Bank regulation means that the way of business and day-to-day operation of a bank will be conducted in such a way that will preserve the interest of the depositors, contribute in a disciplined way to the money and loan system, and provide the banking services to the clients with efficient and quality services.

Bank Regulation: Meaning, Objectives, Tools, Strategies

Meaning Of Bank Regulation

Due to regulation, people will keep confidence in a bank or the whole banking system. Bank specialists provided many definitions of bank regulation.

Banking regulation or supervision is to be seen from its prudential aspects, that is, rules and techniques that aim to protect the depositors through the protection Of soundness of the financial sector or what is generally described as its solvency, liquidity, and profitability.

According to Heller (1991), “Banking regulation means regular audit and analysis of banking activities to protect the interest of the depositors through the proper utilization and implementation of relevant rules.”

Handerson (1993) states, “The main focus of regulation has been to stabilize the financial system against systematic risks brought on by the failure of individual banks.”

The primary aim of bank regulation and supervision is to patronize those activities through which the protection of depositors’ interest is increased, and the strength of the whole banking system is increased, public confidence in the banking system is increased as well.

All the definitions mentioned above state the same theme about bank regulation.

So, we can say that bank regulation means the protection of depositors’ interests, setting up and maintaining public confidence in the banking system, and establishing necessary rules to ensure good governance of the banks and bank-related institutions, which will ensure stability, discipline, and strength in the financial market of the country.

Bank regulation also includes supervision and monitoring of the activities regarding license/ permission of bank business, capital, reserve, and risk control.

