Understand Bank Failure with our Full Guide.

Meaning of Bank Failure

Bank failures result from lax credit standards, ineffectual portfolio risk policies, risks assumed beyond the limits of a bank’s capital, misreading performance barometers and neglecting technological upgrades (both system-wide and specific), loan exposure, and ineffective risk rating systems.

As we shall see, banks have come under increased regulatory scrutiny, with many incurring losses on loan write-offs. It fails when a bank becomes insolvent or unable to pay its debts.

After failure, the bank is usually liquidated or merged with a healthy bank under government supervision. Different countries have different policies for dealing with bank failure.

For example. Japan and some European countries thought dial every problem bank should be close down or merged with a healthy bank.

On the other hand, Britain’s policy is to close down problem banks. The US adopted a new policy in 1933, according to which all problem banks must be closed unless any healthy bank is willing to take over those.

The three ways to deal with a bank failure are described below;

- The bank could be liquidated, and assets could be sold to pay off the insured depositors.

- To merge a failing bank with a healthy bank.

- Finally, the government could nationalize the bank and provide lending assistance or guarantee for claims.

An internationally known bank surveyed its problem loan portfolio and came up with a pattern of root causes:-

- Compromise of credit principles granting loans carrying undue risks or unsatisfactory terms with full knowledge of the violation of sound credit principles.

- Timidity in dealing with individuals having dominating personalities or influential connections or friendships, or personal conflicts of interest involved.

- Dependence on oral information furnished by borrowers instead of reliable financial data.

- Extension of credit on an unsound basis to directors or large shareholders.

- Being influenced by salary incentives and bonuses based on loan portfolio growth.

- Ignoring warning signs about the borrower, economy, region, industry, or other related factors.

- Earnings factor permitted to outweigh dial of soundness.

- Credits representing undue risks or unsatisfactory repayment terms are granted.

- Poor selection of risks.

- Incomplete credit information.

- Failure to obtain or enforce repayment agreements.

- Loans for the speculative purchase of securities or goods.

- Loans are granted without a clear agreement governing repayment.

- Lack of adequate supervision of old and familiar borrowers.

- Technical incompetence.

- Loans wherein the bank advances an excessive proportion of the required capital relative to the equity investment of the borrowers.

- An optimistic interpretation of known credit weakness based on past survival of recurrent hazards and distress.

- Collateral loans are carried without adequate margins of security.

Bank Managers, investors, policymakers, and regulators share a keen interest in knowing what causes banks to fail and predicting which banks will get into difficulty. Managers often lose their job if their banks fail.

The issue is also important for policy because failing banks may prove costly for the taxpayer; depositors and investors want to identify potentially weak banks. Here, this section explores why banks fail are explored, using both a qualitative approach and quantitative analysis.

The Indicators / Determinants of Bank Failure

The previous presentation reviewed the details of a large number of bank failures around the world. It could be gathered factors of bank failure may be categorized into;

- Qualitative Determinants of Bank Failure, and

- Quantitative Determinants of Bank Failure.

Qualitative Determinants of Bank Failure

Poor management of assets

Weak asset management, consisting of a weak loan, flook usually because of excessive exposure in one or more sectors, even though regulators set exposure limits. When these are breached, the regulators may not know it or may fail to react.

Managerial problems

Deficiencies in the management of failing banks are a contributing factor in virtually all cases. Though weak management was the key problem, it is difficult to disentangle it from government interference in its operations.

Fraud

Fraud and thrift are other reasons for bank failure. In fraud cases, many managers bought risky debt (junk bonds) to profit from short-term high-interest payments.

The role of regulators

Bank examiners, auditors, and other regulators missed important signals and/or were guilty of “regulatory forbearance,” putting the regulated bank’s interest ahead of the taxpayer. In many cases of failure, subsequent investigation shows slated exposure limits were exceeded, with the regulator’s knowledge.

Too big to fail

In the three Nordic countries that encountered severe proboscis. Banks were nationalized and, later, largely privatized. The regulators operate a policy of deliberate ambiguity concerning bank rescues. Even though the central banks try to operate a policy of ambiguity, it is normally clear to analysts which bank will be bailed out.

