured by efficient organization management. So, professional management is impossible without crystallizing the authority & responsibility of all the personnel employed in a bank.

Definition of Bank Management

There are many definitions of bank management. In general, bank management refers to managing the bank’s statutory activity.

Bank management is characterized by the specific object of management – financial relations connected with banking activities and other relations, also connected with implementing management functions in banking.

Successful optimization of the “profitability-risk” ratio in bank lending operations is largely determined using effective bank management methods. The ability to take reasonable risks is one of the elements of entrepreneurship culture in general and banking culture.

The following characteristics determine the reliability of the bank management:

- management expertise in strategic analysis, planning, policy development, and management functions;

- quality of planning;

- risk management (credit, interest rate, and currency risks);

- liquidity management;

- management of human resources;

- creation of control systems: audit and internal audit monitoring of profitability and risks liquidity:

- unified information technology system: integrated workflow, accounting, current analysis and control, strategic planning.

All the above conditions show themselves during the implementation of bank management and its components.

3 Importance of Bank Management – Rationale of Increasing Importance of Bank Management

Bank’s management procedure is more challenging as the regulatory system always is there to control the bank management.

3 Importance of Bank Management are;

- Changing Regulation of Banks.

- Increasing competition due to Changing Technological Development.

- Changing International Relationship.

1. Changing Regulation of Banks

At the end of the 3rd decade of the 20th century, thousands of banks worldwide failed due to the economic recession called Great Depression.

Due to the bank failure, millions of depositors suffered from a great problem, as they didn’t get back their deposited money. To protect the interest of depositors, the deposit insurance scheme was made mandatory for banks.

And from this time, the regulation for banks began to multiply from various angles.

Previously, receiving a registration certificate or certificate of commencement of business and submitting the financial statements were considered sufficient for the controlling agencies of banks.

Some of the techniques followed by the bank regulatory authorities to control the activities of commercial banks are;

- Direction for the right price of bank services.

- Introduction of deposit insurance.

- Direction for adequate liquidity.

- Direction for capital adequacy.

- Direction for approval and non-approval of bank loan operation.

- Recruitment of directors and direction regarding recruitment and directing their duties and responsibilities.

- Loan supervision, review, and examination.

- Direction for adequacy reserve etc.

- Day by day, bank management becomes more challenging by introducing rules and regulations by bank regulatory authorities.

2. Increasing Competition due to Changing Technological Development

The number of served clients and quality dimensions of services is the basis of competition. The bank, which provides better service with high quality, is capable of being successful in competition.

Two banks jointly create new services that provide the customers with a sustainable competitive advantage.

Why the new benefit or service that the bank offer is unique and different from that of the other organizations requires the commercial banks to participate in the multidimensional competitive environment.

The bank, which can attract more clients, can create clients repeatedly. This technological environment absorbed more investment and new training.

So, the bank’s management creates a new strategy of banking services adjusted in the competitive banking business.

3. Changing International Relationship

In the international banking business, the bank faces an extensive amount of legislation in the event of a new problem. International relations, global or bilateral, create more competition in the banking business.

Other factors, such as international trade and commerce, laws of found transfer, changes in social and cultural factors, establish a new operational management system that challenges the banking business.

In this era of modern science, a solution of competitive environment and development of international relations among banks, the bank’s management follows a strategy to merge banks in the international banking business.

All these factors stated make bank management more complex and challenging.

Concepts of Bank Management

Banks create funds by collecting surplus savings as deposits or shareholders’ capital or taking loans from other sources, including the central bank. To collect these funds, a bank has to bear some collection_cost and other related costs. After deducting the cost of funds and other administrative expenses, a bank has to profit by collecting funds and investing the same to become an efficient and successful bank.

