The loans that borrowers cannot easily recover are called Problem loans. When the loans can’t be repaid according to the terms of the initial agreement or in an otherwise acceptable manner, they will be called problem loans.

Table of Contents

What is Problem Loan?

Problem loans can be considered as sickness for a bank. When a patient suffers from a disease, people try to cure them. In the same way, if a bank faces a problem loan, it will try to take the initiative to prevent it from becoming a bad loss.

The lending process is trust-based and is imperfect by its nature. Credit analysis may be imperfect or based on faulty data, and loan officers may ignore the true condition because of strong personal lies to the bank. A borrower’s ability to repay may change after a loan is granted.

If management concentrates solely on minimizing losses, a bank will make virtually no loan, profits will shrink, and the legitimate credit needs of customers will not be met.

Lenders can’t eliminate risk, so some loan losses are expected. The objective is to manage loss experience so dial the bank can meet its risk and return target.

Loans are classified as problem loans when the repayment or installment payment of the loans has not been made according to the terms of the initial agreement, either for lack of willingness or for a shortage of capacity.

Loans become problem loans as a result of many factors. Such as:

- The credit analysis may have been faulty because it was based on inadequate information or incomplete analytical procedures.

- Economic conditions may change adversely after the loan is granted, so dial the borrower can’t meet debt service requirements.

- A borrower may choose not to repay.

So problem loans and loan losses essentially reflect the default risk inherent in a borrower’s willingness and ability to repay all obligations.

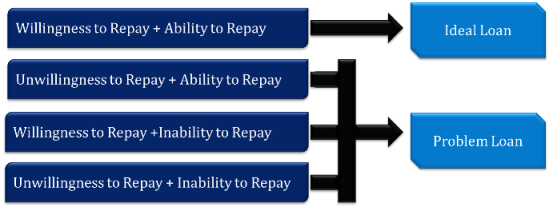

Bank loans can be divided into two categories, such as:

- Ideal Loan.

- Problem Loan.

What is a Problem Loan?

The loans that borrowers cannot easily recover are called problem loans. When the loans can’t be repaid according to the terms of the initial agreement or in an otherwise acceptable manner, they will be called problem loans.

According to the author, “Problem loans refer to those which the borrowers do not return as and when required despite repeated reminders and are not able to show any acceptable reasons for such failure.”

As all of the bank’s loans are not considered ideal loans, in the same way, all of the bank’s loans are not treated as problem loans. Many borrowers have both willingness and ability to repay the loan at the time of taking the loan.

But with the passage of time, both the willingness and ability to repay may be negative, ultimately resulting in problem loans. Let’s consider the following four scenarios:

Loan classification may be shown in the following ways:

- Willingness to repay + Ability to repay = Ideal loan

- Unwillingness to repay + Ability to repay = Problem loan

- Willingness to repay + Inability to repay = Problem loan

- Unwillingness to repay + Inability to repay = Problem loan

The following figure depicts the above-mentioned scenarios:

The willingness and ability of the borrowers to repay the loan may change over time after the loans are made to them. On the other hand, bankers may also make mistakes in the process of lending.

What is a Good Loan?

Good Loans are all banks, darling. Bankers’ lending policy should allow proper in-order to detect problem loans.

As all of the bank’s loans are not considered a good loans, in the same way, all of the bank’s loans are not treated as problem loans.

Some borrowers have both willingness and ability to repay the loan at the time of taking the loan.

Types of Problem Loans

Problem loans can be of 2 types:

- Willful problem loan

- Genuine problem loan.

In the case of a ”willful problem loan”, the dishonest borrowers are inclined to pay off the loan by mere adjustment using political or administrative influence.

On the other hand, a decrease in demand, technical defects, obsolete technology, a sudden accident, or natural calamities are the influencing factors that make a borrower a “genuine problem loanee.”

If these types of borrowers contact the bank when they get their first perception of the problem, the bank may help them recover by changing the loan payment schedule, sanctioning a new loan, or giving specialized advice. In this case, banks can often convert the problem loanee to an ideal loanee.

