A bank is a financial institution that deals with deposits, advances, and other related services. It receives money from those who want to save in deposits and lends money to those who need it. Different Authors and Economists have given some structural and functional definitions of banks from different angles.

Where the word “Bank” came from

The history of the banking industry is long and vast, and Finance is the lifeblood of trade, commerce, and industry. The development of any country mainly depends upon the banking system. The term bank is either derived from the old Italian word “Banca” or the French word “Banque,” both mean a Bench or money exchange table.

In the olden days, European money lenders or money changers displayed (show) coins of different countries in big heaps (quantity) on benches or tables for lending or exchanging. Nowadays, the banking sector acts as the backbone of modem business.

Definitions of Bank

- Oxford Dictionary defines a bank as “an establishment for custody of money, which it pays out on customer’s order.”

- According to R.S. Sayers, “Banks are institutions whose debts are commonly accepted in final settlement of other people’s debts.”

- According to Peter Rose, a “Bank is a financial intermediary accepting deposits and granting loans.

- According to F.E. Perry, “Bank is an establishment which deals in money, receiving it on deposit.”

- According to Cairn Cross, “Bank is an intermediary financial institution which deals in loans and advances.”

- According to R.P. Kent, “Bank is an institution which collects idle money temporarily from the public and lends to other people as per need.”

- According to P.A. Samuelson, “Bank provides service to its clients and in turn receives perquisites in different forms.”

- According to W. Hock, “Bank is such an institution which creates money by money only.”

Meaning of Bank

From the above definitions, a bank means a financial institution that;

- Feals with money; it accepts deposits and advances loans.

- It also deals with credit; it has the ability to create credit, i.e., the ability to expand its liabilities as a multiple of its reserves.

- It is a commercial institution; it aims at earning profit.

- It is a unique financial institution that creates demand deposits that serve as a medium of exchange, and as a result, the banks manage the country’s payment system.

Finally, we can say that bank is an organization where people and businesses can invest or borrow money, change it to foreign money, etc. or a building where these services are offered.

Who is a Banker? Definition of Banker

A banker is an officer of a bank. In a broad sense, a banker conducts the business of banking. A banker is a person who is doing banking activities or business.

Different Authors and Economists have given some structural and functional definitions of Banker from different angles:-

Dr. H.L. Hart states, “A banker or a bank is a person or a company/carrying on the business of receiving money, and collecting drafts, for customers.”

According to John Bouvier, “A banker is one engaged in the business of receiving other person money in deposit, to be returned on demand discounting other persons’ notes, and issuing his own for circulation.”

According to Richmond V. Blake, “A banker is a private person who keeps a bank; one who is engaged in the banking business.”

From the above definition, we can find the following characteristics of a banker:-

- A banker performs multifarious functions.

- A banker is essentially a man of wisdom.

- He deals with others’ money but with his faculties.

- A banker acts as a depository, agent, and repository of financial advice.

- To be a banker, the company’s main function must be the ‘business of banking.’

Finally, we can say that a banker is an individual employed by a banking institution and participates in various financial transactions, which may or may not include investments.

