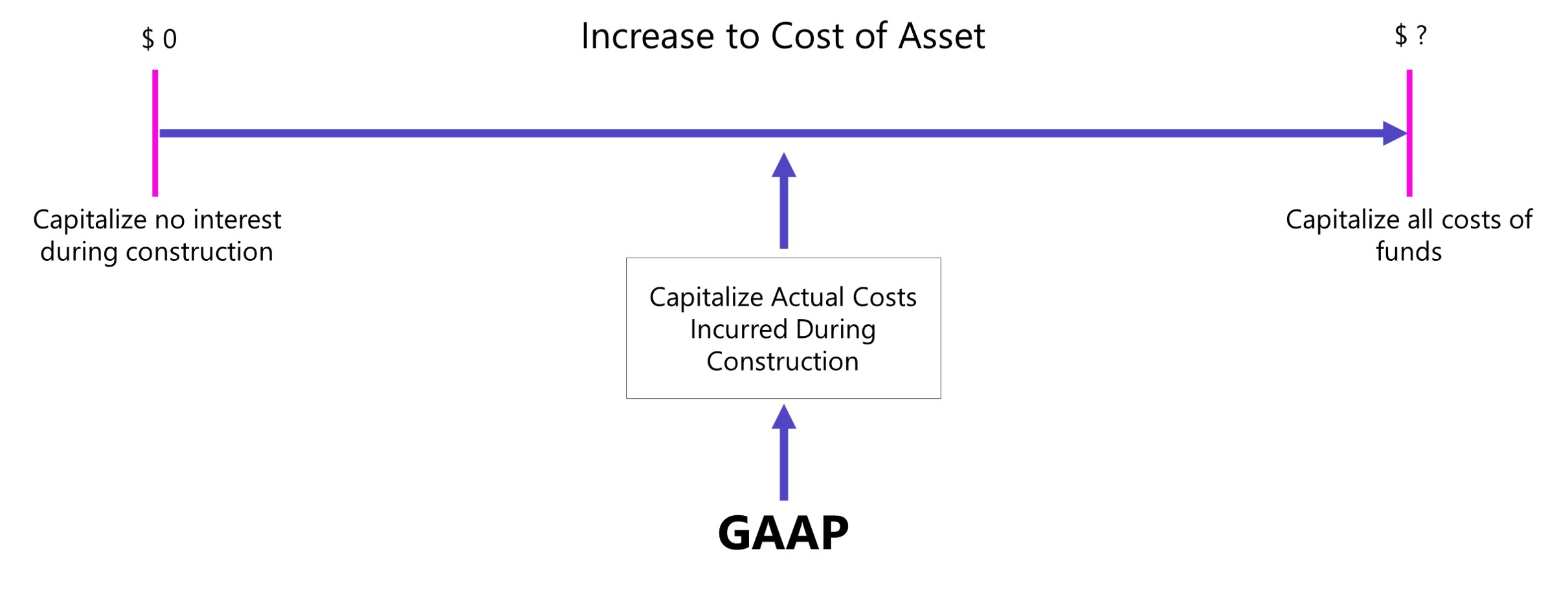

The proper accounting for interest costs has been a long-standing controversy. Three approaches have been suggested to account for the interest incurred in financing the construction of property, plant, and equipment:

Capitalize no interest charges during construction

Under this approach, interest is considered a cost of financing and not a cost of construction. Some contend that if a company had used stock (equity) financing rather than debt, it would not incur this cost.

The major argument against this approach is that the use of cash, whatever its source, has an associated implicit interest cost, which should not be ignored.

Charge construction with all costs of funds employed, whether identifiable or not

This method maintains that the cost of construction should include the cost of financing, whether by cash, debt, or stock.

Its advocates say that all costs necessary to get an asset ready for its intended use, including interest, are part of the asset’s cost. Interest, whether actual or imputed, is a cost, just as are labor and materials

A major criticism of this approach is that imputing the cost of equity capital (stock) is subjective and outside the framework of a historical cost system.