Indicators of problem loans can be identified by regularly monitoring, reviewing, and supervising the loans.

If banks can timely identify the problem loans and take proper initiatives, problem loans can be converted into regular loans. We should remember that only collateral is not sufficient for the repayment of the loan.

Besides collateral, regular supervision and investigation ensure the soundness and mobility of loans. On the other hand, the recovery of loans with the court’s help can be seen as the last step of the recovery effort.

Because, with the help of loopholes in the law, dishonest lawyers defer the decision of the court. So, the recovery effort of the probable bad loan through discussion, solicitation, and negotiation is expected to be beneficial for the bank.

Difference Between Problem Loans and Good Loans

| Points of Difference | Good Loans | Problem Loans |

|---|---|---|

| Meaning | Repayments made on time | Failed to make repayments on time and identified as defaulters |

| Quantum of Loans | Generally, the lion share | Generally, not more than one-fourth of the total loans |

| Repayment Schedule | 100% repayment schedule is adhered to, with the approved exception, if any | Partial adherence to the repayment schedule often violates the schedule without the approval of the bank. |

| Nature of Clients | Most of the clients are prime customers | Most of the clients are unknown/nonprime customers |

| Partiality in Sanction | Loans are sanctioned to the right borrowers without any nepotism. | Most loans are sanctioned through favoritism to relatives, friends, recommended ones of powerful persons, and even those who can buy favor from dishonest bankers. |

| Nature of Terms | Mostly traditional and followable | Most of the time, terms and conditions are strict and difficult to follow. |

| Credit Analysis and Identification of Right Borrowers | Loan identification is made through proper credit analysis | Improper and inadequate credit analysis is made; rather, loans are sanctioned in an unusual process. |

| Taking Bold Steps. | Right, and timely steps are taken when necessary. | Pressure from political and other powerful quarters restricts the bank from taking a right and timely steps when necessary. |

| Intensity of Supervision | Minimum and appropriate supervision is applied | Absence of meaningful supervision. |

| Security. | Adequate security offered by reliable clients | A large number of non-reliable clients offers inadequate security. |

| Profit-Loss. | Transactions increase profit | Transactions increase loss |

| Contact/ Communication | Most cordial and cooperative in making communications through letters, telephones, personal visits, etc. | Non-cooperative and difficult to respond to letters, telephone calls and personal visits, etc. |

| Financing Structure. | The capital structure of the borrowing enterprise is well-balanced with an appropriate mix of debt and equity. | Large amounts of loans often constitute the major portion of the capital structure of the enterprise. |

| Ability to stand the effects of natural calamities and adverse economic conditions. | The capital structure of the borrowing enterprise is well-balanced with an appropriate mix of debt and equity. | As they do not remain prepared well ahead to face the negative effects of natural calamities and economic adversities, these enterprises find no way to get out of the problems, and thus crisis is easily caused. |

| Need for taking legal actions. | In case of a difference of opinion in the terms and conditions, the bankers and the borrowers do not usually sit together, rather avoid face-to-face discussion for a mutual settlement and compel the banker to go to court to settle any misunderstanding. | Remain prepared well to face the negative effects of natural calamities and economic adversities. |

Identifying Problem Loans Early

Detecting Problem Loans is for loan officers and other credit professionals who need to understand how to minimize problem loans and deal with them once they surface.

The course is appropriate for junior to mid-level commercial lenders, credit review and credit policy officers, and junior workout officers.

Importance of identifying problem loans early;

- Maintaining the Profitability of the Bank.

- Providing Client Support.

- Saving Lending Institution Image.

Maintaining the Profitability of the Bank

Problem loans must be identified early because they can affect profitability. Repayments with interest are the primary income source of lending institutions. If repayments are not made regularly, the ability to make a profit is severely affected.

Providing Client Support

If the bank can identify a problem loan early, it will take steps to support a client to pay. For instance, the banker may call them and offer them the option of paying part of the repayment immediately and part later.

