If a company has a sound competitive intelligence system put in place and works, it is easier for the company to devise strategies to deal with competitors.

Because the information provided by the system will help the company decide which competitors should be attacked and which to avoid, managers usually go for customer value analysis before deciding on the attack and avoiding strategies. This analysis helps the company look at its strengths and weaknesses.

Customer value analysis also helps to identify the needs and wants of the target buyers and their rating of competing products in terms of their needs and wants.

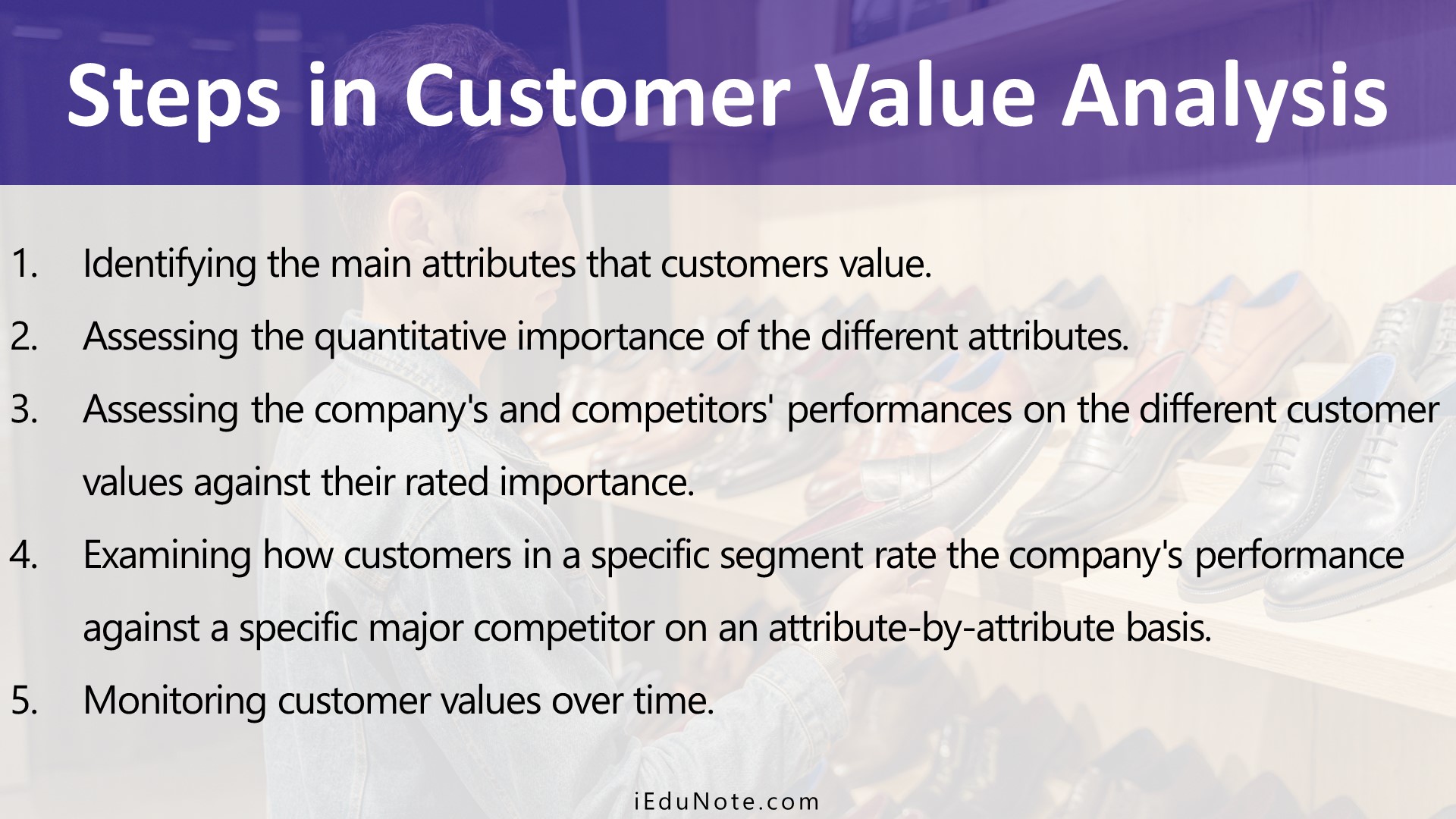

Steps in Customer Value Analysis

Customer value analysis consists of five steps;

- Identifying the main attributes that customers value.

- Assessing the quantitative importance of the different attributes.

- Assessing the company’s and competitors’ performances on the different customer values against their rated importance.

- Examining how customers in a specific segment rate the company’s performance against a specific major competitor on an attribute-by-attribute basis.

- Monitoring customer values over time.

Step -1: Identifying the main attributes that customers value.

This may be identified by asking a group of representative customers of the target segment(s). You may ask them what they look for in a product and how they select a particular seller. You should record their responses to help you identify your company’s position in the minds of your target buyers.

Step-2: Assessing the quantitative importance of the different attributes.

To assess the importance of different attributes that customers consider important, you may request them to rank the attributes in order of ascending value. By averaging their rating, you can decide which attribute is most important, which comes next to it, and so on.

Step-3: Assessing the company’s and competitors’ performances on the different customer values against their rated importance.

On the third stage, you may ask your respondent customers to compare your company’s performance with that of your competitors with respect to each of the attributes they consider important.

Step-4: Examining how customers in a specific segment rate the company’s performance against a specific major competitor on an attribute-by-attribute basis.

ere respondent customers are requested to compare the company’s performance with that of the major competitors against each of the attributes of customers value. It helps the company identify its position with respect to its major competitor. This helps the company to decide whether it should raise its price, reduce it, or keep the price unchanged.

Step-5: Monitoring customer values over time.

Customers’ values always do not remain the same. They may change with the elapse of time, and consequently, a company should, after certain intervals, measure customer values for revising its strategies if required.

Once the customer value analysis is done, the company can decide on the attack and avoid strategies.

To decide on this, it should analyze different classes of competitors. This analysis helps the company decide which competitor(s) to be attacked and avoid. Let us now look at different classes of competitors :

Weak versus Strong Competitors

The usual practice found in the industry is to attack weak competitors and to avoid the strong ones. If you attack the weaker ones, it requires you to spend limited resources and time. But it is not always advisable to attack only the weaker competitors.

You should, at times, decide to attack stronger ones. It helps you to acquire the latest technologies and improve your image and goodwill in the market. On the contrary, if you always attack weak competitors, you may have zero improvements in your acquiring new technologies and increasing image.

Distant versus Close Competitors

Some of the competitors may be very close to you in terms of product, offer prices, and other aspects, whereas others may not resemble you in these respects.

Normally, companies prefer attacking their close competitors and avoiding distant ones. The purpose of competing with close competitors is not to destroy them but to make the market situation more healthy.

Bad versus Good Competitors

In almost every industry, there are good as well as bad firms in operation. Companies should help their good competitors grow and attack bad ones so that they are eliminated.

Companies support their good competitors since they conform to the industry’s rule, make a realistic assumption about the industry’s growth potential, set prices in a reasonable relation to costs, favor a healthy industry, limit themselves to a segment of the industry, motivate others to lower costs or improve differentiation, and accept the general level of their share and profits.

But the bad competitors do not conform to the industry’s rules and take unusual risks, invest in over-capacity, and upset the equilibrium of the industry. Bad competitors, in fact, try to destroy the industry and take advantage of it.