The relationship between a banker and a customer depends on the type of transaction. Both parties have obligations and rights in this banker and customer relationship. The relationship between banker and customer is not only that of a debtor and creditor. However, they also share other relationships.

Relationship Between a Bank and Customer

The relationship between a banker and a customer comes into existence when the banker agrees to open an account in the name of the customer. The relationship between a banker and a customer depends on the activities, products, or services provided by the bank to Its customers or availed by the customer.

Thus the relationship between a banker and customer Is the transaction relationship Bank’s business depends much on the strong bondage with the customer. Trust plays an important role m building a healthy relationship between a banker and a customer.

To become a customer account relationship is a must. Account relationship Is a contractual relationship- Banking is a trust-based relationship. There are numerous kinds of relationships between the bank and the customer.

The relationship between a banker and a customer depends on the type of transaction. Thus the relationship is based on contract, and certain terms and conditions. These relationships confer certain rights and obligations both on the part of the banker and on the customer.

However, the personal relationship between the bank and its customers is long-lasting. Some banks even say that they have a generation-to-generation banking relationship with their customers.

Banker

The term banking may be defined as accepting a deposit of money from the public for lending or investing investment of that money that is repayable on demand or otherwise and with a draw by cheque, draft, or order.

Features of Banking

- The definition of banking describes the following features of banking.

- A banking company must perform both of the essential functions.

- Accepting of deposit.

- Lending or investing the same: The phrase deposit of money from the public is significant. The bankers accept a deposit of money and not of anything else. The world public implies that a banker accepts a deposit from anyone who offers his/her money for such a purpose.

- The definition also implied the time and made to withdraw the deposit. The deposit money should be repayable to the depositor on demand made by the letter or according to the agreement between the two parties.

Customer

A person who has a bank account in his name and the banker undertakes to provide the facilities as a banker is considered a customer.

To constitute a customer, the following requirements must be fulfilled;

- The bank account may be savings, current or fixed deposit must be operated in his name by making a necessary deposit of money.

- The dealing between the banker and customer must be of the nature of the banking business. The general relationship between banker and customer:

