3 Types of Risks in Insurance are Financial and Non-Financial Risks, Pure and Speculative Risks, and Fundamental and Particular Risks. Financial risks can be measured in monetary terms. Pure risks are a loss only or, at best, a break-even situation. Fundamental risks are the risks mostly emanating from nature.

Having dealt with the meaning of risk, we shall now attempt to divert our attention to another aspect of the nature of risk which we shall call as Classification of risk.

It is required to know the complex classification and sub-classification of risk and also an insight into risks that can be insured and which cannot be.

We may look into this subject in the following manner:

- Financial and Non-Financial Risks.

- Pure and Speculative Risks.

- Fundamental and Particular Risks.

In this post, we are going to look into the three classifications of risk.

Financial and Non-Financial Risks

Financial risks are the risks where the outcome of an event (i.e., event giving birth to a loss) can be measured in monetary terms.

The losses can be assessed, and a proper monetary value can be given to those losses. The common examples are:

- Material damage to property arising out of an event. We may consider the damage to a ship due to a cyclone or even the sinking of a ship due to the cyclone. Damage to the motor car due to a road accident may be of partial or total nature. Damage to stock or machinery etc.

- Theft of a property which may be a motorcycle, motor car, machinery, items of household use or even cash.

- Loss of profit of a business due to fire damage the material property.

- Personal injuries due to industrial, road, or other accidents resulting in medical costs, Court awards, etc.

- The death of a breadwinner in a family leads to corresponding financial hardship.

All such losses, i.e., the outcome of unforeseen untoward events, can be measured in monetary terms.

The losses can be replaced, reinstated, or repaired, or even a corresponding reasonable financial support (in case of death) can be thought about.

We would call all such financial risks as insurable risks and these are indeed the main subjects of insurance.

Non-Financial risks are the risks, the outcome of which cannot be measured in monetary terms.

There may be a wrong choice or a wrong decision giving rise to possible discomfort or disliking or embarrassment but not being capable of valuation in money terms.

Examples can be:

- Choice of a car, its brand, color, etc.

- Selection of a restaurant menu,

- Career selection, whether to be a doctor or engineer etc.

- Choice of bride/bridegroom,

- Choice of publicity etc.

Since the outcome cannot be valued in terms of money, we shall call these non-financial risks uninsurable.

Pure Risk and Speculative Risks

Pure risks are those risks where the outcome shall result in loss only or, at best, a break-even situation. We cannot think about a gain-gain situation.

The result is always unfavorable, or maybe the same situation (as existed before the event) has remained without giving birth to a profit (or loss).

As opposed to this, speculative risks are those risks where there is the possibility of gain or profit. At least the intent is to make a profit and no loss (although loss might ensue).

Investing in shares may be a good example. Pricing, marketing, forecasting, credit sale, etc., are yet examples falling within the domain of speculation.

Consider another example where we can have the existence of both pure risks and speculative risks. A garment factory may be in our minds. Here we have:

- Cyclone damage possibility to the factory building,

- Fire damage possibility to stock,

- Machinery breakdown possibility to Machinery,

- Theft possibility to removable items,

- Personal accident possibility of factory workers etc.

Also, we have:

- the question of pricing of the product to remain in the competitive market,

- the question of fashion changes leading to a drastic fall in the demand for the product,

- the question of withdrawal of the quota system,

- the question of credit sale

The students should appreciate that in the first set of examples, we are indeed talking about the possibility of certain losses emanating from certain untoward events or unforeseen contingencies (like a cyclone, fire, theft, accident, etc.), and for convenience, we shall call them the risks of trade.

These are identified as pure risks and, as such insurable. Notice that these losses can also be measured in monetary terms.

As opposed to this, if we refer to the second set of examples, we notice that the outcome of the trade or business is not the result of pure risks but indeed the result of economic factors, supply & demand, change of fashion, trade restriction or liberalization, etc. and for convenience we call them trade risks.

These may be identified as speculative risks and usually not insurable.

