Banking Branch Banking System is a system of banking in which a banking organization works at more than once. This is the world’s most practices banking system.

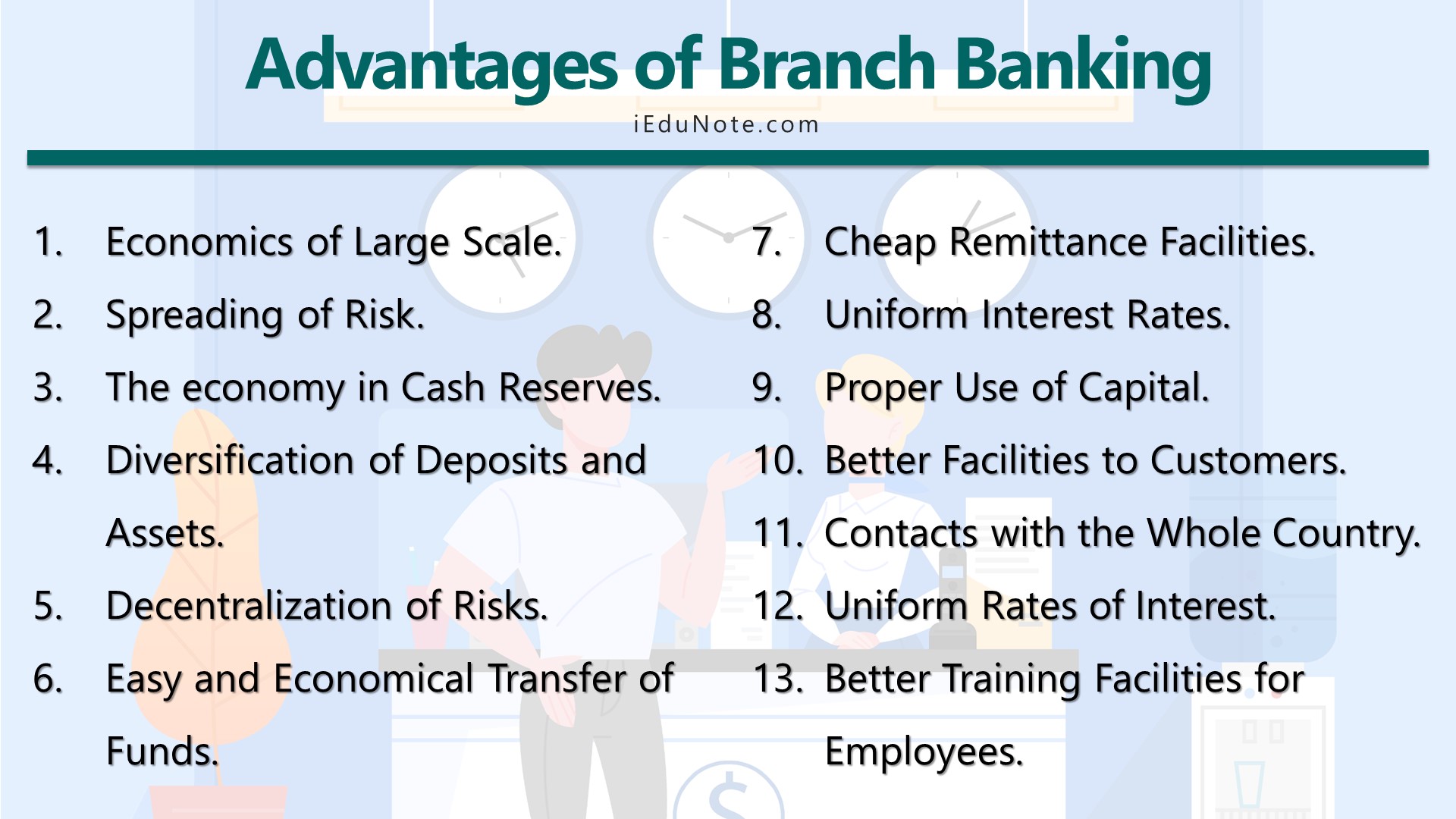

Advantages of Branch Banking

The rapid growth and wide popularity of branch banking systems in the 20th century are due to various advantages.

We have identified 13 advantages of the branch banking system;

- Economics of Large Scale.

- Spreading of Risk.

