The cost sheet is a statement, which shows various components of the total cost of a product. It classifies and analyses the components of the cost of a product.

The previous period’s data is given in the cost sheet for comparative study. It is a statement that shows per unit cost in addition to Total Cost.

The selling price is ascertained with the help of the cost sheet. The details of the total cost presented in the form of a statement are termed as Cost sheet.

The cost sheet is a statement that provides for assembly of the detailed cost & cost center or a cost unit.”

Importance of Cost Sheet.

The importance of cost sheet is as follows:

- Cost ascertainment.

- Fixation of the selling price.

- Help in cost control.

- Facilitates managerial decisions.

Cost ascertainment

The main objective of the cost sheet is to ascertain the cost of a product.

The cost sheet helps in the ascertainment of cost to determine cost after they are incurred. It also helps to ascertain the actual cost or estimated cost of a Job.

Fixation of the selling price

To fix the selling price of a product or service, it is essential to prepare the cost sheet. It helps in fixing the selling price of a product or service by providing detailed information about the cost.

Help in cost control

For controlling the cost of a product, every manufacturing unit must prepare a cost sheet. The estimated cost sheet helps in the control of material cost, labor cost, and overheads cost at every point of production.

Facilitates managerial decisions

It helps in making important decisions by the management, such as: whether to produce or buy a component, what prices of goods are to be quoted in the tender, whether to retain or replace an existing machine, etc.

Major Elements of Cost Sheet / Elements of cost of manufacturing product

The major elements of a product are;

- Material,

- Labor, and

- factory overhead.

Material

To produce or manufacture material is required. For example, to manufacture shirts, the cloth is required, and to produce flour, wheat is required.

Material is classified into two categories:

- Direct Material.

- Indirect Material.

Direct material

Direct material is that material which can be easily identified and related to a specific product, job, and process. For example, Timber is a raw material for making furniture

Indirect material

Indirect material is that material that cannot be easily and conveniently identified and related to a particular product, job, process, and activity. Consumable stores, oil, and waste, printing and stationery, etc., are some examples of indirect material.

Labor

Labor is the main factor of production. For the conversion of raw material into finished goods, human resource is needed, and such human resource is termed as labor. Labor can be classified into two categories:

- Direct Labor

- Indirect labor

Direct labor

Labor, which takes an active and direct part in the production of a product, is called direct labor. Direct labor is that labor can be easily identified and related to a specific product, job, process, and activity.

Indirect labor

Indirect labor is that labor which can not be easily identified and related to a specific product, job, process, and activity. It includes all labor not directly engaged in converting raw material into a finished product.

For example- Night security guards’ salary.

Factory Overhead

Factory overhead includes all costs of manufacturing except direct materials and direct labor, such as indirect material, indirect labor, heat, and light, property tax, depreciation, etc.

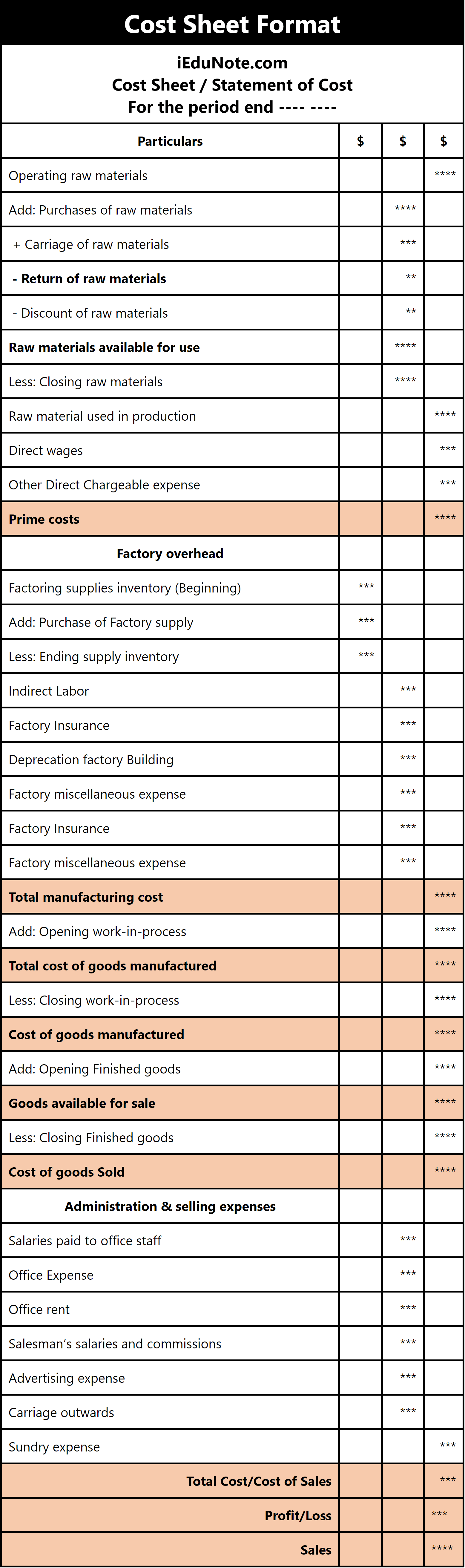

Cost Sheet Format

|

Cost Sheet Format | |||

|

iEduNote.com Cost Sheet / Statement of Cost For the period end —- —- | |||

| Particulars | $ | $ | $ |

| Operating raw materials | **** | ||

| Add: Purchases of raw materials. | **** | ||

| + Carriage of raw materials | *** | ||

| – Return of raw materials | ** | ||

| – Discount of raw materials | ** | ||

| Raw materials available for use | **** | ||

| Less: Closing raw materials | **** | ||

| Raw material used in production | **** | ||

| Direct wages | *** | ||

| Other Direct Chargeable expense | *** | ||

| Prime costs | **** | ||

| Factory overhead | |||

| Factoring supplies inventory (Beginning) | *** | ||

| Add: Purchase of Factory supply | *** | ||

| Less: Ending supply inventory | *** | ||

| Indirect Labor | *** | ||

| Factory Insurance | *** | ||

| Deprecation factory Building | *** | ||

| Factory miscellaneous expense | *** | ||

| Factory Insurance | *** | ||

| Factory miscellaneous expense | *** | ||

| Total manufacturing cost | **** | ||

| Add: Opening work-in-process | **** | ||

| Total cost of goods manufactured | **** | ||

| Less: Closing work-in-process | **** | ||

| Cost of goods manufactured | **** | ||

| Add: Opening Finished goods | **** | ||

| Goods available for sale | **** | ||

| Less: Closing Finished goods | **** | ||

| Cost of goods sold | **** | ||

| Administration & selling expenses | |||

| Salaries paid to office staff | *** | ||

| Office Expense | *** | ||

| Office rent | *** | ||

| Salesman’s salaries and commissions | *** | ||

| Advertising expense | *** | ||

| Carriage outwards | *** | ||

| Sundry expense | *** | ||

| Total Cost/Cost of Sales | *** | ||

| Profit/Loss | *** | ||

| Sales | **** | ||

Use the image of cost sheet format if required:-