Credit analysis is the process of evaluating an applicant’s loan request or a corporation’s debt issue to determine the likelihood that the borrower will live up to his/her obligations. In other words, credit analysis is the method by which one calculates the creditworthiness of an individual or organization.

Let’s Understand All Aspects of Credit Analysis.

What is Credit Analysis?

Credit analysis involves various financial analysis techniques, including ratio and trend analysis, the creation of projections, and a detailed analysis of cash flows.

Credit analysis also includes examining collateral and other sources of repayment and a credit history and management ability. Analysts attempt to predict the probability that a borrower will default on their debts and also the severity of losses in the event of default.

By credit analysis, we mean analysis of the eligibility for getting a loan in the light of applications.

At the time of credit analysis, the loan officer should carefully examine the logic and purpose of the credit. Extending credit without analyzing the applicant and the loan applied will be very risky.

Any lacking in the analysis process or when the analyst’s capability is not up to the mark, credit analysis will turn in vain.

Eligibility in getting loans;

- History of the past loan transaction data

- Ability to use a loan and the characteristics of the potential borrower

- Ability to repay the applied loan amount

- Amount of capital to support any contingencies

- Influence on the repayment ability by the domestic and international economic condition

- The presence of any risk factors that may make him a defaulter by interfering with the cash flow stream

3 Steps of Credit Analysis

1. Steps During the Information Collection Stage

Collecting information about the applicant

The first step in credit analysis is to collect information about the applicant regarding his/her record of loan repayment, character, individual and organizational reputation, financial solvency, ability to utilize the load(if granted), etc.

The bank may inquire into the transaction record of the applicant with the bank and other banks. The repayment history of loans previously granted may also reveal useful information in this regard.

It requires the collection of information from the past. It presents financial statements of the business provided by the applicant.

Whether involved in any forbidden activities such as gambling, drinking habit, or any other unethical affairs, analysis of the personal characteristics is also focused on in this step.

Collecting information about the business for which a loan is required

The loan officer should know the purpose of the loan, the loan amount, and if it is possible to implement the project with that amount. The banker should make sure the project is feasible. The project must have good potential, and the applicant must have a good plan to execute the project.

The bank should know the purpose of the loan, the amount of the loan, and whether it is possible to implement the project with that amount. Collecting information about the sources from which the borrower would repay the loan is essential.

The loan officer should also collect information if the borrower took any loan before and the present condition of that loan and know the asset’s market price that the borrower is willing to pledge against the loan.

Collecting information about the recovery process

The loan officer should collect information about the sources from which the borrower would repay the loan. Information for this purpose may include the profitability of the project, the payback period, the sensitivity of the project cash flow to different economic factors, etc.

- Assessing the overall political and economic risks

- Identification and give explanations for the positive and negative factors in conducting the business

- Evaluation of the positive sides of cash inflow and its possible stability in the light of the historical demand of the business

- Consider the future consequences and need for investment in light of the applied loan proposal and repayment assurance.

- Evaluation of the impact on the balance sheet of the borrowers after using the loan

- Assessing the possibility and the extent to which change occurs in the risk level previously measured

Collecting information about the security

Banks, most often than not, lend money against personal and non-personal securities. A bank would always prefer getting the loan repaid by the borrower to realizing the loan from the sale proceeds of the security.

However, should the borrower defaults in repaying the loan, the lender will have to fall back on the security. Hence, it is always advisable to know information like price stability and security before advancing the loan.

Collecting additional information if necessary

When the loan under consideration is for a large amount, a bank may find it necessary to gather additional information like the overall business activities in the economy, the probably political and economic condition of the country, efficiency and candidness of the management team, likely effect of local and international competition on the project, etc.

- Collection of detailed descriptions of the proposed loan.

- Collection of detailed information about the loan applicant.

- Collection of the growth of business activities of the loan applicant.

- A detailed description of the general financial objectives and plans of the business.

- Collection and evaluation of other related information in this regard.

