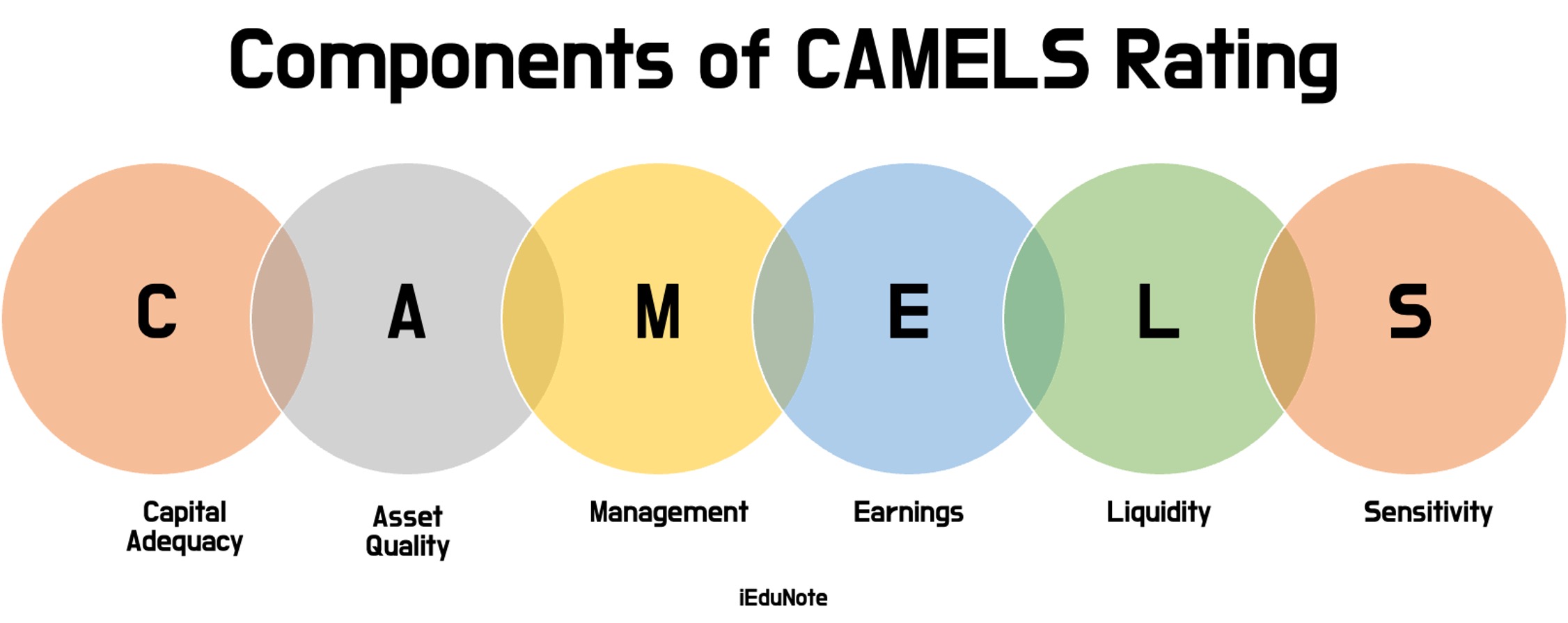

CAMELS rating system is an internationally recognized supervisory rating system to assess the strength of a bank or financial institution according to six factors. CAMELS is an acronym for capital adequacy, assets, management capability, earnings, liquidity, and sensitivity.

CAMELS Rating System: Meaning, Background, Components

CAMELS Meaning

CAMELS, the five initial alphabets each indicate a particular set of functions based on which the “health of the bank” can be diagnosed. As an individual set, these factors can speak about the financial health of the particular aspect of the bank.

CAMELS stands for;

- “C” stands for judgment of Capital Adequacy,

- “A” stands for judgment of Asset Quality,

- M” stands for judgment of Efficiency and Quality of Management,

- “E” stands for judgment of the Volume and Level of Earnings,

- L” stands for judgment of Strength and Level of Liquidity, and

- “S” stands for judging sensitivity to Market Risks.

All five factors together can collectively form a composite index that can reliably speak about the bank’s overall health (s). Such a CAMEL rating evaluation can be attempted monthly or annually for trend analysis.

