Finance relates to the process, institutions, markets, and instruments involved in transferring money among individuals, businesses, and governments. Let’s Understand bus

What is Business Finance?

Business finance is concerned with meeting all the financial needs of a business firm. Business finance is the field of study with the help of which one can understand the formulation of financial planning, organizing, and controlling activities and their application in business.

Definition of Business Finance

- The capital involved in a project, especially the capital that has to be raised to start a new business. – Oxford Dictionary of Finance

- Activities of a business concern relevant to financial planning, coordinating, controlling and their application is called business finance, – E. W. Walker,

- Business finance can be broadly defined as the activity concerned with the planning, raising, controlling, and administering the funds used in business. – Guthmann & Dougall

- Business finance is concerned with the sources of funds available to enterprises of all sizes and the proper use of money or credit from such sources. – Gloss & Backer

- Business finance can be defined as the activity concerned with the planning, organizing, controlling, and administering of funds used in the business. – P. L. Mehta

- Financial management is concerned with the acquisition, finance and management of assets with some overall goals in mind.

- According to B. O. Wheeler, “Business finance is that activities which is concerned with the acquisition and conservation of capital funds in meeting the financial need and over all objective of business enterprise.”

- According to Dr. R. E. Gloss & Dr. H. Baker, “Business finance is concerned with the sources of funds available to enterprise of all sizes and the proper use of money or credit obtained from such sources”

Business finance combines all financial activities, including raising funds, using funds, adjusting, and controlling to earn profit by the business enterprise.

Business finance is related to all business organizations earning or raising money and spending or investing money.

The financial manager is often used to refer to anyone directly engaged in making or

implementing financial decisions.