Saving Lending Institution Image

If the bank is slow to identify and follow’ up on late repayments, it sends a specific message to borrowers. The bank sends the message that it is ‘soft,’ that it will not take immediate action, and that late payment or non-payment is a viable option for them.

To work towards zero delinquency, the bank must avoid this image at all costs”.

Review and Identification of Problem Loans

Generally, regulatory authorities closely and carefully observe the loan collection system of the scheduled banks to minimize the risks to depositors and to ensure the soundness of the whole banking sector of the country.

To increase the quality, banks also take the initiatives to review the provided loans. Member banks are required to submit a quarterly, half-yearly, and annual statement of loan collection and loan in arrears.

Besides, experienced authorized personnel of the bank regulatory authorities frequently visit the bank offices and check the collection of loans and Ioan in arrears.

Regular statements help bank regulatory authorities get a bank’s overall loan situation. In short-term statements, banks can conceal the real condition of uncollected loans by using some unnecessary adjustments.

But in long-term statements, such concealment will definitely be revealed, and bank regulatory authorities can get the real picture of uncollected loan amounts.

The main purpose of bank regulatory authority is to help the bank keep the loan loss at the controllable limit.

Loan review is a special activity of bank regulatory authority related to loan recovery.

By loan review, banks compel the employees in loan activities from the bottom to the top to carefully complete every step of loan activities. As a result, loan collection of the whole banking system remains comparatively good, and banks’ profitability will increase smoothly.

Considerations for Loan Review

The loan review officer must scrutinize every loan file thoroughly to ensure the loan review is true.

This mammoth task is challenging to do with the traditional manual system. But with the advent of computers, the collection and analysis of information with the help of networking has become easier.

However, for loan review purposes, the following factors are needed to be considered:

- The borrowers’ financial condition and repayment capacity.

- Adherence to loan policy.

- Proper maintenance of all the necessary loan documents.

- Accurate compliance with legal and statutory regulations.

- Obtaining reliable securities and ensuring income from the collaterals thereof without any loss.

- Designing and applying realistic profit planning.

Regular and effective loan review does not ensure that all banks’ loans will be collected timely.

But suppose the above factors are properly taken into consideration. In that case, the probability of default loans and bad debt may be reduced greatly compared to the “no loan-review” situation.

Indicators of Problem Loans

If loans are identified earlier as problem loans before they happen, regular monitoring and other measures can prevent them from becoming problem loans.

If the loan can be identified earlier as a problem loan before it happens, regulating monitoring and other measures can prevent it from becoming problem loans.

To identify the “potential” problem loans, we have to know the symptoms of a problem loan. The symptoms of problem loans can be classified in the following way:

- Quantitative Indicators

- Qualitative Indicators

These are shown below;

Quantitative Indicators

- Preparation of irregular and delayed financial statements.

- Refusal of large insurance claims.

- Imbalanced expansion & modernization in improper/premature time.

- Creating hindrances to the main source of income.

- Diminishing deposit balance.

- Excessive increases in inventory.

- Inability to pay the debt of the creditors other than the bank.

- Nop-repayment of the loan installments as add when fell due.

- Repeated requests for refixing the loan repayment dates.

- Entering into big loan contracts frequently with institutions and persons other than the existing bank.

- The continuous decline in the market price of the shares of the borrowing company.

- Repeated application for a short-term loan or bank overdraft.

- Frequent liquidity crisis.

- Sudden rise or fall of large stake deposit withdrawals.

- The factory is operating well below capacity.

- Frequent visit to the customer’s place or business reveals deteriorating general appearance of the premises. For example, rolling stock and equipment have not been properly maintained.

- Showing unusual items in the financial statements.

- Negative trends become evident, such as losses or lower gross and net profits.

- Accounts receivable shows a downward trend.

- Decrease in the volume of sales.

- Cash balances are reduced substantially or are overdrawn and uncollected during normal liquid periods.

- Management fails to take trade discounts because of poor inventory turnover.

- Withholding tax liability bills as taxes are used to pay other debt.