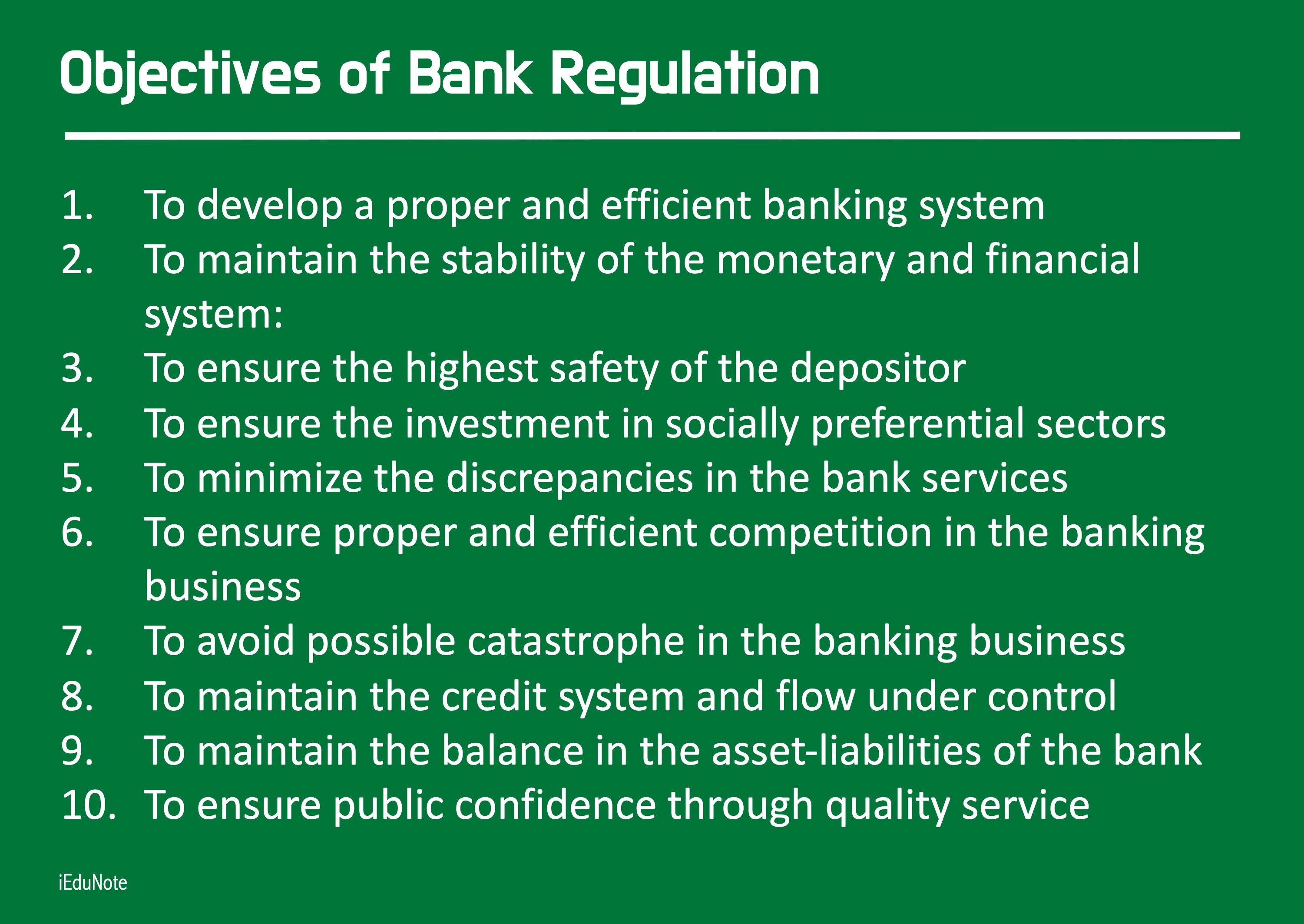

10 Objectives of Bank Regulation

It is clear from the prior discussion that the prime objective of bank regulation is to protect the interest of the depositors, ensuring a healthy and efficient banking system and ensuring a competitive banking activity. A bank failure is a crucial and sensitive matter.

The banking business is severely regulated to protect against bank failure and to maintain a proper banking system. Different controlling authorities, central banks, or other responsible organizations are operated to achieve these objectives.

- Stability in the banking industry is ensured, and public confidence is increased.

- Disasters in the banking industry will not happen due to personal risks, i.e., negligence of the bank officers, irresponsibility, fraud, failure, manipulation, misconduct, etc.

The bank is the most important financial institution in any country. In the business world, the importance of banks is increasing daily, and it becomes more necessary to regulate the banking industry properly.

In this regard, regulatory authorities formulate rules to protect the depositors’ and national interests.

To develop a proper and efficient banking system

In a country. Central Bank and other bank regulatory authorities, either individually or collectively, formulate the rules and regulations to create a proper and efficient banking system.

To maintain the stability of the monetary and financial system:

One of the main purposes of bank regulation is to maintain stability and mobility in the country’s monetary and financial system.

Because the economic development of a country greatly depends on the money market. Besides this, another objective of bank regulation is to increase the faith of foreign countries in the country’s banking system.

To ensure the highest safety of the depositor

Bank regulatory authorities formulate all the rules and regulations required to ensure the highest degree of safety for the depositors’ amount. If banks cannot ensure the required safety of the depositors’ amount, they will definitely lose the clients’ faith.

To ensure the investment in socially preferential sectors

Bank’s role in a country’s socioeconomic development cannot be ignored. Investing in the socially preferential sectors is a bank’s important task.

That’s why bank regulatory authorities create necessary rules and regulations to efficiently use their resources to ensure the proper investment in the socially preferential sectors.

To minimize the discrepancies in the bank services

One of the major purposes of bank regulatory laws is to ensure that no discrepancy arises in giving banking services to the bank’s clients.

To ensure proper and efficient competition in the banking business

The quality of banking services the clients receive greatly depends on the money market situation and the overall banking environment in a country. A banking environment with proper competitiveness is a boon for clients.

That’s why creating a healthy competitive banking environment is another important objective of bank regulation.

To avoid possible catastrophe in the banking business

To avoid sudden disasters in the country’s banking business, bank regulatory authorities formulate necessary rules and regulations regarding liquidity conditions, reserve, and capital adequacy.

To maintain the credit system and flow under control

Credit policy is an important aspect of monetary policy. Many economic factors depend on the effective loan policy.

For example, inflation increases the easy loan policy in a country. So, bank regulatory authorities keep a cautious look at the banks’ overall flow of credit and credit policies.

To maintain the balance in the asset-liabilities of the bank

As an institution, a bank must maintain a proper balance in the assets and liabilities to ensure efficiency in the financial situation.

To ensure public confidence through quality service

In the banking business, mass faith depends mostly on service quality satisfaction. Satisfactory service is almost impossible without improved technology and dedicated service activities.

Bank regulatory authorities regularly guide the existing banks regarding improving services to maintain public faith in the overall banking system.

Tools and Strategies of Bank Regulation

Bank regulatory authorities use different tools and strategies to achieve the objectives of bank regulation.