- The economy is in Cash Reserves.

- Diversification of Deposits and Assets.

- Decentralization of Risks.

- Easy and Economical Transfer of Funds.

- Cheap Remittance Facilities.

- Uniform Interest Rates.

- Proper Use of Capital.

- Better Facilities to Customers.

- Contacts with the Whole Country.

- Uniform Rates of Interest.

- Better Training Facilities for Employees.

Let’s see why the branch banking system is popular and advantageous.

1. Economics of Large Scale

Operations under the branch banking system, the bank with some branches possesses huge financial resources and enjoy the benefits of large-scale operations. Highly trained and experienced staff is appointed, which increases the efficiency of management.

Division of labor is introduced in the banking operations, ensuring a greater economy in the bank’s working. The right persons are appointed at the right place, and specialization increases; large financial resources and wider geographical coverage increase public confidence in the banking system.

2. Spreading of Risk

Another advantage of the branch banking system is the lesser risk and greater capacity to meet risks. Since there are geographical spreading and diversification of risks, the bank’s failure is remote.

The profits earned by other branches may offset the losses incurred by some branches. Large resources of branch banks increase their ability to face any crisis.

3. The economy in Cash Reserves

Under the branch banking system, a particular branch can operate without keeping large amounts of idle reserves. In a time of need, resources can be transferred from one branch to another.

4. Diversification of Deposits and Assets

Because of wider geographical coverage, there is greater diversification of both deposits and assets under a branch banking system.

Deposits are received from the areas where savings are in plenty, and Loans are extended in those areas where funds are scarce and interest rates are high.

The choice of securities and investments is wider in this system, increasing the safety and liquidity of funds.

5. Decentralization of Risks

In the branch banking system, branches are not concentrated in one place or one industry.

6. Easy and Economical Transfer of Funds

Under branch banking, it is easier and more economical to transfer funds from one branch to the other.

7. Cheap Remittance Facilities

Since bank branches are spread over the whole country, transferring funds from one place to another is easier and cheaper. Inter-branch indebtedness is more easily adjusted than inter-bank indebtedness.

8. Uniform Interest Rates

Under the branch banking system, the mobility of capital increases, which in turn, brings about equality in interest rates. Funds are transferred from areas with excessive demand for money to areas with deficit demand for money.

As a result, the uniform rate of interest prevails in the whole area; it is prevented from rising in the excessive demand area and falling in the deficit demand area.

9. Proper Use of Capital

There is a proper use of capital under the branch banking system.

If a branch has excess reserves but no opportunities for investment, it can transfer the resources to other branches, which can make the most profitable use of these resources.

10. Better Facilities for Customers

The customers get better and greater facilities under the branch banking system. The small number of customers per branch and the increased efficiency achieved through large-scale operations result from the small number of customers per branch.

11. Contacts with the Whole Country

Under branch banking, the bank maintains continual contact with all parts of the country. This helps it to acquire correct and reliable knowledge about economic conditions in various parts of the country.

12. Uniform Rates of Interest

In branch banking, the central bank has better control and coordination.

13. Better Training Facilities for Employees

Banks can hire and train employees better. This is possible because the branch banking system has a vast network.