Fundamental Risk and Particular Risks

Now coming to the last stage of classification of risk we may consider the subject from the viewpoint of the cause of risk and its effect. We call such classifications as fundamental risks and particular risks.

Fundamental risks are the risks mostly emanating from nature. These are the risks that arise from causes that are beyond the control of an individual or group of individuals.

The losses arising out of such causes may be catastrophic in dimension and felt by a huge number of populations, the society, or by the state, although an individual may be a part of that catastrophe. The common examples are:

- Flood & Cyclone, Subsidence & landslip,

- Earthquake & volcanic eruptions, Tsunamis,

- The convulsion of nature and other natural disasters,

- Famine, Draught

We may also add to the list perils like war, terrorism, riots & other political activities, which are neither created by nature nor by an individual but result in colossal losses.

But one thing is certain, which are this that all such perils are impersonal not being caused or contributed by an individual or even a group of individuals.

Normally fundamental risks were not supposed to be insurable because of the magnitude, and these were considered to be the responsibility of the State. Now because of demand and insurers’ strength, these risks are easily insurable.

Particular risks are; as opposed to what has been narrated hereinbefore, there are risks that usually arise from the actions of individuals or even groups of individuals.

These may be identified as causes arising from personal (or group) behavior and effects (losses) not being of that magnitude.

These are mostly men created because of their negligence, error in judgment, carelessness, and disregard for law or respect.

We may even go on to suggest that these are indeed the cases (both cause and effect) where there has been an omission to do something which should have been done, or there has been done something which should not have been done.

We may call these risks of personal nature. The common examples are:

- Fire, Explosion,

- Burglary, housebreaking, larceny, and theft,

- Stranding, Sinking, Capsizing, Collision in case of a ship, including cargo loss,

- Machinery breakdown and deterioration of stock due to machinery breakdown,

- Motor accidents, including death and bodily injuries, Industrial accidents,

- The collapse of bridges, Derailments.

Particular risks are insurable risks, and most of the insurances relate to these risks.

However, the students should appreciate that risk is a dynamic concept and may be modified because of the ever-changing situation.

So it may not be unlikely that risk under one classification is changing its character and identifying itself under another classification.

Levels of Risk in Insurance

Having identified the risk, the question of its frequency or magnitude would be very much relevant in insurance.

Consider a factory by the bank of a river causing regular floods and consider another factory near the same river but situated uphill.

Is the risk of flood damage the same for both factories?

Simple common sense would dictate that the risk of the flood would be more concerning the first factory (by the bank of the river) as opposed to the second factory (uphill).

To take yet another example to consider a house in a comfortable residential area near a fire brigade office and another house in a very crowdy locality surrounded by lanes and alley-bounds and far from any fire brigade office.

Certainly, the possibility of a fire loss would be far higher in the second house as opposed to the first house.

What we are indeed suggesting here is that in the study of risk, we are not simply to contend with the uncertainty as to the causation of an event. We should also know the behavioral pattern or risk frequency and its severity as well.

Extend the example of the house by another hypothesis that gives value to the houses. The first house in the posh area is valued at $1 million, whilst the second house in the crowdy area is valued at $100K.

Now our imagination is a bit changed because we shall have to bring the severity of loss into our scenario. Because it is the magnitude of the cost of a loss also which is of concern to insurers.

Frequency & Severity

As has been indicated in the extended example above, as an insurer and risk bearer, we no doubt are interested in loss (event) frequency, but at the same time, we are also interested in the severity (cost) of loss.

This is so because, ultimately, we shall have to pay a loss, and our premium generation should be such that it would enable us to pay all such claims insured. Therefore, a correlation is to be established between frequency and severity.

Is it that the more frequent the events are, the more the cost or severity?

This necessarily follows that a distinction is to be drawn between these two.