These tools and strategies of bank regulation may differ in different countries and may differ in the same country at different times.

The tools and strategies of bank regulation formulated by the authorities differ over time due to political, social, and economic situations.

Generally, all the activities are taken to ensure the interest of some sectors-

- To protect the interest of customers.

- To raise the skill and interest of the bankers.

- To uphold national interest.

11 Strategies/Tools To Safeguard The Interest Of The Bank Customers

To safeguard the security of the depositors’ money

Bank regulatory authorities ensure the banks’ safety by formulating rates and forcing the banks to maintain those guidelines.

To provide guidelines for justified/reasonable price of bank services

Bank regulatory authorities create different rules and regulations so no banks can charge an exorbitant price for their services.

To protect consumers’ interest

Some special rules are formulated to provide consumer credit facilities to their clients and other loan activities.

To ensure confidentiality and secrecy of customers’ account

Every bank regulatory authority urges to maintain the secrecy of the client’s accounts in all respects except in the case required by the government.

To ensure deposit insurance

With the help of deposit insurance, bank regulatory authorities ensure the return of the depositor’s money kept at the bank.

To ensure monitoring and supervision of clients’ accounts

Often, by appointing their auditors, bank regulatory authorities supervise and examine the loan accounts of the clients.

To minimize discriminatory banking services

Bank regulatory authorities take necessary actions so that no banks can provide discriminatory banking services to clients.

To provide guidelines to extend credit based on social priority

Bank regulatory authorities ensure the Ioan activities of the banks based on social preference by creating and formulating different guidelines, rules, and regulations.

To provide guidelines to raise public confidence

Public faith depends on rm the better quality service provided by banks. Bank regulatory authorities give specific guidance so that banks can provide improved services.

To provide guidelines to maintain adequate liquidity

Public faith mostly depends on the liquidity of the banks. Banks are bound to return the deposits of the clients on demand. So, regulatory authorities direct the banks regarding the types of assets and reserves to maintain adequate liquidity.

For example, we can say that the bank regulatory authority makes it mandatory to maintain 5% CRR and 20% SLR on the daily deposit of commercial banks to maintain proper liquidity.

To provide approval of innovative services:

The modes and types of services are changing rapidly in this changing world. Banks can introduce newly invented services with the permission of bank regulatory authorities.

21 Tools/Strategies To Safeguard The Interest Of The Banks

To permit licenses for new banks

A bank is a profit-oriented organization. Bank regulatory authorities issue necessary guidelines to establish new banks. These guidelines differ from time to time based on the area, population density, potential clients’ financial solvency, m the locality.

For example, the guidelines for opening new branches or bonks in urban areas will differ from those for rural areas.

To sanction opening new brandies

Existing banks must get permission from the bank regulatory authorities to open new branches.

To provide directions regarding the appointment of directors, their duties, and responsibilities

The qualifications and responsibilities of the bank directors should not only be according to the Banking Company Act’s guidelines but also according to the guidelines of the bank regulatory authority.

To provide directions for the use of funds

As the majority owners of the funds are not the shareholders but the depositors, bank regulatory authorities establish the directions regarding the use of funds in risky investments.

To provide a warning against sensitive deposits

The more sensitive the deposits are, the harder it becomes for the banks to collect funds. So. for the well-being of the banks, bank regulatory authorities often fix the highest ceiling for sensitive deposits.

To provide guidelines for capital adequacy

Shareholders’ capital is only a small part of the total funds of the bank. Bank regulatory authorities often ask the banks’ shareholders to keep at least a small portion of funds (8% of the banks’ weighted average risky assets).

To provide guidelines for adequate liquidity

Inadequate liquidity creates different types of problems for the banks, most often. So. bank regulatory authorities give proper guidance to the adequacy of liquidity to the banks.

To provide guidelines against interlocking directors

To protect the interest of the depositors and other concerned parties in the banks, bank regulatory authorities issue guidance regarding the prohibition of the same person being the director of many banks simultaneously.To provide guidelines for acceptable deposits

Bank regulatory authorities give directions regarding which assets should be or should not be accepted as deposits.

To control large loans to reduce risk

The funding risk of the bank increases due to the large volume of loans to a small number of loanees. For this reason, the bank regulatory authority specifies the highest ceiling of the loan amount.

