A sole proprietorship is the oldest and the most common form of business organization. “Sole” means single, and “proprietorship” means ownership. It means only one person or an individual becomes the owner of the business.

Thus, a business organization in which a single person owns, manages, and controls all the activities of the business is known as a sole proprietorship of a business organization. The individual who owns and runs the sole proprietorship business is Called a ‘sole proprietor’ or ‘sole trader.’

A sole proprietor pools and organizes the activities with the sole objective of earning profit.

Is there any such shop in your locality where a single person is the owner?

Small shops like vegetable shops, grocery shops, telephone booths, chemist shops, etc., are some common sole proprietorship forms of business organizations.

Apart from trading businesses, small manufacturing units, fabrication units, garages, beauty parlors, etc., can also be run by a sole proprietor.

A sole proprietorship is an informal type of business owned by one person. Let’s learn all about it.

A Sole proprietorship, also called sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. The owner receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts.

The proprietor owns every asset of the business, and all debts of the business are the proprietors.

This means that the owner has no less liability than if they were acting as an individual instead of as a business. It is a “sole” proprietorship in contrast with partnerships.

A sole proprietor may use a trading name or business name other than his or her legal name. In many jurisdictions, there are rules to enable the true owner of a business name to be ascertained.

In practice, there is generally a requirement to file a business as a statement with the local authorities.

What is a Sole Proprietorship? – Definition of Sole Proprietorship

According to Davidson, “A sole proprietor carries business for his profit, bearing all risks”.

In the words of Gloss & Baker, “A sole proprietorship is a business owned by one person and operated for his profit.”

B .O. Wheeler defines sole proprietorship as “The forms of business ownership which is owned and controlled by a single individual.”

Koontz and Fulmer define, “A sole proprietorship is a business owned and controlled by one person”.

According to Janies L. Lundy, “Sole proprietorship is an informal type of business owned by one person.”

According to J. L. Hanson, “Sole proprietorship is a type of business unit where one person is solely responsible for providing the capital, for bearing the risk of the enterprise, and for the management of the business.”

According to Kimbell and Kimbell, “Sole proprietorship is a form of business where the individual proprietor is the supreme judge of all matters pertaining to his business.”

Under the sole proprietorship, a single individual organizes and operates the business in his name. He is not only responsible for its management but also its risks.