Capitalize only the actual interest costs incurred during construction

This approach agrees in part with the logic of the second approach that interest is just as much a cost as labor and materials.

However, this approach capitalizes only on interest costs incurred through debt financing. (That is, it does not try to determine the cost of equity financing.)

Under this approach, a company that uses debt financing will have an asset of higher cost than a company that uses stock financing.

Some consider this approach unsatisfactory because they believe the cost of an asset should be the same whether it is financed with cash, debt, or equity.

The illustration below shows how a company might add interest costs (if any) to the cost of the asset under the three capitalization approaches.

GAAP requires the third approach—capitalizing actual interest (with modification). This method follows the concept that the historical cost of acquiring an asset includes all costs (including interest) incurred to bring the asset to the condition and location necessary for its intended use.

The rationale for this approach is that during construction, the asset is not generating revenues.

Therefore, a company should defer (capitalize) interest costs. Once construction is complete, the asset is ready for its intended use and a company can earn reVenues.

At this point, the company should report the interest as an expense and match it to these revenues. It follows that the company should expense any interest cost incurred in purchasing an asset that is ready for its intended use.

To implement this general approach, companies consider three items:

- Qualifying assets.

- Capitalization period.

- Amount to capitalize.

Qualifying Assets

To qualify for interest capitalization, assets must require a time to get them ready for their intended use. A company capitalizes on interest costs starting with the first expenditure related to the asset. Capitalization continues until the company substantially readies the asset for its intended use.

Assets that qualify for interest cost capitalization include assets under construction for a company’s own use (including buildings, plants, and large machinery) and assets intended for sale or lease that are constructed or otherwise produced as discrete projects (e.g., ships or real estate developments).

Examples of assets that do not qualify for interest capitalization are;

- assets that are in use or ready for their intended use, and

- assets that the company does not use in its earnings activities and that are not undergoing the activities necessary to get them ready for use.

Examples of this second type include land remaining undeveloped and assets not used because of obsolescence, excess capacity, or need for repair.

Capitalization Period

The capitalization period is the period of time during which a company must capitalize on the interest. It begins with the presence of three conditions:

- Expenditures for the asset have been made.

- Activities that are necessary to get the asset ready for its intended use are in progress.

- Interest cost is being incurred.

Interest capitalization continues as long as these three conditions are present. The capitalization period ends when the asset is substantially complete and ready for its intended use.

Amount to Capitalize

The amount of interest to capitalize is limited to the lower of actual interest cost incurred during the period or avoidable interest.

Avoidable interest is the amount of interest cost during the period that a company could theoretically avoid if it had not made expenditures for the asset. If the actual interest cost for the period is $90,000 and the avoidable interest is $80,000, the company capitalizes only $80,000.

Or, if the actual interest cost is $80,000 and the avoidable interest is $90,000, it still capitalizes only $80,000. In no situation should interest cost include a cost of capital charge for stockholders’ equity.

Furthermore, GAAP requires interest capitalization for a qualifying asset only if its effect, compared with the effect of expensing interest, is material.

To apply the avoidable interest concept, a company determines the potential amount of interest that it may capitalize during an accounting period by multiplying the interest rate(s) by the weighted-average accumulated expenditures for qualifying assets during the period.

Weighted-Average Accumulated Expenditures

In computing the weighted-average accumulated expenditures, a company weights the construction expenditures by the amount of time (fraction of a year or accounting period) that it can incur interest cost on the expenditure.

To table, assume a 17-month bridge construction project with current-year payments to the contractor of $240,000 on March 1, $480,000 on July 1, and $360,000 on November 1. The company computes the weighted-average accumulated expenditures for the year ended December 31 as follows.

|

Expenditures | X | Capitalization Period* | = |

Weighted-Average Accumulated Expenditures | |

| Date | Amount | ||||

| March 1 | 240,000 | 10/12 | 2,00,000 | ||

| July 1 | 4,80,000 | 6/12 | 2,40,000 | ||

| November 1 | 3,60,000 | 2/12 | 60,000 | ||

| 10.80.000 | 500,000 | ||||

*Months between the date of expenditure and date interest capitalization stops or end of the year, whichever comes first (in this case December 31).

