Generally, if aggregate supply is less than aggregate demand within a country and the price level of goods and services increases year after year then the situation is termed inflation. Therefore, we can say that the tendency of increasing price levels is known as inflation. Inflation holds the following two conditions:

- Inflation is a rise in prices.

- A more exact definition of inflation is a situation of a sustained increase in the general price level in an economy.

Inflation means an increase in the cost of living as the price of goods and services rises. Inflation leads to a decline in the value of money. “Inflation means that our money won 7 buy as much today as we could yesterday.”

Features of inflation

- The price level gradually or continuously increases.

- The purchasing power of money decreases.

- The importance of money as a medium of exchange and store of value decreases.

- Aggregate demand becomes greater than aggregate supply.

- Investment, employment, and production increases.

- Unemployment reduces and the growth rate increases.

We can measure GDP for a particular year using the actual market prices of that year. This gives us the nominal GDP or GNP at market prices.

Usually, we are more interested in determining what has happened to the real GDP which measures GDP in a set of constant or invariant prices.

To obtain real GDP, we divide nominal GDP by the price index which is known as the GDP deflator.

Calculation of rate of inflation

It is expressed as a percentage. It is calculated by the following formula.

Inflation rate

= ( (Price index of the current year – Price index of the previous year ) / Price index of the previous year ) * 100

= ( ( p1-p0 ) / p0 ) * 100

Here,

Pi = Present year price index

Po = Previous year’s price index

Suppose, Pi=120 and Po=l 10

So Inflation rate = 120 110 X 100 = — x 100 = 9.09%

no no

Example: If the price level of America in 2009 is 120 and the price level in 2010 is 125 respectively. Then the rate of inflation would be Inflation rate= x 100 = x 100 = 5%

Types of Inflation

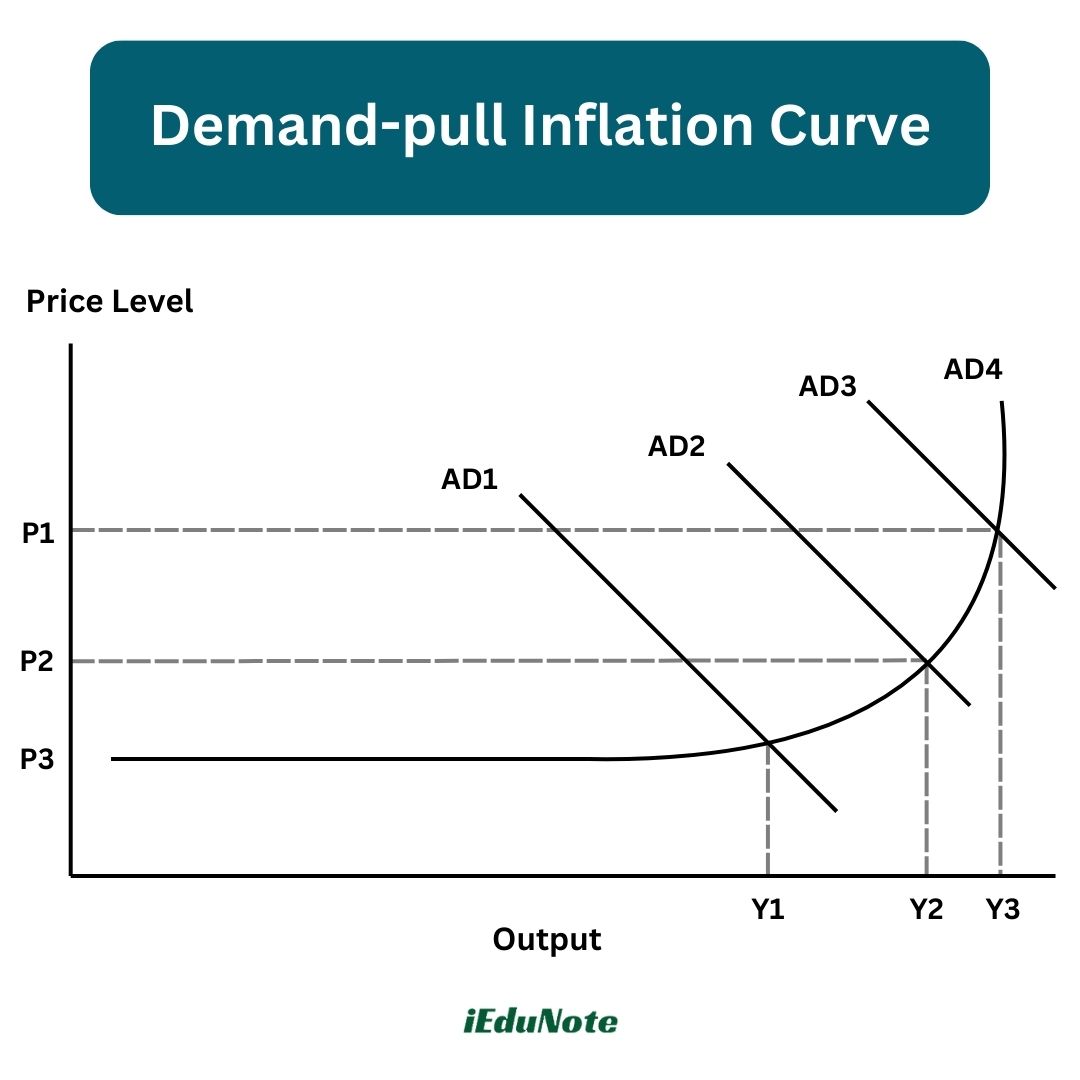

A. Demand-pull inflation

If inflation is occurred due to an increase in the demand for goods and services in the market then it is termed as demand pull inflation.