Each of the above features is judged on a five-point scale to diagnose the level of health from the point of view of the individual set or as a combination of all sets together. The five-point scale is as follows:

| 1 | 2 | 3 | 4 | 5 |

| Excellent | Satisfactory | Fair | Marginal | Unsatisfactory |

Background of CAMELS Rating

In the USA, the Uniform Financial Institution’s Rating System is an internal supervisory tool currently used by the federal supervisory agencies as follows;

- Board of Governors of the Federal Reserve System (FRB).

- Federal Deposit Insurance Corporation (FDIC).

- Office of the Comptroller of the Currency (OCC).

- Office of Thrift Supervision (OTS).

- National Credit Union Administration (NCUA).

In addition, state banking departments and the Farm Credit Administration use the CAMEL rating system. Supervisory agencies use the rating system to evaluate the soundness of financial institutions uniformly and identify those institutions requiring special supervisory attention or concern.

6 Components of the CAMELS Ratings

Six components of the CAMELS ratings are;

- Capital Adequacy,

- Asset Quality,

- Management Capability,

- Earnings,

- Liquidity,

- Sensitivity to market risk.

Capital Adequacy

A bank’s Tier 1, total capital, and leverage ratios to its peer group are the most important factors in assigning a preliminary rating. Peer groups are based on bank asset size, offices, and location in a metropolitan or non-metropolitan area.

More capital is required for banks with deficiencies in other examination areas, particularly asset quality.

Examiners also pay close attention to how equity and asset growth affect capital rations. They look at retained earnings as a ratio of average total equity to determine whether a bank’s equity growth is through retained earnings or an unsustainable outside source. They also look at the size of the dividend payout.

Asset quality

The asset quality rating is an indicator of future losses to the bank. It affects the ratings of other areas of examination, which must be considered in light of their adequacy to absorb anticipated losses.

The most important factor in the asset quality rating is the bank’s weighted classified asset ratio, which is computed as;

[ 15% X substandard assets + 50% X doubtful assets + 100% X loss assets ]

[ Tier 1 capital + allocation for loan and lease losses ]

Examiners also consider the level, trend, and composition of classified assets and nonaccrual and renegotiated loans, loan concentrations, lending policies, and effectiveness in monitoring past-due loans, insider loans, and the types of risks inherent in the bank’s on-and off-balance sheet portfolios.

Management

Management is evaluated on several criteria, including compliance with applicable laws and regulations, whether there is a comprehensive internal or external review audit, internal controls to safeguard bank assets, and systems for timely and accurate information.

Examiners also consider the other components of the CAMELS rating, shareholder return, and the extent to which the bank serves all sectors of its community.

Earnings

Earnings are assessed for the ability to absorb future losses, so this rating is affected by asset quality, a bank s level trend and relation to a peer of net interest income, noninterest income, overhead expense and provision for loan and lease losses, extraordinary items, additional required provision for loan and lease losses or other nonrecurring items, and dividend payouts.

Liquidity

The liquidity rating determines a bank’s ease in obtaining money cheaply and quickly and a bank’s management of interest rate risk.

Considerations include the bank’s loan commitments and standby letters of credit, the presence of an “unstable core” of funding, access to capital markets, the ratio of federal funds purchased and brokered deposits to total assets, and the ratio of loans to deposits.

Sensitivity to Market Risk

Rating is based on, but not limited to,

- assessments of the sensitivity of tire financial institution’s earnings or the economic value of its capital to adverse changes in interest, rates, foreign exchange rates, commodity prices or equity prices,

- the ability of management to identify, measure, monitor, and control exposure to market risk given the institution’s size,

- complexity, and risk profile,

- nature, and complexity of interest rate risk,

- exposure arising from non-trading positions where appropriate,

- the nature and complexity of market risk exposure arising from trading and foreign operations.

The CAMELS rating system workbook CAMELS is in the subdirectory Models. The model has been augmented and can be used to rate financial institutes.

