Contract Costing is a special type of job costing in which the unit of cost is a single contract. The contract is a cost center executed under the customer’s specifications.

What is Contract Costing?

Contract costing is a variant of the applicable job costing system, particularly in the case of the organization doing construction work. It is also known as terminal costing. Each contract, short-term or long-term, is treated as a job.

It is understood from common sense that construction work involves massive investment and labor employment. So, no organization can undertake a large number of contracts at a time.

Features of Contract Costing

A cost unit is a specific contract. Each contract takes a long time to complete.

The work being of a constructional nature, the same is executed at the customer’s site, as per his specifications.

Materials

The bulk of the materials are purchased and delivered directly to the contract site or obtained from the central stores through the requisition slips.

Wages

The wages which cannot be charged directly to any contract are treated as indirect wages that require apportionment.

Direct Charges

Most of the costs which are normally treated as indirect can be identified specifically with a particular contract and are charged to it as direct costs.

Bill of sub-contractors

Third parties often do parts of large contracts under sub-contracts. Sub-contracts is a practice normally followed on the region of economy, specialized nature of work, want of capacity, etc.

Certificate of completion

The contracts do not pay the full value of the work certified as completed but retain a certain percent under the terms of the agreement.

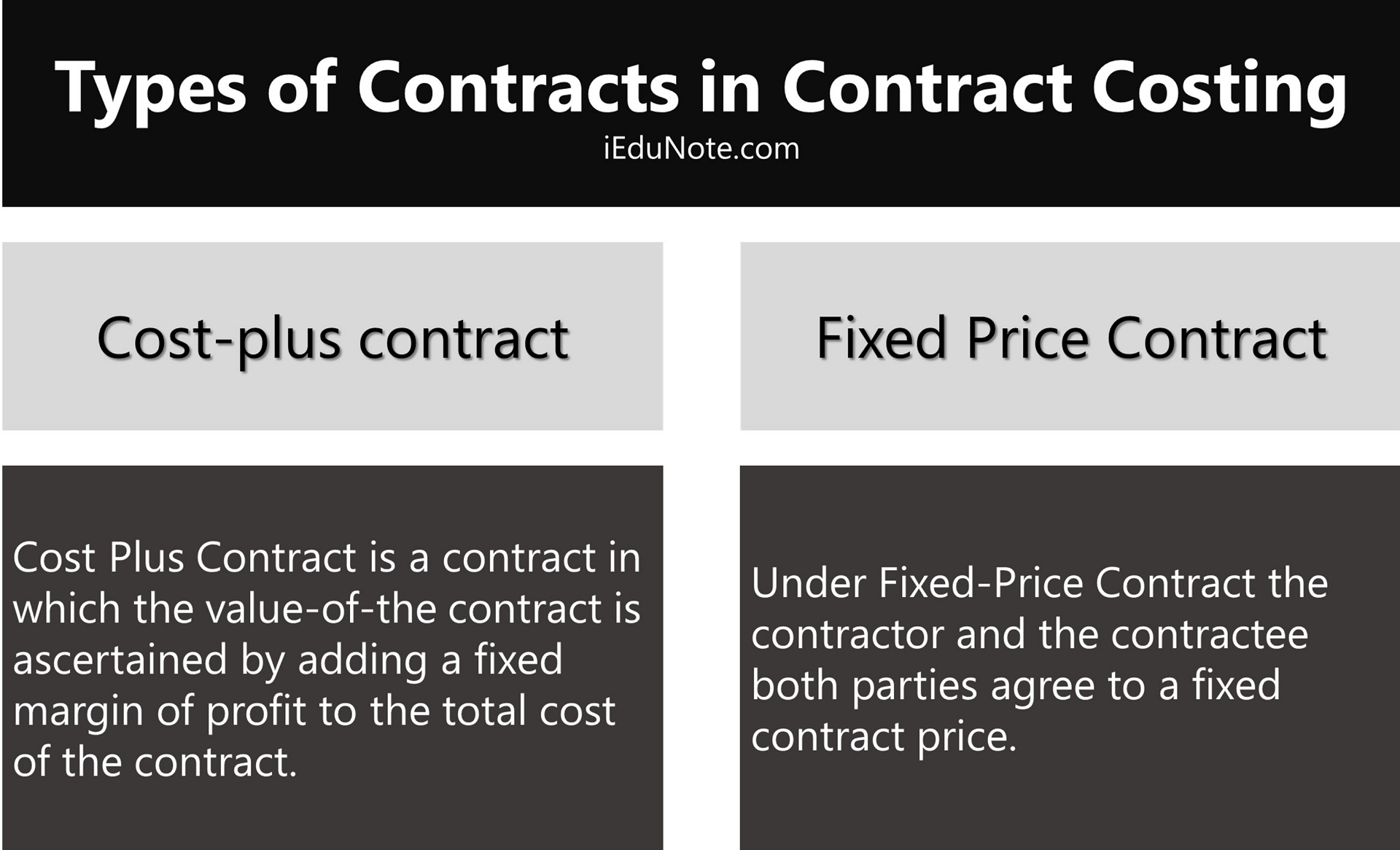

Types of Contracts in Contract Costing

Generally, there are two types of contract:

Cost-plus contract

Cost Plus Contract is a contract in which the value-of-the contract is ascertained by adding a fixed margin of profit to the total cost of the contract.

In this case, the manufacturer is assured of a certain percentage of profit in advance and is protected against any fluctuations in the market prices of the various cost elements involved in the production.

As a result of the viewpoint of the manufacturer, the possibility of incurring any loss is eliminated.

Fixed Price Contract

Under Fixed-Price Contract, the contractor and the contractee both parties agree to a fixed contract price.

In this case, the manufacturer is not assured of a certain percentage of profit in advance and is not protected against any fluctuations in the market prices of the various cost elements involved in the production.

