Deposit is the main component of a bank’s funds. The existence of a commercial bank is impossible in the absence of deposits. So, every bank expects that deposits will be a sufficient and safe flow of deposits will remain smooth.

What is Bank Deposit Management?

Changes and different mixtures in economic and commercial activities make deposit management a challenge to bank managers. The diversity of transactions among the money market and capital market participants continuously influences bank deposits.

It is mentionable that some years ago, the amount in current deposits was more significant than that of term deposits. But over time, nowadays, term deposits contribute more to the volume of bank deposits.

The amount of deposits largely influences the magnitude of loan and investment activities. A large number of earnings come from bank deposits. Banks try to collect funds primarily through time deposits, often of large denominations.

Bank gives the option to change the clients’ preference of term deposits mainly to increase the advantage and profitability of bank funds. In a nutshell, we can say that deposit management includes all activities related to bank deposits, i.e., volume, mixes, levels, ownership, movements, and the like.

5 Objectives of Bank Deposit

Banks collect deposits mainly from clients to accumulate their investable funds.

5 objectives of bank deposits are;

- Collection of Bank Fund.

- Ensure Productive Investment of the Scattered Savings of the Clients.

- Extending the Scope of Loan.

- Fulfilling the excess need for money.

- Maintaining social responsibility.

1. Collection of Bank Fund

When we say “commercial bank,” the image of deposit collection and loan sanction comes into our mind. Bank collects interest income from the loans sanctioned.

To raise the extent of such income, the bank has to attract deposits as much as it can. Actually, the bank collects deposits to provide the same as loans.

2. Ensure Productive Investment of the Scattered Savings of the Clients

A more or less large number of persons in society have some surplus savings. Banks collect these scattered savings as deposits and invest those in productive fields to facilitate the country’s economic development.

Thus, the small deposits of people, which may be utilized in the day to day activities, are turned into profitable investments with the help of banks.

3. Extending the Scope of Loan

Banks extend loans by collecting deposits. Sometimes, banks offer loans to the depositors in various multiplications, i.e., double, triple, or quadruple their deposited money. Thus, many depositors deposit more money to get loan facilities, eventually increasing the bank loan scope.

4. Fulfilling the excess need for money

Banks provide overdraft facilities, which means the opportunity of withdrawing more amounts than deposited. Usually, business persons can avail of this opportunity to be offered by the banks from the deposits mobilized.

5. Maintaining social responsibility

On behalf of the clients and institutions, banks perform various service-oriented activities. For example, discounting bills, paying insurance premiums, paying electricity bills, etc.

To avail of these services, people often keep deposits in the banks. So mobilization of deposits helps banks render some social responsibility.

Factors Determining the Bank’s Level of Deposits

The level of deposit is one of the determinants of a bank’s or its branch’s performance. The level of deposit means how much deposit is collected from the clients, i.e., the size of the deposit amount collected by the bank is known as the level of deposit.

- If the relative deposit amount is high, the bank or the branch is called an A-level bank/branch.

- If the relative amount of deposit is medium, the bank or the branch is called a B-level bank/branch.

- And if the relative amount of deposit is low, the bank or the branch is called a C-level bank/branch.

It will be clear from the following example:

| Levels | Amount in Millions of $ (for the bank) | Amount in Millions of $ (for the branch) |

|---|---|---|

| A-Level Bank | $1000 Million and above | Above $500 Million and above |

| B-Level Bank | Above $100 Million to below 1000 Million | Above $50 Million to $500 Million |

| C-Level Bank | Below $100 Million | Below $50 Million |

From the above table, we can easily understand that bank itself/ any interested agency can rank a bank based on the deposit level. However, existing and potential clients give weight to prefer to select or change a bank based on the level of deposits and quality of the service.

Clients assume that the higher the category of bank/ branch better the possibility of having professionals posted, thereby better the quality of service possible. Besides, the employees enjoy different incentives based on the level of deposits, i.e., the size of the bank.