Clustering

Looking at failures across some cases and countries, there appears to be a clustering effect. Bank failures in a country tend to be clustered around a few years rather than spread evenly through time.

Bank Failure: Quantitative Models

Qualitative determinants of bank failure provide insight into the causes of how and why a bank fails, but these ideas are subject to more rigorous testing. Any econometric model of bank failure must incorporate the basic point that insolvency is a discrete outcome at a certain point in time.

In situations where the outcome is binary, the bank fails, or it does not, two econometric methods commonly used are –

- Discriminant analysis, and

- Logit/ Probit analysis.

Multiple discriminant analysis is based on the assumption that all quantifiable, pertinent data may be placed in two or more statistical populations.

- The discriminant analysis estimates a function that can assign an observation to the correct population.

- Applied to bank failure, a bank is assigned to either an insolvent population or a healthy one. Historical economic data are used to derive the discriminant function that will discriminate against banks by placing them in one of two populations.

- Early works incorporating bankruptcy made use of this method. However, Martin in 1977 demonstrated that discriminant analysis is just a special case of logit analysis.

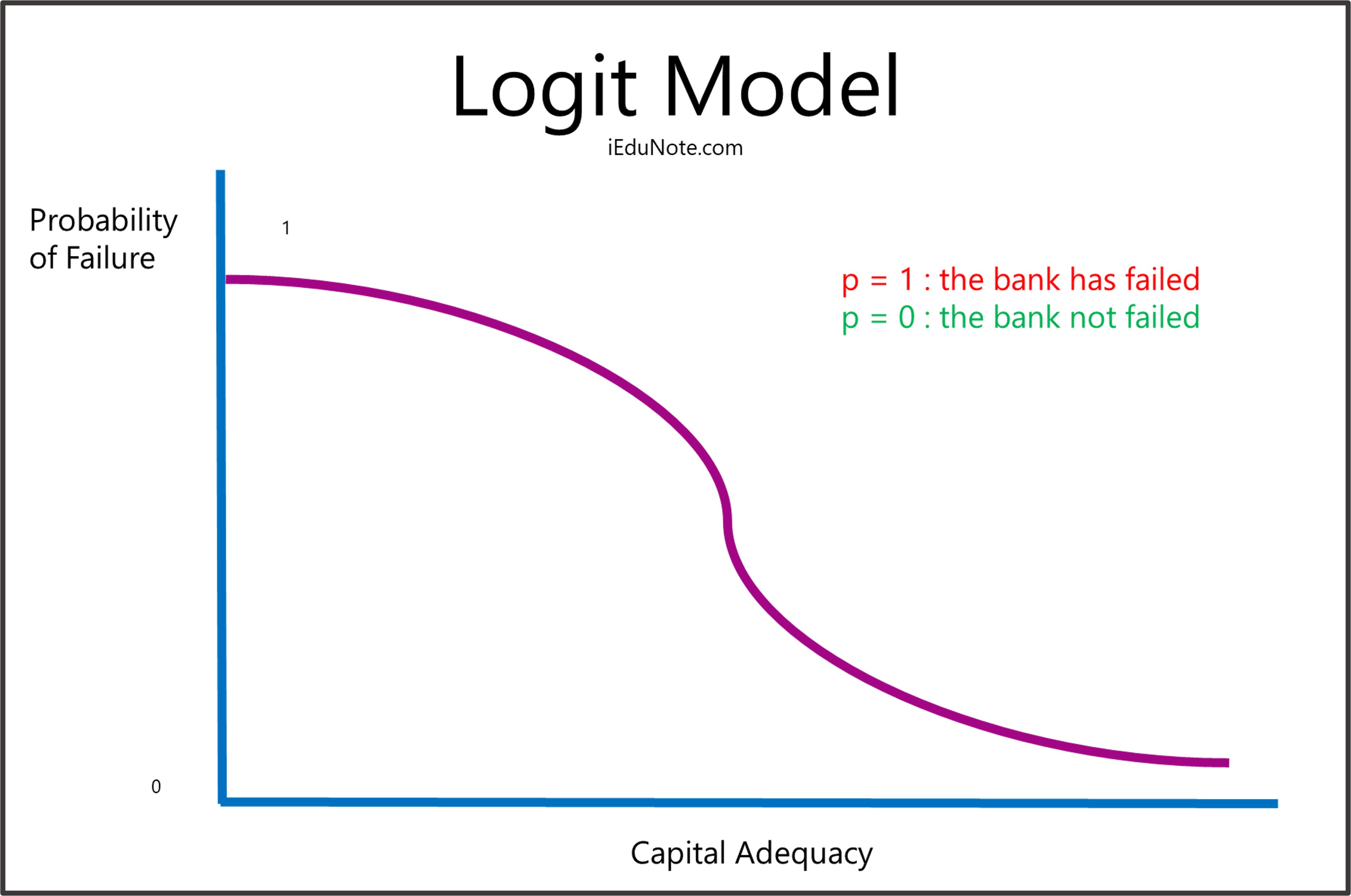

- The logit model identifies the significant variables that increase or reduce the probability of a • bank failing. The model has a binary outcome as well. Either the bank fails (p=1) or it does not (p=0). The following standard equation can express the logit model:-

Z = ßo + ß’x + c

Where;

Z = possibility of bank failure,

ßo = a constant term,

ß’= the vector of coefficients on the explanatory variables,

x = the vector of explanatory variables,

c = the error term.

And p=1 if Z>0, p=1 if Z≤0.

In the logit model, the dependent variable Z is explained by explanatory variables like capital adequacy, loan growth rates or loan losses, etc.

An intuitive idea of the logit model can be obtained by referring to the following figure.