2. Steps During the Information Analysis Stage

Analyzing the accuracy of information

The information given in and along with the application is analyzed to judge their accuracy.

In this regard, the analyst would scrutinize the national identity card, driver’s license, trade license, partnership deed, corporate charters, resolutions, and other legal documents attached to the application.

- Inspection of the proposed business location

- Collection of detailed information regarding profit earnings from- the existing bank clients and other parties related to the business

- Inspection of the internal working environment of the business

- Analysis of the information regarding trading (selling/ purchasing) and the availability of getting credit opportunities from the suppliers (Trade Credit), and the relationship with the suppliers

- Analysis of the audited financial statements

Analyzing the financial ability of the applicant

In this stage, the financial ability of the applicant is taken into consideration. The financial solvency of the applicant and his skill and capability are important factors in this regard.

The analyst works out different financial ratios from the past, proforma income statements, balance sheets, cash flow statements, and other applicants’ financial statements and analyzes them to conclude their financial ability.

- Analyze the honesty, integrity, sincerity in an individual, and overall sense towards the proposed business on the owners, employees, staff, and laborers.

- After considering the success of the management of the business, the loan officer should examine the intention to repay the loan.

- Analysis of the possible political and economic risk.

- Identification and measurement of positive and negative aspects in conducting the business.

- Evaluation of the operational possibility in consideration of the proposed loan.

- Identify the sources and uses of the proposed loan project’s future cash inflow and outflow.

- Determination of demand for working capital at present and shortly.

- Assessment of secondary safety of the collateral and surety.

Analyzing the effectiveness of the project

One aspect of credit analysis is the analysis of the quality, purpose, and prospect of the project for which the loan has been applied. The banker will be at ease to grant loans if the project is productive, expandable, and of course, profitable.

On the other hand, if the project is in a declining stage, is up against intense competition, or is confronted by adverse conditions, the bank is likely to be reluctant to grant any loan.

- Determination of the explicit or implicit risk levels of the proposed loan.

- If the level of risk is beyond acceptable, then the loan proposal should be closed with a negative comment.

Analyzing the possibility of loan repayment

The analyst looks at what effect the proposed loan will have on increasing the liquidity and income of the applicant.

The net cash flow is a good indicator of the ability of the applicant to repay the loan along with interest and other expenses within due time.

An analyst may also be interested to see the interest burden and fixed charge burden of the applicant.

- Determination of the loan types, duration of the loan, and amount of interest in light of risks associated with the loan.

- The loan analysis process should be stopped here if the terms and conditions for the applied loan are not acceptable.

- Get approvals from the appropriate loan sanctioning authority.

- Sit for discussion with the borrowers about the acceptable conditions of the loan.

- Preparation and maintenance of necessary documents for the permitted loan.

3. Decision-Making Stage

Depending on the analysis, the analyst identifies and measures the credit risk associated with a loan application and determines whether the inherent risk level is acceptable.

Suppose the analyst is satisfied with the acceptable risk and is convinced that the loan will be repaid. In that case, he/she prepares and submits a recommendation to the appropriate loan approval authority for sanctioning the loan.

