Audit procedures are the acts performed or the methods and techniques used by the auditor to gather and evaluate audit evidence. They may be applied to the underlying accounting data or to obtaining and evaluating corroborating information.

In designing audit procedures, it is common to spell out insufficiently specific terms to permit their use as instructions during the audit.

For example, the following is an audit procedure for the verification of cash disbursements:

Obtain the cash disbursements journal and compare the payor name, amount, and date on the canceled check with the cash disbursements journal.

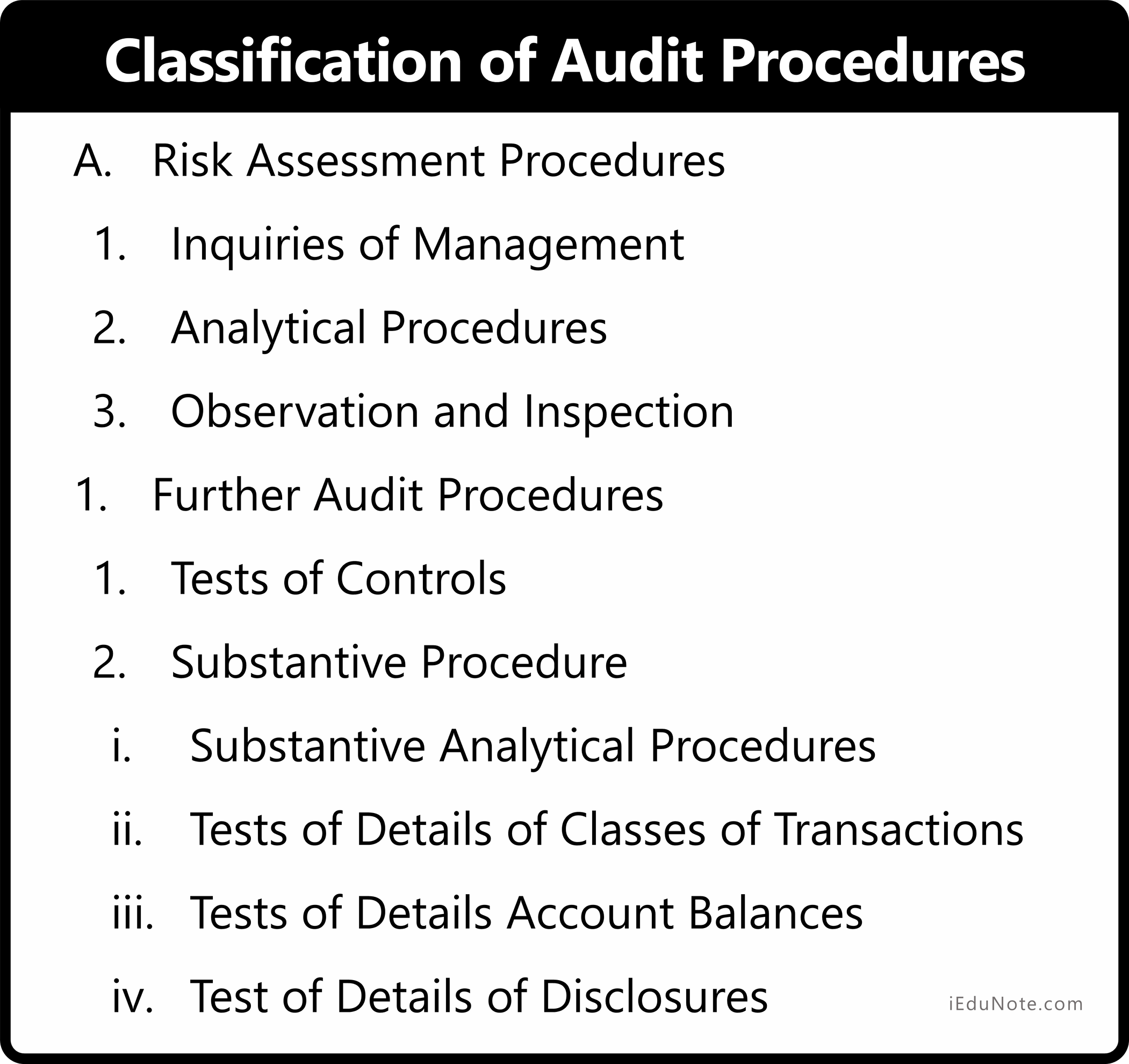

Classification/ Types of Audit Procedures

Audit evidence to draw reasonable conclusions on which to base the auditor’s opinion is obtained by performing the following:

- Risk assessment procedures,

- Further audit procedures, which comprise-

- Tests of controls, when required or when the auditor has chosen to do so, and

- Substantive procedures include tests of details and substantive analytical procedures.