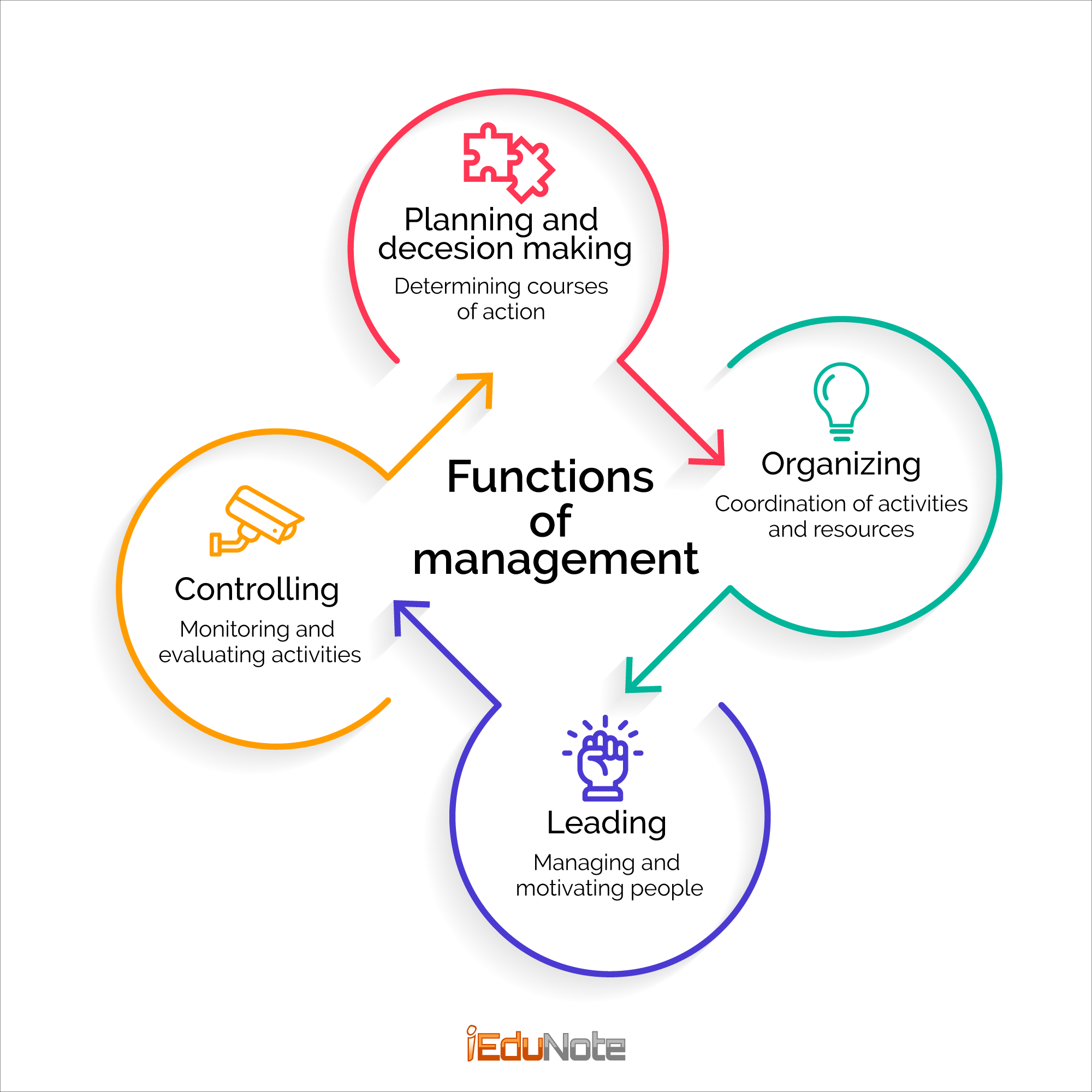

For building a professional management brigade, a bank needs to select an appropriate organizational structure to do its activities. The process of bank management is described below as a circle. But the management process starts from planning, followed by organization, coordination, motivation, and control. Ideal management can be ensured by the proper coordination of all these elements.

According to Peter F. Drucker, “The manager has the task of creating a true whole that is larger than the sum of us parts, a productive entity that turns out more than the sum of the resources pul into it.”

Concepts of bank management run in the sequence as under:

Elements in bank management are;

- Planning

- Objectives

- Policies

- Rules

- Strategy

- Communication

- Organizing

- Coordinating

- Motivating

- Controlling

- Reports

- Audit

- Examination

Planning

The bank management process starts with planning. Planning is the activity through which a business firm charts its future course of action. In bank management, planning gives answers to the questions related to a bank as a whole or a particular branch, or a particular work division. These questions can be like

- What role to be performed by a bank, branch, or work division?

- How does a work division contribute to the activities of other work divisions?

- What type of activities is the bank engaged in?

- Is the bank providing any exceptional services?

The second step of planning is to set long-term and short-term goals. One point must be remembered here we are not talking about the separate long-term and short-term planning. Rather a plan with the combination and coordination of body long term and short term goals is considered here.

The long-term goals of banks identify some overall topics, which are achievable in the future. For example

- What will be the optimum scope and size of the bank in some future period of time?

- What type of efforts would be taken to develop new market segments?

- What type of loan assets will comprise the future loan portfolio of banks?

- What will be the size of a specific work division in the future?

Short-term goals of planning describe the targets achievable shortly elaborately. A budget is attached to this part of the planning.

Some techniques and tools are helpful for planning. Management by objective (MBO) is one of those. MBO can not help planning automatically. But in the hand of an efficient bank manager, it acts as a strong and unique tool.

Planning is the activity through which a business firm charts its future course of action. The result of planning is to develop a strategy for utilizing the resources of a business within its projected environment to attain its overall objectives.

Many banks realize the importance of this function and have planning departments staffed with technical personnel. Others do it intermittently.