In this situation, the rate of increase in aggregate demand is greater than the rate of increase in the aggregate supply.

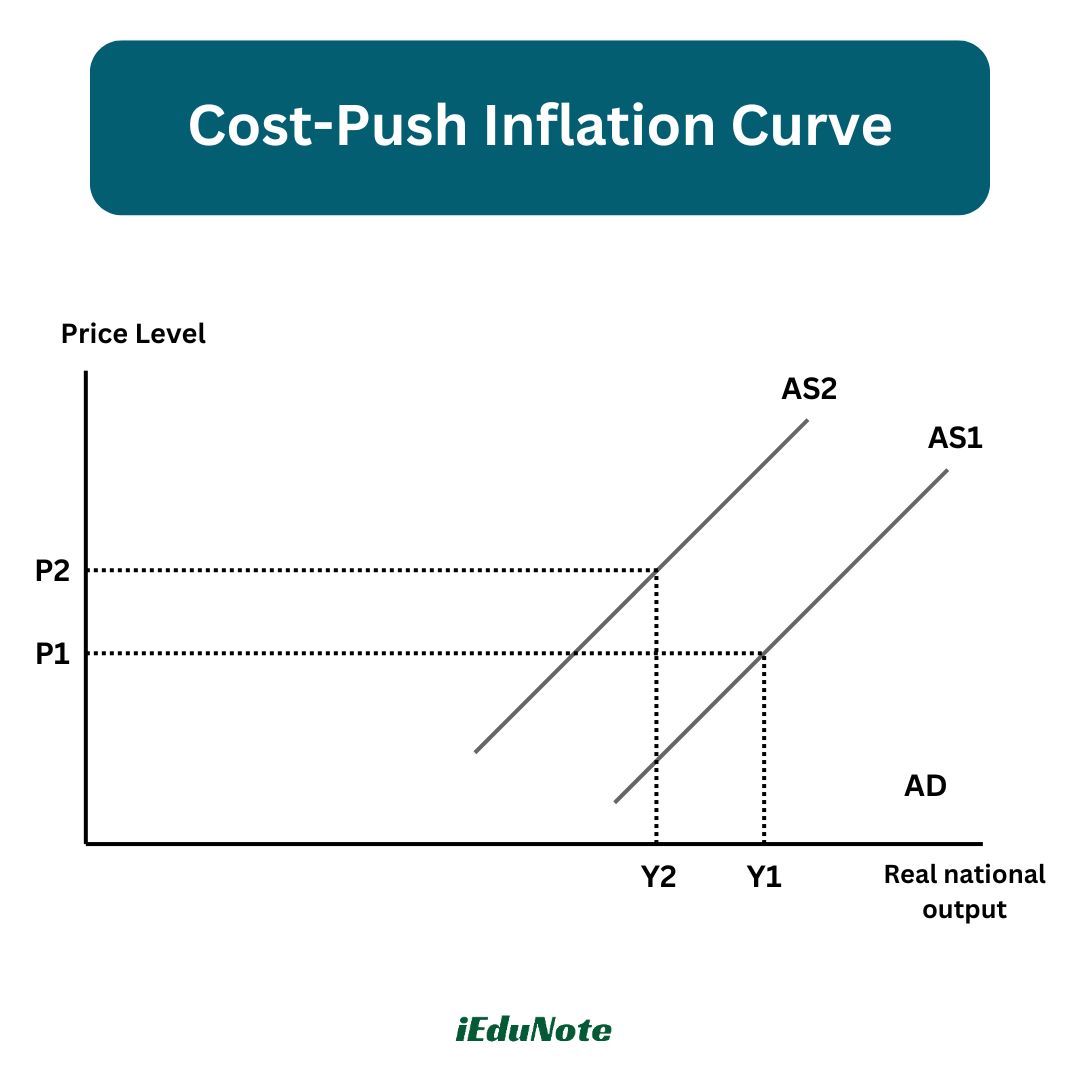

B. Cost-push inflation

This type of inflation is the inflation which is occurred due to the increase in the cost of production.

Here production cost increases for several causes or aggregate supply decreases and price level increases.

C. Inflation due to deficit financing

If the government adopts the deficit financing policy that is taxation rate and expenditure increase then there creates a tendency to increase price level.

This situation is termed as inflation due to deficit financing.

D. Inflation due to an increase in the money supply

If money supply in the economy increases and a constant tendency of increasing price level is observed then it is called inflation due to an increase in money supply.

E. Inflation due to an increase in the supply of credit

If an open credit system is provided and the supply of credit increases in the economy consequently the tendency to increase price level occurs then it is termed as inflation due to an increase in the supply of credit.

F. Wage-push inflation

Wage push inflation is a general increase in the cost of goods that is preceded by and results from an increase in wages.

To maintain corporate profits after an increase in wages, employers must increase the prices they charge for the goods and services they provide.