To compute the weighted-average accumulated expenditures, a company weights the expenditures by the amount of time that it can incur interest cost on each one.

For the March 1 expenditure, the company associates 10 months’ interest cost with the expenditure. For the expenditure on July 1, it incurs only 6 months’ interest costs. For the expenditure made on November 1, the company incurs only 2 months of the interest cost.

Interest Rates:

Companies follow these principles in selecting the appropriate interest rates to be applied to the weighted-average accumulated expenditures:

- For the portion of weighted-average accumulated expenditures that is less than or equal to any amounts borrowed specifically to finance the construction of the assets, use the interest rate incurred on the specific borrowings.

- For the portion of weighted-average accumulated expenditures that is greater than any debt incurred specifically to finance the construction of the assets, use a weighted average of interest rates incurred on all other outstanding debt during the period.

The table below shows the computation of a weighted-average interest rate for debt greater than the amount incurred specifically to finance the construction of the assets.

| Principal ($) | Interest ($) | |

| 12%, 2-year note | 6,00,000 | 72,000 |

| 9%,10-year bonds | 20,00,000 | 1,80,000 |

| 7.5%, 20-year bonds | 50,00,000 | 3,75,000 |

| 76.00.000 | 6.27.000 | |

| Weighted-average interest rate |

Total interest / Total principal | 627,000 / 7,600,000 = 8.25% |

Comprehensive Example of Interest Capitalization

To illustrate the issues related to interest capitalization, assume that on November 1, 2009, Tom Company contracted Pfeifer Construction Co to construct a building for $1,400,000 on land costing $100,000 (purchased from the contractor and included in the first payment).

Tom made the following payments to the construction company in 2010.

| January 1 ($) | March 1 ($) | May 1 ($) | December 31 ($) | Total ($) |

| 210,000 | 300,000 | 540,000 | 450,000 | 500,000 |

Pfeifer Construction completed the building, ready for occupancy on December 31, 2010. Tom had the following debt outstanding at December 31, 2010.

|

Specific Construction Debt | ||

| 1 | 15%, 3-year note to finance the purchase of land and construction of the the building, dated December 31, 2009, with interest payable annually on December 31 | $750,00 0 |

|

Other Debt | ||

| 2 | 10%, 5-year note payable, dated December 31, 2006, with interest payable annually on December 31 | $550,000 |

| 3 | 12%, 10-year bonds issued December 31, 2005, with interest payable annually on December 31 | $600,000 |

Tom computed the weighted-average accumulated expenditures during 2010 as shown in Illustration below.

| Expenditures | X | Current-Year Capitalization Period | = | Weighted-Average Accumulated Expenditures | |

| Date | Amount ($) | ||||

| January 1 | 210,000 | 12/12 | 210,000 | ||

| March 1 | 300,000 | 10/12 | 250,000 | ||

| May 1 | 540,000 | 8/12 | 360,000 | ||

| December 31 | 450,000 | 0 | 0 | ||

| 500,00 | 820,000 | ||||

Note that the expenditure made on December 31, the last day of the year, does not have any interest cost. Tom computes the avoidable interest as shown;

| Weighted-Average Accumulated Expenditures | x | Interest Rate | = | Avoidable Interest |

| 750,000 | 0.15 (construction note) | 112,500 | ||

| 70,000 | 0.1104 (Weighted-Average of other debt)b | 7,728 | ||

| 820,000 | 120,228 |

*The amount by which the weighted-average accumulated expenditures exceed the specific construction loan.

