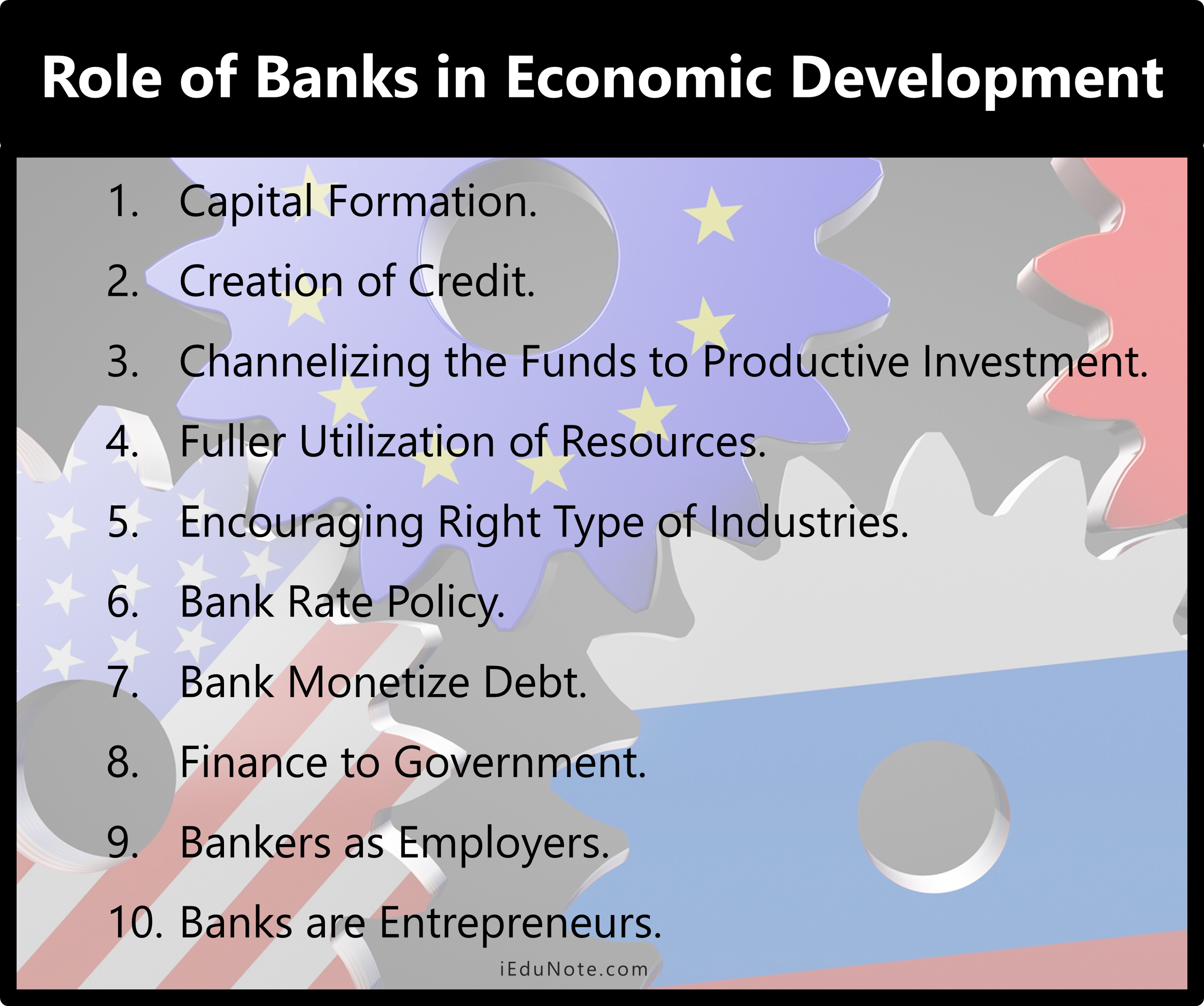

Banks have always played an important position in the country’s economy. They play a decisive role in the development of industry and trade. The main contributions made by the banks to the economic development of the nation;

10 Role of Banks Play Economic Development

Capital Formation

Banks play an important role in capital formation, which is essential for the economic development of a country. They mobilize the small savings of the people scattered over a wide area through their branches throughout the country and make it available for productive purposes.

Creation of Credit

Banks create credit to provide more funds for development projects. Credit creation leads to increased production, employment, sales, and prices, and thereby, they cause faster economic development.

Channelizing the Funds to Productive Investment

Capital formation is not the only function of commercial banks. Banks invest the savings mobilized by them for productive purposes. Pooled savings should be distributed to various sectors of the economy to increase the nation’s productivity.

Fuller Utilization of Resources

Savings pooled by banks are utilized to a greater extent for the development purposes of various regions in the country. It ensures fuller utilization of resources.

Encouraging the Right Type of Industries

The banks help develop the right industries by extending loans to the right type of persons. In this way, they help the country’s industrialization and economic development.

Bank Rate Policy

Economists believe that changing the bank rates can make changes in a country’s money supply. Federal or state banks in developing countries; the interest rate is to be paid by banks for the deposits accepted by them and the rate of interest to be charged by them on the loans they granted.

Bank Monetize Debt

Commercial banks transform the loan to be repaid after a certain period into cash, which can be immediately used for business activities. Manufacturers and wholesale traders cannot increase their sales without selling goods on credit. But credit sales may lead to the locking up of capital.

Finance to Government

The government is acting as the promoter of industries in underdeveloped countries for which finance is needed it. Banks provide long-term credit to the government by investing their funds in Government securities and short-term finance by purchasing Treasury Bills.

Bankers as Employers

After the nationalization of big banks, the banking industry has grown to a great extent. Bank branches are opened in almost all the villages, which creates new employment opportunities. Banks are also improving people for occupying various posts in their office.

Banks are Entrepreneurs

Recently, banks have assumed developing entrepreneurship, particularly in developing countries like India. Developing entrepreneurship is a complex process. It includes forming project ideas, identifying specific projects suitable to local conditions, etc.

Finally, we can say that bank plays a vital role in the country’s economic development.