The overall increased cost of goods and services has a circular effect on the wage increase;

eventually, as goods and services in the market increase, then higher wages will be needed to compensate for the increased prices of consumer goods.

Demand-pull inflation

Demand-pull inflation is caused by increases in aggregate demand due to increased private and government spending, etc.

Demand-pull inflation is constructive to a faster rate of economic growth since the excess demand and favorable market conditions will stimulate investment and expansion.

Demand-pull inflation is asserted to arise when aggregate demand in an economy exceeds aggregate supply.

It involves inflation rising as real gross domestic product rises and unemployment falls, as the economy moves along the Phillips curve.

Causes of demand-pull inflation

- Increase in income: Over income level may increase the demand for consumption of goods and services. For this reason, the price level increases, and inflation may arise.

- Increase in government expenditure: If deficit financing occurs or government expenditure increases, then income flow increases in the economy but production cannot be increased at the same rate, and thus, it may cause inflation.

- Decrease in taxation: If taxes are decreased, then the disposable income of people increases. Thus, demand for goods and services increases in the market, and inflation occurs.

- Supply of money increases: If the government increases the supply of money in the market, then the price level increases and inflation occurs.

- Extensive credit policy: If commercial banks disburse credit on easy terms and conditions, then the supply of money in the economy increases, the price level rises, and thus, inflation occurs.

- Increase in foreign loans and aids: If the rate of foreign loans and aids increases, then income flow increases, and thus, aggregate demand increases. However production does not increase proportionately, and thus, inflation occurs.

- The prospect of increasing profit in business: If profit expectations of a business increase, then investment increases, and consequently, income flow increases. Thus, aggregate demand increases, and then inflation occurs.

- Expectation of an increasing price level: If there is an expectation among people to increase the price of a commodity, then people can buy more at higher prices at present, and inflation may occur.

- Increase in the propensity to consume: To lead a higher-class life, consumption increases, and demand may increase, consequently, savings may be reduced, and aggregate demand may increase; thus, inflation may occur.

- Increase in the flow of foreign investment: If the direct investment flow from abroad increases, then income flow within the country increases, aggregate demand increases, and thus, primarily demand-pull inflation may occur.

Cost-push inflation

Cost-push inflation, also called “supply shock inflation,” is caused by a drop in aggregate supply. This may be due to natural disasters or increased prices of inputs.

For example, a sudden decrease in the supply of oil, leading to increased oil prices, can cause cost-push inflation. Producers for whom oil is a part of their costs could pass it on to the consumers in the form of increased prices.

in the figure above, when the supply curve is AS1 then the price is P1. When the supply curve shifts to AS2 then the price also rises to P2

Causes of cost-push or supply shock inflation

If the cost of production increases due to one or more than one cause and consequently the production of goods and services decreases or supply decreases, then it is termed cost-push inflation. The causes of cost-push inflation are as follows:

- Increase in the price of inputs: If the price of inputs increases, then the cost of production increases, and the supply of goods decreases, and thus, inflation occurs.

- Natural disasters: Natural calamities like floods, droughts, etc., can reduce production, and supply may be reduced, and thus, inflation occurs.

- Weak infrastructure: If weakness in infrastructure prevails in the economy, like weakness in transportation, communication, and the supply of electricity and gas, then production is hampered, and the supply of goods and services can also be hampered. Moreover, if communication and transportation systems are hampered, then artificial crises may be created, and the price level may increase.

- Increase in the rate of interest: If the interest rate is higher, it means that the cost of credit is increased. Thus, production costs increase, and production is reduced. Thus, supply is reduced, and the price level rises.

- Artificial crisis: Dishonest businessmen illegally store the products to earn higher profits. As a result, the price of that product increases. Usually, in Bangladesh, this type of higher price is almost seen. Thus, inflation may occur.

- Political unrest, fall of law and order situation: If social law and order situation are hampered due to political unrest, then price hikes may occur, and thus, inflation may be seen.

- Import reduced: If any economy is dependent on the import of some goods and services, then import may be reduced for any causes, or it may be stopped due to one or more causes. Then supply may be decreased, and the price level may rise.

Effects of inflation

General effects of inflation

- An increase in the general level of prices implies a decrease in the purchasing power of the currency.

- That is, when the general level of prices rises, each monetary unit buys fewer goods and services.

In the economy, inflation has both positive and negative impacts. Especially long-run inflation has a long-run effect. Here are some general effects of inflation on different professionals or different class groups:

- Effect of inflation upon consumers or buyers: Through inflation, the purchasing power of money decreases. At the same time, a consumer or buyer can purchase fewer amounts of goods and services than before. Therefore, during inflation, the consumer gets losses.

- Effect on the seller: During inflation, the seller can earn greater profit. Because the seller can sell the product comparatively at a higher rate.

- Effect on the fixed-earning people: During inflation, the people of fixed-salaried or fixed-earning people get a loss. Because of the rising price level, their cost of livelihood increases but their income does not increase at the same rate. Therefore, they may face a loss.

- Loan taker vs. loan giver: During inflation, the loan giver faces a loss. Because by the same amount of loan recovered, he cannot purchase an equal level of goods as before. On the other hand, the loan taker becomes a gainer because he can repay the loan, which is a lower amount of equivalent goods and services.