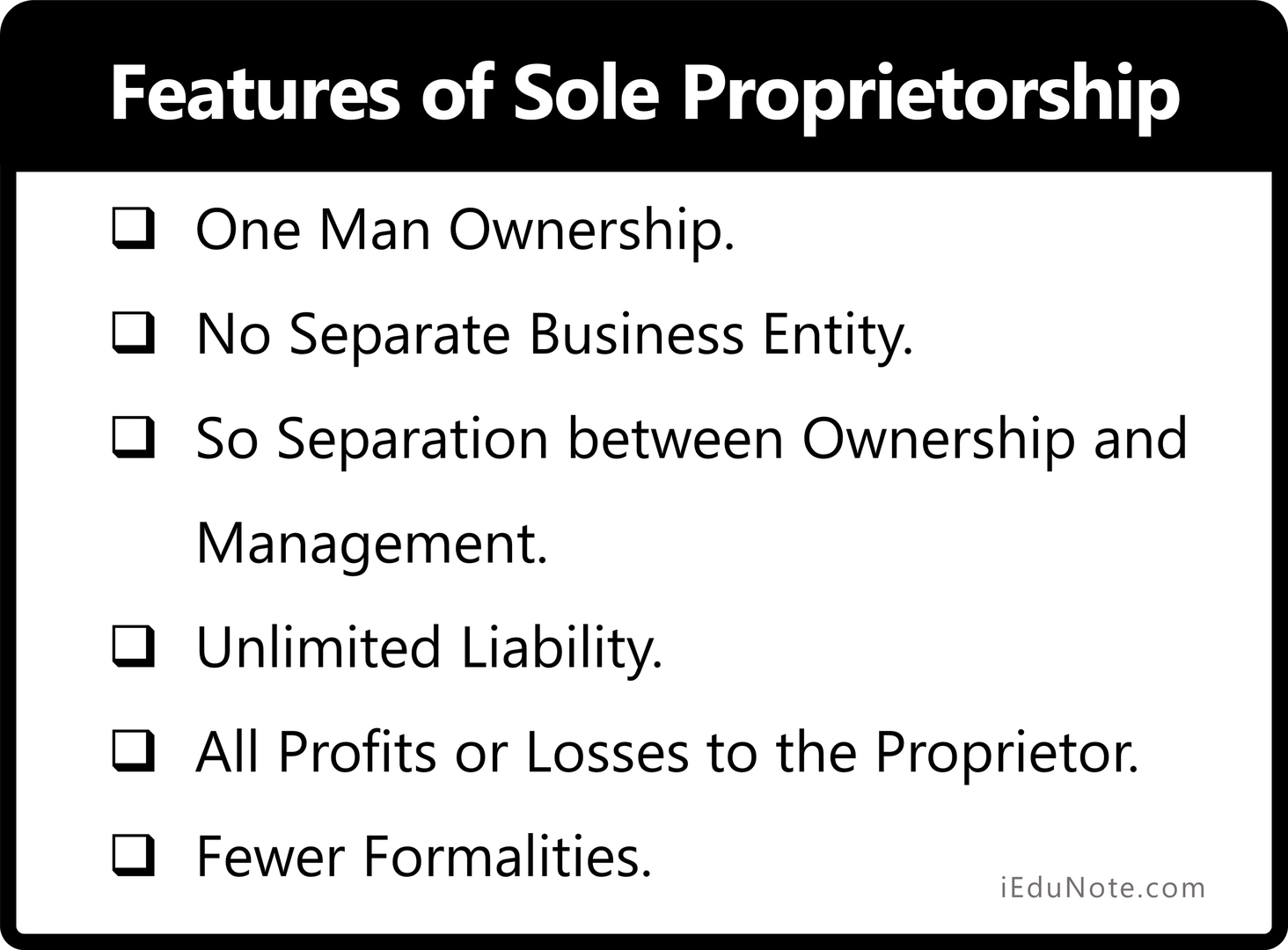

Main Features of Sole Proprietorship – What Makes up a Sole Proprietorship?

The main features of the proprietorship form of business owners can be listed as follows:-

- One Man Ownership.

- No Separate Business Entity.

- So Separation between Ownership and Management.

- Unlimited Liability.

- All Profits or Losses to the Proprietor.

- Fewer Formalities.

One Man Ownership

In a proprietorship, only one man is the owner of the enterprise.

No Separate Business Entity

No distinction is made between the business concern and the proprietor. Both are the same.

Separation between Ownership and Management

In a proprietorship, management rests with the proprietor himself/herself. The proprietor is also a manager.

Unlimited Liability

Unlimited liability means that in case the enterprise incurs losses, the private property of the proprietor can also be utilized to meet the business obligations to outside parties.

All Profits or Losses to the Proprietor

Being the sole owner of the enterprise, the proprietor enjoys all the profits earned and bean the full brunt of all losses incurred by the enterprise.

Fewer Formalities

A proprietorship business can be started- without completing many legal formalities. There are some businesses that, too, can be started simply after ‘obtaining the necessary manufacturing licenses and permits.