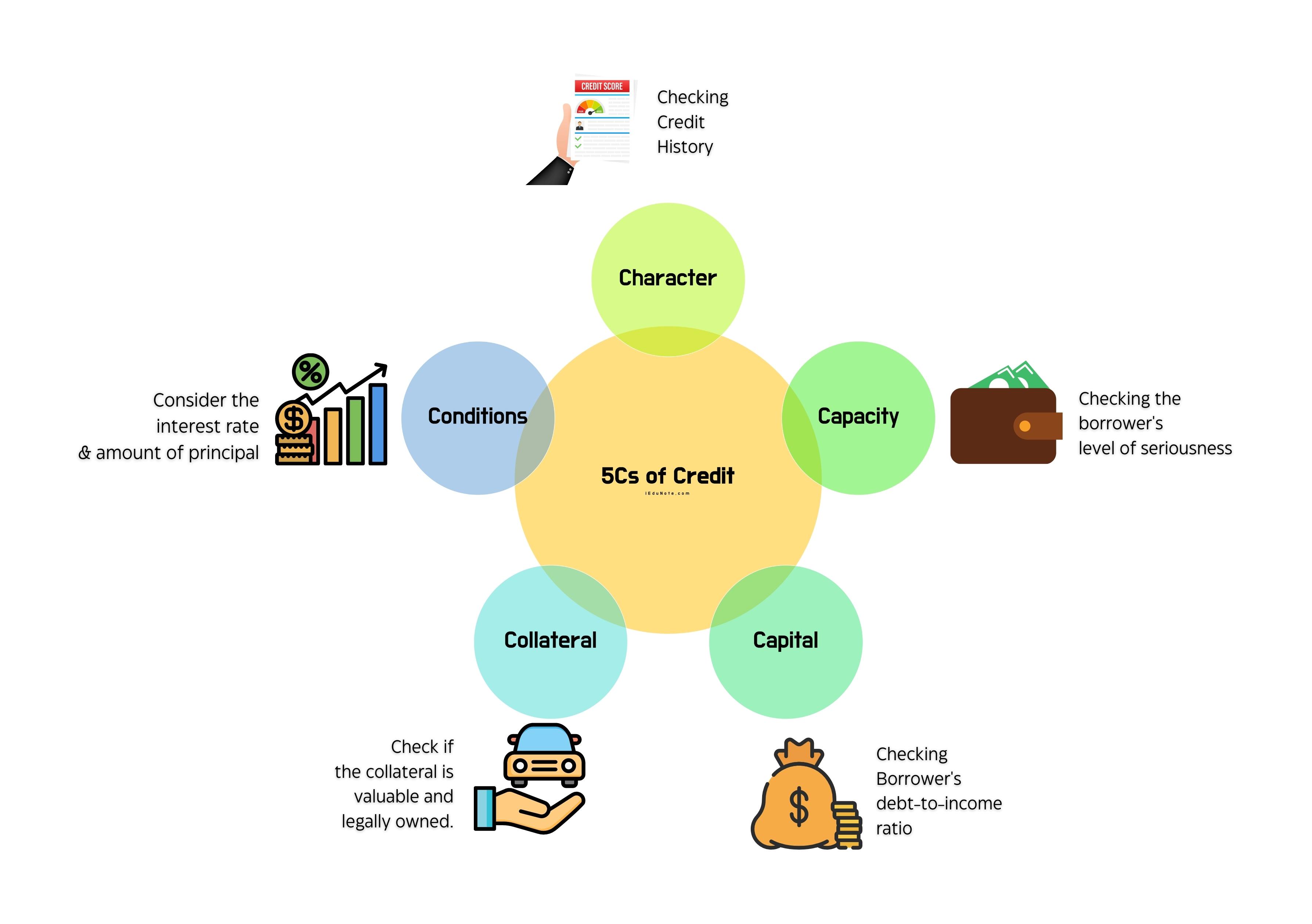

What Are The 5Cs of Credit?

Banks must do a credit analysis before giving the loan, and the 5 Cs of Credit is a good way to understand the potential of a loan application.

Credit analysis covers analyzing the borrowers’ character, capacity to use loan amount, capital condition, objectives of taking the loan, planning for uses, probable repayment schedule, etc.

Loan activity is one of the risky functions of a bank. This is risky because a major portion of the loanable fund is the depositors’ money.

5 Cs of Credit are;

- Character

- Capacity

- Capital

- Collateral

- Conditions

Character

Character (credit character) refers to the prospective borrower’s reputation in meeting the bank’s obligations upon maturity. This includes certain moral and mental qualities of integrity, fairness, responsibility, temperance, trustworthiness, industry, and the like credit character is a relative matter.