- In a simple application of equation (1), if x consists of just one explanatory variable, in this case, capital adequacy, the logit model becomes a two-dimensional sigmoid-shaped curve, as shown above.

- The probability of failure is on the vertical axis, and the explanatory variable, in this case, capital adequacy, is on the horizontal axis.

- As the bank’s capital adequacy falls (approaching 0 in figure 1), the probability of bank failure rises.

- The logit model identifies significant variables in explaining the probability of bank failure.

The econometric results are broadly consistent with the findings from the case studies. The econometric variables contributing to bank failure include falling profitability, capital adequacy, rising loan losses, greater liquidity, fraud, moral hazard, regulatory forbearance, etc.

How to deal with Failed Banks

The last layer is considered unsatisfactory, explained in our article on the five-layer CAMELS rating. In the CAMELS rating five-layer evaluation viewpoint, a bank faces insolvency if the bank falls to the last layer.

If banks fall in the third layer, they improve their position. In that condition, the bank improves its position simply. It is difficult to improve their position if the banks fall in the fourth and fifth layers.

In this condition, to change the financial structure and make proper decisions to rescue the Banks from bankruptcy.

FDIC shows that the banks which fall fourth and fifth layer in the USA are given below (Source The FDIC Quarterly Banking Profile. Fourth Quarter. 1990):

| Year | Number of problem bank | Number of bank bankruptcy | Percentage rate of bankruptcy hank by problem bank |

|---|---|---|---|

| 1984 | 848 | 80 | 9.43% |

| 1985 | 1140 | 120 | 10.53% |

| 1986 | 1484 | 145 | 9.77% |

| 1987 | 1575 | 203 | 12.89% |

| 1988 | 1406 | 221 | 15.72% |

| 1989 | 1109 | Not Found | |

| 1990 | 1046 | Not Found |

In the above figure, we can conclude that the bank is properly identified using the CAMEL layer. After identification, the bank can be rescued from bankruptcy by stopping properly.