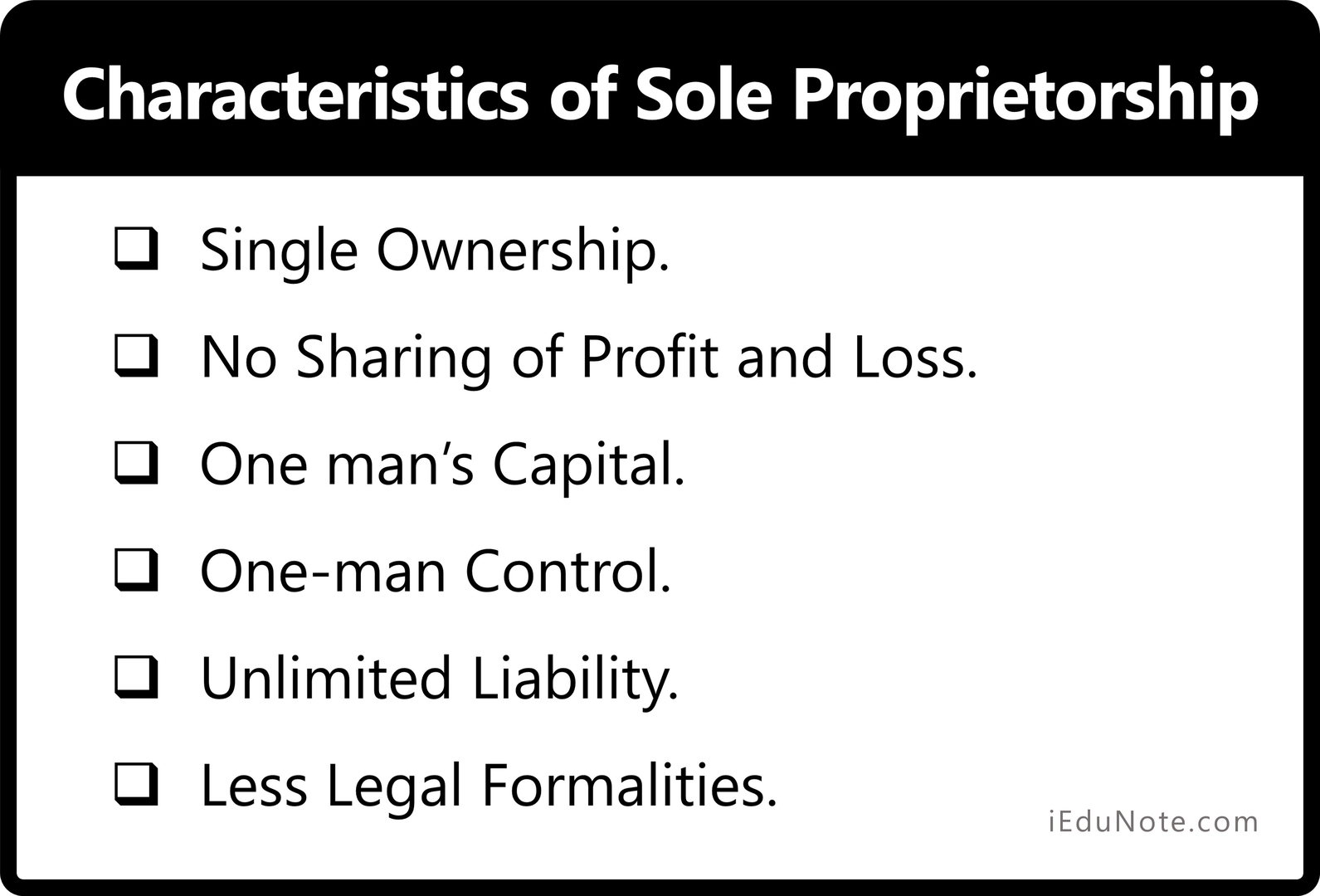

Characteristics of Sole Proprietorship – How Sole Proprietorship Looks Like!

A sole proprietorship has these characteristics:-

- Single Ownership.

- No Sharing of Profit and Loss.

- One man’s capital.

- One-man Control.

- Unlimited Liability.

- Less Legal Formalities.

Single Ownership

A single individual always owns a sole proprietorship form of business organization. That individual owns all assets and properties of the business.

Consequently, he alone bears all the risks of the business.

Thus, the business of the sole proprietor comes to an end at the will of the owner or upon his death.

No Sharing of Profit and Loss

The entire profit arising out of a sole proprietorship business goes to the sole proprietor. If there is any loss, it is also to be borne by the sole proprietor alone.

Nobody else shares the profit and loss of the business with the sole proprietor.

One man’s capital

The capital required by a sole proprietorship form of business organization is arranged by the sole proprietor.

He provides it either from his resources or by borrowing from friends, relatives, banks, or other financial institutions.

One-man Control

The controlling power in a sole proprietorship business always remains with the owner.

The owner or proprietor alone makes all the decisions to run the business. Of course, he is free to consult anybody as he likes.

Unlimited Liability

The liability of the sole proprietor is unlimited.

This implies that in case of loss, the business assets, along with the personal properties of the proprietor, shall be used to pay the business liabilities.

Less Legal Formalities

The formation and operation of a sole proprietorship form of the business organization require almost no legal formalities.

It also does not require to be registered.

However, for the business and depending on the nature of the business, the sole proprietorship has to have a seal.

He may be required to obtain a license from the local administration or the health department of the government, whenever necessary.