The character will the potential borrower repay the loan according to the loan contract;

- Past track record of loan transactions with this bank.

- Information from other lenders.

- Examining the accuracy of the information provided in the loan application.

Capacity

Capacity refers to the ability of the potential borrowers to repay the debt when it falls due. It indicates the borrower’s competence to utilize the loan effectively and profitably.

This is a significant variable of credit analysis as the customers’ ability to repay depends on their earning capacity.

Here, the bank must check the loan applicants’ capability of repaying the loan;

- Monthly cash inflow over monthly cash outflow.

- Stability and certainty of the source of income.

- Stability of the financial condition.

- Positive liquidity condition.

Capital

Capital represents the general financial position of the potential borrower’s firm with a special emphasis on tangible net worth and profitability, indicating the ability to generate funds continuously over time.

The net worth figure in the business enterprise is the key factor that governs the amount of credit that would be made available to the borrower.

The bank must find out whether the loan applicant can collect funds from alternative sources to repay and face adverse situations;

- Amount of net assets

- Amount of personal assets in case of proprietorship or partnership business.

- The uncalled portion of capital from the shareholders.

Collateral

Collateral is represented by assets that may be offered as pledges against loan extension. Collateral in pledged assets compensates for a deficiency in one or several of the first three ‘Cs.’ Collateral thus serves as a cushion or shock absorber if one or several loans are on maturity.

Bank needs to check whether the sale proceeds of the collateral will be sufficient to satisfy the full loan obligation.

- Loan to collateral ratio.

- Easy marketability.

Questions When Evaluating Collateral

The Commercial Bank Examination Manual suggests that lenders ask the following questions when evaluating collateral:

- Is negotiable collateral held under joint custody?

- Has the customer obtained and filed for released collateral sign receipts?

- Are Securities and commodities valued and margin requirements reviewed at least monthly?

- When the support rests on the cash surrender value of insurance policies, is a periodic accounting received from the insurance company and maintained with the policy?

- Is a record maintained of entry to the collateral vault?

- Are stock powers filed separately to bar negotiability and deter abstraction of both the security and the negotiating instruments?

- Are securities out for transfer, exchange, and so on controlled by pre-numbered temporary vault-out tickets?

- Has the bank instituted a system that ensures that security agreements are filed, collateral mortgages are properly recorded, title searches and property appraisals are performed in connection with collateral mortgages, and insurance coverage (including loss payee clause) affects the property covered by collateral mortgages?

- Are acknowledgments received for pledged deposits held at other banks?

- Is an officer’s approval necessary before collateral can be released or substituted?

- Does the bank have an internal review system that reexamines collateral items for negotiability and proper assignment, checks values assigned to collateral when the loan is made, and at frequent intervals after that, determines that items out on temporary vault out tickets are authorized and have not been outstanding for an unreasonable length of time, and determines that loan payments are promptly posted?

- Are all notes assigned to consecutive numbers and recorded on a note register or similar recorded? Do numbers on notes agree with those recorded on the register?

- Are collection notices handled by someone not connected with loan processing?

- In mortgage warehouse financing, the bank holds the original mortgage note, trust deed, or other critical documents, releasing only against payment.

- Have standards been set for determining the percentage advance to be made against acceptable receivables”

- Are acceptable receivables defined?

- Has the bank established minimum requirements for verifying the borrower’s accounts receivable and minimum documentation standards?

- Are accounts receivable financing policies reviewed at least annually co-determine if they are compatible with changing market conditions?

- Have loan statements, delinquent accounts, collection requests, and past due notices been checked to the trial balances used to reconcile subsidiary records of accounts receivable financing loans with general ledger accounts?

- Have inquiries about accounts receivable financing loan balances been received and investigated?

- Is the bank receiving documents supporting recorded credit adjustments to loan accounts or accrued interest receivable accounts? Have these documents been checked or tested subsequently?