If we now go through the extended example again, can we possibly visualize that although the possibility (frequency) of fire in a house situated in a crowdy fire-prone locality is higher as opposed to a house situated in a posh area, the severity of loss, should there be a fire engulfing the house of the posh area, will be much more in comparison to the house of the crowdy area simply because of the higher value involved?

Having said this, when we measure a risk that is necessarily required from the viewpoint of both insurer and the insured, we realize that a distinction between frequency and severity of risk assumes importance.

This helps the insured to decide whether to go for insurance or not.

Similarly, it helps the insurer to decide what premium would be reason enough to cover loss payment and other incidental expenses, such as administrative costs, dividends, etc.

Let us recall our previous understanding of uncertainty and lack of knowledge about the future causation of an event.

The more and more an event occurs, our knowledge about the future causation of the same event increases, and our uncertainty gradually diminishes, giving way to certainty.

When uncertainty turns into certainty, our prediction about the future becomes stronger and stronger, and our forecast for the future becomes more and more accurate.

This is what an insurer’s objective is, and when this point is struck, we sit in the driving seat and take control of forecasting future events as masters thereof.

Going back to the issue of frequency and severity, if a person finds from experience that in his trade or profession, the frequency as to the causation of an event is quite high with low cost or severity, he might consider retaining the risk of loss on his shoulder.

On the other hand, if it is found that the frequency of the causation of an event is rather substantially low with high severity and cost, he may transfer the risk to insurers.

Clandestine thefts in private dwelling houses may be one example of high-frequency losses with low cost or severity. Shipping risks, Aviation risks, Petrochemical risks, etc.

Maybe examples of low-frequency losses with commendable severity and costs involved.

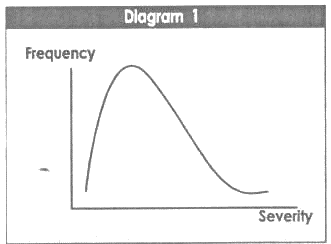

The following diagrams demonstrate this:

Here the verticle axis represents the frequency of the loss event, and the horizontal axis represents the severity (cost) of loss.

In private dwelling houses, the incidence of theft is quite high, but the losses are all small clandestine thefts.

What is demonstrated here is that as the number of incidences or frequency goes up, the severity comes down, and as the frequency comes down, the severity increases.

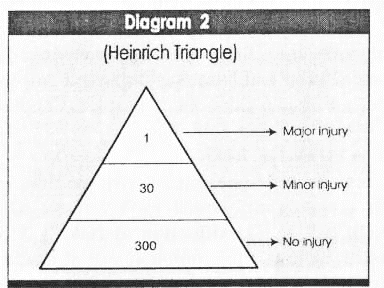

This position is also supported by a well-known study referred to as Heinrich Triangle.

This was done about industrial injury cases, which revealed that the number of major bodily injuries to workmen emanating from industrial accidents is much less as opposed to minor bodily injuries or no injuries at all.

The study was made of workers employed in various industries. The object was to find out the number of bodily injuries arising out of industrial accidents and their severity.

The study revealed that for each major injury, there were relatively 30 minor injuries, and in 300 incidents, there was no injury at all:

This is the normal behavioral pattern of most of the risks.

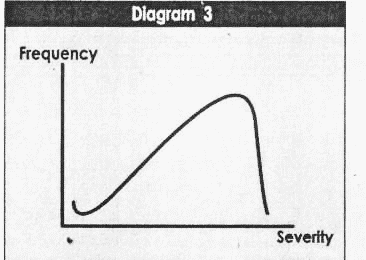

However, a typical scenario may emerge in rare cases where with the increase in frequency, the severity also increases, as demonstrated in the following diagram:

Here as the frequency becomes higher and higher, the severity also goes higher and higher. These are normally very high-valued risks such as Petro-chemical, Aeroplanes, and Ships, etc.

To complete the study of the meaning of risk and understanding peril and hazard is important.

![Types of Insurance Organizations [A Comprehensive Guide]](https://www.iedunote.com/img/259/types-insurance-organization-e1529504882393.png)