To provide guidelines for investible securities

It is very risky for commercial banks to invest by borrowing funds from the open market. That’s why bank regulatory authorities give necessary direction regarding investable debentures.

To provide guidelines to ensure loan recovery

To circulate the bank funds, we need a satisfactory loan collection rate. An inactive loan badly affects the circulation of loanable funds.

To provide guidelines for loan classification and provisioning

Bank regulatory authorities also give proper guidance regarding the classification and provisioning of loans.

To frame necessary rules and regulations for credit courts

Bank regulatory agencies give proper guidance regarding the collection of inactive loans. In this case, establishing loan courts is an alternative.

To provide guidelines for credit monitoring and supervision

By ensuring supervision and reexamination of loans, bank regulatory authorities ensure satisfactory loan collection by commercial banks.

To provide guidelines for maintaining reserves

To meet up the daily demands, banks need to maintain sufficient liquidity. For this reason, bank regulatory authorities issue rules and regulations for keeping a certain portion of primary and secondary reserves from the deposits.

To provide guidelines to reduce risk in a foreign exchange transaction

Bank regulatory authorities generally try to avoid the risks associated with foreign exchange transactions by determining the optimum rate of foreign exchange. This is done for the betterment of the country.

To control the operations and activities of a bank holding company

To control the monopoly in the banking business, bank regulatory authorities issue necessary rules and regulations regarding the opening of holding or subsidiary companies by large banks.

To develop an efficient and competitive financial system

Bank regulatory authorities issue necessary rules and regulations to ensure healthy competition among banks.

To provide guidelines for the identification and nursing of sick banks

Bank regulatory authorities issue necessary guidelines, rules, and regulations to help sick banks to improve their conditions.

To ensure the liquidation of failed banks in a proper and well-accepted way

Bank regulatory authorities also help the failed banks to liquidate themselves expectedly. Bank regulatory bodies try to protect the interest of the creditors.

16 Tools/Strategies To Safeguard The Interest Of The Economy and Nation

To ensure money supply and financial stability

Bank regulatory authorities try to control loan activities and increase or decrease the money supply. This is done to keep the money supply of the country at a stable level. This also ensures economic stability in the Country.

To develop an efficient and competitive financial system

Bank regulatory authorities also formulate guidelines and regulations to ensure healthy competition.

To ensure diversification and proper distribution of loans by controlling large loans

The risk of bank funds increases if a large loan is distributed to fewer borrowers. Bank regulatory authorities ensure the diversification of loans by controlling many loans given to a smaller group of people.

To control bank mergers and subsidiaries

To control the monopoly by large banks, bank regulatory authorities impose regulations on keeping tire holding or subsidiary companies by the large banks.

To provide guidelines for the coordination among banks

Bank regulatory authorities give necessary directions to maintain necessary coordination among banks.

To provide guidelines against interlocking directors

To protect the interest of the depositors and other concerned parties in the banks, bank regulatory authorities issue guidance regarding the prohibition of the same person being the director of many banks simultaneously.

To control discriminatory banking services

Bank regulatory authorities take necessary actions so that no banks can provide discriminatory banking services to clients.

To provide directions for dividend distribution

If the banks distribute all the profits in dividends, there will be little scope for enhancing the owner’s capital. That’s why bank regulatory authorities issue necessary guidelines regarding profit distribution.

To provide guidelines for acceptable and unacceptable loans

The deposited money of the clients serves as the major source of loanable funds for commercial banks. Bank regulatory authorities provide guidelines to commercial banks for acceptable and unacceptable loans to ensure profitable and secured loan-providing activities.

To provide guidelines to extend credit based on social priority

Bank regulatory authorities ensure the loan activities of the banks based on social preference by creating and formulating different guidelines, rules”and regulations.

To permit licenses for new banks

Bank is a profit-oriented organization. Bank regulatory authorities issue necessary guidelines to establish new banks. These guidelines differ from time to time based on the area, population density, type of potential clients, and financial solvency of the clients in the locality.

For example, opening new branches or new banks in urban areas will not be the same as the guidelines for rural areas.

To sanction opening new branches

Existing banks are required to get permission from the bank regulatory authorities to open new branches.

To provide guidelines for capital adequacy

Shareholders’ capital is only a small part of the total funds of the bank. Bank regulatory authorities often ask the banks’ shareholders to keep at least a small portion of funds (8% of the banks’ weighted average risky assets).