In this market economy, private banks motivate their employees by providing them an allowance, performance bonus, car, and other facilities.

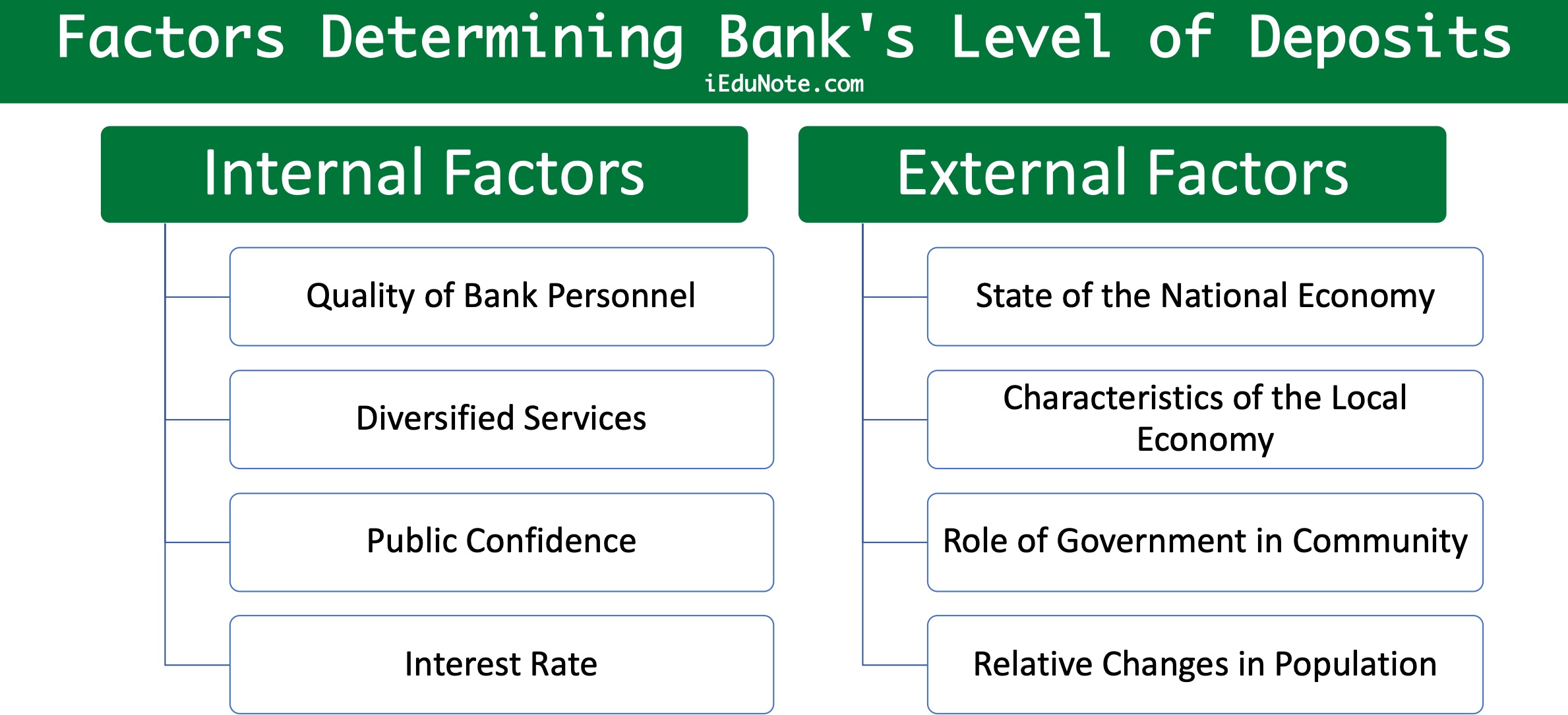

The level of deposit is determined by some internal factors that the bank or the bank’s employees. The deposit level also depends on external factors over which the bank or its employees have no control.

