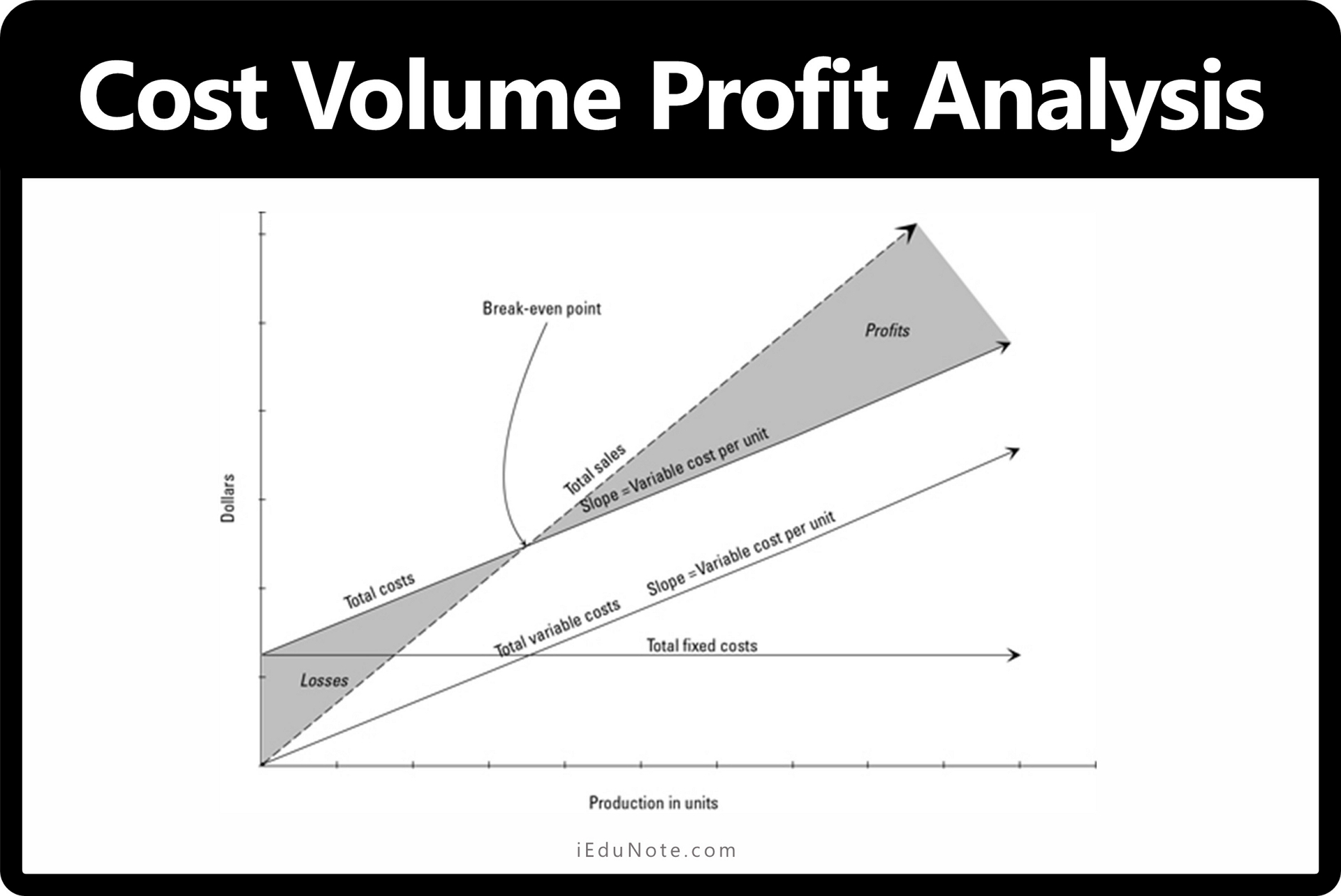

The total cost of a firm depends on its volume of output. The total cost has two parts— fixed and variable. Fixed cost remains fixed at all levels of production in the short-run, but variable cost proportionately changes with the volume of output.

Again the profit of the firm is dependent on its total sales and total cost. It is because of the positive difference between gross revenue (sales), and the total cost is profit.

So there is a direct relationship between the cost of production, the volume of output, and profit earned. All these factors are interdependent.