Indicators of a failed bank are given below:

| Ratio | Effect |

|---|---|

| Return on assets | (-) |

| Loans to assets | * (+) |

| Capital to assets | (-) |

| Purchased funds to assets | (+) |

| Net bad debt to loans | (+) |

| Commercial & Industrial loans to assets | (+) |

Bankruptcy is identified based on 1985-86 USA banks (20% of the average size and performance).

| Indicators | The average performance of the best bank | The average performance of an insolvent bank |

|---|---|---|

| Year | 1986 | 1985 |

| Net income | 1.63% | -13.14% |

| The average income of owners’ capital | 18.11% | -249.68% |

| Increased in owners’ capital | 10.84% | -98.24% |

| Net overhead expense and acquired asset rate | 2.83% | 11.19% |

| Increased in total asset | 8.5% | -10.20% |

| Net bad debt to total debt | 0.67% | 9.09% |

| The recovery rate of bad debt | 32.05% | .00% |

| Nel debt to asset | 47.40% | 64.30% |

| Fixed debt to capital | 11.93% | 235.89% |

In the above information, we understand that a higher specific ratio shows higher financial performance and a lower ratio shows the bad financial performance of the bank.

So. we have to focus on the following key points to handle the failed or “to be’ failed banks:

- As the banking sector is different from other sectors, it needs more intense regulation than other sectors.

- Any rumor of financial difficulties at a bank results in withdrawing uninsured deposits and investors selling their stocks.

- The contagion could arise because of the failure of a healthy bank, and depositors could rush on liquidity.

- The government may ask all banks to hold up capital asset ratio or risk-weighted ratio to ensure that banks guard against failure.

- So if the authority thinks that the bank is experiencing a liquidity problem, it will intervene and provide the necessary liquidity.

- Otherwise, the run will continue, and the bank will collapse. In an extreme case, a “bank holiday” could lx? declared to gate some more fines to combat the situation.

- But if the bank holiday agreement fails to solve the situation, a failure is inevitable. And a contagion begins.

Kaufman’s findings of contagion theories are as follows-

- Bank contagion spread faster than other companies.

- Depositors tend to be less well informed about the performance of banks compared to other industries.

- Bank contagion results in a longer number of failures.

- Contagion results in larger losses for depositors.

- To sum up, the run on banks does not cause insolvency among solvent banks.

- But these findings are based on the US market in which the most generous deposits are insured. So it’s an extraordinary case.

On the other hand;

- With the increased regulation of banks or the presence of deposit insurance, there is a chance of moral hazard.

- Because if a deposit is backed by insurance, then the depositors are unlikely to withdraw the deposits if there is a rise in the bank’s health.

- So management could undertake risks greater than they might have in the absence of that.

Case study on Bank Failure

- Bank failure has happened in different countries at different times. In Britain, the Bardi Family of Florentine Bankers was ruined by the failure of Edward III.

- The USA faced a serious crisis from 1930 to 1933. In some cases, state support of problem banks proves to be costly.

- In 1998 the Japanese banking system caused the taxpayer about $560 billion.

Fall of Banco Ambrosiano

- Banco Ambrosiano (BA), an Italian-based commercial bank, collapsed in June 1982 following confidence among depositors after its chairman, Robert Calvi’s controversial death in London.

- The main cause of the insolvency appears to have been fraud on a massive scale, though there were other factors whose contribution is unclear.

- Some correspondence to the central bank suggests that regulatory authorities were aware of the problem to BA.

Penn Square

- Penn Square Bank, located in Oklahoma City, opened in 1960. On 5 July 1982, the bank collapsed, with $470.4 million in deposits and $526.8 million in assets.

- It embarked on an aggressive lending policy to the oil & gas sector.

- It sold a majority interest in these loans to oilier banks but remained responsible for their

Johnson Matthey Bankers

- Jhonson Matthey Bankers is the banking arm of Johnson Matthey, dealers in gold bullion and precious metals.

- Jhonson Matthey Bankers got into trouble because it managed to acquire loan losses of only £450 million, so it had to write off over half of its original loan portfolio.

- Press reports noted that most of these bad loans were made to traders involved with Third World countries, especially Nigeria, suggesting a high concentration of risks.