- Effect on investor or entrepreneur: Here the investors and entrepreneurs become gainers. During inflation, if the wage rate or the production cost is unchanged, then the products may be sold at a higher price or a higher profit.

- The tax giver: The tax giver is benefitted. Because if the price level is increased, then the tax giver thinks himself less of a loser by giving tax.

- The farmers: During inflation, the rich farmers think of themselves as gainers because they sell their produced crops at higher rates. On the other hand, the landless marginal farmers and agricultural labor classes face a loss. Despite their limited income, they have to buy their necessary food at a higher rate.

- The labor class: The labor classes face a loss. Because their wages are fixed they have to buy necessary goods at higher prices than before.

- Effect on production: A minimum rate of inflation has a positive impact. Because in expectation of profit, production will increase. On the other hand, during a higher rate of inflation, expecting lower prices in the future, the producer will reduce production.

- Impact on investment: Inflation increases the expectation of profit, and the risk of investment decreases. Therefore, investment is enhanced, but hyperinflation or a very high rate of inflation may create uncertainty in the mind of the producer. Therefore, extra investment may be discouraged.

- Employment: If investment is increased during inflation, then the scope of employment is facilitated. However a very high rate of inflation can discourage the investors.

- Social impact: Income inequality rises rapidly during inflation. The gap between the rich and the poor becomes greater. Social peace and order are hampered. People try to increase their income through illegal ways, and an unhealthy social environment prevails.

- Economic stability is hampered: Long-run inflation creates instability in economic activities; that’s why social economic stability is hampered.

Negative effects of inflation

- Hoarding (people will try to get rid of cash before it is devalued, by hoarding food and other commodities creating shortages of the hoarded objects).

- Distortion of relative prices (when the prices of goods go higher, then relative prices of goods are distorted).

- Increased risk – Higher uncertainties (risk in business always exists, but with inflation, risks are very high because of the instability of prices).

- Income diffusion effect (which is basically an operation of income redistribution).

- Existing creditors will be hurt (because the value of the money they will receive from their borrowers later will be lower than the money they gave before).

- Fixed-income recipients will be hurt (because while inflation increases, their income doesn’t increase, and therefore, their income will have less value over time).

- Increased consumption ratio at the early stages of inflation (people will be consuming more because money is more abundant and its value is not lowered yet).

- Lowers national savings (when there is high inflation, the value of saving money would decrease day after day, so people tend to spend the cash easily).

- Illusions of making profits (companies will think they are making profits while in reality, they’re losing money if they don’t take into consideration the inflation rate then the illusion of profit will be observed).

- Causes an increase in tax (people will be taxed a higher percentage of their income increases following an inflation increase).

- Causes mal-investment (in inflation times, the data given about an investment is often deceptive and unreliable; there will be losses in investments).

- Causes business cycles (many companies will have to go out of business because of the losses they incurred from inflation and its effects).

- Currency debasement (which lowers the value of a currency, and sometimes causes a new currency to be born)

- Rising prices of imports (if the currency is debased, then its purchasing power in the international market is lower).

Positive effects of inflation

- It can benefit the inflators (those responsible for the inflation).

- It is beneficiary for early and first recipients of the inflated money (because the negative effects of inflation are not yet there).

- It can benefit the cartels (it is beneficent for big cartels, destroys small sellers, and can cause price control set by the cartels for their benefits).

- It might be relatively beneficent to the borrowers who will have to pay the same amount of money they borrowed (+ fixed interests), but the inflation could be higher than the interests; Therefore, they will be paying less money back (for example, you borrowed $1000 in 2005 with a 5% fixed interest rate and you paid it back in full in 2007, let’s suppose the inflation rate for 2005, 2006, and 2007 has been 15%, you were charged %5 of interest, but in reality, you were earning %10 of interests, because 15% (inflation rate) – 5% (interests) = %10 profit, which means you have paid only 70% of the real value in the 3 years).

- Many economists favor a low steady rate of inflation, low (as opposed to zero or negative) inflation may reduce the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reducing the risk that a liquidity trap prevents monetary policy from stabilizing the economy.

Avenues for controlling inflation

As inflation creates greater inequality in the income of the people, therefore, economic instability prevails in the economy, which is why social economic stability is hampered. Higher inflation must not be extended. The government measures against inflation may be of several types:

- Monetary policy

- Fiscal policy

- Other measures

Monetary policy for controlling inflation

In controlling inflation, the government can take steps through monetary measures besides fiscal measures. Here the principal objective should be to reduce money supply and thus lower the price level.

- Open market operation: The saving certificates may be sold in the open market. Thus, the cash is deposited in the hands of the government or the central bank from the hands of individuals and commercial banks. Thus, the credit capacity of commercial banks is lowered. The supply of money in the market is reduced. Thus, inflation is controlled.

- Increase in bank rate: For contraction of credit, the central bank can increase the bank rate. For this, the interest rate of commercial banks increases, and the cost of credit increases. The supply of credit decreases and the supply of money also decreases, thus, inflation is controlled.

- Increase in reserve ratio: To reduce the amount of credit, the central bank can increase the reserve ratio. For this, the cash of commercial banks decreases. The credit capacity of commercial banks is reduced. Thus, the money supply in the economy decreases, and inflation is controlled.