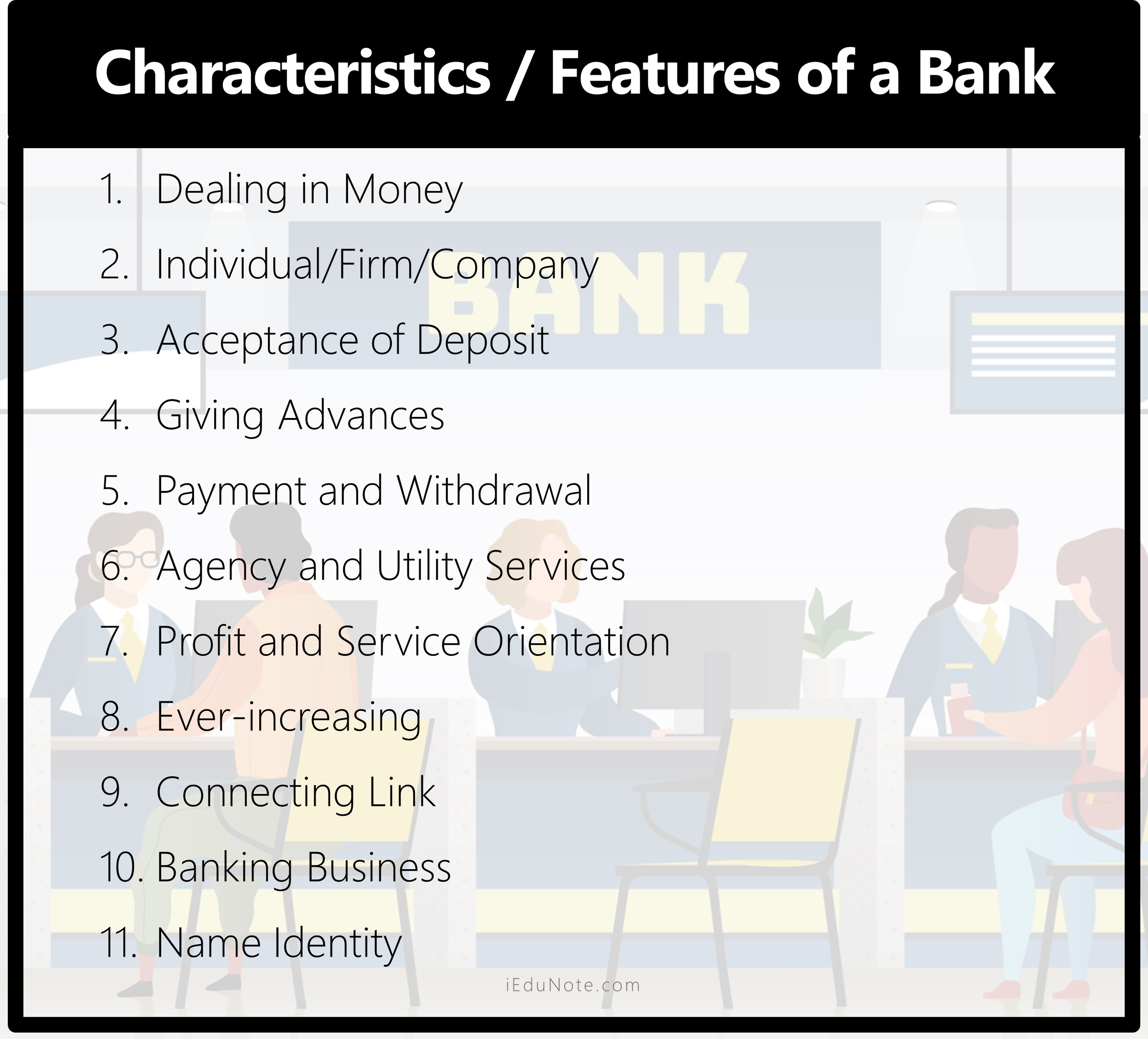

Characteristics / Features of a Bank

A bank is a financial institution licensed to receive deposits and make loans. Banks may also provide financial services like wealth management, currency exchange, and safe deposit boxes.

11 characteristics/features of a bank are;

- Dealing in Money

- Individual/Firm/Company

- Acceptance of Deposit

- Giving Advances

- Payment and Withdrawal

- Agency and Utility Services

- Profit and Service Orientation

- Ever-increasing

- Connecting Link

- Banking Business

- Name Identity

The main characteristics/ features of a bank are discussed below:-

1. Dealing with Money

The bank is a financial institution that deals with other people’s money, i.e., the money given by depositors.

2. Individual/Firm/Company

A bank may be a person, firm, or company. A banking company is a company that is in the business of banking.

3. Acceptance of Deposit

A bank accepts money from people in deposits that are usually repayable on demand or after a fixed period expires. It gives safety to the deposits of its customers. It also acts as a custodian of funds of its customers.

4. Giving Advances

A bank lends out money in loans to those who require it for different purposes.

5. Payment and Withdrawal

A bank provides its customers with an easy payment and withdrawal facility in checks and drafts. It also brings bank money into circulation. This money is in the form of checks, drafts, etc.

6. Agency and Utility Services

A bank provides various banking facilities to its customers. They include general utility services and agency services.

7. Profit and Service Orientation

A bank is a profit-seeking institution with having service-oriented approach.

8. Ever-increasing

Functions Banking is an evolutionary concept. There is continuous expansion and diversification regarding a bank’s functions, services, and activities.

9. Connecting Link

A bank acts as a connecting link between borrowers and lenders of money. Banks collect money from those who have surplus money and give the same to those who require money.

10. Banking Business

A bank’s main activity should be to do banking business that should not be a subsidiary of any other business.

11. Name Identity

A bank should always add the word “bank” to its name to let people know that it is a bank that deals in money.