- Excessive cash dividend payouts from reserve funds or even from the capital.

- At the end of the cycle, creditors are not completely paid out.

- Officer’s salaries are sharply reduced.

- Interim results become erratic.

- Changes in inventory are followed by an excessive inventory buildup or the retention of obsolete merchandise.

- Inventory to one single customer increases.

- Concentration changes from a major well-known customer to one of lesser stature.

- The lender permits advances on the seasonal loan to fund other purposes.

- Concentrations are in receivables and payables, and the lender fails to get satisfactory explanations from the company on these concentrations.

- Loans are made to or from officers and affiliates.

- Unable to clean up bank debt, or cleanups are affected by rotating bank debt.

- Improper pricing is detected.

- Investment in fixed assets has become excessive.

- Proceeds from assets sales are used to fund working capital needs.

- The company begins to borrow against remaining unsecured assets.

- A profitable business department/ division is sold or liquidated.

- Increase in large sales discounts or significant sales returns.

- The company is unable to make timely deposits of trust funds, such as employee withholding taxes.

- Regular borrowing is at or near the credit limit, or increased credit lines and borrowing inquiries begin to rise.

Qualitative Indicators

- Sudden death or accident of chief executive of the business

- Avoiding communication with the lending bank.

- Not welcome the loan inspectors in their office.

- The frequent departure of key executives of the borrowing organization for better opportunities.

- The borrower is involved with any complicated suit, the verdict of which may go against him.

- The borrowing organization is not operating smoothly due to some conflicts among the executives and the board members.

- The adverse business situation resulting from war/conflict between the borrowers’ country and suppliers’ country.

- Continuing strike or labor unrest.

- Bitter relationship between borrower and lending bank.

- Deteriorating relationship with the raw materials suppliers.

- Occurrence of theft, fraud, robbery, and/or hijacking in the organization of the borrowers.

- Conflicts among the heirs of the owners of the borrowing organization.

- In-house orders are slow in comparison to corresponding periods in previous years.

- Pretending in the manner that payables are paid.

- Owners no longer take pride in their business.

- Inter-company payables/receivables are not adequately explained.

- Financial reporting is frequently “down tiered” due to changes in financial management.

- Delayed responses of financial transactions.

- Management is unwilling to provide budgets, projections, or interim information.

- Suppliers cut back terms or request Cash on Delivery (COQ).

- The borrower changes suppliers frequently.

- The company loses an important supplier or customer.

- The principals or the company do not know what condition the company is in and the direction in which it is headed.

- The lender overestimates the peaks and valleys in the seasonal loan.

- The company fails to conduct investigations on the creditworthiness of larger receivables.

- The lender finances a highly speculative inventory position in which the owner is trying for a “home run.”

- Product demand changes.

- Distribution or production methods become obsolete.

- The company has overexpanded without adequate working capital.

- The company has grown dependent on troubled customers or industries.

- There have been frequent changes in senior management.

- The board of directors is no longer active in making crucial business decisions.

- Lack of depth in managerial decision-making.

- Management is performing functions that should be delegated to others.

- Financial control mechanisms are weak.

- The company has experienced unusual or extraordinary litigation and events not customarily encountered in the industry.

- Dissatisfied key personnel.

- Surprise losses and significant variances from expected or projected results compared to actual results for several years without adequate explanation.

- Suppliers begin to request credit information late in the selling season, or creditors become unwilling to advance credit.

- Evidence of non-compliance with financial covenants, excessive renegotiation, or broken loan covenants.

- Management cannot or will not explain unusual or complete off-balance-sheet investments.

- Very low or no social capital is built around helpful parties, including competitors.

We cannot pick one as the most important between the qualitative and quantitative indicators of problem loans. That is, both of them provide valuable information to the bank about the problem loans.

But, the bank can easily guess the problem when the client fails to pay the first installment or make repeat requests to increase or defer the installment date.

After getting this preliminary indication, banks may seek information regarding the above-mentioned qualitative and quantitative factors. Then, the bank can be certain about the problem loan.