4 Internal Factors Determining the Bank’s Level of Deposits

Banks or branches of banks emphasize internal factors to attract depositors. Internal factors are described below:

- Quality of Bank Personnel

- Diversified Services

- Public Confidence

- Interest Rate

1. Quality of Bank Personnel

If a bank’s personnel utilizes their knowledge and experience properly, depositors will certainly be satisfied with them. Employees with professionalism and social skill can attract more deposits.

2. Diversified Services

At present, banking businesses are very much competitive. If the bank takes the initiative to implement attractive products both for deposits and loans through newer & acceptable projects, the volume of deposits will increase.

So. diversified services and projects are acting as an important variable determining the level of deposit.

3. Public Confidence

Depositors want to deal with such a bank worthy of confidence, reliability, and acceptance by all. We notice that people deposit money for their safety.

But depositors may lose confidence in the bank if there is any bankruptcy probability. So. banks should focus on building the public’s confidence by exhibiting financial and professional strength through which more deposits can be attracted.

4. Interest Rate

There are different types of deposits in a bank. Bank provides a certain rate of interest on that deposited amount. The interest rate may increase or decrease at the end of time. The public will be interested in depositing their money if the interest rate is high. As a result, the volume of deposits will also increase.

For this reason, interest rate determination has a strong influence in 4 determining the level of deposit.

4 External Factors Determining the Bank’s Level of Deposits

- State of the National Economy

- Characteristics of the Local Economy

- Role of Government in Community

- Relative Changes in Population

1. State of the National Economy

A bank deposit is related to the economic condition of a country. If the economic condition is good, the volume of deposits will increase; if it is bad, the reverse effect will occur.

2. Characteristics of the Local Economy

The volume of deposits depends on the location where the banks or their branches are situated. If the region where the bank is established is economically sound, then the deposit volume will increase.

3. Role of Government in Community

Suppose the government takes initiatives to develop the economic condition by developing and implementing community projects. In that case, the income of the people will rise, thereby increasing the level of deposits in the bank.

In this way, if government facilitates the business or industrial production, gross domestic product (GDP) and national income will increase, eventually ensuring social development. Again, social development will increase the number of transactions in a bank, which will increase the number of deposits.

4. Relative Changes in Population

People migrate from one place to another for different reasons. If the population is smaller in size, the number of transactions will be lower.

On the other hand, if the population size is relatively larger, the number of transactions will definitely increase. The volume of deposits will also be large in a place where the population is large.

Factors Determining the Level of Deposits of the Commercial Banking System

In the commercial banking system, the deposit amount depends primarily on loans and the pattern of investments by banks. If banks do not involve lending and investing activities, they will keep their clients’ money deposits.

In this case, the source of the bank s income will only be service charges, commissions & brokerage, etc.

But nowhere in the world is it observed that banks collect deposits but don’t engage in loan-providing activities. That is, no commercial bank conducts its operations without both loan and investment activities.

Some portions of the funds are collected from the depositors and are kept as Statutory Reserves, and some portions are kept in the banks to meet liquidity needs.

Thus, banks determine their loanable funds.

By increasing or decreasing statutory reserve, the open market operation, bank rate, and discount rate, the government says the central bank expands or squeezes the supply of deposits/credits in the economy.

For example, if the total deposits of A-Commercial Bank become $200 million. 5% SLR should be kept, and if 20% is needed to fulfill daily liquidity requirements, then A-Commercial Bank can invest or lend 75% of its deposits, which is $150 million.