Difference between Job Costing and Contract Costing

The difference between job costing and contract costing are:

Size

Job costing refers to very small work, while contract costing refers to large work like building a bridge.

Recording of expense

All kinds of expenses are not charged to the job account. All kinds of expenses, either direct or indirect, are charged to the contract account.

Profit Determination

Under job order costing profit is determined after all cost related to the job is incurred.

But under contract costing as it is operated for several years, so each year-end an estimated profit is determined, which is known as notional profit.

Complexity in accounting

Under job order costing, Complexity in accounting is lower. But Under contract costing, Complexity in accounting is high.

Work Place

Under job order costing work is done in the company’s factory. But Under contract costing work is done in the worksite.

Payroll

The payroll is prepared either at the site or at a central administrative office.

Control

The scale of operations and cost control becomes difficult due to the theft of materials, labor time utilization, pilferages, etc.

Why is the profit of incomplete contract ascertained?

Profit in respect of each contract during every financial year can be ascertained.

While there is no controversy as to the treatment of loss incomplete contract, there is a controversy as to the treatment of profit on the incomplete contract.

The loss on incomplete contract in any year should, however, be transferred to the year’s Profit & Loss Account.

So, on the conservative approach, the work-in-progress are valued at cost only.

No portion of the profit, if any, is included in the value of work-in-progress. The arguments in favor of this approach are:

- Until a contract is completed, nobody can say that ultimately there will be profit. So, profit it any year before completion is nothing but anticipated profit.

- If profit is considered, income-tax shall be payable on that profit much earlier than the year of completion.

- A contract may show a profit during earlier years of execution, but ultimately it may prove loss. Dividends paid on this basis of profit in earlier years shall be ultimately unjustified.

How the Profit of Incomplete Contract is Determined

The treatment of profit on incomplete contracts is given below:

- Profit should be considered in respect of work certified only; work uncertified should always be valued at cost.

- If the work started recently and one-fourth or less is done, no profit should be transferred to the profit and loss account.