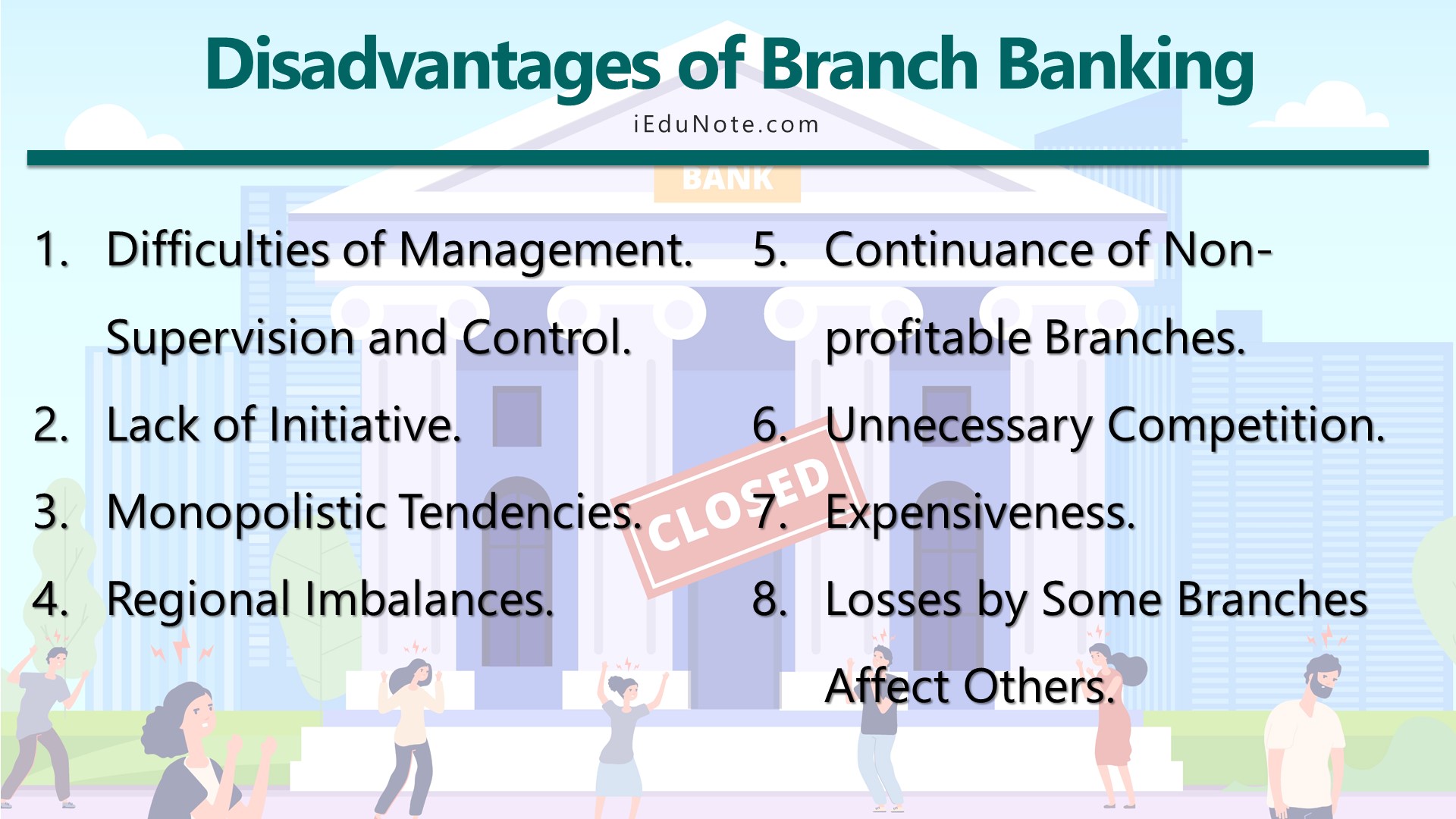

Disadvantages of Branch Banking

The Branch banking system has many disadvantages that can affect the grassroots customers and the entire economy.

8 disadvantages of the branch banking system are;

- Difficulties in Management. Supervision and Control.

- Lack of Initiative.

- Monopolistic Tendencies.

- Regional Imbalances.

- Continuance of Non-profitable Branches.

- Unnecessary Competition.

- Expensiveness.

- Losses by Some Branches Affect Others.

Let’s see how the branch banking system can be disadvantageous.

1. Difficulties in Management, Supervision, and Control

Since hundreds of bank branches were under this system, management, supervision, and control became more inconvenient and difficult.

2. Lack of Initiative

Under this system, the bank branches suffer from a complete lack of initiative on important banking problems confronting them.

3. Monopolistic Tendencies

Branch banking encourages monopolistic tendencies, dominating and controlling the country’s whole banking system through its branches.

4. Regional Imbalances

The branch banking system encourages regional imbalances in the country.

5. Continuance of Non-profitable Branches

In this system, unprofitable branches continue to operate under the protection cover of the stronger and profitable branches.

6. Unnecessary Competition

Under branch banking branches, competing banks try to tempt customers by offering extra inducements and facilities.

7. Expensiveness

The Branch Banking system is much more expensive than the unit banking system.

8. Losses by Some Branches affect Others

When some branches suffer losses due to certain reasons, this has repercussions on other bank branches.