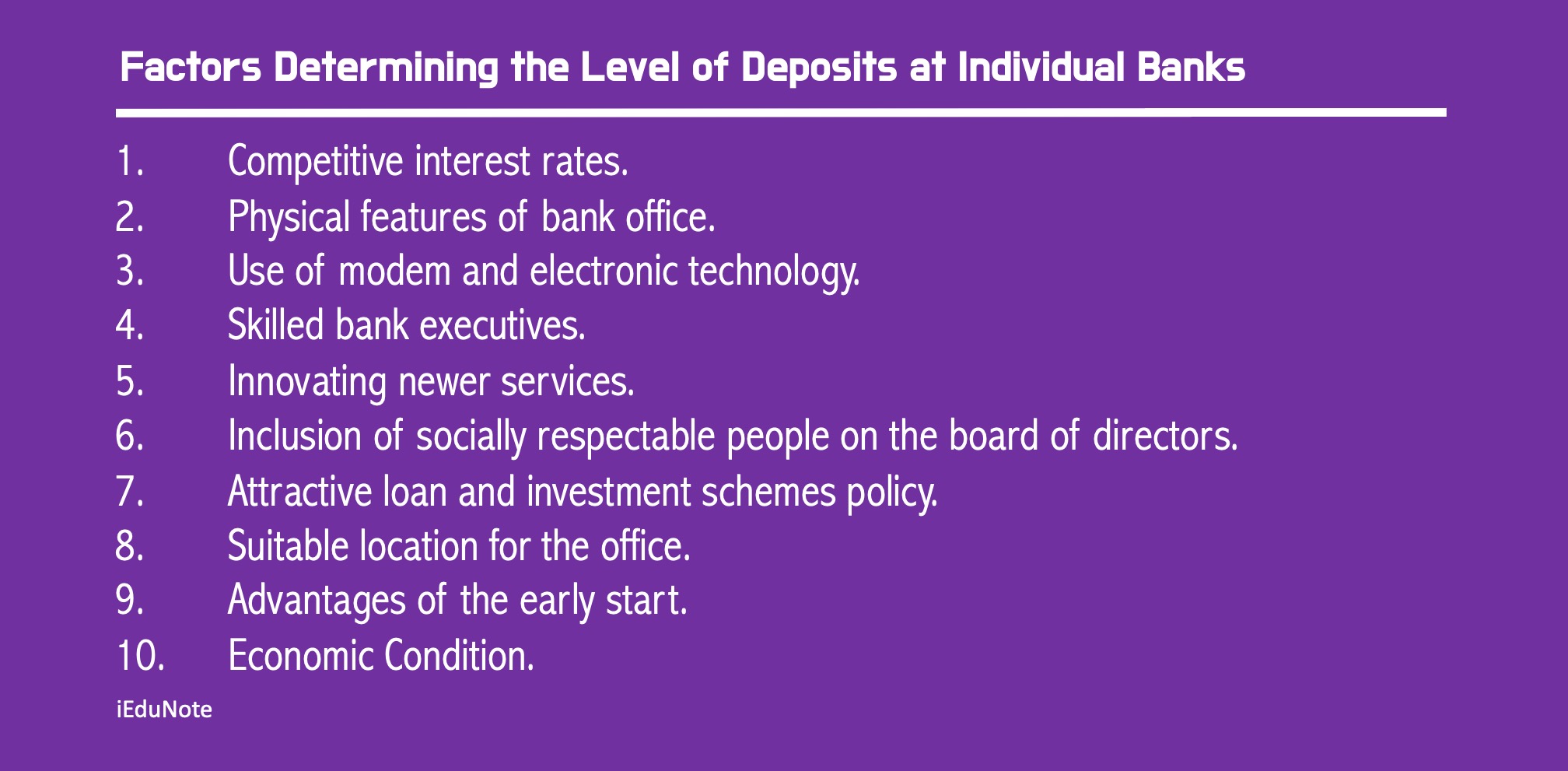

10 Factors Determining the Level of Deposits at Individual Banks

Banks cannot collect deposits as much as they want. Many factors influence the level of deposits in the banks:

- Competitive interest rates.

- Physical features of bank office.

- Use of modem and electronic technology.

- Skilled bank executives.