To provide guidelines for adequate liquidity

Inadequate liquidity creates different types of problems for the banks, most often. So, bank regulatory authorities give proper guidance to the adequacy of liquidity to the banks.

To protect consumers’ interest

Some special rules are formulated to provide consumer credit facilities to their clients and other loan activities.

To provide guidelines for securing accurate and reliable credit information

Sufficient and updated information is required for proper credit analysis. Bank regulatory authorities facilitate easier access for commercial banks to collect information from the Credit Information Bureau (CIB) and other relevant sources.

Bank Regulatory Authorities

Generally, the central bank controls all the commercial banks of a country. One or more regulatory authorities are responsible for controlling the banks. The controlling power is given to a higher and more powerful authority to increase efficiency and reduce or, if possible, eliminate risks.

But it does not apply to all countries and all economies. Recently, disputes have arisen among specialists regarding whether the control of the activities of commercial banks will be vested in the central bank only or whether there should be other separate authorities.

Besides this, the types and nature of regulatory authorities vary from country to country, which will be clear from the table below. Recently, questions have arisen that the central bank should be engaged only in money and money supply-related activities.

If the central bank is engaged in the controlling and inspection activities, monetary stabilization and supervision activities may be vested in (Efferent agencies. As a result, a lack of coordination in the banking activities will occur, which is not desirable for a healthy and optimum banking system.

So, in reality, we can see that controlling power is vested in the central bank and other authorities. It will be clear from the following table-

- Japan. Kiribati and Korea

- Australia

- Dominica, Mexico & Sent Luis,

- Madagascar

- Hong Kong & Markal Island

- Belgium, Denmark, Germany, Hungary, Norway, Sweden & Switzerland

- Lebanon

- Antigua and Bermuda, Bolivia, Canada, Chile, Colombo, Dominican Republic, Ecuador, El Salvador, Guatemala, Nicaragua, Panama, Peru, USA, Venezuela

We have observed two recent issues regarding the change in the power and responsibilities of controlling bank and financial systems:

The sovereign power of controlling Britain’s banks and financial systems is vested in the “Financial Service Authority” agency from the hand of the “Bank of England.” On the other hand, in Australia, the “APRA” (Australian Prudential Regulatory Authority) is formed to control the Financial sector of Australia.

The above analysis shows that controlling banking systems is vested in different organizations in different countries. Government and the central bank will determine the institution controlling a country’s banking system.

Conclusion

Like other business organizations, banks should also be regulated.

Without regulation, business people can commit any act for their personal betterment without considering the effect on society. It was also evidenced from the ancient world that the merchants didn’t hesitate to adopt any action which may have been detrimental to the customers to maximize their self-benefits.

In 2100 BC, Hammurabi, the king of Babylon, engraved 300 rules in an 8-foot high wall to improve the situation and control the merchants’ activities, including death and other punishments.

Among all the business activities, the banking business is more sensitive. Before establishing the central bank of America in 1913, there was no control over the commercial banks. The motive of excessive profit earning by the bank owners created indiscipline in society.

As a result, in the period of the 1930s-world’s great economic depression, thousands of commercial banks had to shut down due to excessive .and fierce competition. Since it was impossible to avoid the public demand in democratic America, all commercial banks were regulated to preserve the interest of the depositors.

The banking business depends on public confidence. Bank collects deposits from the public and provides these deposits to the public as loans.

But if the bank fails to reimburse the deposit holders and charges high interest on loans, people will lose their confidence in that bank. Sometimes, it may destroy the full confidence in the banking system and can cause anarchy in the economy.

The economic activities of an economy are directed through the banking system. The money market, currency value, money supply, and credit market of a country are controlled through the banking system.

The main indicator of national economic development, i.e., an increase in savings, is accomplished through the banking system. So bank regulation is mandatory for financial and economic stability.

As a result, keeping the banking sector well organized and regulated has been maintained since the 13th century, and this process became complete in the 20th century.

Banking is one of the most controlled businesses globally because almost 90% of the bank fund is collected from depositors.

But the owners of the banking businesses bear less risk than the owners of other businesses because of their low volume of capital relative to that of other businesses.

Control in the banking sector from the regulatory agencies is needed due to the higher risk of depositors. Proper and fruitful control helps the banks to operate the business properly and to avoid excess risk.

On the other hand, effective control plays a vital role in preserving the interest of the depositors and the country.