Organizations are interlinked and their strengths derive from that interlinkage more than they do from standalone activity. There is a linkage between the results the organization seeks for its shareholders, the strategy it adopts and the various activities it carries out as part of its day-to-day operation.

The creation of loss of value occurs if the organization is casual about those linkages and fails to capture the learning that occurs every day to improvise and strengthen its operations. Measurement is the central theme in the balanced scorecard developed by Norton and Kaplan (1996).

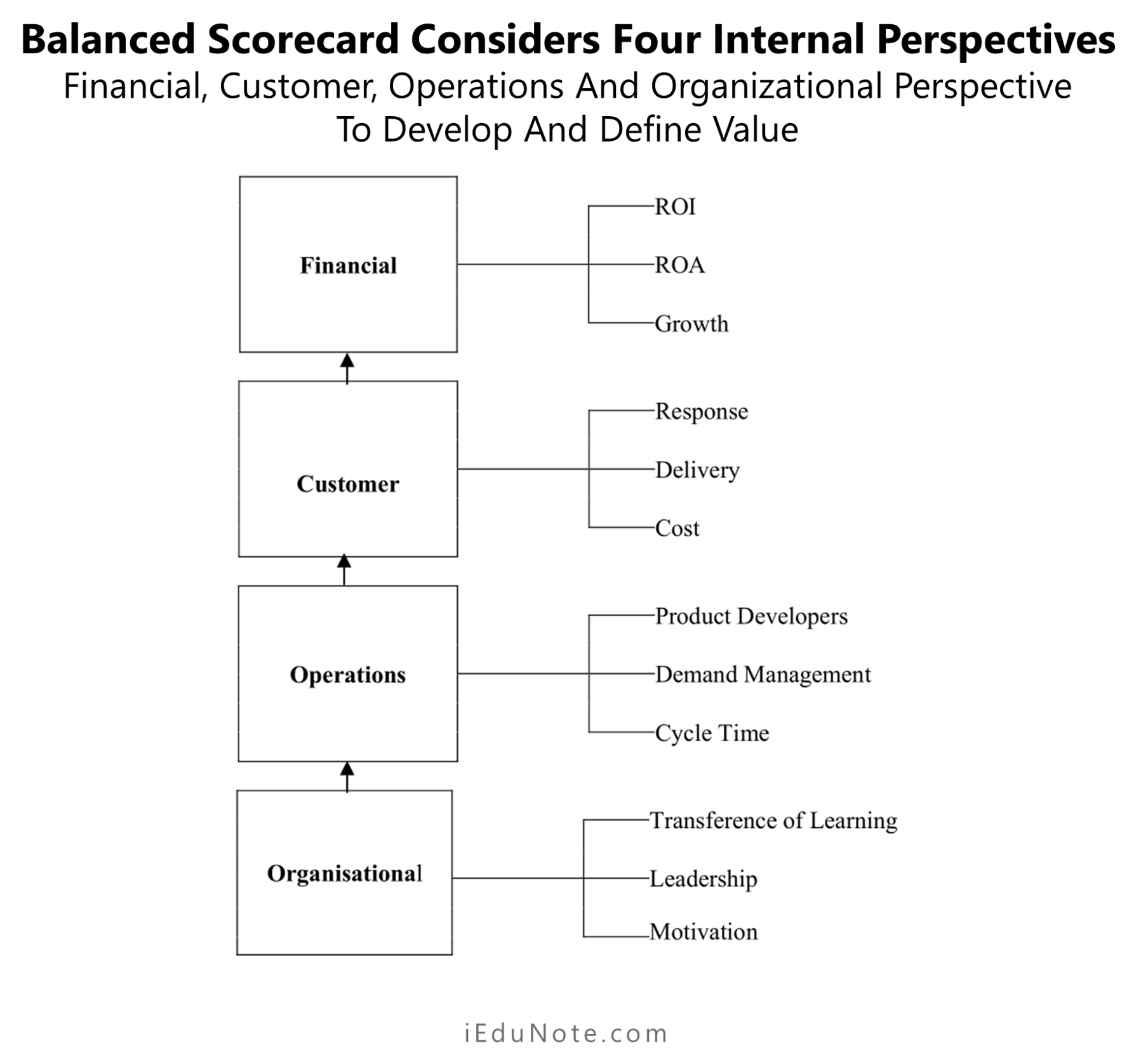

Balanced scorecard considers four interlinked internal perspectives – the financial, customer, operations and organizations to develop and define value. The scorecard was initially used as a performance improvement tool but later it became popular as a strategy implementation tool as it emphasizes measurement.

Balanced Scorecard emphasizes “what cannot be measured cannot be improved” and the scorecard either measured quantitatively or qualitatively.

If profitability is the result of increased sales and lowered operating costs and investments then the organization should be able to translate the implication of lowered costs of operations and investments into marketing, sales, procurement, and maintenance targets for the front line.