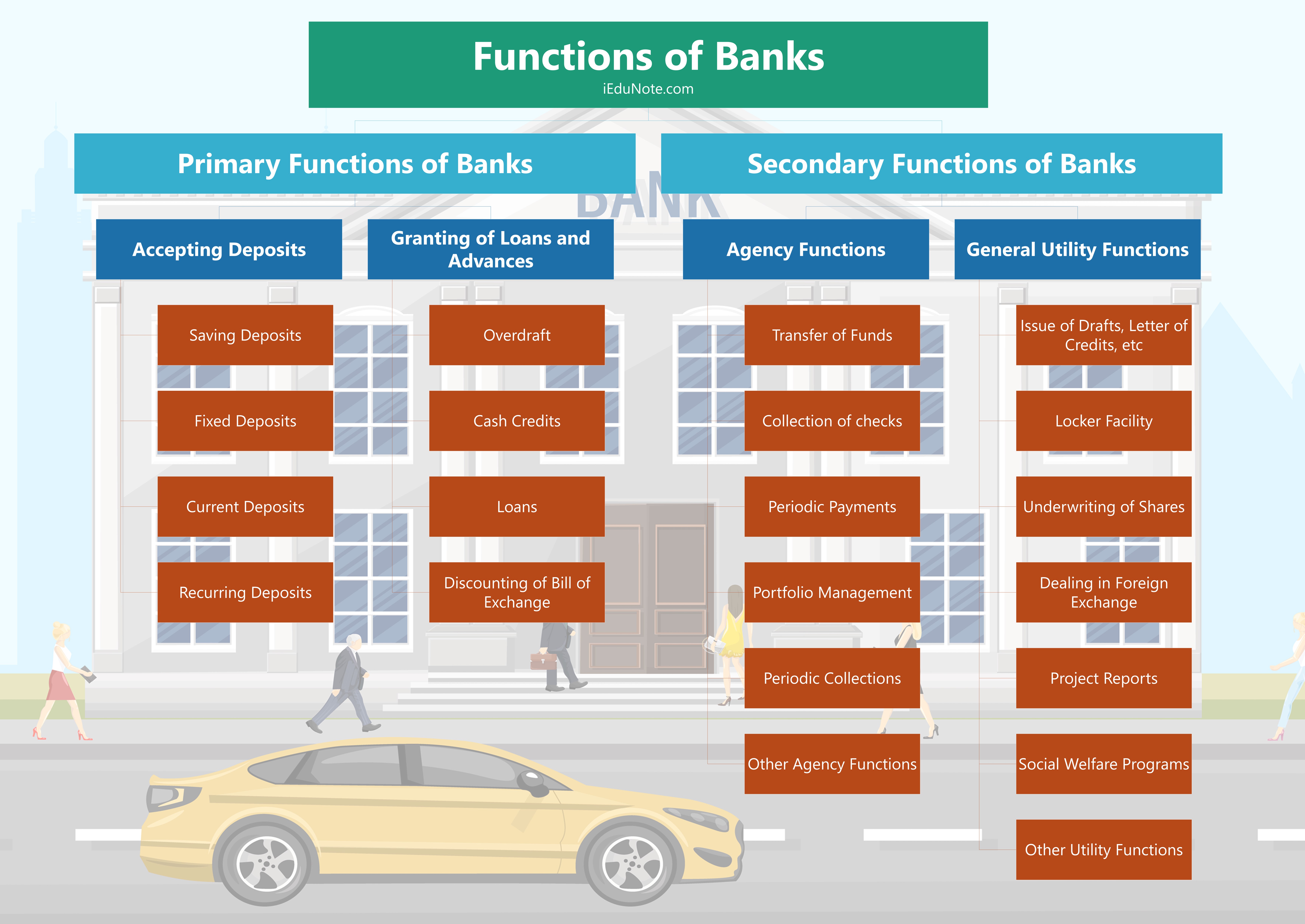

Functions of Banks

The functions of banks are briefly highlighted in the following diagram or chart.

- Primary Functions of Banks.

- Accepting Deposits.

- Saving Deposits.

- Fixed Deposits.

- Current Deposits.

- Recurring Deposits.

- Granting of Loans and Advances.

- Overdraft

- Cash Credits

- Loans

- Discounting of Bill of Exchange

- Accepting Deposits.

- Secondary Functions of Banks.

- Agency Functions.

- Transfer of Funds.

- Collection of checks.

- Periodic Payments.

- Portfolio Management.

- Periodic Collections.

