Accounting is the systematic recording of all business transactions, preparing financial reports, providing analysis of accounting data, and providing information to the accounting information users (i.e., management, shareholders).

For this, the accounting department in any organization continuously creates a journal, ledger, trial balances, worksheets, balance sheets, income statements, and profit-and-loss statements.

While accounting has methods for fixing errors in these processes, it is often not enough. Also, there is always a chance of human error and fraud in accounting books.

An independent and separate process is required to check the accuracy of the accounting process’s financial data. That’s where auditing comes in.

An audit is a systematic examination and verification of a company’s financial and accounting records and supporting documents by an independent professional (i.e., auditor) against established criteria and professional audit standards.

All the claims in the accounting records and financial statements are checked and verified by doing an audit.

The auditing process gathers evidence, evaluates evidence against established criteria, thoroughly checks and verifies the accounting records and all related documents, and then provides an honest and professional opinion based on the findings.

So, auditing is verifying if the accounting process is giving the correct data.

Accounting collects and summarizes the business transaction in financial statements, and auditing checks and verifies these business transactions in financial statements.

That is why the accounting and auditing profession is very closely related.

Accounting and auditing are similar in that they work on a company’s business transactions and financial positions. However, the main difference between accounting and auditing is that; accounting records and reports the financial positions, whereas auditing checks and verifies the accounting reports on financial positions.

Let’s understand all the similarities and differences between Accounting and Auditing.

Similarities between Accounting and Auditing

The similarities between accounting and an audit require a thorough knowledge of accounting procedures and are usually done by those with an accounting degree.

An auditor will generally be an accountant who is “knowledgeable about the organization’s auditing procedures and processes.

Another similarity; both processes aim to ensure the company’s records accurately reflect its financial position.

There are significant differences in the methods, objectives, and parties responsible for the accounting process by which the financial statements are prepared and the audit of the statements.,

Accounting methods involve identifying the events and transactions that affect the entity.

Once identified, these items are measured, recorded, classified, and summarized in the accounting records. This process results in preparing and distributing financial statements that conform to generally accepted accounting principles (GAAP).

The ultimate objective of accounting is communicating relevant and reliable financial data that will be useful for decision-making.

An entity’s employees are involved in the accounting process; ultimately, responsibility for financial statements lies with the entity’s management.

The typical audit of financial statements involves obtaining and evaluating evidence concerning management’s financial statements to enable the auditor to verify whether the statements are presented in conformity with GAAP.

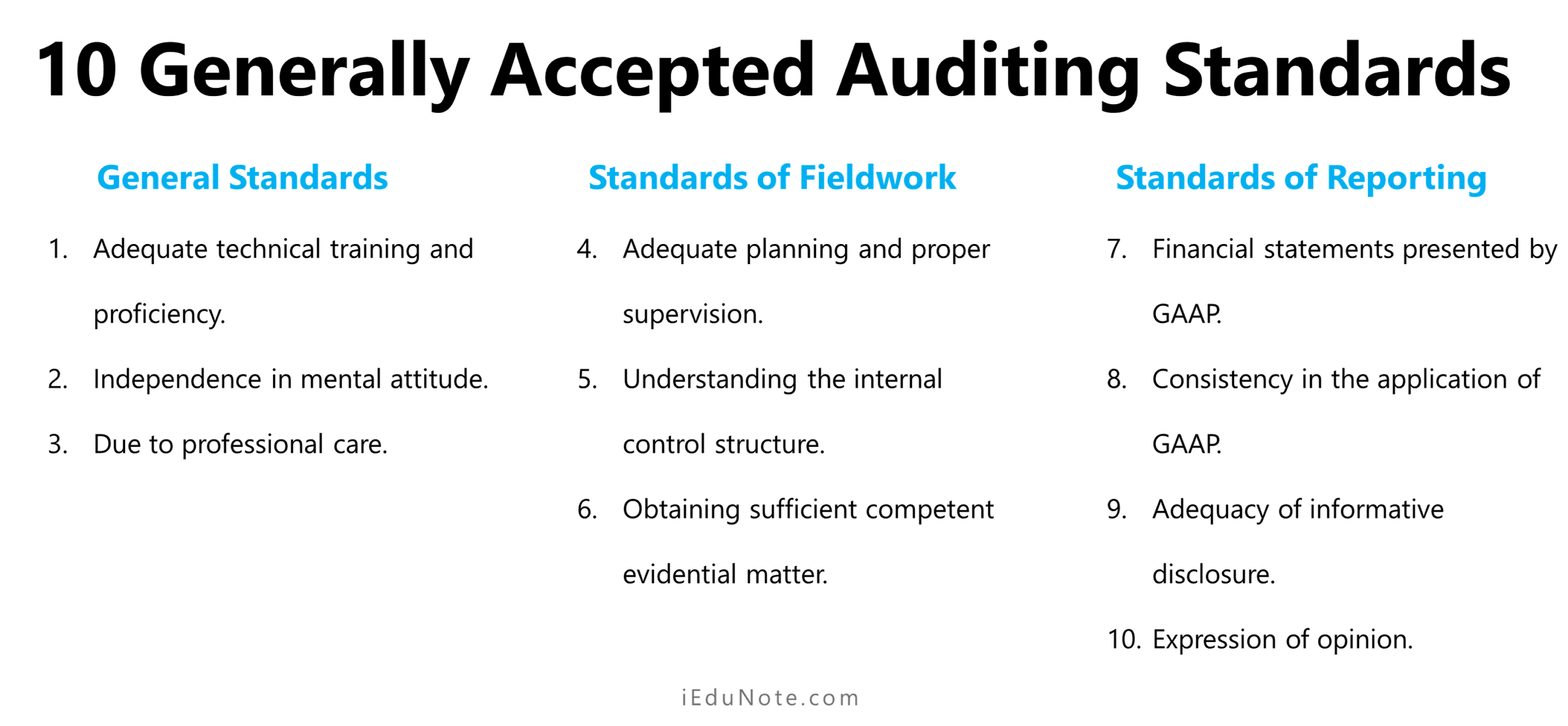

The auditor is responsible for adhering to generally accepted auditing standards in gathering and evaluating the evidence and issuing an audit report containing the auditor’s conclusion expressed as an opinion on the financial statements.

The primary objective of auditing is to add credibility to the financial statements prepared by management.

Differences between Accounting and Auditing

Accounting is related to the collection, recording, analysis, and interpretation of financial transactions, but auditing refers to examining books of accounts and evidential documents.

Meaning

Accounting is collecting, recording, analyzing, and interpreting financial transactions.

Still, auditing examines books of accounts and evidential documents to prove the true arid fair view of profitability and financial position.

Beginning of Work

The work of accounting begins when financial transactions take place, but the work of auditing begins when the work of accounting ends.

Scope

The accounting scope includes preparing profit and loss accounts, balance sheets, and other statements per the auditor’s instruction. Still, the auditor’s scope includes checking the books of accounts, considering their fairness, and complying with the provision of the company act or not.

Nature of Work

Accounting keeps the record of financial transactions but the auditor checks and verifies the books of accounts.

Staff

An accountant is a staff of an organization and draws the salary from the business. Still, an auditor is an independent person who is appointed for a specific period and gets a sum of remuneration.

Preparation of Report

An accountant does not prepare a report after completing his task, but he has to give information to the management when needed. The auditor must prepare and present a report after completing his work to the concerned authority.

Responsibility

An accountant remains responsible for the management, but an auditor is responsible to the owners or shareholders.