Understanding CAMELS Ratings – Descriptions of Composite CAMELS Ratings

5 categories of composite ratings. These are:

| Rating | Composite Range | Description |

| Composite Score of 1 | 1.00- 1.49 | Strong |

| Composite Score of 2 | 1.50-2.49 | Satisfactory |

| Composite Score of 3 | 2.50 – 3.49 | Fair |

| Composite Score of 4 | 3.50 – 4.49 | Marginal |

| Composite Score of 5 | 4.50 – 5.00 | Unsatisfactory |

Meaning of composite rating Under CAMEL Rating Analysis

Composite Score of 1 | Composite Range 1.00 – 1.49 | Description: Strong

A composite score of 1 indicates that a bank;

- basically, sound, in every respect,

- findings are of a minor nature and can be handled routinely,

- resistant to external economic and financial disturbances, and

- no cause for supervisory concern.

A scale of 1 implies that a bank exhibits a robust performance, is sound, and complies with risk management practices.

Banks/institutions in this group are basically sound in every respect; any critical findings or comments are of a minor nature and can be handled routinely.

Such institutions are resistant to external economic and financial disturbances and are more capable of withstanding the vagaries of business conditions than institutions with lower ratings. As a result, such institutions give no cause for supervisory concern.

Composite Score of 2 | Composite Range 1.50-2.49 | Description: Satisfactory

A composite score of 2 indicates that a bank is;

- fundamentally sound,

- findings are of a minor nature and can be handled routinely,

- stable and can withstand business fluctuations well, and

- supervisory concerns are limited to the extent that findings are corrected.

Banks/institutions in this group are also fundamentally sound but may reflect modest weaknesses correctable in the normal course of business. However, the nature and seventy of deficiencies are not considered material; therefore, such institutions are stable and able to withstand business fluctuations quite well.

While areas of weakness could develop into conditions of greater concern, the supervisory response is limited to the extent that minor adjustments are resolved in the normal course of business and operations continue satisfactorily.

Composite Score of 3 | Composite Range 2.50 – 3.49 | Description: Fair

A composite score of 3 indicates that a bank is;

- financial, operational, or compliance weaknesses ranging from moderately severe to unsatisfactory,

- vulnerable to the onset of adverse business conditions,

- easily deteriorate if actions are not effective in correcting weaknesses, and

- Supervisory concern and more than normal supervision to address deficiencies.

Banks/institutions in this category exhibit a combination of financial, operational, or compliance weaknesses ranging from moderately severe to unsatisfactory.

When weaknesses relate to the financial condition, such institutions may be vulnerable to the onset of adverse business conditions. They could easily deteriorate if concerted action is ineffective in correcting the weaknesses.

Institutions that are in significant noncompliance with laws and regulations may also be accorded this rating. Generally, these institutions give more cause for supervisory concern and require more than normal supervision to address deficiencies.

However, overall strength and financial capacity are still such to make failure only a remote possibility.

Composite Score of 4 | Composite Range 3.50 – 4.49 | Description: Marginal

A composite score of 4 indicates that a bank is;

- the immoderate volume of serious financial weaknesses,

- unsafe and unsound conditions may exist which are not being satisfactorily addressed,

- without corrections, these conditions could develop further and impair future viability,

- high potential for failure, and

- close supervision surveillance and a definite plan for correcting deficiencies.

Banks/institutions in this group have an immoderate volume of serious financial weaknesses or a combination of other unsatisfactory conditions. Major and serious problems or unsafe and unsound conditions may exist which are not satisfactorily addressed or resolved.

Unless effective action is taken to correct these conditions, they could reasonably develop into a situation that could impair future viability, threaten depositors’ interests, and/or pose a potential for disbursement of funds by the insuring agency.

A higher potential for failure is present but not imminent or pronounced. Institutions in this category require close supervisory attention, financial surveillance, and a definitive plan for corrective action.

Composite Score of 5 | Composite Range 4.50 – 5.00 | Description: Unsatisfactory

A composite score of 5 indicates that a bank is;

- High immediate or near-term probability failure.

- Seventy of the weaknesses are so critical that urgent aid from stockholders or other financial sources is necessary, and

- It will likely require liquidation, merger, or acquisition without immediate connective actions.

This category is reserved for institutions with an extremely high immediate or near-term probability of failure. The volume and severity of weaknesses or unsafe and unsound conditions are so critical that they require urgent aid from stockholders or other public or private sources of financial assistance.

Without urgent and decisive corrective measures, these situations will likely require liquidation and the payoff of depositors, disbursement of insurance funds to insured depositors, or some form of emergency assistance, merger, or acquisition.