- Hyperinflation

- During hyperinflation, the government may declare any note invalid. Any new note may be issued. Thus, the money supply in the market is reduced to control inflation.

Galloping or Hyperinflation

If inflation increases with rapidness, then it is termed hyperinflation. Here price level increases gradually.

If in any economy there is more than a 50% rate of inflation, then it is termed hyperinflation.

After all, in this situation of the economy, money loses its importance as a store of value. It creates financial instability, etc.

Fiscal policies to control inflation

The government policy regarding its revenue and expenditure is called fiscal policy. In controlling inflation, we should keep in mind that the price level increases through increasing income or by increasing aggregate demand (except cost-push inflation).

Therefore, the change in fiscal policy should be in such a way that money income flow of a society decreases and thus aggregate demand decreases. Then inflation may be controlled.

In controlling inflation, the government may adopt the following measures:

Decrease in government expenditure

During demand-pull inflation, government expenditure may be reduced. Especially expenditure in unproductive sectors must be stopped.

Consequently, income flow in the economy will decrease, and aggregate demand will also decrease. The price level will also decrease, and inflation will be controlled.

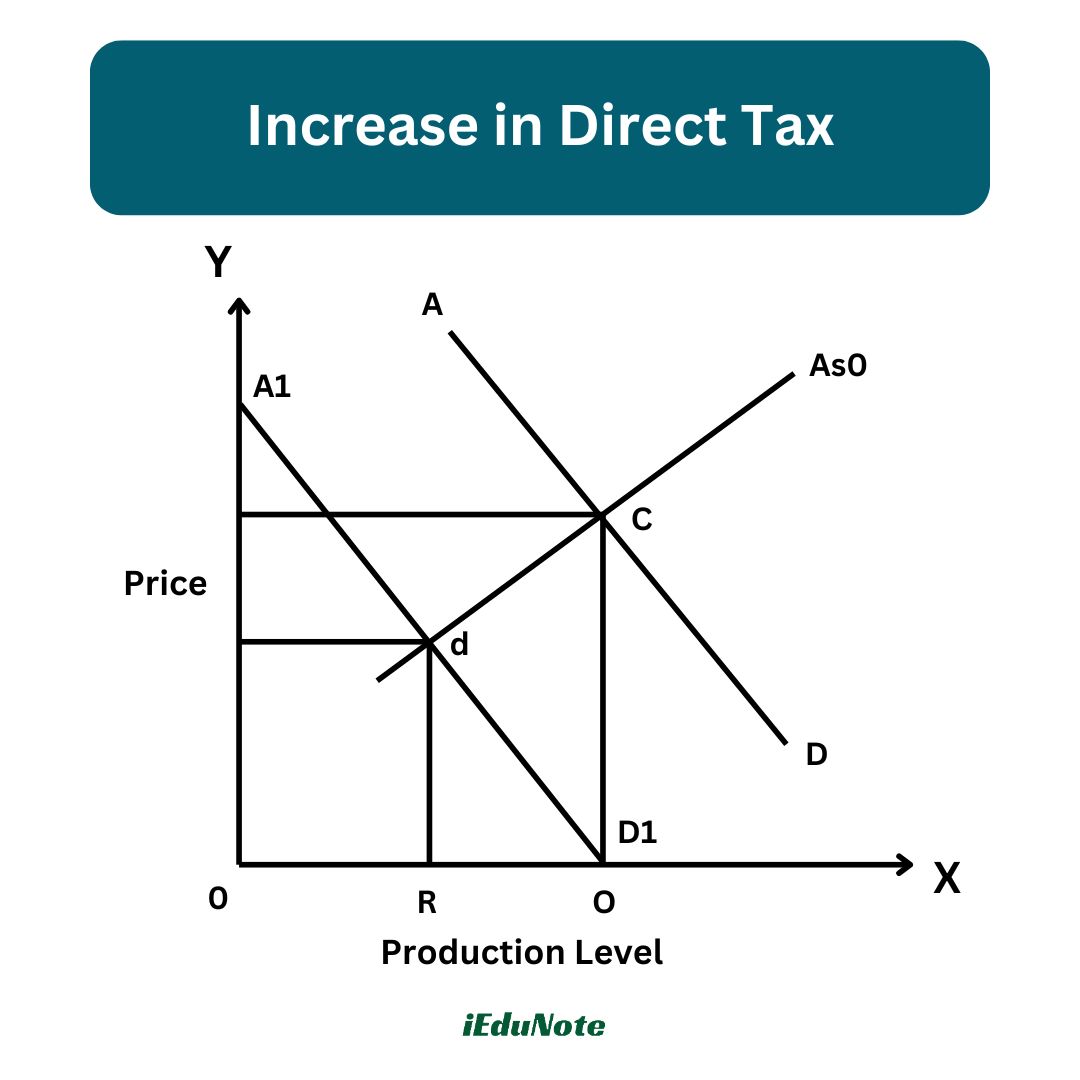

Increase in direct tax

During demand-pull inflation, the government can increase direct tax. If tax is increased, then disposable income of people will be reduced, and demand for goods and services in the market will decrease.

Thus, aggregate demand decreases, and inflation is controlled. The AD curve is shifted to the left, and price level decreases.