Objectives

Objectives are goals, and it is toward these results that all activities are directed. Objectives may change over time, but they are looked upon as firm and binding contracts once formulated. Bank objectives are usually stated in short, concise terms and limited to ten to twelve items. A few items from a list of one bank s objectives follow:

- Our business is selling financial services in Oregon and in selected regional, national, and international markets. We will extend our business into areas that provide sound expansion opportunities meeting predetermined profit criteria.

- We will strive for stability in earning growth, acquiring high-quality investments, and pursuing sound and innovative tactics ‘. Through strategic planning and strong management, we will aggressively expand income sources while remaining in control of costs.

- Our primary marketing objective is to increase our market share through superior service and appropriate products consistent with corporate strategic plans.

- Management will provide continuity of policies and directions. Changes will be implemented quickly and in a manner that considers both individual and corporate needs.

- Our objective is to promote people within the organization. However, expansion into new fields and the need for specialized talent may require hiring people from other sources.

- We are sensitive to social and economic concerns and recognize our responsibilities as corporate citizens. We support and participate in activities to improve social and economic conditions.

Policies

After the setting of objectives, the establishment of bank policies naturally follows. Policies are general statements of understandings that are designed to stimulate thinking and action in decision making. An example of a bank policy might involve pricing. Policies assist those people who are concerned with planning.

It is difficult to conceive of the preparation of a budget without the knowledge of the overall policies. Policies also serve as an overall guide or boundaries within which the officers and committees of a bank can operate.

If a set of circumstances arises, the bank has a policy or a determined course of action upon which it can rely for guidance. The policy acts as a coordinating force to call forth group effort Policies may appear in the minutes of the board of directors or standing committees or the manual of the organization.

Rules

Rules should not be confused with policies. A rule requires that specific and definitive actions be taken or not taken for a given situation. A bank may require that a corporation opening an account provide the bank with a resolution prepared by the firm’s board of directors authorizing certain individuals to sign checks and borrow funds. This would be a rule.

Strategy

Once a bank’s objectives and policies are formulated, the next step is to arrive at a strategy to accomplish these goals and objectives. While objectives represent a subjective choice as to the enterprise’s quality, direction, and pace, strategy is the plan by which a bank can best realize the established objectives.

Communication

One of the problems in any business firm is communicating the established objectives, policies, and rules of operation to all who need them, and banking is no exception.

Rules of operation are essential to banking because of bank regulatory authorities’ many rules and regulations.

Banks’ senior officers are usually in close daily contact, and the knowledge of various developments does not present a major problem. The same is true of lending officers who work closely together and are concerned with specific types of lending, such as commercial and consumer loans.

Communication channels must dept open in branch and group banking organizations and among the numerous clerks, tellers, bookkeepers, computer operators, and others widely dispersed throughout the organization.

Organizing

Organizational structure is the extra strength of hank management under the umbrella of planning. After setting the objectives and rules, necessary components are organized to achieve the goal.

Louis A Allen says. “The process of identifying and grouping the work to be performed, defining and delegating responsibility and authority, and establishing relationship to enable people to work most efficiently together in accomplishing the objectives.”

Earnest Dale says, “Organization is the structural process in which individuals interact for achieving the stated objectives.”,

The main objective of organizational activities is to earn expected profit. Other factors of production can be integrated effectively and efficiently by organizations to achieve the expected goal.

If every person of an organization docs their duties according to the established plan, their combined activities make a bank achieve its goals. If the duty of every person is not defined properly, the organizational activities become slow, confusing, and ineffective.

If what is to be done is unclear, achieving the targeted goals becomes almost impossible. Again without well-defined goals, organizational activities are impossible. We can organize the activities of banks according to types, divisions, geographical areas, floors, etc.

Organizational activities can be defined by the scale of work description and work completion. A manager does all the duties to achieve the goal. But they will be accountable for their work areas. The organizational concept depends on the concept of labor segmentation.

A person should be given proper authority within their accountable work-areas. This is called delegation of authority. Assigned work makes new responsibility to be accountable for the work. Authority docs do not increase or decrease the responsibility which was assigned before. So authority can be delegated, but responsibility and accountability can never be delegated.

By delegating authority, administrative decentralization is made. This decentralization works more when a manager limits the delegated authority by law, rules, moral responsibility, and budget.

The summary is organization is related to a human being. It is created through interpersonal relationships. The nature of human beings influences the organization. So. all the tools and rules for developing human capital in a bank help a manager develop an organizational system.

Coordinating

Coordination means working together. Because group skill is the most considerable issue in coordination, we should also keep in mind that some freedom is essential for creativity.

So the right decision should be taken at in right time through proper coordination. Coordination was due importance in bank management for a long time. Different types of business activities, departments, divisions, and personalities of the organization, if not methodically coordinated, will result in low performance and confusion in implementing planned activities.