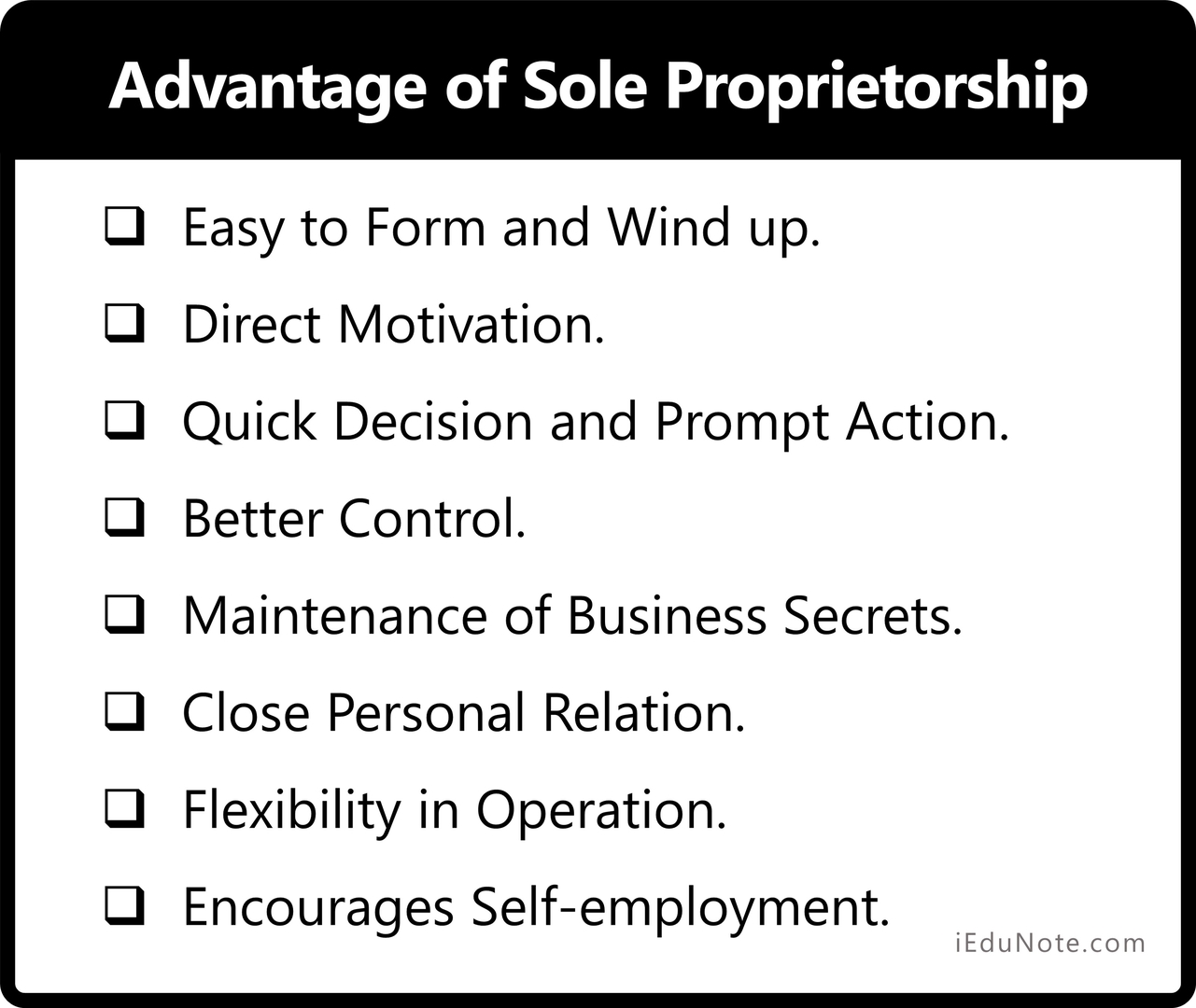

Advantage of Sole Proprietorship – What gives Sole Proprietor an Advantage Over Giants?

These criteria make sole proprietorship advantageous:-

- Easy to Form and Wind up.

- Direct Motivation.

- Quick Decision and Prompt Action.

- Better Control.

- Maintenance of Business Secrets.

- Close Personal Relation.

- Flexibility in Operation.

- Encourages Self-employment.

Easy to Form and Wind up

A sole proprietorship form of business is very easy to form.

With a very small amount of capital, you can start the business.

There is no need to comply with any legal formalities except for those businesses which require a license from local authorities or the health department of government.

Just like formation, it is also very easy to wind up the business. It is your sole discretion to form or wind up the business at any time.

Direct Motivation

The profits earned belong to the sole proprietor alone, and he bears the risk of losses as well. Thus, there is a direct link between effort and reward.

If he works hard, then there is a possibility of getting more profit, and of course, he will be the sole beneficiary of this profit.

Nobody will share this reward with him. This provides strong motivation for the sole proprietor to work hard.

Quick Decision and Prompt Action

In a sole proprietorship business, the sole proprietor alone is responsible for all decisions. Of course, he can consult others. But he is free to make any decision on his own.

Since no one else is involved in decision-making, it becomes quick, and prompt action can be taken based on this decision.

Better Control

In a sole proprietorship business, the proprietor has full control over every activity of the business. He is the planner as well as the organizer, who efficiently coordinates every activity.

Since the proprietor has all authority over him, it is possible to exercise better control over the business.

Maintenance of Business Secrets

Business secrecy is an important factor for every business. It refers to keeping the plans, technical competencies, business strategies, etc., secret from outsiders or competitors.

In the case of sole proprietorship business, the proprietor is in a very good position to keep his plans to himself since management and control are in his hands.

There is no need to disclose any information to others.

Close Personal Relation

The sole proprietor is always in a position to maintain good personal contact with the customers and employees. Direct contact enables the sole proprietor to know the individual likes, dislikes, and tastes of the customers.

Also, it helps in maintaining close and friendly relations with the employees, and thus, business runs smoothly.

Flexibility in Operation

The sole proprietor is free to change the nature and scope of business operations as and when required as per his decision. A sole proprietor can expand or curtail his business according to the requirement.

Suppose, as the owner of a bookshop, you have been selling books for school students. If you want to expand your business, you can decide to sell stationery items like pens, pencils, registers, etc.

If you are running an STD booth, you can expand your business by installing a fax machine in your booth.

Encourages Self-employment

A sole proprietorship form of business organization leads to the creation of employment opportunities for people. Not only is the owner self-employed, but sometimes he also creates job opportunities for others.

You must have observed in different shops that several employees are assisting the owner in selling goods to the customers.

Thus, it helps in reducing poverty and unemployment in the country.