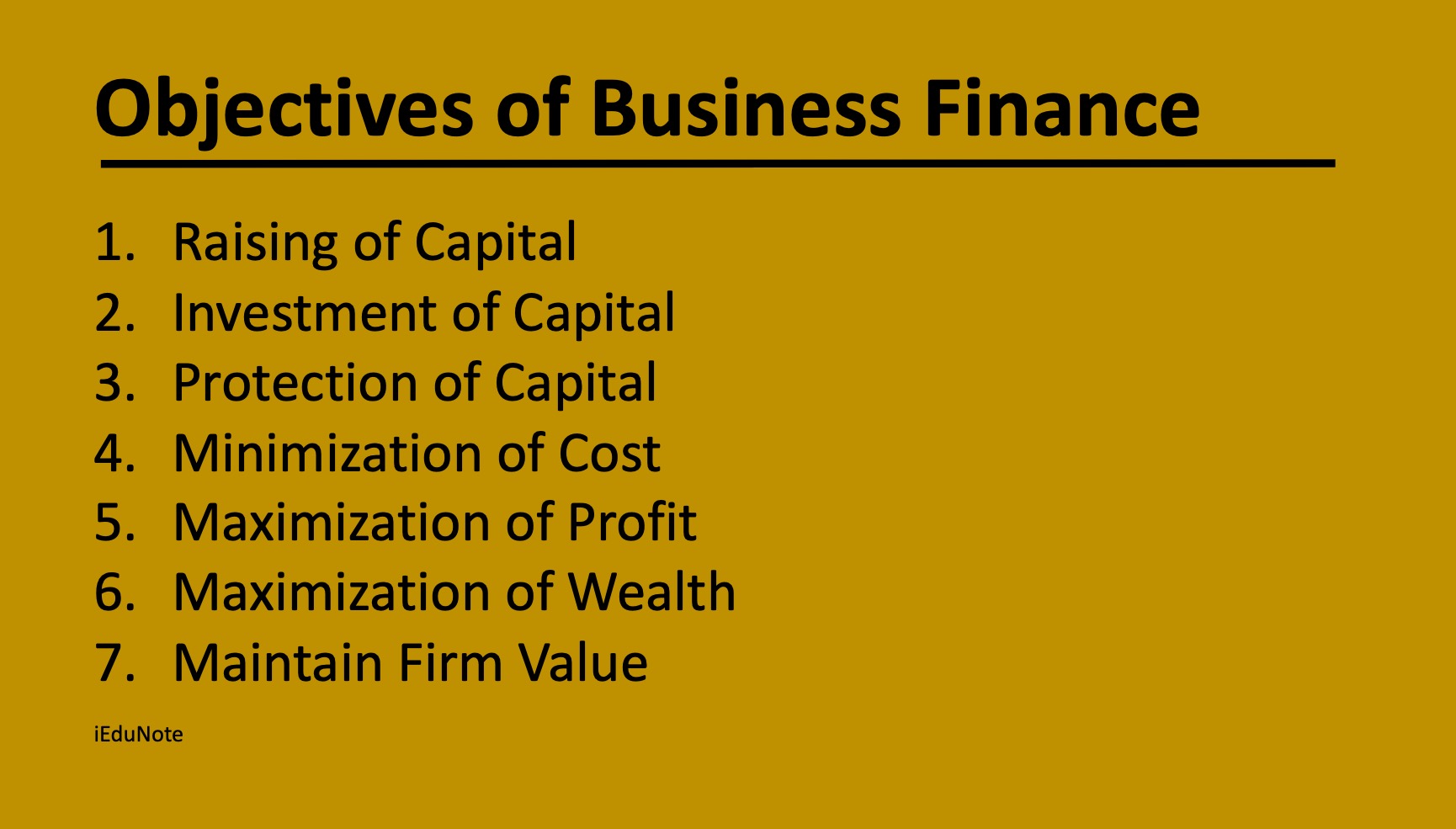

7 Objectives of Business Finance

The principal objectives of finance are to raise capital to earn adequate profit through investment, conservation, and efficient utilization of investable capital.

Raising of Capital

Finance’s first and foremost objective is to raise the capital needed for the organization concerned.

The financial manager attempts to raise the capital economically so that excess funds do not remain idle or a shortage of funds does not create a bottleneck in running the business.

Investment of Capital

The second objective is to invest the capital raised appropriately and in proper sequence. By investment of funds, we mean financial managers should decide where corporate money may be invested.

Generally, money should be invested where it will do the most good. In a corporate setting, this means being profitable.

Protection of Capital

It is also the objective of finance to protect the capital invested in the business. Uncertainty always prevails in the business world.

If the investment is made unwisely and un-prudently, it may bring disaster to the business unit. Therefore, to fulfill the objective of finance, the risk of loss and protection of capital must be given due consideration.

Minimization of Cost

One objective of finance is to minimize the cost of funds to maximize shareholders’ wealth. That involves examining all alternative sources of financing.

A firm may decide to issue bonds instead of stock. Bonds are riskier than stocks; on the other hand, bonds cost less than stocks. Here, the firm accepts the risk of borrowing in exchange for a lower cost of funds.

Maximization of Profit

One of the important objectives of finance is to maximize the firm’s profit. The financial manager would take actions expected to make a major contribution to the firm’s overall profits.

For each alternative being considered, the financial manager would select the one expected to result in the highest monetary return.

Maximization of Wealth

The other most important objective of the firm is to maximize the wealth of the owners for whom it is being operated. The wealth of corporate owners is measured by the share price of the stock, which in turn is based on the timing of returns, magnitude, and risk.

Maintain Firm Value

One of the important objectives of finance is to maintain the firm’s value. It is generally believed that the firm’s value is maximized when the cost of capital is minimized.

The optimum capital structure exists the value of the firm is maintained constantly. So, maintain firm value associated with the formation of optimum capital structure.