- Innovating newer services.

- Inclusion of socially respectable people on the board of directors.

- Attractive loan and investment schemes policy.

- Suitable location for the office.

- Advantages of the early start.

- Economic Condition.

1. Competitive interest rates

Fluctuation of interest rate on deposits acts as the tool for attracting deposits. In some countries, government, more specifically, the regulatory authority of the money market, fixes the rate to a certain level.

On the other hand, in countries with the freedom to select any interest rate or countries with a fixed range of interest rates, banks depending on the professional quality, attract deposits from other banks or new deposits by assuring relatively higher interest rates.

2. Physical features of the bank office

In this competitive world, the banks are nicely decorated and well furnished, attracting more attention from the depositor clients. The more attractive the physical looks & logistics of the bank building, the more depositor clients will be available for that bank.

3. Use of modem and electronic technology

Modem technology like computers, ATMs, EFTs, and automated book-keeping facilities guarantees better service and draws more deposits.

4. Skilled bank executives

Banks employ efficient and eligible employees to raise the service standard, which raises the impression and is acceptable to the clients with ample confidence. Skilled bank executives help ensure the service standard and increase the number of deposits.

5. Innovating newer services

By innovating newer projects/deposit schemes and developing a newer horizon of services, Kinks can encourage clients to come to the banks with increasing deposits. To avail of these newer services, depositors open new deposit accounts in the banks, as a result of which the amount of deposits increases,

6. Inclusion of socially respectable person on the board of directors

If the respected persons in the society become a member of the board of directors of the bank, people do logically have much confidence that eventually helps to increase the number of deposits of the bank

7. Attractive loan and investment schemes policy

Banks can increase their deposits by keeping pace with the demand of time and introducing new products and schemes for financing according to the changed needs of the depositors. Newer loans and investment projects undertaken by banks can attract newer customers to the business banks.

8. Suitable location for the office

A major portion of the deposit of banks depends on the location of the banks. Where many transactions occur or many clients come, the probability of collecting newer deposits increases. Depositors expect to share their banks at the nearest locations.

So, the banks operating in the business centers can attract more deposits than banks in other locations with no or low economic activities.

9. Advantages of early start

The earlier the bank can open a branch in a locality to take the first-mover advantage, the more deposits it can attract. Old banks gain more attention from clients and attract more deposits because of being early starters.

10. Economic condition

The increase and decrease in deposits depend on the economic condition of the country and the command area in particular. In a “bad” economic situation, the number of deposits reduces greed, while in a good economic situation, the number of deposits will increase.

Deposit Mix of Bank

Deposit Mix is the combination of total deposits of the bank with different kinds of deposits. This is very useful to have stable funds for better bank management.

The nature of bank deposit mixes is mainly of three categories:

- Ownership mix of deposit.

- Types of deposit mix.

- Size mix of deposit.

1. Ownership Mix of Deposit

Individuals, business firms, industrial organizations, the government, and foreigners (institutions and individuals) can own the deposits. The pattern of deposit and withdrawal of each owner is different.

So, it is risky to maintain the deposit considering only one kind of depositor. Depending on the ownership, the nature of the withdrawal amount and the number of withdrawals in a certain time interval differs.

So different types of owners help maintain balance in the deposit transactions towards a stable fund for profitable utilization.

Banks can minimize the potential risks by collecting deposits from a diversified segment of the population, like- people with different professions, different governments, non-government organizations, business houses, etc.

2. Types of Deposit Mix

Deposits are of three types- savings, current and fixed deposits. In the case of a savings account, the frequency of deposit and withdrawal are more in number, but the amount is usually smaller. It is just the reverse in the case of fixed deposits.

Banks may face problems if they emphasize only one type of account. But current deposit holders are very frequent in making deposits and withdrawals. Their amount of transactions is observed to be relatively larger.