- Other Agency Functions.

- General Utility Functions.

- Issue of Drafts, Letters of Credit, etc.

- Locker Facility.

- Underwriting of Shares.

- Dealing in Foreign Exchange.

- Project Reports.

- Social Welfare Programs.

- Other Utility Functions.

- Agency Functions.

A. Primary Functions of Banks

The primary functions of a bank are also known as banking functions. They are the main functions of a bank. These primary functions of banks are explained below.

1. Accepting Deposits

The bank collects deposits from the public. These deposits can be of different types, such as

- Saving Deposits: This type of deposit encourages saving habits among the public. The rate of interest is low. At present, it is about 4% p.a.

- Fixed Deposits: The lump sum amount is deposited at one time for a specific period. A higher rate of interest is paid.

- Current Deposits: This type of account is operated by businessmen. Withdrawals are freely allowed. No interest is paid.

- Recurring Deposits: This type of account is operated by salaried persons and petty traders. Withdrawals are permitted only after the expiry of a certain period. A higher rate of interest is paid.

2. Granting of Loans and Advances

The bank advances loans to the business community and other members of the public. The rate charged is higher than what it pays on deposits. The types of bank loans and advances are:

- Overdraft: This type of advance is given to current account holders. It is sanctioned to business people and firms. An overdraft facility is granted against collateral security.

- Cash Credits: The client is allowed cash credit up to a specific limit fixed in advance. The cash credit is given against the security of tangible assets and or guarantees. The advance is given for a longer period, and a larger loan amount is sanctioned than that of an overdraft.

- Loans: It is normal for the short term, say a period of one year, or medium-term, says a period of five years. Nowadays, banks do lend money for the long term. Loans are normally secured against the tangible assets of the company.

- Discounting of the bill of exchange: The bank can advance money by discounting or purchasing bills of exchange, both domestic and foreign. The bill is presented to the drawee or acceptor of the bill on maturity, and the amount is collected.

B. Secondary Functions of Banks

The bank performs some secondary functions, also called non-banking functions. These important secondary’ functions of banks are explained below.

1. Agency Functions

The bank acts as an agent of its customers. The bank performs several agency functions, which include:-

- Transfer of Funds: The bank transfers funds from one branch or place to another.

- Collection of checks: The bank collects the checks’ money through its customers’ clearing section. The bank also collects money from the bills of exchange.

- Periodic Payments: On standing instructions of the client, the bank makes periodic payments regarding electricity bills, rent, etc.

- Portfolio Management: The banks also undertake to purchase and sell the shares and debentures on behalf of the clients and accordingly debit or credit the account. This facility is called portfolio management.

- Periodic Collections: The bank collects salary, pension, dividend, and other periodic collections on behalf of the client.

- Other Agency Functions: They act as trustees, executors, advisers, and administrators on behalf of their clients. They act as representatives of clients to deal with other banks and institutions.

2. General Utility Functions

The bank also performs general utility functions, such as,

- Issue of Drafts and Letter of Credits: Banks issue drafts for transferring money from one place to another. It also issues letters of credit, especially in the case of import trade. It also issues travelers’ checks.

- Locker Facility: The bank provides a locker facility to safely store valuable documents, gold ornaments, and other valuables.

- Underwriting of Shares: The bank underwrites shares and debentures through its merchant banking division.

- Dealing in Foreign Exchange: Commercial banks are allowed by.RBI to deal in foreign exchange.

- Project Reports: The bank may also undertake to prepare project reports on behalf of its clients.

- Social Welfare Programs: It undertakes social welfare programs, such as adult literacy programs, public welfare campaigns, etc.

- Other Utility Functions: It acts as a referee to customers’ financial standing. It collects creditworthiness information about clients of its customers. It provides market information to its customers, etc. It provides travelers’ check facilities.