- Are terms, dates, weights, descriptions of the merchandise, and other particulars, shown on invoices, shipping documents, delivery receipts, and bills of lading? Are these documents scrutinized for differences?

- Were customer payments scrutinized for differences in invoice dales, numbers, terns, and so on?

- Do bank records show, on a timely basis, a first lien on the assigned receivables for each borrower?

- Do loans granted on the security of the receivables also have an inventory assignment?

- Does the bank verify the borrower’s accounts receivable or require independent verification periodically?

- Does the bank require the borrower to provide aged accounts receivable schedules periodically?

Conditions

Conditions imply economic and business conditions that affect the borrower’s ability to earn and repay debt beyond the borrower’s control. Economic conditions include all these factors affecting production, distribution, and consumption processes.

Bank must find out if problems in repaying the loan may arise under the business’s current financial position.

- Forecasting of general economic condition during the loan period.

- The possibility of the stability of the forecasted source of income of the loan applicant.

Use of Financial Ratios for Credit Analysis

The creditworthiness of a loan application can be measured by analyzing the data in the financial statements.

Ratio analysis is done either for comparison or for identifying trend analysis indicators. However, the fundamental ratios calculated from the financial statements are stated below;

- Measures of Liquidity

- Measures of Management Efficiency

- Measures of Loan-Equity Balance

- Measures of Profitability

| Purposes of use | Title of ratio | Determining formula |

|---|---|---|

| 1. Assessing Liquidity These ratios examine the ability of the organization to meet short-term obligations. | 1. Current ratio | Current assets / Current liabilities |

| 2. Acid test ratio | (Current assets – stock in trade) / Current liabilities | |

| 3. Current test ratio | Working capital / Current assets | |

| 4 Stock to current assets ratio | Stock in trade / Current assets | |

| 2. Assessing Management Efficiency These ratios examine the skill & the efficiency of the management by earning profits through increased sales. | 1. Average collection period | Receivables / No of days in a year |

| 2. Stock turnover ratio | Sales / Average Stock in trade | |

| 3. Fixed assets town over ratio | Sales / Net fixed assets | |

| 4. Total assets town over ratio | Sales / Total assets | |

| 2. Debt-equity ratio | Profit / Sales | |

| 3. Leverage Ratios These ratios determined the organization’s data capacity and the interest payability of the debts managed. | 1. Debt to total assets ratio | Total debts / Total assets |

| 2. Debt-equity ratio | Total long-term debts / Total equity capital | |

| 3. Times of interest earned | Income before interest and. taxes / Annual interest expense | |

| 4. Long-term debt to total capitalization | Average payable creditors / Daily average purchase | |

| 5. Profitability Ratio These ratios determined the existing performance & future profit-earning potentiality. | 1. Income to total sales | Net income / Sales |

| 2. Income to total assets | Net income / Total assets | |

| 3. Net income to equity | Net income / Equity and retained earnings | |

| 4. Total income to sales | Net income / Sales | |

| 5. Cost of sales to total cost of production | Cost of sales / Cost of production | |

| 6. Distribution cost to cost of sales | Distribution cost / Cost of Sales | |

| 7. Administrative cost to cost of sales | Administrative cost / Cost of sales |

View Points of Credit Analysis

Loan activity is one of the risky functions of a bank. This is risky because a major portion of the loanable fund is the depositors’ money.

The source of the loanable funds is the depositor’s money, which the bank should pay on demand. So, if the bank becomes unable to pay on demand, it may be at the fury of the depositors.

On the other hand, loans are the main source of a bank’s profit. Thus, banks have to keep the faith of the depositors put onto it and earn profit to make the business viable.

Bank takes some necessary information from the borrower to recover the loan and analyze his financial condition. This is called Credit Analysis. In 1975, Jack R Crigger described this in his article “An Ocean of 5 C-s”.

The five C’s are popularly used in many countries around the world. Along with the 5 C’s, three other methods are used in the same perspective. These three methods are “CAMPARI,” “PARSAR,” and “5Rs”.