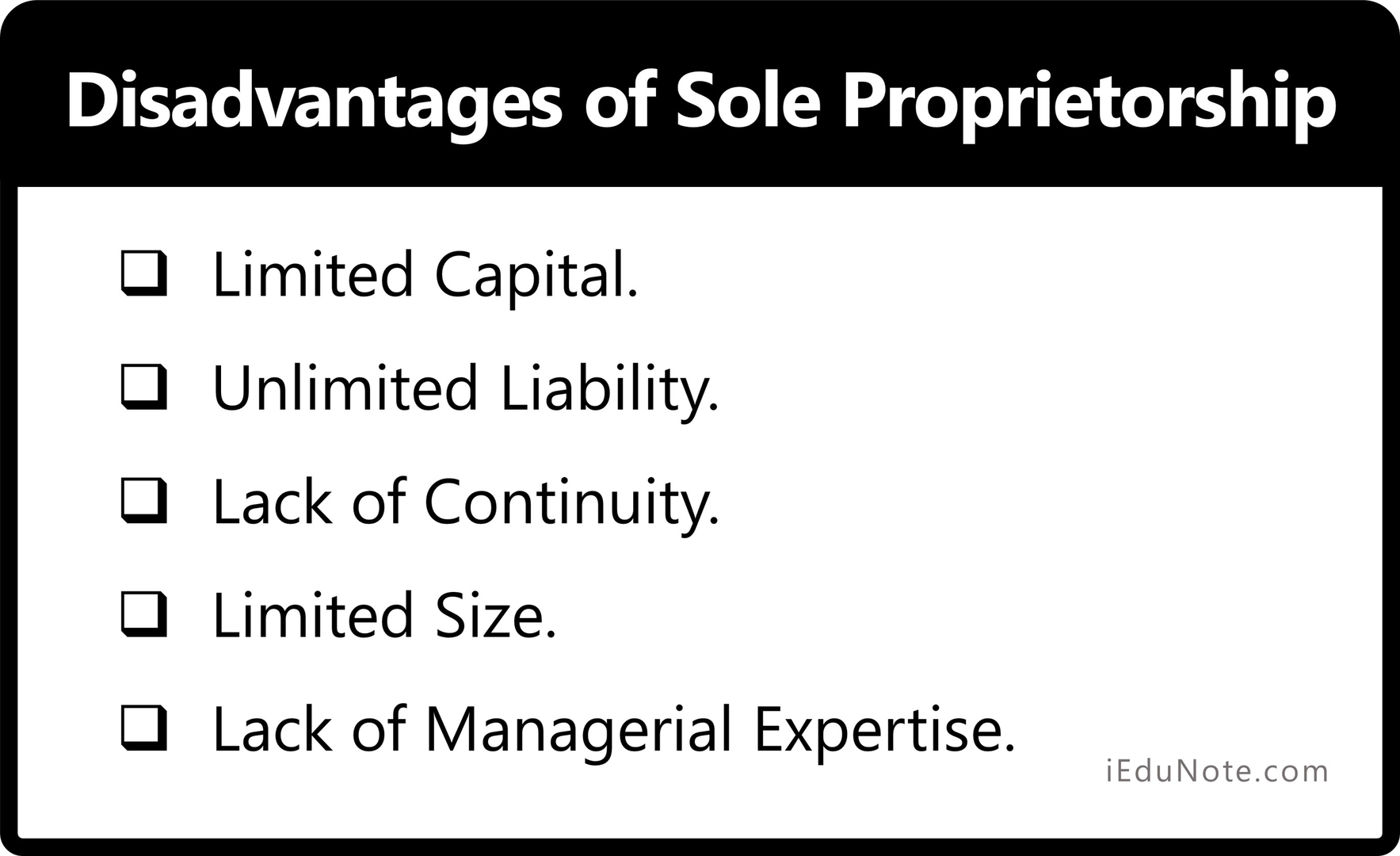

Disadvantages of Sole Proprietorship – Sole Proprietorship Comes with its Limitations

One-man business is the best form of business organization because of the above-discussed advantages.

Still, there are certain disadvantages too, such as;

- Limited Capital.

- Unlimited Liability.

- Lack of Continuity.

- Limited Size.

- Lack of Managerial Expertise.

Let us learn those limitations.

Limited Capital

In a sole proprietorship business, it is the owner who arranges the required capital of the business. It is often difficult for a single individual to raise a huge amount of capital.

The owner’s funds, as well as borrowed funds, sometimes become insufficient to meet the requirements of the business for its growth and expansion.

Unlimited Liability

In case the sole proprietor fails to pay the business obligations and debts arising out of business activities, his personal properties may have to be used to meet those liabilities.

This restricts the sole proprietor from taking risks, and he thinks cautiously while deciding to start or expand the business activities.

Lack of Continuity

The existence of a sole proprietorship business is linked to the life of the proprietor. The illness, death, or insolvency of the owner brings an end to the business. The continuity of business operation is, therefore, uncertain.

Limited Size

In the sole proprietorship form of business organization, there is a limit beyond which it becomes difficult to expand its activities.

It is not always possible for a single person to supervise and manage the affairs of the business if it grows beyond a certain limit.

Lack of Managerial Expertise

A sole proprietor may not be an expert in every aspect of management. He/she may be an expert in administration, planning, etc., but may be poor in marketing.

Again, because of limited financial resources, it is also not possible to employ a professional manager. Thus, the business lacks the benefits of professional management.