A. Risk Assessment Procedures

The auditor shall perform risk assessment procedures to provide a basis for identifying and assessing risks of material misstatement at the financial statement and assertion levels.

However, risk assessment procedures do not provide sufficient appropriate audit evidence on which to base the audit opinion.

The risk assessment procedures shall include the following;

1. Inquiries of Management

In the auditor’s judgment, inquiries of management and of others within the entity may have information that is likely to assist in identifying risks of material misstatement due to fraud or error.

Much of the information from the auditor’s inquiries is obtained from management and those responsible for financial reporting.

However, the auditor may also obtain information or a different perspective in identifying risks of material misstatement through inquiries of others within the entity and other employees with different levels of authority.

2. Analytical Procedures

The analytical procedures performed as risk assessment procedures may identify aspects of the entity of which the auditor was unaware and may assist in assessing the risk of material misstatement to provide a basis for designing and implementing responses to the assessed risks.

Analytical procedures performed as risk assessment may include financial and non-financial information, for example, the relationship between sales and square footage of selling space or volume of goods sold.

3. Observation and Inspection

The observation and inspection procedures may support inquiries of management and others and may also provide information about the entity and its environment.

Examples of such audit procedures include observation or inspection of the following;

- the entity’s operations,

- documents (such as business plans and strategies), records, internal control manuals,

- reports prepared by management (such as quarterly management reports and interim financial statements) and those charged with governance (such as minutes of the board of directors’ meetings),

- the entity’s premises and plant facilities.

B. Further Audit Procedures

In addition to the risk assessment procedure, there are some other audit procedures known as further audit procedures.

They are described below;

1. Tests of Controls

Tests of controls are audit procedures performed to test the operating effectiveness of controls in preventing or detecting material misstatements at the relevant assertion level.

An auditor might use inspection of documents, observation of specific controls, reperformance of the control, or other audit procedures to gather evidence about controls.

The objective of the tests of controls in an audit of internal control over financial reporting is to obtain evidence about the effectiveness of controls to support the auditor’s opinion on the company’s internal control over financial reporting.

The auditor’s opinion relates to the effectiveness of the company’s internal control over financial reporting at a point in time and taken as a whole.

2. Substantive Procedure

Substantive procedures are audit procedures performed to test material misstatements (monetary errors) in an account balance, transaction class, or disclosure component of financial statements.

A substantive procedure is a process, step, or test that creates conclusive evidence regarding the completeness, existence, disclosure, rights, or valuation (the five audit assertions) of assets and/or accounts on the financial statements.

To qualify as a substantive procedure, enough documentation must be collected so that another competent auditor could conduct the same procedure on the same documents and make the same conclusion.

Four Categories Substantive Procedure

Substantive Analytical Procedures

Analytical procedures” means evaluations of financial information made by a study of plausible relationships among both financial and non-financial data.

Analytical procedures also investigate identified fluctuations and relationships inconsistent with other relevant information or deviate significantly from predicted amounts.

Tests of Details of Classes of Transactions

Tests of details of class transactions involve examining the evidential support for the individual debits and credits to an account and are usually done through vouching and tracing.

Tests of Details Account Balances

Tests of details of account balances involve examining support of the closing balances directly, for example, confirming an ending account receivable balance directly with the customer.

Test of Details of Disclosures

Test of details of disclosures involve examining whether;

- all disclosures that should have been included in the financial statements following the applicable financial reporting framework have been included,

- all the disclosures are clearly expressed, and

- all the disclosures are made fairly and at appropriate amounts.