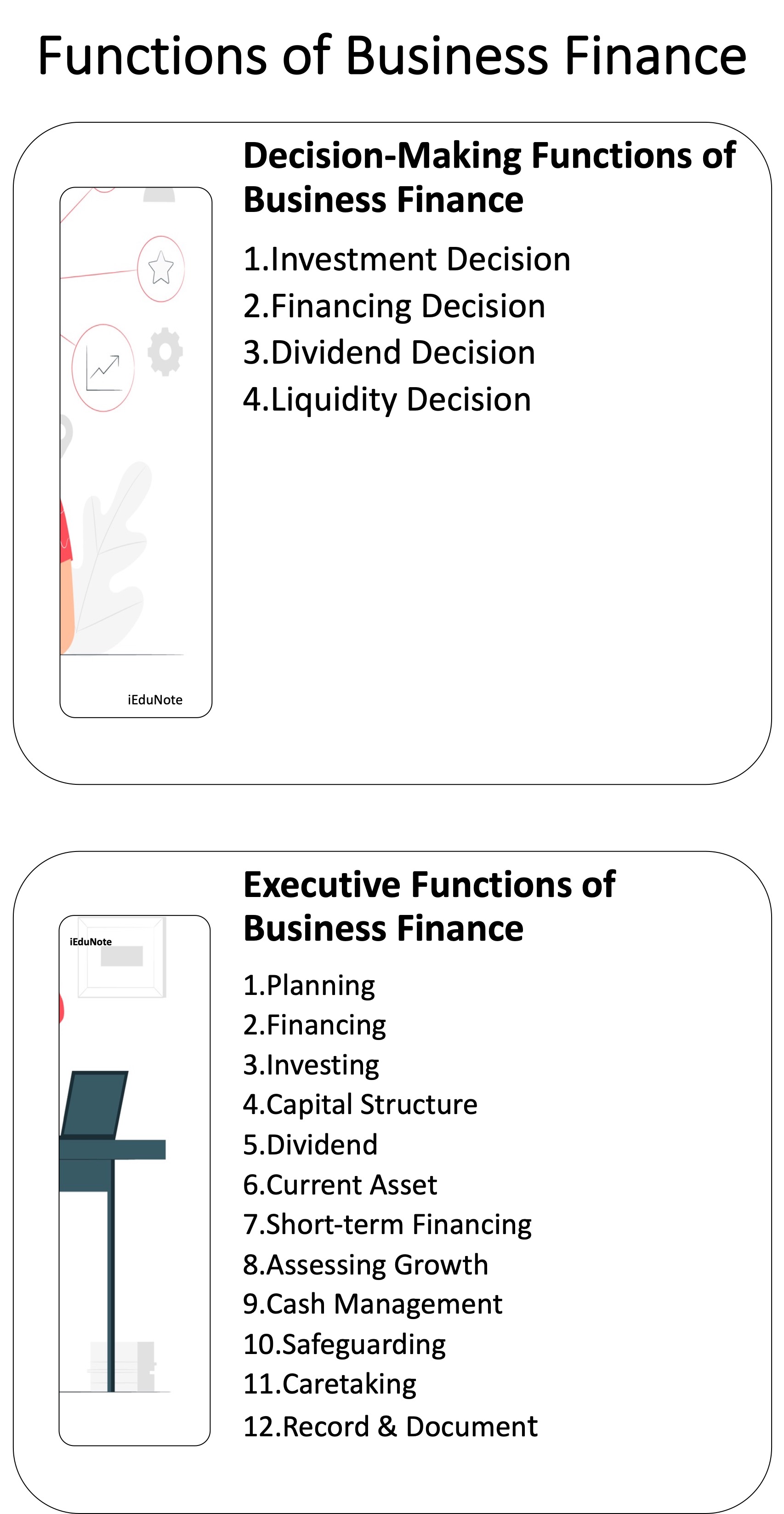

Functions of Business Finance

Financial managers are all those individuals whose decision-making responsibility affects the firm’s financial health.

4 Decision-Making Functions of Business Finance

The functions of raising funds, investing them in assets, and distributing returns earned from assets to shareholders are respectively discussed below;

Investment Decision

An investment decision involves the decision to the allocation of capital to long-term assets that would provide benefits in the future. Two important aspects of the decision are ;

- The evaluation of the prospective profitability of new investment, and

- The measurement of an expected return against the prospective return of new investments could be compared.

Financing Decision

Financing decision decides when, where, and how to acquire funds to meet the firms’ investment needs. The central issue to determine is the proportion of equity and debt.

The mix of debt and equity is known as the firm’s capital structure. The financial manager must strive to obtain the best financing mix or the optimum capital structure for the firm.

Dividend Decision

The financial manager must decide whether the firm should distribute all profits, retain them, or distribute a portion and retain the balance.

Like the debt policy, the dividend policy should be determined regarding its impact on the shareholders’ value. The optimum dividend policy maximizes the market value of the firm’s shares.

Thus, if shareholders are not indifferent to the firm’s dividend policy, the financial manager must determine the optimum dividend payout ratio.

Liquidity Decision

Current assets management that affects a firm’s liquidity is yet another important finance function, in addition to managing long-term assets.

Current assets should be managed efficiently to safeguard the firm against the dangers of illiquidity and insolvency. Investment in current assets affects the firm’s profitability, liquidity, and risk. A conflict exists between profitability and liquidity while managing current assets.

Thus a proper trade-off must be achieved between profitability and liquidity.

12 Executive Functions of Business Finance (Routine Functions of Business Finance)

For the effective execution of the finance functions, certain other functions have to be routinely performed:

Planning

Planning for the ongoing activities of the firm and ensuring that the firm responds to the changing financial and economic environment.

Financing

Evaluating, securing, and serving long-term financing from within the firm or from financial securities.

Investing

Investment and management of long-term assets through the capital budgeting process.

Capital Structure

Determination of the required rate of return through attention to the firm’s capital structure and alternative sources of funds.

Dividend

Distribution of profits to the firm’s stockholders via a cash dividend policy.

Current Asset

Securing, managing, and investing in current assets such as cash, accounts receivable, and inventory.

Short-term Financing

Obtaining short-term financing from creditors or financial markets.

Assessing Growth

Assessing the viability of growth via merging and ensuring the economic vitality of the firm.

Cash Management

Supervised cash receipts and payments and safeguarded cash balances.

Safeguarding

Custody and safeguarding of securities, insurance policies, and other valuable papers.

Caretaking

Taking care of the mechanical details of new outside financing.

Record & Document

Record keeping and reporting the financial information. A firm performs finance functions simultaneously and continuously in the normal course of the business.

They do not necessarily occur in a sequence. Finance functions require skillful planning, control, and execution of a firm’s activities.