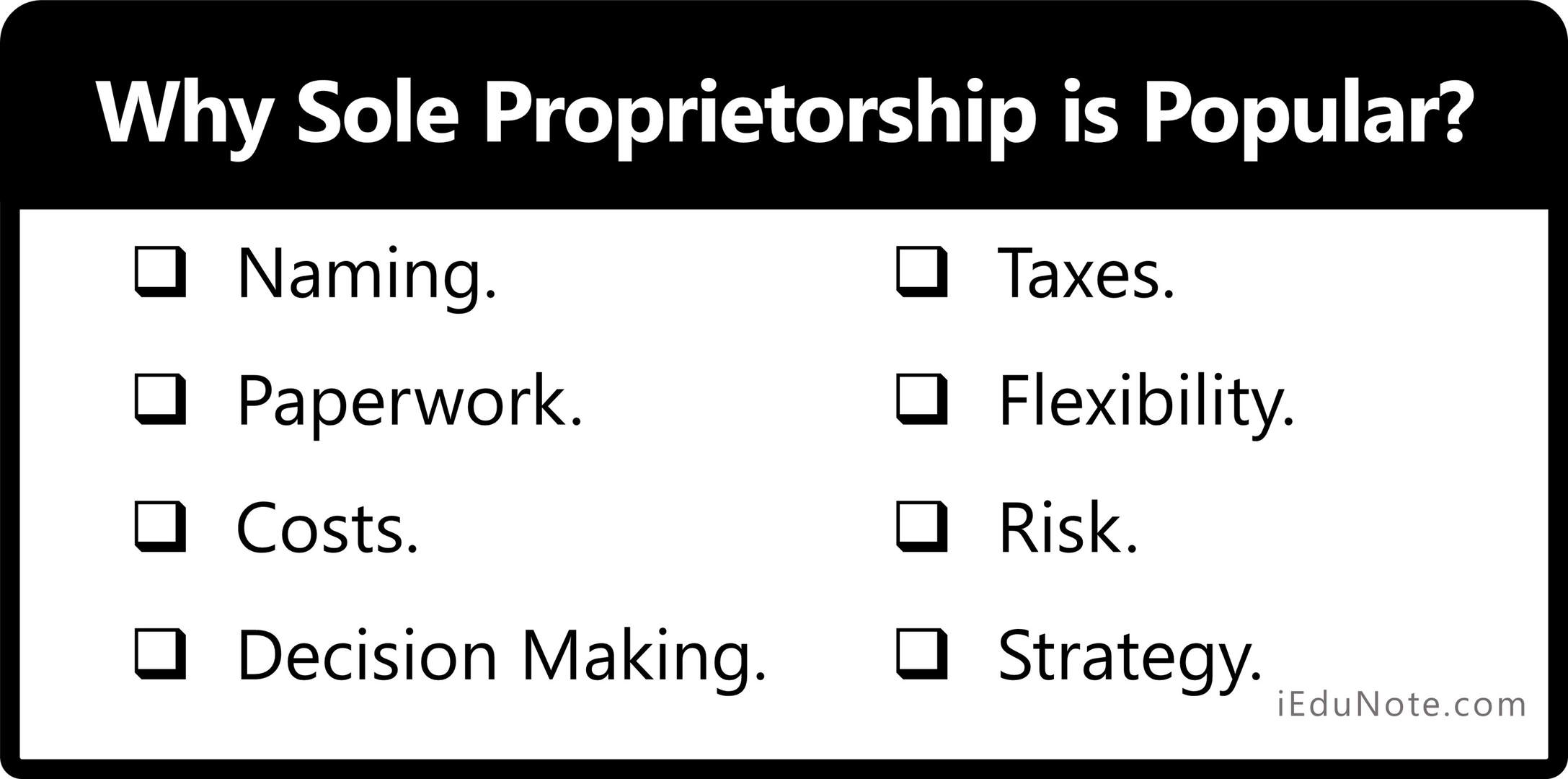

Why is Sole Proprietorship Popular? – Causes of Popularity of Sole Proprietorship

Sole proprietorship appears to be the most common form of business ownership because of the ease of formation and the relatively low cost with which it can be formed.

It is because:-

- Naming.

- Paperwork.

- Costs.

- Decision Making.

- Taxes.

- Flexibility.

- Risk.

- Strategy.

Companies that don’t formally organize as another type of business entity will automatically be treated as a sole proprietorship.

Naming – Just Put Your Name Here (if you can’t think of a cool name)

A sole proprietorship may be named after the owner of the business.

Paperwork – Quick and Easy

Another reason for the popularity of sole proprietorships concerns the minimal amount of paperwork necessary to register a sole proprietorship. Unlike other business entities, sole proprietorships don’t have to file organization paperwork.

In most cases, a sole proprietor only needs a business license and various permits issued by the state and local government.

Costs – Very Little to Start

The costs of forming a sole proprietorship are significantly less when compared to corporations and LLCs. Forming a corporation or LLC may require hundreds of dollars, whereas a sole proprietorship may be formed free of charge.

Again, the primary costs to form a sole proprietorship involve the costs of attaining a business license and permits.