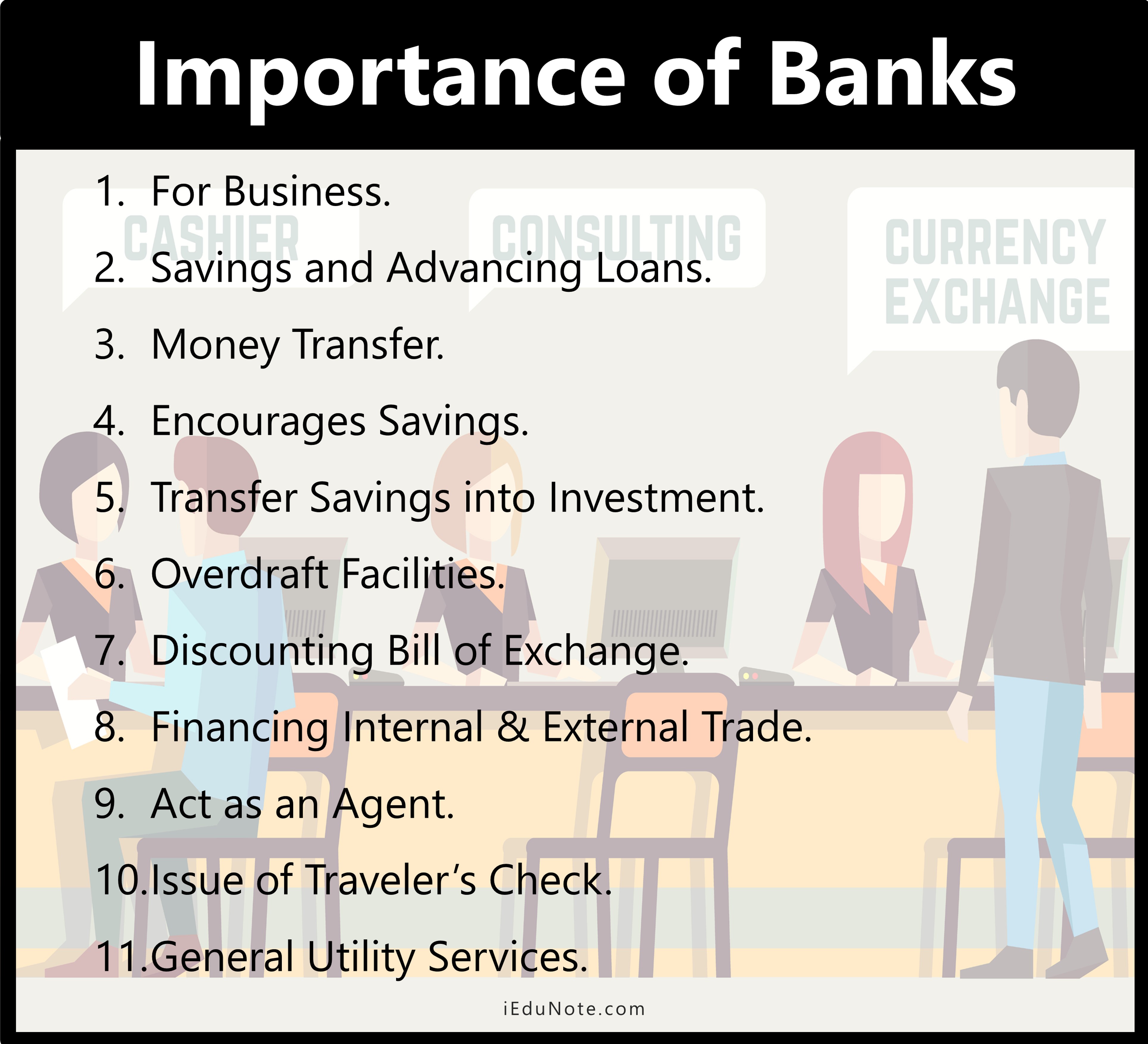

Importance of Banks

Banking plays an important role in financial life, and the importance of banks can be seen from the fact that they are considered the lifeblood of the modem economy.

Although bank creates no wealth, their essential activities facilitate wealth production, exchange, and distribution. In this way, banks become effective partners in the process of economic development and growth.

11 important of banks are;

- For Business.

- Savings and Advancing Loans.

- Money Transfer.

- Encourages Savings.

- Transfer Savings into Investment.

- Overdraft Facilities.

- Discounting Bill of Exchange.

- Financing Internal & External Trade.

- Act as an Agent.

- Issue of Traveler’s Check.

- General Utility Services.

Let’s try to understand these;

1. For business

Based on these important functions of Banks, we may easily describe the importance of banks in today’s global life.

2. Savings and Advancing Loans

Acceptance of deposits and advancement the loans is the basic function of commercial banks.

3. Money Transfer

Banks have facilitated payments from one place or person to another utilizing checks, bills of exchange, and drafts, instead of cash.

4. Encourages Savings

Banks perform an invaluable service by encouraging savings among the people. These savings help in capital formation.

5. Transfer Savings into Investment

Banks transfer the savings collected from the people into investment and thus increase the amount of effective capital, which helps the process of economic growth.