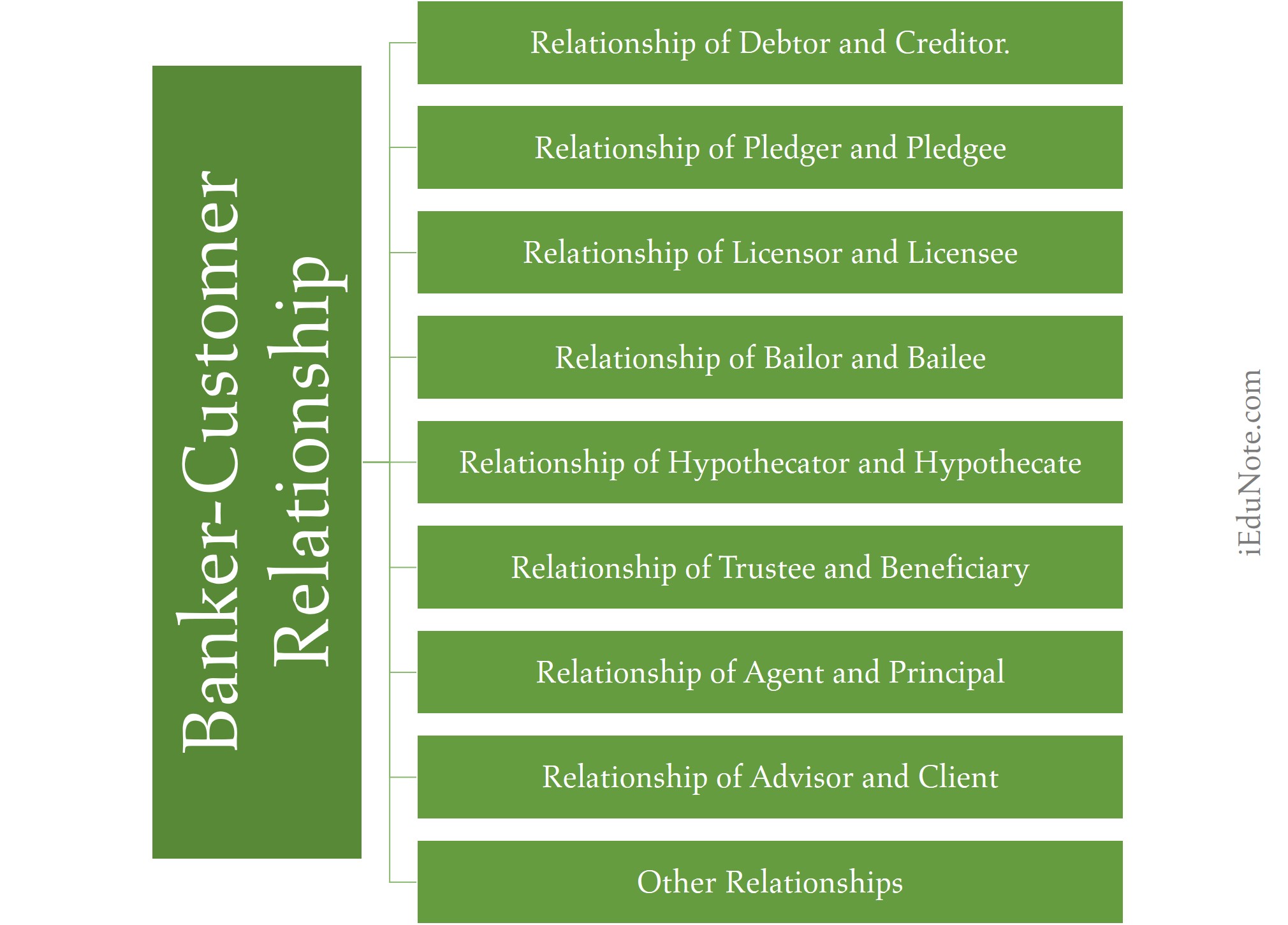

Types of the Relationship between Banker and Customer

The relationship between banker and Customer are categorized into three;

- Relationship as debtor and creditor.

- Banker as a trustee.

- Banker as an agent.

- Other special relationships with the customer, obligations of a banker

Relationship as Debtor and Creditor

On opening an account, the banker assumes the position of a debtor. A depositor remains a creditor of his banker so long as his account carries a credit balance.

The relationship with the customer is reserved as soon as the customer’s account is overdrawn.

The banker becomes a creditor of the customer who has taken a loan from the banker and continues in that capacity fills the loan is repaid.

Debtor and Creditor

When a ‘customer’ opens an account with a bank, he fills in and signs the account opening form. By signing the form, he agrees/contracts with the bank.

When a customer deposits money in his account, the bank becomes a debtor of the customer, and the customer becomes a creditor.

The money so deposited by the customer becomes the bank’s property, and the bank has a right to use the money as it likes. The bank is not bound to inform the depositor of the manner of utilization of funds deposited by him.

Bank does not give any security to the depositor, l.e. debtor. The bank has borrowed money and it is only when the depositor demands, the banker pays.

The bank’s position is quite different from that of normal debtors. While issuing Demand Draft, Mail / Telegraphic Transfer, the bank becomes a debtor as it owns money to the payee/ beneficiary.

Creditor and Debtor

Lending money is the most important activity of a bank. The resources mobilized by banks are utilized for lending operations. Customers who borrow money from the bank send money to the bank. In the case of any loan/advances account, the banker is the creditor, and the customer is the debtor.

The relationship is the first case when a person deposits money with the bank and reverses when he borrows money from the bank. The borrower executes documents and offers security to the bank before utilizing the credit facility.

Banker as a Trustee

Ordinally, a banker is a debtor of his customer in the report of the deposit made by the letter, but in certain circumstances, he also acts as a trustee.

A trustee holds money or assets and performs certain functions to benefit some other person called the beneficiary.

For example; if the customer deposits securities or other values with the banker for safe custody, the letter acts as a trustee of his customer.

Banker as an Agent

A banker acts as an agent of his customer and performs a number of agency functions for the convenience of his customer.

For example, he buys or sells securities on behalf of his customer, collects checks/cheques, and pays various customer dues.

Special relationship with customer/obligation of a banker

The primary relationship between a banker and his customer is a debtor and a creditor or vice versa. The special features of this relationship, as a note above, impose the following additional obligations on the banker.

- Trustee and Beneficiary (Bank as a Trustee and Customer as a Beneficiary)

- Bailee and Bailor (Bank-Bailee and Customer- Bailor)

- Lessor and Lessee (Bank- Lessor and Customer- Lessee)

- Agent and Principal (Bank- Agent and Customer- Principal)

- Indemnity holder and Indemnifier (Bank-Indemnity holder and Customer-Indemnifier)

- Hypothecatee and Hypothecator (Bank-Hypothecatee and Customer-Hypothecator)

- Pledgee and Pledger (Bank-Pledgee or Pawnee and Customer-Pledger or Pawnor)

- Mortgagee and Mortgagor (Bank-Mortgagee and Customer-Mortgagor)

- Custodian (Bank- Custodian)

- Guarantor (Bank- Guarantor)

- Advisor and Client (Bank- Advisor and Customer- Client)

The obligation to honor the Check/Cheques

The deposit accepted by a banker is his liabilities repayable on demand or otherwise. Therefore, the banker is under a statutory obligation to honor his customer’s check/cheque in the usual course.

- Availability of sufficient funds of the customer.

- The correctness of the check/cheque.

- Proper presentation of the check/cheque.

- A reasonable time for collection.

- Proper drawing of the check/cheque.

The obligation to maintain the secrecy of the customer accounts

The banker must take the utmost care to keep his customer’s account secret.

By keeping secrecy, the account books of the bank will not be thrown open to the public or government officials if the following reasonable situation does not occur,

- Discloser of information required by law.

- Bankers’ practice and wages permit disclosure. The practice and wages are customary amongst bankers to permit disclosure of certain information and the following circumstances.

- With express or implied consent of the customer.

- Banker reference.

- Duty to the public to disclose.