Decision Making – Can be quick.

Sole proprietors have full control over all aspects of the business. This luxury isn’t enjoyed by other business entities that involve one or more partners or shareholders.

Taxes – Easy to Pay Taxes

No filing of a business tax return provides individuals with an attractive incentive to form a sole proprietorship. As indicated on the All Business website, sole proprietors pass business profits and losses to their tax returns.

Flexibility – Make Changes Anytime.

A small business owner is organizing as a sole proprietor to benefit from the management’s flexibility to make all business decisions.

Risk – Unlimited Liability

However, the major risk in operating as a sole proprietorship is that liability rests solely on the owner. As a result, personal assets are at risk if a debt is incurred or the business is subject to legal action.

Strategy – Fast to Form a Strategy

Business is organized as a sole proprietorship until the expense of incorporating or forming a partnership is justified by the business’s increase in size, complexity, and value.

From Where Does a Sole Proprietor Start? – Suitability Form of Business for Sole Proprietorship

Let us consider the type of businesses where the sole proprietorship form is most suitable. A sole proprietorship form of business organization is suitable:

Where the market for the product is small and local. For example, selling grocery items, books, stationery, vegetables, etc.

Where customers are given personal attention according to their tastes and preferences, for example, making a special type of furniture, designing garments, etc.

Where the nature of business is simple, for example, grocery, garments business, telephone booth, etc.

Where a capital requirement is small, and the risks involved are not heavy—for example, vegetables and fruits business, tea stalls, etc.

Where manual skill is required, for example, making jewelry, haircutting or tailoring, cycle or motorcycle repair shop, etc.

The previous description reveals that sole proprietorship or one-man control is the best in the world if that man is big enough to manage everything. But such a person does not exist.

Therefore, a sole proprietorship is suitable in the following cases-

- Where a small amount of capital is required, e.g., sweet shops, bakeries, newsstands, cyber cafes, retailing houses, etc.

- Where quick decisions are very important, e.g., shut down brokers, bullion dealers, etc.

- Where limited risk is involved, e.g., automobile repair shop, confectionery, small retail store, etc.

- Where personal attention to individual tastes and fashions of customers is required, e.g., in beauty parlors, tailoring shops, lawyers, painters, etc.

- Where the demand is local, seasonal, or temporary, e.g., retail trade, laundry, fruit sellers, etc.

- Where fashions change quickly, e.g., artistic furniture, etc.

- Where the operation is simple and does not require skilled management.