6. Overdraft Facilities

The banks allow overdraft facilities to their trusted customers and thus help them in overcoming temporary financial difficulties.

7. Discounting bill of exchange

The importance of banks can be seen through the discounting bill of exchange. Banks discount their bill of exchange of consumers and help them with financial difficulties.

8. Financing Internal & External Trade

Banks help merchants and traders finance internal and external trade by discounting a foreign bill of exchange, issuing letters of credit, and other guarantees for their customers.

9. Act as an Agent

The bank acts as an agent and helps its customers purchase and sell shares, provision lockers, payment of monthly, and dividends on stock.

10. Issue of Traveler’s check

The bank provides travelers’ checks for the convenience and security of money for travelers and tourists.

11. General Utility Services

The existence of commercial banks is essential for contributing to general prosperity. Banks are the main factors in raising the world’s economic development level.

A bank is a Financial Intermediary.

A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction, such as a commercial bank, investment bank, mutual fund, and pension fund.

Financial intermediaries offer some benefits to the average consumer, including safety, liquidity, and economies of scale involved in commercial banking, investment banking, and asset management.

A bank is one of the major financial intermediaries because banks move funds from parties with excess capital to parties needing funds. The process creates efficient markets and lowers the cost of conducting business.

For example, a financial advisor connects with clients by purchasing insurance, stocks, bonds, real estate, and other assets.

Banks connect borrowers and lenders by providing capital from other financial institutions and the Federal Reserve. Insurance companies collect premiums for policies and provide policy benefits. A pension fund collects funds on behalf of members and distributes payments to pensioners.

Management of Commercial Bank

Management is a universal concept that is necessary for the success of profit-oriented business organizations and non-trading and non-profit organizations such as families, clubs, religious institutions, self-serving organizations, and nationalized institutions.

Banks can be of different types. But from the very outset, “bank” popularly means only commercial banks. Although different types of hanks are found, only commercial banks are the major participants in the hanking world.

For the past thirty years, commercial banks more or less have been performing all types of activities of specialized banks, more or less. The usual activities of commercial hank and specialized banks are almost the same.

For example, commercial and specialized banks may also take money as a deposit, but sometimes specialized banks are engaged in collecting government long-term debt funds.

On the other hand, commercial banks make a profit by selling services. In the same way, specialized banks are also engaged in debt offerings.

So. we can see that, though specialized banks are established for the development of the specific sector, there is no basic difference between these in the context of banking activities.

Deposit is the Blood of the Bank, and the bank is the blood of the country’s economy.

Money can be compared with the blood of the bank.

As long as blood remains in circulation, all the organs in the body will remain sound and healthy. If blood is not adequately supplied to any organ or part of the body, that part will be starved of nutrients and oxygen and become useless.

In the same way, as long as money remains in circulation, all the banks in society will remain economically sound and healthy. If money is not adequately supplied to the bank, it loses its existence in society.

Similarly, a bank can be compared with the blood of society.

As long as all the banks remain economically sound and healthy, society will gradually develop toward prosperity and solvency.

So, in reality, the deposit is the blood of a Bank, and the bank is the blood of a country’s economy.

Conclusion

Stephenson & Britain defined banks as “Banks are the custodians and distribution of liquid capital, which is the lifeblood of our commercial and industrial activities and upon the prudence of their administration depends on the economic well-being of the nation.”

A bank is a financial institution that collects society’s surplus cash and gives a part of that as a loan to investors to earn profit. So, a bank is an intermediary institution that makes a relationship between the owner of surplus savings and the investor of deficit capital.

The bank is an institution that is registered by the central bank and mainly performs the following activities;

- receives the current deposit and gives the withdrawal facilities to clients through a check

- receives a term deposit and pays interest on it

- discounting notes, approving loans, and investing in government and other credit instruments

- collect the check, draft, notes, etc.

- issue draft and cashier’s check

- notification of depositors’ check

- act as a trustee following government permission.

We knew before that a bank is a blank doc. These activities of banks are changing with the change of time. Logically, banking activities will change with the change in culture, time, and perception of people in a country. So, it isn’t easy to give a valid & precise definition that fits all situations.

In this process, banks earn profit by receiving interest from borrowers who want to take short-term or long-term loans and make relatively lower interest payments to the depositors to provide their funds for use by the bank.

Banks are using various types of credit products to honor the demand of time. In this way, the risk associated with using paper currency or metallic coins is properly managed.