When the authority is delivered after an organization is divided into different managerial units, each unit starts to work as an autonomous organization. According to effective planning, a predefined general goal helps organize the activities of different groups of an organization only when properly coordinated.

But if the organizational structure becomes complex, it will be challenging to organize different groups based on general goals.

Every department enjoys some autonomous power and facilities according to the norms of the management process. As every department is a part of the bank, relationship building among the departments is essential for undertaking the right approach in realizing the bank’s goals in general and the unit in particular.

Every bank manager is basically a coordinator, and they play an important role by directing and helping the personnel working under his management area. As a coordinator, they coordinate the work of their subordinates in the group with other groups of the bank or other groups outside the bank.

When a bank manager is assigned with mid-level or lower-level management, he may find it difficult to make a relationship between an unrelated work with their department’s goals. But a manager should motivate his people to coordinate with that work. For ease of coordination, different types of tools are used. Communication is one of them.

In the case of communication, honesty is necessary. The flow of information will be effective if a manager is honest in providing training to their subordinates. Employee and work-schedule coordination ability is the prerequisite of a successful manager. A successful manager adjusts with the personal goal of the employees and the organizational goals through guidance, counseling, and direction.

Motivating

Motivation is the most discussed issue of the bank officials and bank management process. It is the key to employees’ work performance with the required efficiency. Group activities at)d satisfaction depend on it. A human being is the source of their motivation. A bank manager helps to create some stimuli among the employees to be self-motivated.

A bank manager should be concerned about the high ambition of human beings. Work satisfaction is the prerequisite of success. On the other hand, work success influences work satisfaction. Every efficient manager has to find out some ways so that employees can assess their success. There are different ways of self-assessment: for example –

- • Evaluation

- • Appraisal

- • Performance review

- • Merit rating

Each of these has two basic procedures:

- Evaluation for quality improvement

- Evaluation to remove weaknesses

In every organization, such systems should be established, which will help the employees to judge themselves logically. A manager has to use the assessment tools properly. Besides determining the evaluation criteria, banks should ensure a positive & neutral evaluation system to establish efficient management. If the assessment is unbiased and friendly to overcome the weak side of the employees, they will be motivated to work properly.

The prize, honorarium & remuneration, medals, promotion, transfer to preferred place, training, travel and lours, etc., are some tools popularly used to raise motivation. A good reward system is necessary to encourage and acknowledge the contribution of self-motivated managers.

Most people want success in their professional life. So an efficient manager gives freedom to subordinates to reach a better position because they know that the highly skilled employees may change the job to achieve more professional development and reach a better position.

In this way, managers try to improve the employees’ work efficiency by giving them the freedom to reach better professional positions. Effective motivation not only raises productivity but also reduces employee turnover to a great extent.

Controlling

Of all the functions of management in banking, probably the most thoroughly executed is controlling. The reason stems from the role that commercial banks play in our society.

Banks, more than any other industry, rely on public confidence. Banks hold the bulk of the cash balances of the nation and are closely regulated by bank regulatory agencies that have spawned a multitude of rules and regulations. High standards and accuracy are expected of them.

Reports

There are many avenues for control in commercial banks. Banks are noted for the multitude of information systems made possible by the computer age and the consumption of tons of paper. There seem to be reports available on every function.

Audit

Many banks have an audit department that does not normally employ an outside accounting Finn to perform a periodic audit of the bank. Auditing is concerned with reviewing transactions for accuracy and determining whether such transactions have been recorded in conformity with accepted accounting principles and banking regulations.

Examination

Excellent external control is the bank examination. Federal and or state regulatory authorities usually examine a bank once a year and those in financial difficulties more often.

Conclusion: Basis of all Round Management

To achieve the specific goals, managers of hanks must be efficient. The accuracy of decision-making must be ensured to reach the goals by focusing on the past, present, and future. This requires appropriate knowledge and personality.

Appropriate knowledge is enhanced in the light of relevant education, training, and experience. That’s why philosopher Socrates emphasizes the gathering of knowledge. But according to Einstein, only knowledge is not sufficient for success.

Rather, and imaginative capacity is also highly required. A bank manager must focus on earning appropriate profits for the shareholders.

Efficient bank managers take every decision in the context of present and future potentiality. They cannot overlook the interest of the stakeholders. It must be remembered that there are no alternatives for achieving a bank’s success without efficient and quality service.

It must be mentioned that business people are not the only customers for banks in society. Other service-related people are either depositors of borrowers or both.

On the other hand, there are different types of business customers. Some are producers, some are sellers, and some are consumers. These businessmen are the owners of the big, medium, or small business houses. The bank manager should keep good relations with every kind of customer to perform the transaction for success.

One successful bank manager must keep positive relationships with every customer. To build stable good relations, the bank manager should know some useful information about their client, if not all but something.