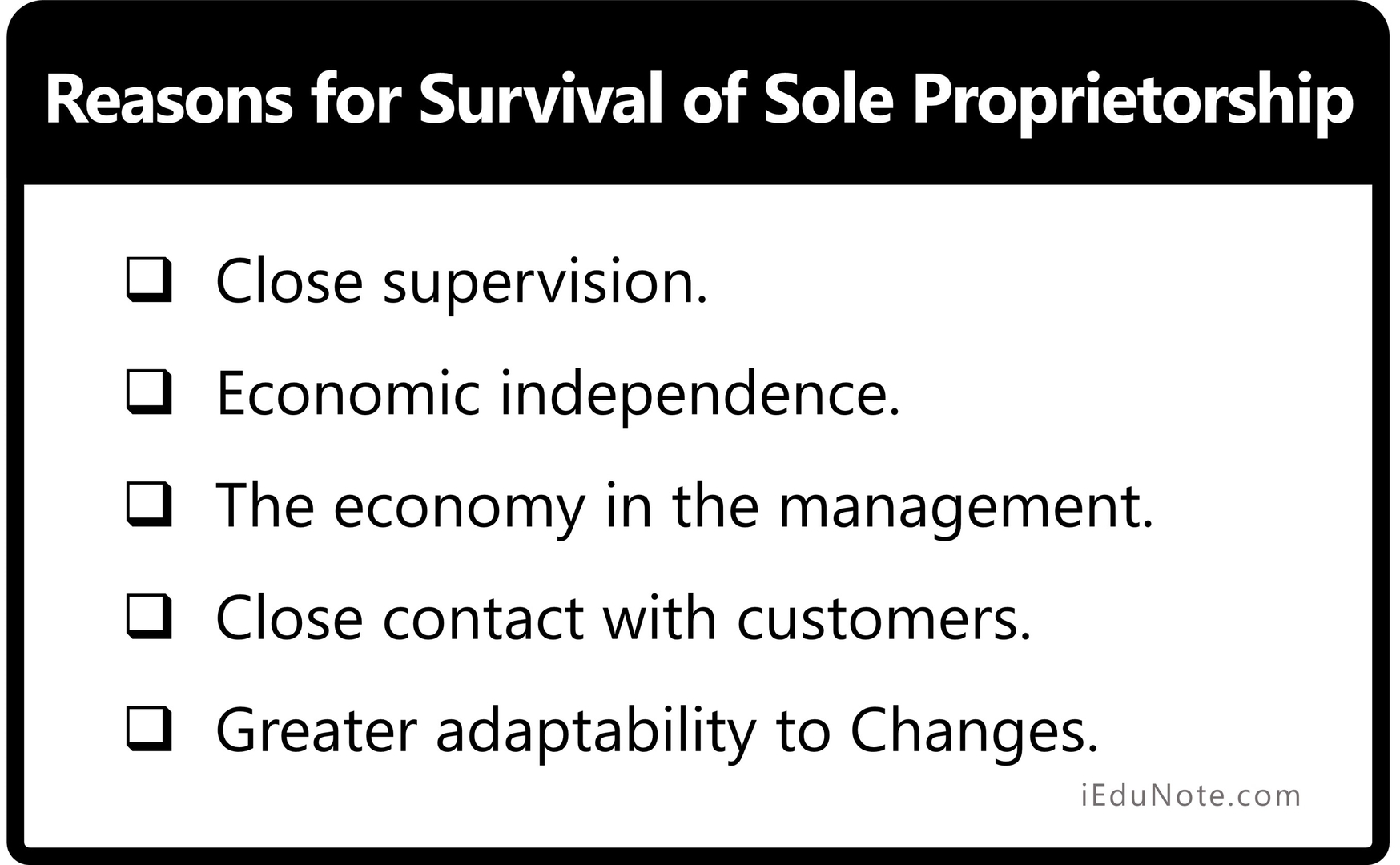

Reasons for Survival of Sole Proprietorship – Why Are Most Small-Scale Firms by Sole Proprietors Thriving?

A sole proprietorship is considered to be the seedbed of a large-scale enterprise. In addition to that, proprietorship is surviving along with medium and giant joint efforts due to the following reasons:-

- Close supervision.

- Economic independence.

- The economy in the management.

- Close contact with customers.

- Greater adaptability to Changes.

Close supervision

When production is being carried out on a small scale, the producer can easily supervise each part of the work.

The raw material is fully utilized by avoiding waste. As the workers are closely supervised, they work efficiently. The machines are carefully handled. All this results in the lowering of the cost of production.

Economic independence

In a small firm, the producer is generally the sole proprietor himself. When he knows that the whole profit will go to him and not to anybody else, he works untiringly.

The economy in the management

A large firm has to spend a sizeable portion of its income on maintaining administrative machinery, but that is not the case with a small firm. In a small firm, the proprietor himself is the manager.

He does not need excessive account keeping. He writes the income and expenditures of his business in a small notebook and keeps that to himself.

Close contact with customers

As the workers employed in a small firm are few, the employer can have close contact with them. He can listen to their grievances personally and can redress them if he thinks they are justified.

Due to a better understanding between the and the employees, the chances of industrial disputes are reduced.

Greater adaptability to Changes

Another advantage claimed by a small firm is that it can easily adjust its supply to the changed conditions in demand.

As the small firm does not have to consult the various shareholders of the business, it can easily arrive at quick decisions, and these decisions can be promptly executed.

Difference between Partnership and Sole Proprietorship form of Business Organization

Both Partnership and Sole Proprietorship forms have their features, advantages, and limitations. Let us compare them to find out the difference between them:

| Basis of Difference | Partnership | Sole Proprietorship |

|---|---|---|

| 1. Formation | It can be formed only based on an agreement among the partners. | No agreement is required to start the business. It is formed at any time whenever desired by the sole proprietor. |

| 2.Ownership and Management | Owned, controlled, and managed by partners. | This is completely owned, controlled, and managed by the sole proprietor. |

| 3. No. of members | Minimum two and maximum 10 in banking and 20 in other businesses. | Only one member. |

| 4. Capital | Capital is provided by partners in an agreed ratio. | Capital is arranged by the sole proprietor alone. |

| 5. Decisionmaking | It takes time to decide upon important matters because all the partners must be consulted for making a decision. | Decision-making is very quick because there is no need to consult anyone else to make a decision. |

| 6. Sharing of profit and loss | Profits and losses are shared by partners as per the agreement. | The question of the sharing of profits or losses does not arise. The sole proprietor alone takes all profits and |

| 7. Governing Act | Usually, It is governed by The Partnership Act. | There may no specific act that governs a sole proprietorship business depending on the country. But trade or business laws in the country do apply on Sole Proprietorship. |

Final Words: Sole Proprietorship is One Guy’s Dream Coming True.

Proprietorship, also called sole tradership, is the oldest form of business ownership in the world. A sole proprietorship is a ‘one-man show’ where an individual tries to make his business a success by his cleverness, courage, ability, honesty, education, and cooperation.

A sole proprietor is an individual who carries on business exclusively by and for him. The proprietor not only bears all the risks but also receives all the gains from the business.

In a proprietorship, the enterprise is owned and controlled by one person, the master of his/her show; he/she sows, reaps, and harvests the outputs of the effort and manages the business on his own.

If necessary, he/she may take the help of his/her family members and relatives and employ some employees.

Proprietorship is the simplest and easiest to form. It does not require legal recognition and attendant formalities. The one-man control is the best in the world if that man is big enough to manage everything.