3. Size Mix of Deposit

Deposits may be small, medium, or large. Emphasis on any single size again may put the bank into a problem. This is the reason why banks manage deposits based on deposit size. Banks give higher importance to the big depositors. Banks also persuade and discourage big depositors from withdrawing a large amount at a time.

Banks offer different incentives for small depositors. Small depositors are persuaded to keep their deposits at a higher level. Banks also take the initiatives to impose legal restrictions on withdrawal in a week by small depositors.

Management of the deposit mix is not a very simple and easy task. Theories or rules and regulations are not so much effective in this case. The bank officials’ ambiguous behavior and indirect advice greatly influence the depositors.

Deposits should be managed by considering all three types of deposit mixes.

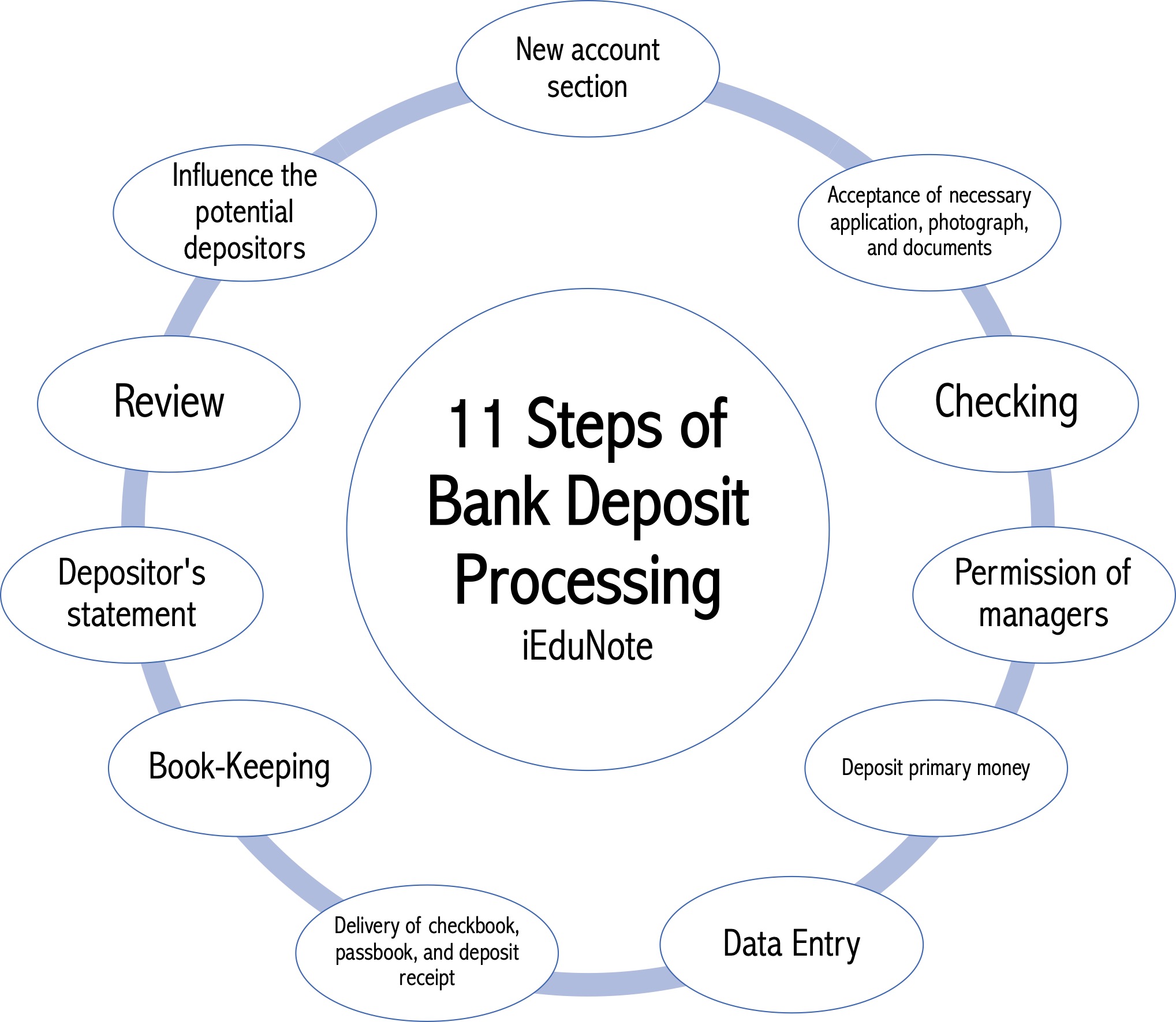

11 Steps of Bank Deposit Processing

Deposit processing starts with opening new accounts and designing all the activities, including the chequing deposits and withdrawals. If we observe, we can see that all the transactions in a depositor’s account are reflected in the books of accounts of the bank.

11 stages of deposit processing are;

- New account section.

- Acceptance of necessary application, photograph, and documents

- Checking

- Permission of managers

- Deposit primary money

- Data Entry

- Delivery of checkbook, passbook, and deposit receipt

- Book-Keeping

- Depositor’s statement

- Review

- Influence the potential depositors

New account section

At the preliminary stage of opening an account, a depositor should be informed about the various types of accounts and the type that will be most convenient and beneficial for them. The depositors should also be informed about the necessary papers.

Acceptance of necessary application, photograph, and documents

The official should collect the necessary documents from the depositors along with Filled-in forms and photographs.

Checking

This department will check whether the documents provided are fake or not. This department also checks for any errors or omissions in the submitted documents and forms.

Permission of managers

After examination, if the documents are proven to be correct, they are sent to the manager. The manager then considers whether the applicant will be allowed to open the account or not.

If the applicant is found eligible according to the bank’s criteria, the manager will permit them to open their desired account with the bank.

Deposit primary money