- The Jhonson Matthey Bankers affair revealed two gaps in the reporting system.

- First, auditors had no formal contact with the Bank of England and could not register their concerns unless they resigned or qualified their reports.

- Second, based on management interviews, the statistical returns prepared for the Bank of England were not subjected to an independent audit.

The US Bank and Thrift Crises

- Between 1980-94 there were 1295 thrift failures in the USA, with $621 billion in assets. The failures peaked between 1988 and 1992. when a Kink or thrift was, on average, failing once a day.

- The thrift industry suffered due to the concentration of credit risk in the real estate market and exposure to interest rate risk through long-term fixed-interest loans and mortgage-backed securities.

- Policies of regulatory forbearance compounded the problem.

To summarize, the thrift industry suffered due to the concentration of credit risk in the real estate market and exposure to interest rate risk through long-term fixed-interest loans and mortgage-backed securities valued on their books at the original purchase price.

Rising interest rates reduced the value of these securities and forced the thrifts to bear the burden of fixed interest rates reduced loans.

| Bank | Failure Date | Assets ($ m) | Resolution Cost as a % of Assets |

|---|---|---|---|

| Penn Square | 05.07.82 | 436 | 14.9 |

| Abilene National | 06.08.82 | 437 | 0 (open bank assistance given) |

| First National Bank of Midland | 14.10.83 | 1410 | 37.3 |

| First Oklahoma | 11.07.86 | 1754 | 9.6 |

| Banc Oklahoma | 24.11.86 | 468 | 16.9 |

| Banc Texas | 17.07.87 | 1181 | 12.7 |

| First City Bancorp | 29.07.88 | 12374 | 8.9 |

| First Republic | 29.03.89 | 21277 | 12 |

| Mcorp | 29.03.89 | 15641 | 18.2 |

| Texas American | 20.07.89 | 4665 | 21.1 |

| National Bancshares | 01.06.90 | 1594 | 13.4 |

Some of the banks could expand their asset base relatively quickly because of the change in the status of mutual banks in this region.

Daiwa Bank

In November 1995, Daiwa Bank of Japan was compelled to cease its US operations for the deception of one of its employees, Mr. Toshihide Iguchi.

Allied Irish Bank/Allfirst Bank

- On 6 February 2002, Allied Irish Bank (AIB) announced a one-off charge of $520 million to cover losses from a suspected fraud of $ 750 million involving currency trades at its subsidiary, Allfirst Bank.

- Ludwig’s investigation report states that the fraud began in 1977 when Rusnak MDin foreign exchange dealing lost money on proprietary trading.

- Though AlB’s solvency was never in question, the losses represented 17.5% of their tier 1 capital and reduced earnings by 60%.

- In September 2002, Allfirst was sold to M&T Banking Corporation for $ 886 million and a 22.5% stake in M&T. To appease shareholders angered by the fraud, half of the cash from the sale was to be used to buy back AIB shares.

Daiwa and AIB/Allfirst suffered from rogue traders, resulting in the UK’s oldest merchant bank failing and another respected Japanese bank being barred from operating in the USA.

Canadian Bank Failures

During the autumn of 1985, five out of 14 Canadian domestic banks found themselves in difficulty. In the summer of 1985, government investigations revealed that 40% of the loan portfolio was marginal or unsatisfactory.

Conclusion

Banks can successfully handle the risk properly by properly allocating and using funds. We should be aware of the capital collection and capital adequacy. The banker must constantly attempt to assess the difference between the original capital and capital adequacy.

Taking a loan from the free market to maintain adequate liquidity is not improper. The bankers make both loan and investment decisions to earn profit.

Too much thrifty and cautious use of these two (loan and investment) cause an excess of the fund, adversely affecting the bank’s profitability. On the other hand, too many flexible loan and investment activities contribute to the bank’s profitability but may sometimes create a liquidity crisis.

If the bankers know the indicators of success well ahead, they can emphasize those for better success. In contrast, knowing early indicators of failure warns us to be cautious to guard against likely sickness or even failure & bankruptcy.