| b Weighted-average interest rate computation: | Principal | Interest |

| 10%, 5-year note | 550,000 | 55,000 |

| 12%, 10-year bonds | 600,000 | 72,000 |

| 1,150,000 | 127,000 | |

| Weighted-average interest rate | Total Interest / Total Principle | 127,000 / 1,150,000 = 11.04% |

The company determines the actual interest cost, which represents the maximum amount of interest that it may capitalize during 2010, as shown in the Illustration below.

| Construction note | 750,000 | x | .15 | = | 112500 |

| 5-year note | 550,000 | x | .10 | = | 55,000 |

| 10-year bonds | 600,000 | x | .12 | = | 72,000 |

| Actual interest | 239,500 |

The interest cost that Tom capitalizes is the lesser of $120,228 (avoidable interest) and $239,500 (actual interest, or $120,228. Tom records the following journal entries during 2010:

| January 1 | Dr. | Cr. |

| Land | 100,000 | |

| Building (or Construction in Process) | 110,000 | |

| Cash | 210,000 | |

|

March 1 | Dr. | Cr. |

| Building | 300,000 | |

| Cash | 300,000 | |

| May 1 | Dr. | Cr. |

| Building | 540,000 | |

| Cash | 540,000 | |

|

December 31 | Dr. | Cr. |

| Building | 450,000 | |

| Cash | 450,000 | |

| Building (Capitalized Interest) | 120,228 | |

| Interest Expense ($239,500 – $120,228) | 119,272 | |

| Cash ($ 12,500 + $55,000 + $72,000) | 239,500 |

Tom should write off capitalized interest costs as part of depreciation over the useful life of the assets involved and not over the term of the debt.

It should disclose the total interest cost incurred during the period, with the portion charged to expense and the portion capitalized indicated.

On December 31, 2010, Tom disclosed the amount of interest capitalized either as part of the non-operating section of the income statement or in the notes accompanying the financial statements.

Let’s illustrate both forms of disclosure in two different Illustrations below:

| Income from operations | ***** | |

| Other expenses and losses: | ||

| Interest expense | 239,500 | |

| Less: Capitalized interest | 120,228 | 119,272 |

| Income before income taxes | ***** | |

| Income taxes | ***** | |

| Net income | ***** | |

| Note 1: Accounting Policies. Capitalized Interest. During 2010 total interest cost was $2o9,500, of which $120,228 was capitalized and $119,272 was charged to expense. | ||

Special Issues Related to Interest Capitalization

Two issues related to interest capitalization merit special attention:

- Expenditures for land.

- Interest revenue.

Expenditures for Land

When a company purchases land with the intention of developing it for a particular use, interest costs associated with those expenditures qualify for interest capitalization.

If it purchases land as a site for a structure (such as a plant site), interest costs capitalized during the period of construction is part of the cost of the plant, not the land.

Conversely, if the company develops land for lot sales, it includes any capitalized interest cost as part of the acquisition cost of the developed land.

However, it should not capitalize on interest costs involved in purchasing laud held for speculation because the asset is ready for its intended use.

Interest Revenue

Companies frequently borrow money to finance the construction of assets. They temporarily invest the excess borrowed funds in interest-bearing securities until they need the funds to pay for construction.

During the early stages of construction, interest revenue earned may exceed the interest cost incurred on the borrowed funds.

Should companies offset interest revenue against interest cost when determining the amount of interest to capitalize as part of the construction cost of assets?

In general, companies should not net or offset interest revenue against interest costs. Temporary or short-term investment decisions are not related to the interest incurred as part of the acquisition cost of assets.

Therefore, companies should capitalize on the interest incurred on qualifying assets whether or not they temporarily invest excess funds in short-term securities.

Some criticize this approach because a company can defer the interest cost but report the interest revenue in the current period.

Observations

The interest capitalization requirement is still debated. From a conceptual viewpoint, many believe that, for the reasons mentioned earlier, companies should either capitalize on no interest cost or all interest costs, actual or imputed.

![Users of Accounting Information [Internal & External Users]](https://www.iedunote.com/img/1545/users-of-accounting-information.png)