Some preliminary money is needed to be deposited to open a bank account. Different types of accounts demand different amounts of money. The required amount will be deposited by filling up a deposit slip.

Data entry

At the time of opening an account, a number is allotted for the account. This number is keyed into the computer under which all the information is kept safely.

If and when required, this unique number will help find the information regarding the particular customer. For the customer, all transactions will be performed through the number given in their name.

Delivery of checkbook, passbook, and deposit receipt

At this step, the necessary books, that is, checkbooks, passbooks, and deposit receipts, are given to the depositors to facilitate the banking activities.

Book-keeping

Accounts must be maintained for every deposit account. For each account, a separate ledger page is maintained where each transaction of the depositors is listed.

Depositor’s statement

Bank will send the statement regarding the status of the accounts to the depositors.

Review

At a certain time interval, the bank will review the statements of the depositors to check the status and activity in the depositor accounts. Bank will try to identify the depositors with the “good” category and the “bad or non-operating or dormant” category.

Bank will encourage the depositors with the “good” category and advise the depositors with the “bad” category to improve the status of the accounts.

Influence the potential depositors

The depositors whose transactions are regular and who perform transactions satisfactorily are encouraged with better advice and service.

Conclusion: Collecting Deposits is the First Step in Banking Activities

Collecting deposits is the first step in banking activities. Providing credit or making investments without collecting funds through deposits is unbelievable. There are different steps for collecting deposits.

By following these steps sequentially, banks must manage the depositors’ accounts and submit the deposit statements as of and when demanded. Efficient banks will avoid liquidity crises by maintaining an adequate amount of deposit mix.

In addition, a deposit mix can reduce sensitive deposits and increase stable deposits, thus ensuring more profitable bank funds. More deposits could be collected by honoring the respective depositors with proper service in the shortest possible time. Moreover, some modem electronic banking technologies ensure desired quick and accurate service.

Deposit Insurance is necessary to save small depositors when a bank failure arises. Banks can operate their banking activities with certainty through such deposit insurance schemes.