Causes of Problem Loans

Loans may become of a problem nature for various reasons. If the loan officers of banks properly act, then the chance of problem loans occurring reduces. Mainly there are two types of reasons for which loans become problem loans.

These are:

- Quantitative causes.

- Qualitative causes.

These causes are shown below:

Quantitative causes

- Excessive loan expansion for getting a high rate of profit.

- Ambitious lending of large-sized loans to overpower the competitors.

- Providing loans beyond the repayment capacity of the borrowers.

- Sanctioning loans without adequate collateral.

- Accepting overvalued collaterals above the market price.

- Disbursement of funds before documentation is finished.

- Renewal of large-sized loans without asking for additional collateral.

- Repeatedly asking for loan renewal to avoid overdue interest.

- Inaccurately assessing the capacity of inflow of cash.

- Funds not applied as represented; diverted to borrower’s personal use; no attempt to verify for what purpose money was applied.

- Funds are used out of the bank’s command area.

- Ignoring the overdraft situation as the tip-off to borrowers’ major financial problems.

- Lending against fictitious assets and unaudited financial statements.

- Failure to call a loan or move against collateral quickly when deterioration becomes obviously hopeless.

- Insufficient/improper analyst-of loan proposals.

- Overemphasis on bank profile and growths.

- Loans are given based on transactions rather than net worth.

- Loans are made on the size of the deposit rather than net worth.

- Loans for real estate transactions are based on excessive debt instruments.

- Loans are based on unmarketable stock/shares or bonds.

Qualitative causes

- The repayment plan is unclear or staled on the note’s face.

- Failure to receive or infrequent receipt of borrower’s financial statements.

- Inadequate, professionally capable persons to handle loan cases.

- Sanctioning loans through nepotism and favoritism.

- Loan to a new business with an inexperienced owner/manager.

- Undue delay in realizing loans by selling collaterals for reasons of legal complexities.

- Misunderstanding and failure to follow conventional elements of loan policies are not usually recorded in written form.

- Hurriedly sanctioning loan cases without going through all technical steps to judging Creditworthiness.

- Failure to inspect borrower’s business premises.

- Sanctioning credits are ignoring reports of negative track records provided by other banks and those provided by credit information bureaus.

- Officers not regularly reviewing the loan’s status systematically.

- Analyzing creditworthiness based on incomplete/wrong credit information.

- Technical incompetence in making a thorough analysis of potential borrowers’ particulars.

- Ill-conceived terms placed on loans.

- Unclear and confused legal remedy often encourages wicked borrowers to default.

- Absence or inadequate loan review.

- Absence or inadequate loan supervision.

- Timidity/indifference/reluctance to remind repayment due dates often to the persons in power.

- Loans for speculative business.

- Sanctioning large loans through favoritism on immovable property collateral to non-business persons.

- Loans to borrowers with bad moral character.

- Poor communications with borrowers.

- Sanctioning loans against securities is not currently marketable for reasons of low quality.

- Not regularly classifying Joans based on replayability.

- Arbitrarily allowing repayment schedule not specified in the loan agreement.

How Should Banks Deal with Problem Loans? Handling Problem Loans.

Problem loans can be handled in different ways, such as:

- Taking legal action through the court.

- Preventive Steps by Banks for Handling Problem Loans.

- Curative Steps by Banks for Handling Problem Loans

Taking Legal Actions through the Court for Handling Problem Loans

If a bank finds no way to handle problem loans, it takes legal action to handle them. This can be done in two ways. Such as:

General recovery suit

When the bank finds that the borrower can repay the loan but has no interest in paying, the bank tries to resolve the matter by mutual discussion.

Still, if it fails, the bank goes for a general recovery suit to collect the loan and the expenses of the suit from the borrower. In this case, the borrowing institution pays the amount declared in the verdict.

Recovery suit by liquidation

In this case, the borrowing institution is unable to repay the debt. When the borrowing organization becomes bankrupt, the bank and all the creditors may go for a recovery suit through liquidation.