- If the contract has advanced and if the architect of the contractee certifies that the work completed more than 25%, in that case, one-third of notional profit should be recognized as profit.

PROFIT = 1/3 *cash received/work certified.

NOTIONAL PROFIT = Value of work certified-(cost of work to date-uncertified amount) - If the contract is made more than 50%, but less than 90% in that situation, two-third of notional profit should be recognized as profit.

Profit = Notional profit *2/3*cash received /work certified. - If the contract is made 90% or more in that situation, the total profit may be recognized.

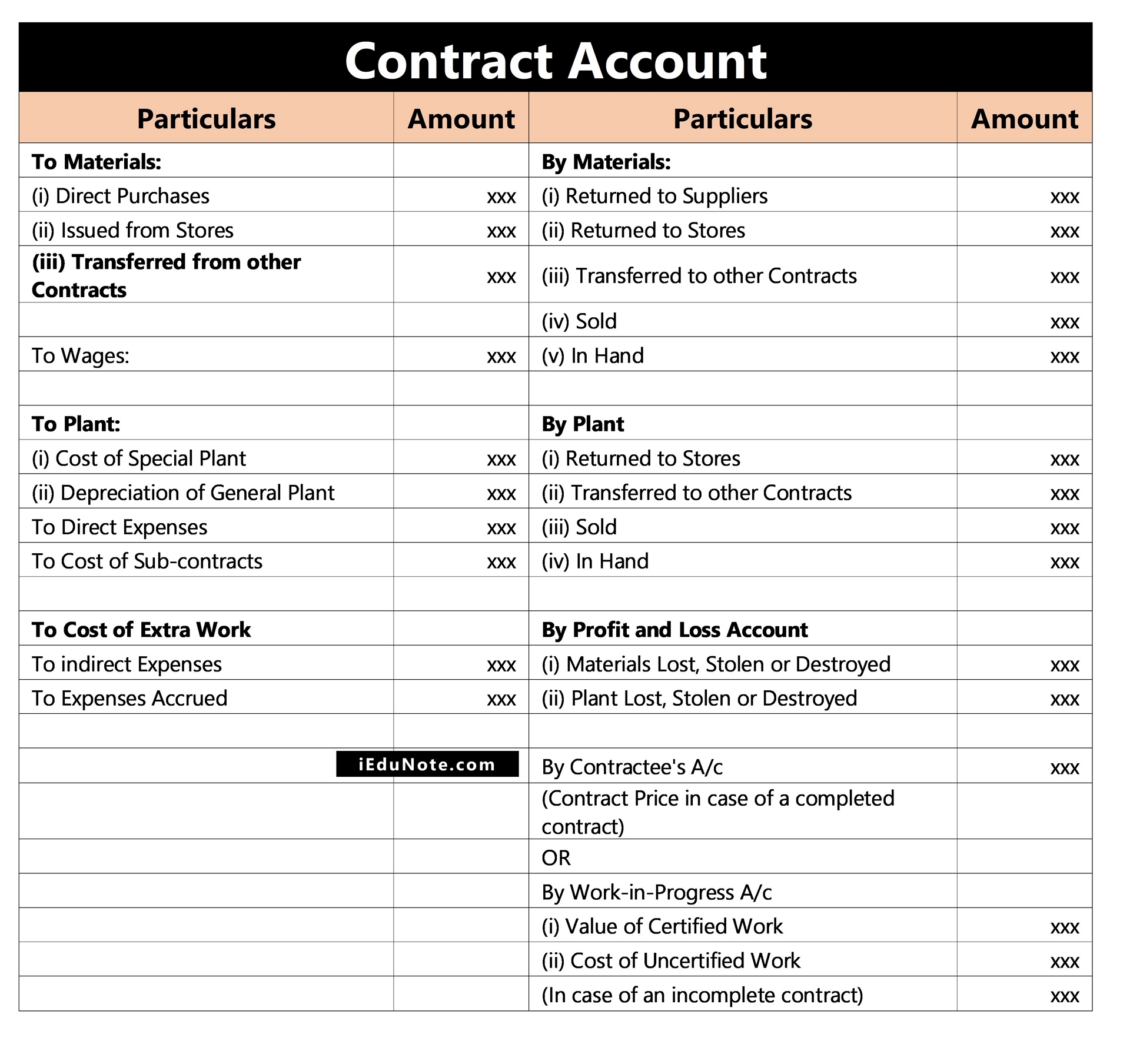

Format of Contract Account

We added formats of contract account, contractee’s account, balance sheet, and valuation of closing stock.

| Contract Account | |||

|---|---|---|---|

| Particulars | Amount | Particulars | Amount |

| To Materials | By Materials | ||

| (i) Direct Purchases | (i) Returned to Suppliers | ||

| (ii) Issued from Stores | (ii) Returned to Stores | ||

| (iii) Transferred from other Contracts | (iii) Transferred to other Contracts | ||

| (iv) Sold | |||

| To Wages | (v) In Hand | ||

| To Plant | By Plant | ||

| (i) Cost of Special Plant | (i) Returned to Stores | ||

| (ii) Depreciation of General Plant | (ii) Transferred to other Contracts | ||

| To Direct Expenses | (iii) Sold | ||

| To Cost of Sub-contracts | (iv) In Hand | ||

| To Cost of Extra Work | By Profit and Loss Account | ||

| To indirect Expenses | (i) Materials Lost, Stolen or Destroyed | ||

| To Expenses Accrued | (ii) Plant Lost, Stolen or Destroyed | ||

| By Contractee’s A/c | |||

| (Contract Price in case of a completed contract) | |||

| OR | |||

| By Work-in-Progress A/c | |||

| (i) Value of Certified Work | |||