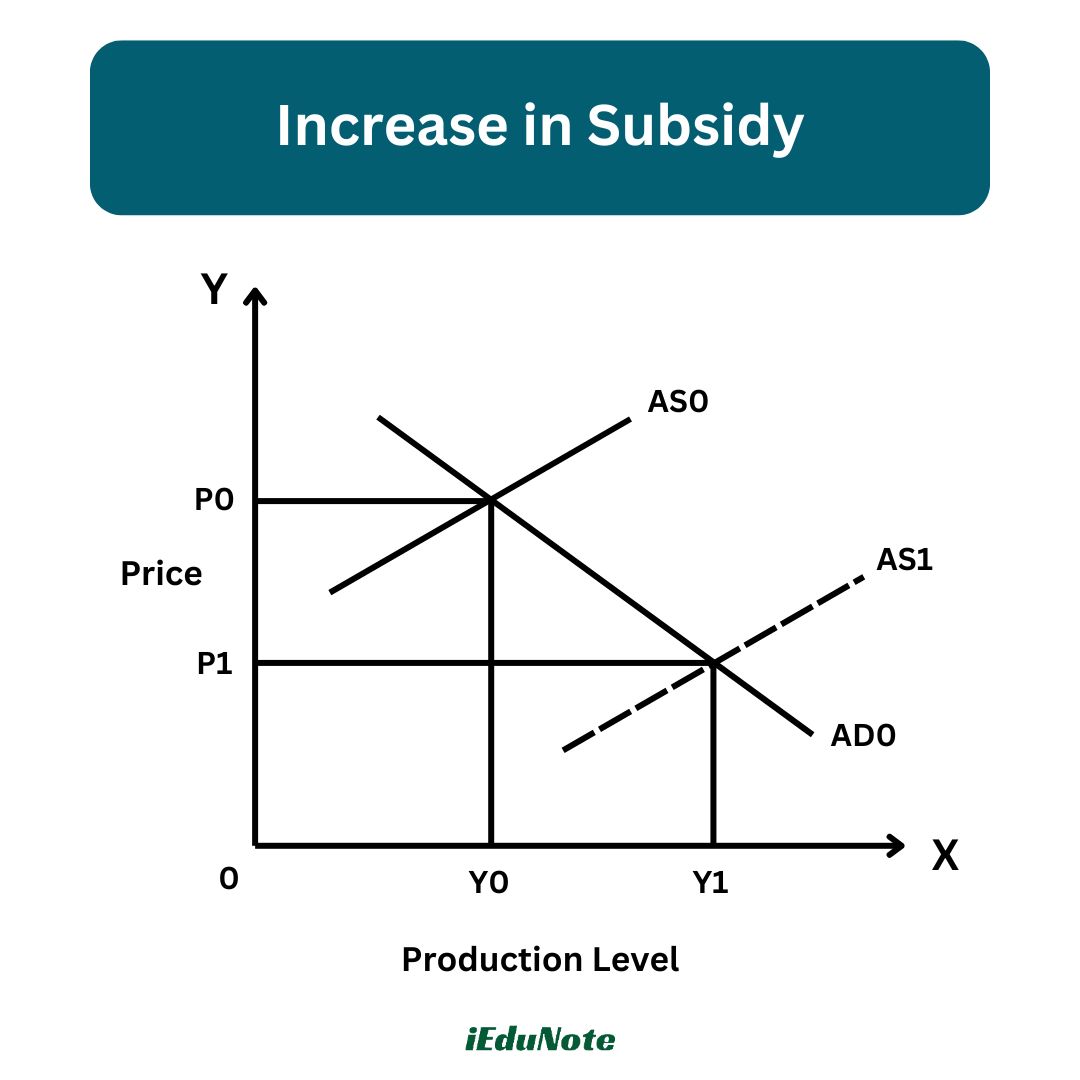

Increase in subsidy

If in economy inflation may be occurred as cost push inflation. Here the government may provide subsidy on input price. Here input price decreases output or production increases. Aggregate supply is also increased and price level decreases.

Consequently inflation is occurred .If cost push inflation occurs then price level increases. Here after subsidy aggregate supply curve is also shifted rightward.

For this, the production level increases from Yo to Yj and price level decreases from Po to Pi and thus inflation is controlled.

Decrease in indirect tax rate

Here govt, can decrease VAT, import tax, tax on input items etc. That is why price level decreases. Because production cost decreases and production increases and thus inflation is controlled.

Internal debt

During inflation, the government can take a loan from any person, institute, and bank within the country. For this income flow in the economy decreases, aggregate demand reduces and thus price level or inflation is lowered

Other pleasures to control inflation:

- Price ceiling: The government can fix up the highest price of goods or services. This policy is known as the price ceiling. For this reason, the price level cannot exceed this level. But there is a chance of hidden black marketing. If it cannot be controlled, the problem will be more complex.

- Establishment of fair-priced shopping centers: During inflation, the government can arrange a fair-price shopping center. Thus demand in the private sector will be decreased and inflation will be controlled.

- Increase in production and import: The most effective measure against inflation is to increase production. If the structure of production is changed to increase it, the aggregate supply will increase. Moreover, import from other countries may reduce inflation.

- Anti-hoarding: Proper action should be taken legislatively by taking measures against hoarding and certain artificial crises. And anti-inflationary measures must be taken by the government.

