What is the Principle of Contribution?

The principle of contribution is implemented when multiple insurance policies cover the same property or loss. The total payment for actual loss is proportionally divided among all insurance companies.

In insurance, the principle of contribution is inborn from the principle of indemnity. It is used to will maintain continued existence to preserve the principle of indemnity.

Therefore, the principle of contribution only applies to those insurance contracts, which are contracts of indemnity.

In fact, however, there would have been possibilities of getting more than the actual loss had the principle of contribution not been established with legal force. Just to give a probability, the insured would have received a claim in full a number of times by affecting a number of policies with different insurers, thereby defeating the principle of indemnity entirely.

Subrogation, therefore, has come up with the principle of contribution with the sole intent of preserving the principle of indemnity.

The contribution is a right that an insurer has, who has paid under a policy, to call other interested insurers in the loss to pay or contribute rate-able to the payment.

This means that if, at the time of loss, it is found that there is more than one policy covering the same loss, then all policies should pay the loss proportionately to the extent of their respective liabilities so that the insured does not get more than one whole loss from all these sources.

Suppose a particular insurer pays the full loss. In that case, that insurer shall have the right to call all the interested insurers to pay him back to the extent of their individual liabilities, whether equally or otherwise.

The insured, under no circumstances, shall be allowed to take advantage of all the policies individually so as to get the full claim number of times. Even if the insured recovers from all the policies, he shall have to refund all such payments in excess of the actual loss sustained.

As this principle virtually comes to the rescue of the principle of indemnity, therefore, like subrogation, the assertion “it is a corollary to the principle of indemnity” equally holds well with regard to the principle of contribution.

As life and personal accident contracts are not contracts of indemnity, this principle does not apply thereto.

The Principle of Contribution: Apply it to Policy Claims

It is virtually from the perspective of claims settlement that this doctrine is of vital importance. In this regard, the following considerations must be noted carefully;

When Contribution Principle Operates

Before contribution can operate, the following conditions must be fulfilled;

- There must be more than one policy involved, and all the policies covering the loss must be in force. This is well understood. If there is only one policy involved, there is nothing that can contribute, and similarly, if, at the time of loss, it is found that a particular policy in the lot is not in force because of some reason that that policy cannot be called upon to contribute.

- All the policies must cover the same subject matter. If all the policies cover the same insured but different subject matters altogether, then the question of contribution would not arise.

- All the policies must cover the same peril causing the loss. If the policies cover different perils, some common and some uncommon, and if a common peril does not cause the loss, the question of contribution would not arise.

- All the policies must cover the same interest of the same insured. An example will make the proposition clear. Let us assume that “A” is the owner of a car and has obtained a loan from “B” on the security of the car. Here both A and B have got insurable interests and can, therefore, affect policies individually. In the case of damage to a car, both A & B will get claims independently, and no contribution will apply between the policies.

The reason is that the interests are different and also the insureds. It should be remembered that if any of the above four factors are not fulfilled, the contribution will not apply;

How Contribution Principle Works

Once it is established that the above factors are satisfied and contribution is to apply, then the next course is to find out the liability under each policy.

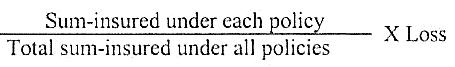

Usually, this is on the sum-insured basis under each policy and is commonly known as the proportionate liability or respective liability of each policy. The formula applied is,

Let’s see the examples below to get a better idea;

The Principle of Contribution in Insurance Law and Contract

It should be clearly borne in mind that even though there is no contribution condition in the policy, that is to say,, even if it is not mentioned in the policy, that contribution will apply. Nevertheless, it is the legal right of the insurers to get the benefit of contribution.

The right is implied by law. However, the position as to when and how the right can be exercised differs at common law and under policy conditions.

Under common law, the position is that the insured can claim the full amount of loss from any of the insurers of his choice when that insurer will have the trouble of asking for contributions from the other interested insurers.

But under a policy condition, the insurers may require the insured to claim proportionately from all the insurers right at the inception rather than claiming full from the policy subject to this condition.

In practice, non-marine policies do usually contain a condition as such, and it is most unusual to find such a condition in marine policies.

![Types of Insurance Organizations [A Comprehensive Guide]](https://www.iedunote.com/img/259/types-insurance-organization-e1529504882393.png)