Cost determines the selling price to be fixed for arriving at the desired level of profit; the selling price and quantity sold directly affect the volume of production, and cost depends on the volume of production.

The method of studying the relationship among these factors i.e., total cost, the volume of production, sales, and profit, is known as cost-volume-profit analysis.

Cost-volume-profit analysis may be defined as a managerial tool for profit planning that reveals the interrelationship among cost, the volume of production, loss, and profit earned.

Objectives of CVP analysis

Earning of profit depends on the efficient management of cost because each unit sold has its specific cost controlling of cost through efficient management; on the other hand, it depends on the quantum of output.

The main objective of the cost-volume-profit analysis is to help management make important decisions revealing the interrelationship among the volume of output and sales, cost, and profit.

In other words, cost-volume-profit analysis is an important tool through which the management can have an insight into the effects on profit due to variations in cost and volume of sales for taking appropriate decisions.

The objectives achieved by such analysis may also be identified as its benefits. These objectives or advantages of cost-volume-profit analysis are as follows:

- Profit planning;

- Help in preparation of flexible budgets;

- Ascertainment of no profit and no loss level;

- Ascertainment of optimum product mix;

- Taking pricing decisions;

- Production planning;

- Taking other managerial decisions;

- Help in controlling cost;

- Achieving efficiency;

Assumptions of CVP

Basic Assumptions of CVP Analysis

Several assumptions commonly underlie CVP analysis:

- The selling price is constant. The price of a product or service will not change as volume changes.

- Costs are linear and can be accurately divided into variable and fixed elements. The variable element is constant per unit, and the fixed element is constant in total over the entire relevant range.

- In multiproduct companies, the sales mix is constant.

- In manufacturing companies, inventories do not change. The number of units produced equals the number of units sold.

While these assumptions may be violated in practice, the results of CVP analysis are often “good enough” to be quite useful.

Perhaps the greatest danger lies in relying on simple CVP analysis when a manager is contemplating a large change in volume that lies outside of the relevant range.

Limitations of CVP

Despite being considered as an important tool for decision making and planning the cost-volume-profit analysis, the technique has the following limitations:

- Problems in identifying fixed and variable costs.

- Fixed costs not always fixed.

- Proportionate relation between variable cost and volume of output not always effective.

- Unit selling price not always constant.

- Not suitable for a multiproduct firm.

- Ignoring the influence of other factors on cost and profit.

- Presence of inventory.

- Not effective in the long run.

- More emphasis on sales.

- A statistic tool.

More Assumptions of CVP Analysis

The technique of cost-volume-profit analysis rests on a set of assumptions.

These assumptions may be identified as the fundamental base of such analysis. The assumptions underlying the cost-volume-profit analysis are discussed below:

- All costs can be divided into fixed and variable elements.

- The selling price is constant. So total revenue will change direction and proportionately with the output, and the TR curve will be linear.

- Total fixed costs remain constant.

- Prices of factors of production e.g., material price wage rates, etc. are constant.

- The variable cost per unit is also constant. Therefore total variable costs are directly proportioned to volume.

- There will be no change in the firm’s efficiency or productivity.

- For a multiproduct firm, product-mix is constant.

- The volume of output is the only revenue and cost driver.

- There will no be any significant change in the inventory level at the beginning and the end of the year.

- The firm is assumed to analyze the short run.

- The analysis will be effective for a limited range of operations over which the firm was operating the past and is expected to operate in the future. It is known as a relevant range.

- No risk or uncertainty is involved, and the analysis is deterministic.

Uses or application of CVP

The cost-volume-profit analysis enables the management to reach planning and policymaking decisions more -intelligently.

Examples of specific uses to which information derived from cost-volume-profit analysis can be put are given below:

- Sales and Pricing Policies.

- Determination of profit which will result from any given volume of sales.

- Analysis of the effect of changes in selling price.

- Effect of changes in the product mixture.

- Additional sales volume needed to support additional expenditure.

- The lowest price at which business may be accepted to utilize facilities and contribute something towards net profit.

- The particular products to be emphasized to reflect the highest net profit.

- Financial and Production Problems.

- Interpretation of proposed or alternative budgets and effect of suggested cost and other changes when the goals are not satisfactory to management.

- Determination of unit costs at various volume levels.

- Determination of the probable effect of investment in new plant and equipment.

- Determination of the most profitable use of scarce materials.

- Assistance in the choice between the make or buys decisions.