Cash Control means managing and monitoring credit and collection policies, cash allocation, and disbursement policies, accounts payable policies and the invoicing cycle.

Cash Control is an important part of business as it is required for proper cash management, monitoring and recording of cash flow and analyzing cash balance.

Cash is the most important liquid asset of the business. A business concern cannot prosper and survive without proper control over cash.

In accounting, cash includes coins; currency; deposited negotiable instruments such as cheques, bank drafts, and money orders; amounts in chequing and savings accounts and demand certificates of deposit.

A certificate of deposit (CD) is an interest-bearing deposit that can be withdrawn from a bank at will (demand CD) or at a fixed maturity date (time CD).

Cash only includes demand CDs that may be withdrawn at any time without prior notice. Cash does not include postage stamps, IOUs, time CDs or notes receivable.

A business concern maintains two types of cash accounts in its general ledger – cash and petty cash. But in the balance sheet, the balances of these two accounts are shown together as cash.

Since most of the transactions of a business concern are cash transactions, cash is considered an important liquid asset.

Misuse of cash may happen easily through stealing or due to carelessness.

Steps of Cash Control are;

- Cash transactions of a business are to be accounted for properly to know cash flow and cash balance.

- Cash sufficiency is to be ensured on due dates of notes payable.

- Idle cash should be minimal because additional cash investment earns more revenue.

- Loss caused due to misappropriation and forgery is to be controlled and stopped.

The necessity of cash control is very clear and it has many sides. A business cannot survive without time-related cash flow and proper cash management.

At this stage cash receipts, control and cash disbursement control are discussed.

Controlling of Cash Receipts

A business concern can receive’ cash of sale proceeds immediately after the sale or at an interval of some days or weeks.

A cash counter clerk records cash receipts immediately and posts them into the cash register.

If cash receipts of cash sales are recorded in the cash register in the presence of the customers, it is almost certain that the cashier has recorded be a correct figure of cash in cash register.

At the close of the day, the accountant reconciles the balance of cash register with that of cash register-tape or computer statement (for register concerned).

Later, when a cheque is received for sale, the accountant records it immediately in the books of accounts. A business concern receives cash through cheques from customers after the expiry of a certain period.

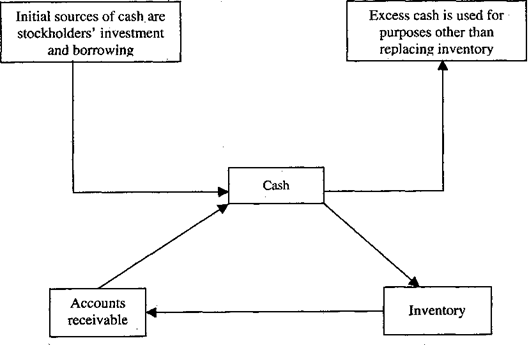

Cash receipts cycle of merchandise sale of a business concern is as follows:

Although the control system of cash receipts of all business concerns is not similar the following principles are generally followed by all.

- Cash receipts are accounted for right after the occurrence. Because in most cases cash stealing happens before the recording of cash. Detection of cash misappropriation becomes easier if cash receipts are recorded in time.

- Cash is to be deposited into the bank right after receipts. The day-end collection of cash might not possibly be deposited in the bank on the same day because of banking hours. In such a case, it should be deposited on the following day during business hours to avoid misappropriation of cash.

- The person who receives cash must not be allowed to record cash receipts in the accounting record. Some other accounts assistant should do this work.

- The receiver of cash should not be allowed to disburse cash. This work is to be done by someone else. This control measure is possible in all except the very small companies.

Controlling cash disbursements

A business concern must have proper control over cash disbursements. A business concern settles most of the cash transactions by cheques.

For this reason, internal control of cash payment is related to cheques and cash payment authorization. In a cash disbursement control system, principles of segregation of job responsibility are followed.

Some basic principles of cash payments are mentioned below:

- All payments are to be made by cheques or petty cash. Payments are to be approved and every payment is to be recorded. Many retailers pay cash for the return of merchandise. If such a policy is followed cash payment is to be made after obtaining a payment ticket for the return of merchandise approved by the supervisor.

- Cash payments are to be numbered serially and cheque issuing power of an employee is to be limited.

- Every cheque must be signed by two persons so that no one can withdraw money from the bank by his single signature.

- Job responsibility is to be assigned in such a way as the person responsible for payment of the bill is not empowered to sign cheques. Otherwise, false payment may be made issuing a cheque in favor of one’s friend circle.

- The issuance of cheques must be supported by approved documents.

- The person empowered to issue cheques must be directed to make the exact payment to the genuine person.

- In payment of a debt, relevant documents must be stamped and the issued cheque must contain date and signatures to avoid the possibility of repeated payment for the same head.

- Job responsibility should be assigned in a way that a person who signs cheques is empowered neither to cancel the signed cheque nor prepare a bank reconciliation statement. Under this system, no employee can conceal the act of misappropriation of cash.

- The monthly bank statement is to be prepared by such a person as is not associated with the job of cash receipts or cash payment in any way. Under this process errors and shortfalls can easily be detected.

- Improperly prepared cheques are to be canceled. Canceled cheques marking void are to be preserved to avoid misuse of these cheques in the future.

Internal control consideration

Most of the business concerns maintain cash transactions through bank accounts. A business concern deposits cash receipts in a bank chequing the account and makes payment of bills by cheques.

The bank sends a monthly statement. The business concern verifies the information and bank balance shown in the bank statements with accounting records of the business.

If any discrepancy is detected, it is reconciled by preparing a bank reconciliation statement.