Lowered costs of production translate into lower prices. The strategy sought to be attained for shareholders must be translated across the functional areas so as to be discernible to those who perform the daily operations.

The strategy is not fully realized if the description of strategy in terms of what it wants to do for customers, the position it wishes to occupy in the market, is not converted into specific attainable and measurable targets for the lowest-level employee.

If McDonald’s has to attain position of the low cost and quality producer of fast food and earn a return on investment of say 11 percent, it must be able to translate its financial targets for strategy into customer-specific targets (time to be taken to deliver the food), operations targets (batch of fries to be obtained in one even, machine maintenance periodicity and organisational targets (transferring learning from the Hamburger University to the outlets).

The monitoring must be put in place so that any detraction from operational efficiency is addressed. The organization’s efficiency that is created is enduring for the organization.

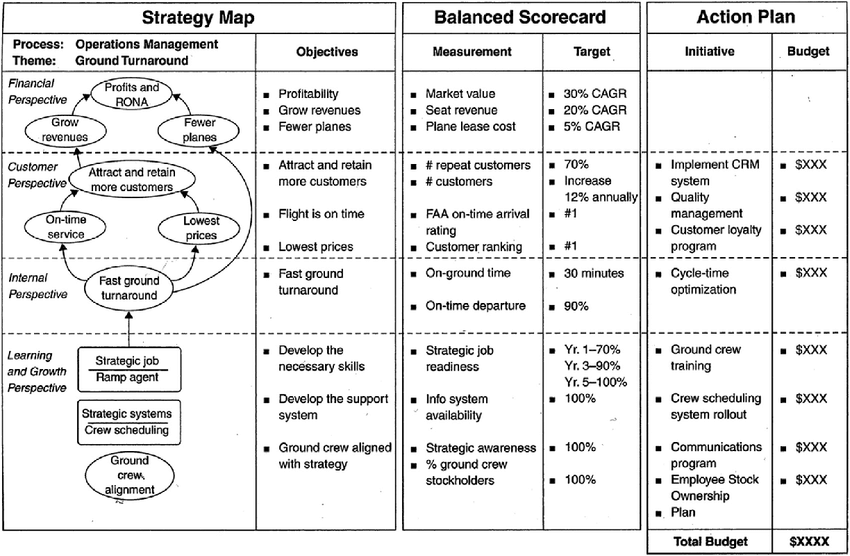

To use the Balanced Scorecard as a tool for internal analysis the key managers can do a retrospective analysis for the strategy being pursued and a prospective analysis of factors that need to develop for the success of a future strategy.

Generally, it has been seen that it is not the shortfall of practices that leads to erosion in the organization it is the continuation of practices whose usefulness must be questioned but has not been for historical or emotional reasons.

Despite the fact that financial measures of performance in a business organization are highly important, as a manager, you will recognize that traditional accounting data/financial information has limitations in measuring performance.

Financial information is not enough for measuring the true performance of a business unit. These limitations have somewhat been overcome by the use of a Balanced Scorecard.

Robert Kaplan and David Norton developed this tool, which supplements financial measures with a set of non-financial measures.

The non-financial measures, when used along with accounting data, provide better insight into the likely future performance of a business unit.

Thus, Balanced Scorecard can be used as “a tool for ex-ante (anticipatory) control rather than ex-post analysis,”

The Balanced Scorecard maintains a ‘balance’ between financial measures (such as profit, return on investment, cash flow, increase in market share, and periodical sales growth) and non-financial measures (such as customer service, product quality, morale of employees, business ethics, corporate social responsibility, reduction of pollution, and community involvement).

Emphasis is given on balance between financial and non-financial measures, between measures of past results and measures that influence future performance, and between more objective measures and more subjective measures.

The basic tenet of Balanced Scorecard is that firms should, establish objectives and evaluate strategies on items other than financial measures.

The financial and non-financial measures combined constitute the essence of Balanced Scorecard.

For a business unit, a Balanced Scorecard is “simply a listing of all key objectives to work toward, along with an; associated time dimension of when each objective is to be accomplished, as well as primary responsibility or contact person, department, or division for each objective.”

A sample Balanced Scorecard is presented below.

However, it should be clear that the exact Balanced Scorecard will differ from firm to firm. But the basic rationale remains the same.

That is, it can be used as a management tool to balance long-term to short-term concerns of the firm, to balance financial with non-financial concerns, and to balance internal with external concerns.

More specifically, the aim of the Balanced Scorecard is to evaluate the strategies of a firm on the basis of quantitative and qualitative measures.

The Balanced Scorecard combines a complete set of financial and non-financial measures.

When evaluated, the results provide the business-unit managers’ clear insight into the entire performance-picture of the organization.

Thus, they are in a position to reevaluate the organization’s mission, goals/objectives, and strategies. And then they can decide about taking corrective actions as necessary.