In this case, the net asset of the borrowing company is smaller than the net claim of the creditors. The court employs a liquidator or receiver. This liquidator proportionately distributes the proceeds from selling the company’s assets to all creditors.

Preventive Steps by Banks for Handling Problem Loans

Preventive steps involve identifying the cause of problem loans and taking necessary steps to control them. These steps are two types –

- General preventive steps.

- Steps for specific problem loans.

However, banks can take the following steps to handle problem loans:

Discussion and advice

At the end of a specific time, the bank asks the borrower for discussion, or the loan inspectors of the bank visit the borrower’s business organization and discuss with the borrower.

At the end of the meeting, if any problem arises on the borrower’s part, the bank will provide appropriate advice regarding that problem.

Arrangement of the new loan

Bank may also arrange a new loan for the borrower to increase the ability to repay the loan.

Additional collateral

Additional collateral is required when the value of the previous collateral has decreased.

Advice for inventory control

In most cases, inventory is either kept in raw materials or semi-finished or finished goods. If the inventory level is higher, a huge amount of money is tied to that inventory.

Banks may advise the borrower to control the inventory level so that much money is not kept idle.

Accountability of the loan officer

Banks must ensure the accountability of the loan officer to their superior. Every loan officer must perform their duty according to the established loan policy. Then, they inform the superior about the progress.

Limit-based loans

According to the loan policy, banks have specific limits for a specific type of loan. The loan officer should not cross this limit.

Discouraging loans to directors

If not mentioned in the loan policy, it is better not to sanction loans to the directors.

Not making loans without proper credit analysis

Banks should not make loans without conducting proper credit analysis.

Collection and preservation of all the documents related to the loan

Before sanctioning loans, all the documents related to the loans must be collected and preserved.

Man supervision and review

If loan supervision and inspection are conducted regularly, and sometimes a sudden visit can be conducted, the borrower will not take any detrimental steps with the loan amount.

Application of warning or advice of the regulatory agencies

Banks need to follow the regulatory agencies’ application of warnings or advice. This will ensure the prevention of the worsening of the credit.

Maintenance of properties

Banks may create awareness among the employees about maintaining the properties properly.

Restrict diversion of loans.

In many cases, dishonest borrowers utilize loans not for the purpose stated in the Ioan agreement but for consumption or other risky investments. By restricting this type of diversion, banks can reduce problem loans.

Curative Steps by Banks for Handling Problem Loans

To control problem loans, banks need to be very careful about the financial discipline of the borrowing organization. Banks can undertake the following steps to get rid of problem loans:

Adjusting financing structure

If the firms use much debt in their capital structure, the bank will encourage them to use more equity financing rather than debt financing.

Additional loan facilities

The bank will provide additional loan facilities to help the firm recover from its present crisis. If the firm can recover now, it will repay its previous loan and this additional loan.

Change of repayment schedule of loan

Sometimes, borrowers may be unable to repay the loan installments according to their cash flow pattern. In this case, if the bank changes the repayment schedule in favor of the cash flow pattern of the firm, most of the problem loan borrowers will be able to make the repayments.

Correction of loan diversion

If banks find that the problem loan is the utilization of loans in the unproductive sector by the borrower, banks need to correct the loan diversion to cure the problem loan.

Exemption or deferment of due installments and interests payment

Banks may exempt or defer the honest and reputed borrower’s due installments and interest payments. This may make the borrower a long-term loan client of the bank.

Rationalization of client’s overhead expenses

Banks may advise clients to reduce their overhead expenses. Banks also guide the problem loanee to reduce unproductive and unnecessary expenses. As a result, the productivity of the loan client will increase, and they will be able to repay the loan.

Advice to merge

The client may be advised to merge with other big organizations to minimize the loss. The combined company may be able to repay the debt.

Advice to temporarily defer modernization and expansion plan

Banks may temporarily advise the organization’s deferring modernization and expansion plan. This will help improve the liquidity position of the client, which will ultimately help repay the loan.

