The market demand for a commodity is obtained by adding up the total quantity demanded at various prices by all the individuals over a specified period of time in the market. It is described as the horizontal

summation of the individual’s demand for a commodity at various possible prices in a market.

In a market, there are a number of buyers for a commodity at each price. In order to avoid a lengthy addition process, we assume here that there are only four buyers for a commodity who purchase different amounts of the commodity at each price.

Market Demand Schedule

The horizontal summation of individuals’ demand for a commodity will be the market demand for a commodity as is illustrated in the following schedule:

A Market Demand Schedule in a Four Consumer Market:

| Price $ | Quantity Demanded | Quantity Demanded | Quantity Demanded | Quantity Demanded | Total Quantity Demanded Per Week |

| First Buyer | Second Buyer | Third Buyer | Fourth Buyer | ||

| 10 | 10 | 13 | 6 | 11 | 40 |

| 8 | 15 | 20 | 9 | 16 | 60 |

| 6 | 25 | 30 | 10 | 20 | 85 |

| 4 | 40 | 35 | 15 | 30 | 120 |

| 2 | 60 | 50 ‘ | 30 | 40 | 180 |

In the above schedule, the amount of commodity demanded by four buyers (which we assume constitute the entire market) differs for each price. When the price of a commodity is $10, the total quantity demanded is 40 thousand units per week. At the price of $2, the total quantity demanded increases to 180 thousand units.

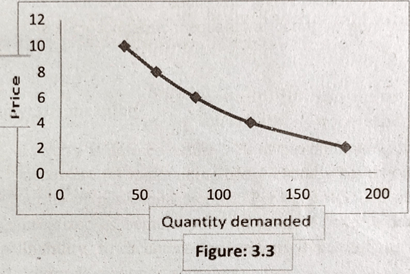

Market Demand Curve

The market demand curve for a commodity is the horizontal sum of individual demand curves of «all the buyers in a market. This is illustrated with the help of the market demand schedule given above.

The market demand curve for a commodity, like the individual demand curve, is negatively sloped. It shows that under the assumptions (ceteris paribus) – other things remaining the same – there is an inverse relationship between the quantity demanded and its price.

At a price of $10, the quantity demanded in the market is 40 thousand units. At a price of $2, it increases to 180 thousand units. In other words, the lower the price of the good X, the greater the demand for it ceteris paribus.

Factors causing Changes in Demand/ Determinants of Demand

While explaining the law of demand, we have stated that with other things remaining the same (ceteris paribus), the demand for a commodity is inversely related to the price per unit of time. The other things have an important bearing on the demand for a commodity.

They bring about changes in demand independently of changes in price. These non-price factors or shift factors or determinants that influence demand are as follows:

Changes in population

If the population of a country increases on account of immigration or through a high birth rate or other factors, the demand for various kinds of goods will increase even if the price remains the same.

The demand curve will shift upward to the right. The nature of the commodities demanded will depend on the taste of the consumers.

If, due to a high net production rate, the percentage of children to the total population increases in a country, there will be a greater demand for toys, children’s food, etc.

Similarly, if the presence of aged people to the total population increases, the demand for walking sticks, artificial teeth, etc. will increase.

Changes in tastes and fashions

Demand for a commodity may change due to changes in tastes and fashions. For example, people may develop a taste for coffee. There is then a decrease in the demand for tea. The demand curve for tea shifts to the left of the original demand curve.

Similarly, women’s fashions are usually ever-changing. Sometimes, they keep their hair long and sometimes short. So, whenever there is a change in their hairstyle, the demand for hairpins, hairnets, etc., is greatly affected.

Changes in income

When the income of consumers increases, it generally leads to an increase in the demand for some commodities and a decrease in the demand for other commodities.

For example, when the income of people increases, they begin to spend money on those items which were previously regarded by them as luxuries or semi-luxuries and reduce their expenditure on inferior goods. Take the case of a man whose income has increased from $1000 to $20,000 per month.

His consumption of wheat will go down because he now spends more money on superior foods such as cake, fish, dairy products, fruits, etc.

Changes in the distribution of wealth

If an equal distribution of wealth is brought about in a country, then there will be less demand for expensive luxury goods. There will be more demand for necessities and comfort items.

Changes in the price of substitutes

If the price of a particular commodity rises, people may stop further purchases of that commodity and spend money on its substitute, which is available at a lower price. Thus, we find that a change in demand can also be brought about by a change in the price of the substitute.

Changes in the trade cycle

The total quantity of goods demanded is also affected by the cyclical fluctuations in economic activities. If the trade is prosperous, the demand for raw materials, machinery, etc., increases. If, on the other hand, the trade period is dull, the demand for producer goods will fall sharply as compared to the demand for consumer goods.

Climate and weather conditions

Climate and weather conditions have an important bearing on the demand for a commodity. For instance, consumers’ demand for woolen clothes increases in winter and decreases in summer.