- Controlling black marketing: It creates inflation or rising prices. Therefore, controlling black marketing will control inflation.

- Business syndicate controlling: Dishonest businessmen should be brought under necessary measures so that they cannot make the price hike through mutual understanding within themselves.

- Infrastructural development: In order to control inflation, there is no other alternative than ensuring infrastructural development. Because in order to minimize the crisis of goods and services proper distribution through communication and transportation is a must.

- Political unrest must be removed: Political unrest, strike, and all sorts of violations must be removed in order to maintain economic stability. Otherwise, production or supply must be hampered, the price level will be higher, and there will be inflation.

Some basic concepts of inflation

True inflation versus bottleneck inflation

After attaining full employment production does not increase despite rising prices. In this situation, rising prices are called true inflation. Before attaining full employment due to labor unrest, falling in capital, aggregate supply does not increase despite increasing aggregate demand. This is termed as bottleneck inflation.

Open versus suppressed inflation

If the price level rises without any control or any measure of government, then it is termed as open inflation. On the other hand, if inflation occurs in spite of government actions or steps, then it is called suppressed inflation.

Expected inflation versus unexpected inflation

If people of an economy expect a certain rate of inflation year after year, then the inflation is termed as expected inflation. On the other hand, if people do not expect a rising price level or inflation in this situation, the inflation is termed as unexpected inflation.

The former inflation creates any burden to any people or financial institute. The latter one is a burden to all because it may create a problem to prepare a budget or may create a problem in the realization of the budget.

Wage price spiral

At a time, the tendency of rising wage rate and price level is termed as wage price spiral. If the price level increases, the labor organizations create movement to realize their claim of increasing the cost of production.

Mixed inflation

If in any economy demand-pull inflation and cost-push inflation occur at the same time, then it is called mixed inflation. Here price level increases due to an increase in aggregate demand and due to an increase in the cost of production again price level increases. This situation is termed as mixed inflation.

Demand-pull inflation versus cost-push inflation

The demand-pull inflation is when the aggregate demand is more than the aggregate supply in an economy, whereas cost-push inflation is when the aggregate demand is the same and the fall in aggregate supply due to external factors will result in an increased price level.

The difference between demand-pull and cost-push inflation are as follows:

- The tendency of rising price due to an increase in demand is termed demand-pull inflation. On the other hand, rising price level due to the rise in the cost of production is called cost-push inflation.

- In the case of demand-pull inflation, the aggregate demand or AD curve shifts towards the right. On the other hand, in the case of cost-push inflation, the aggregate supply or AS curve shifts towards the left.

- In the case of demand-pull inflation, the price level as well as production increases. But in the case of cost-push inflation, the price level increases but production decreases.

- In the case of demand-pull inflation, production increases and the economy becomes enriched through the increase in production. But in the case of cost-push inflation, production is decreasing, depression in the economy arises as well as unemployment is occurred.

- Increase in government expenditure and decrease in taxes cause demand-pull inflation. On the other hand, a decrease in government subsidy and an increase in sales taxes, profit taxes result in cost-push inflation in an economy.

- Demand-pull inflation creates profit expectations. The producers and investors are inspired to invest more. It creates production and employment. On the other hand, cost-push inflation affects investment through creating fear of loss in business. Investment is discouraged, production is reduced, and unemployment may arise.

- Cost-push inflation may create or arise through external forces like input costs rising abroad, price hikes in oil, and consequently import costs of oil and machinery may be increased. On the other hand, demand-pull inflation cannot be affected by external forces. But surplus income flow from abroad may create extra demand within the country. And it may cause demand-pull inflation.

Is inflation always avoidable?

Inflation is not always harmful. A slow or lower rate of inflation is helpful for economic development. If the price level increases by a tolerable degree, then

- Marginal efficiency of capital increases.

- Investment increases.

- Including natural resource uses of other resources is increased, employment is created, and unemployment is reduced.

- Production or income increases.

- Economic growth rate increases.

- Economic development is enhanced.

Considering all these, we can observe that inflation at a tolerable rate has a positive impact on the economy. But excessive inflation creates a negative impact on the economy for the following causes-

- Purchasing power of people or real income decreases.

- Actual demand for goods and services in the market is reduced.

- The investors do not feel interest to invest due to the future tendency of decreasing price level.

- The investors lose their interest in new investment.

- It creates speculative motives and black marketing.

- It creates a tendency for illegal activities and social crime, etc.

- Unequal distribution of income is encouraged. The poor become poorer.

- The fixed earning people suffer from a crisis.

- The loan givers suffer. For this, the supply of loans decreases.

- Political unrest prevails in society and thus instability of law and order situation may create.

Measuring Inflation

Inflation is a key concept in macroeconomics and a major concern for government policymakers, companies, workers, and investors. Inflation refers to a broad increase in prices across many goods and services in an economy over a sustained period of time.

onversely, inflation can also be thought of as the erosion in the value of an economy’s currency (a unit of currency buys fewer goods and services than in prior periods). The most common measures are as follows:

Consumer Price Index (CPI)

It is the most commonly used measure of inflation. The CPI uses a so-called “market basket” of goods to measure the changes in prices experienced by average consumers in the economy.

CPI is usually expressed as an index, which means that one year is the base year. The base year is given a value of 100. The index for another year (say, year 1) is calculated by:

CPIyear1 = (Basket Costyear1 – Basket Costbaseyear) x 100

The percent change in the CPI over time is the inflation rate.