Advice to change the credit policy of the firm

A businessman generally collects raw materials on credit. On the other hand, it may also sell the goods on credit to the agents or wholesalers.

If the term of credit provided is greater than the term of credit taken, liquidity problems for the firm may arise. In this case, the bank may suggest changing the firm’s credit policy.

By changing credit terms, the firm may be able to repay the loan.

Problem loans cause delinquency and loss to the lending institution. Having identified which loans are problematic, the banker needs to do the following:

Create Policies and Procedures for Dealing with Problem Loan

A policy is a set of decisions about how your company operates. Policies are written guidelines that help operations.

Procedures are written instructions that tell staff how to implement policies. Each lender must have its policy for identifying problem loans and dealing with problem loans.

Distinguish Between Can Pay versus Won’t Pay

It is important to distinguish between borrowers who won’t pay and those who can’t. If borrowers can’t pay, bankers waste time and resources sending letters. If borrowers won’t pay, offering soft options wastes time when a more assertive approach would be more effective.

For borrowers who can’t pay, consider the following:

- Find out whether they have relatives or children who can pay.

- Be assertive in finding a source of repayment.

- Be firm and unshakable – borrowers must feel it is not worth missing a repayment.

For borrowers who won’t pay, consider the following:

- Put in place procedures that protect you from these types of borrowers from the beginning of the loan process.

- Get a list of assets upfront so you have some collateral to fall back on if the borrower doesn’t pay.

- Avoid lending to won’t-payers if at all possible.

- Do not get trapped in a cycle of sending letters without the intention to follow up.

- Take legal action earlier rather than later.

- Make quick use of garnishee orders and emolument attachment orders.

- Emolument Attachment Order: An emolument attachment order is a court order obtained by the lender / any creditor, which instructs an employer to deduct from the borrower’s salary monthly until the debt has been settled.

- Garnishee Order: A garnishee order allows the lender to attach money from the debtor’s bank account.

Develop a relationship with the Client Up-Front.

It is worth taking the time to establish a good relationship with the borrower at the beginning of the loan process. This sets the tone for future relations. Lenders need to establish from the beginning that not late.

Prompt and effective follow-up

Some action needs to be taken as soon as repayment is past due. That action needs to be effective in securing the repayment. Procedures should not be devised that waste resources without securing payment.

For example, sending a letter to a rural client, who cannot read, is not an effective procedure. It would be more effective to identify someone who lives nearby to visit the non-payer and secure payment.

Periodic stress testing of loans

Lenders should conduct Periodic stress testing of their loan portfolios to understand the potential risks better. The objective here is to identify those scenarios that could result in severe losses and jeopardize the bank’s financial stability if they did occur.

Stress testing individual loans can serve as a valuable early-warning system to identify those customers most likely to experience financial stress under adverse economic conditions. Stress testing can give valuable insights into potential future losses; identify key areas of risk exposure within the portfolio.

Can Good Loans Become Problem Loans?

Inevitably, despite the safeguards most banks build into their lending program, some loans on a bank’s books will become problem loans.

Usually, this means the borrower has missed one or more promised payments, or the collateral pledged behind a loan has declined significantly in value.

Problem loans lengthen the loan cycle, and the bank misses opportunities to extend loans to many potential customers. Problem loans require close supervision and, in some cases, require legal action.

The bank faces a liquidity crisis because planned cash flows have not come in as scheduled, which may create doubt in the depositor’s mind.

Hence, it is essential to identify problem loans at the earliest and take necessary actions.

Problem loans refer to those which the borrowers do not return as and when required despite repeated reminders and cannot show any acceptable reasons for such failure.

There are different opinions regarding whether or not a loan will be called a problem loan if the borrower has a proper reason for the default.

Some opine that a loan cannot be called a distressed one if the borrower has both the ability and the willingness to repay the loan and will certainly repay it as soon as the reason for default is pulled out. However, the borrower has missed one or more promised payments.

However, if the default is not likely to be removed in the near future, the loan will be called a problem or distressed loan.

If the borrower has both the ability and the willingness to repay the loan, it is called a good loan.