| (ii) Cost of Uncertified Work | |||

| (In case of an incomplete contract) | |||

Image of formats of contract account:-

Contractee’s Account for Contract Costing

| Particulars | $ | Particulars | $ |

|---|---|---|---|

| Contract account (value of work certified) | xxxxx | Bank A/C (cash received) Balance c/d | xxxxx |

| xxxxx | |||

| xxxxx | xxxxx |

Balance Sheet for Contract Costing

| Liabilities | $ | $ | Assets | $ | $ |

| Profit & loss: | Fixed asset: | ||||

| Profit on contract | xxxxx | Plant | xxxxx | ||

| (-) Less: loss on fire | xxxxx | xxxxx | (-)Less depreciation | xxxxx | xxxxx |

| Outstanding Liabilities: | Other fixed assets | ||||

| Accrued wages xxxxx | (-)Less depreciation | ||||

| Accrued direct expense | xxxxx | xxxxx | |||

| Other accrued expense | xxxxx | Current assets: | |||

| xxxxx | Material at site | xxxxx | |||

| Work-in-progress | xxxxx | ||||

| Cash in hand | xxxxx | ||||

| xxxxx | |||||

| xxxxx | xxxxx |

Valuation of closing stock

If realized & unrealized profit can be determined; then:-

| Explanation | $ |

| Cost of work certified | xxxx |

| (+) Cost of work certified | xxxx |

| = | xxxx |

| (-) cash received | xxxx |

| = | xxxx |

| (-) provision for unrealized profit work-in- | xxxx |

| progress | |

| Work in progress = | xxxx |

If national profit can be determined but realized profit could not be determined:-

| Explanation | $ |

| Cost of work certified | xxxxx |

| (+) Cost of work certified | xxxxx |

| = . | xxxxx |

| (-) cash received | xxxxx |

| = | xxxxx |

| (-) National profit | xxxxx |

| Work in progress = | xxxxx |

If national profit cannot be determined:-

| Explanation | $ |

| Cost of contract | xxxxx |

| (-) cash received | xxxxx |

| Woi;k in progress = | xxxxx |