Example

assume you spend your money on bread, jeans, DVDs, and gasoline, and you’d like to measure the inflation that you experience with this basket of goods.

In the base period, you purchased three loaves of bread (Tk.4 each), two pairs of jeans (Tk.30 each), five DVDs (Tk.20 each), and 10 gallons of gasoline (Tk.3.50 each).

The price of the basket of goods in the base period is the total money spent on this quantity of items at the base period prices; in this case, this equals Tk.207.

Now imagine that in the current period, bread still costs Tk.4, jeans are Tk.35, DVDs are $18, and gasoline is Tk.4.

Using the quantities from the base period, the total cost of the market basket in the current period is Tk.212. The price index is (212/207)* 100, or 102.4. This means that the inflation rate between the base period and the current period was 2.4%.

When the inflation rate is 2.4%, it means that a Taka can buy 2.4% fewer goods and services than it could in the previous period.

Producer Price Index (PPI)

The Producer Price Index is a family of indexes that measures the average change over time in the selling prices received by domestic producers of goods and services.

PPIs measure price change from the perspective of the seller. This contrasts with other measures, such as the Consumer Price Index (CPI), that measure price change from the purchaser’s perspective.

The following formula is used for the calculation of the Producer Price Index.

It is a modified Laspeyres index that compares the current period revenue of goods with the base period revenue of the same goods

PPI = [Σ (Qo * Po * (Pi/Po)) / Σ (Qo * Po)] x 100

In the above formula, Po shows the base year commodity price, the current year commodity price is denoted by Pi, and the quantity of commodity sold during the base year is Qo.

Example

The basic formula for calculating the PPI requires basic information such as the quantity of the product at the start date, the selling price at the start date, and the selling price at the end date

[(Quantity * Original selling price * (New selling price / Original selling price) / Quantity) * 100

Let’s look at a simplified example of how PPI is calculated. Let’s say we have an industry that has only one product, Soap.

The industry reports information about the quantity of Soaps they had on hand at the beginning of the period (2000), the original selling price (Tk.2.00), and the ending selling price (Tk.2.50).

We plug our Soap numbers into the formula: [(2000 * 2.00 * (2.50/2.00)] / 2000) * 100Broken down, it looks like this:

New selling price/Original selling price: 2.50/2.00 = 1.25.Quantity * Original price * the change in price calculated above: 20002.001.25 = 500

Divide the number by the original quantity:5000/2000 = 2.50Multiply the new number times the base of 100:2.5*100 = 250, it is the PPI for the Soap industry.

GDP deflator

It is another option for measuring prices and inflation. As the name suggests, the GDP deflator is a price measurement tool that is used to convert nominal GDP to real GDP.

The GDP deflator is a broader measure than the CPI, as it includes goods and services bought by businesses and government.

The GDP deflator is calculated by dividing nominal GDP by real GDP and multiplying by 100.

GDP deflator = (Nominal GDP / Real GDP) x 100Example: if nominal GDP is Tk.100,000 and real GDP is Tk.45,000, then the GDP deflator will be 222 (GDP deflator = Tk.100,000 / Tk.45,000 x 100 = 222.22).

Other terms related to inflation

Creeping Inflation

Creeping or mild inflation occurs when prices rise by 3% or less annually. This type of inflation can be beneficial for economic growth as it signals stability and encourages consumer spending.

With mild inflation, consumers anticipate future price increases, prompting them to purchase goods and services sooner rather than later. This increased demand stimulates economic activity and supports overall expansion.

Walking Inflation

Walking inflation ranges from 3% to 10% annually and poses significant risks to the economy. As prices rise more rapidly, consumers rush to buy goods before prices escalate further. This surge in demand outpaces supply, leading to shortages and higher prices.

Walking inflation erodes purchasing power, making essential goods and services less affordable for many people. It can also destabilize economic planning and investment, hindering long-term growth.

Galloping Inflation

Galloping inflation occurs when inflation rates soar to 10% or more annually, severely disrupting economic stability. During galloping inflation, the rapid loss of purchasing power undermines consumer confidence and business profitability.

Businesses struggle to maintain operations as costs skyrocket faster than income can keep pace. Foreign investors may withdraw capital, exacerbating economic woes and reducing essential investment needed for growth.

Hyperinflation

Hyperinflation is an extreme form where prices skyrocket by more than 50% per month. This rare phenomenon often results from severe economic crises or government mismanagement, such as excessive money printing.

Hyperinflation erodes the value of currency rapidly, causing economic chaos, skyrocketing prices, and undermining public trust in financial institutions. It requires urgent and drastic measures to stabilize the economy and restore confidence.

Deflation

Deflation is characterized by a general decrease in income and price levels, often leading to economic contraction. It occurs when prices continuously decline, discouraging consumption as consumers anticipate further reductions.

During deflationary periods, businesses may delay investments and hiring, exacerbating unemployment and economic stagnation. Central banks often combat deflation by lowering interest rates and implementing stimulus measures to encourage spending and investment.

“Deflation” is often confused with “disinflation.” While deflation represents a decrease in the prices of goods and services throughout the economy, disinflation represents a situation where inflation increases at a slower rate.