General approaches to pricing are of three types;

- Cost-Based Pricing Approach (cost-plus pricing, break analysis, and target profit pricing).

- Buyer-Based Pricing Approach (perceived-value pricing).

- Competition-Based Pricing Approach (going-rate and sealed bid pricing).

In setting prices, a firm may follow one or more of these three approaches. A brief discussion of each approach is given below:

Cost-Based Pricing Approach

In a cost-based pricing approach, a producer or seller can use the following pricing techniques:

Cost-Plus Pricing

Cost-plus pricing is the simplest of all the pricing methods in which a standard markup is added to the cost of the product.

For example, construction firms submit job bids by estimating the total project cost and adding a standard markup for profit. Some sellers charge cost plus a specified markup.

To illustrate markup pricing, suppose a toothpaste producer had the following costs and expected sales;

Variable cost = $10, Fixed cost = $300,000, Expected unit sales= 50,000

Then the producer’s cost per toothpaste is given by :

Unit Cost = Variable Cost + ( Fixed Costs / Unit Sales ) = $10 + ( $300,000 / 50,000) = $16

Now, suppose the producer wants to earn a 20 percent markup on sales. The producers’ markup price is given by:

Markup Price = Unit Cost / (1 – Desired Return on Sales ) = $16 / ( 1 – 0.20 ) = $20

The producer would charge distributors $20 a toothpaste and make a profit of $4 per unit. If distributors want to earn a 50 percent profit on sales price, they will fix the price to $40 ($20+50% of $40). This is equivalent to a markup of 100 percent on cost ($20/$20) for the distributor.

Using standard markups to set prices does not always prove to be wise. Any pricing method that does not consider demand and competitor prices is not likely to lead to the best price.

Suppose the toothpaste producer charged $20 but only sold 30,000 kinds of toothpaste instead of 50,000.

The unit cost would have been higher since the fixed costs are spread over fewer units, and the realized percentage of markup on sales would have been lower. Markup pricing is only effective if that price brings in the expected level of sales.

Still, markup pricing is widely followed for many reasons.

First, sellers are more certain about costs than about demand. By linking the price to cost, sellers simplify pricing and not require frequent adjustments as demand changes.

Second, when all firms in the industry follow this pricing method, prices tend to be similar, and price competition is minimized.

Third, many people think that cost-plus pricing is fairer to both buyers and sellers. Sellers get a fair return on their investment but do not exploit the buyers when demand is high.

Breakeven Analysis and Target Profit Pricing

Another cost-oriented pricing approach is break-even pricing. A variation of this approach is called target profit pricing.

In break-even pricing, the firm tries to determine the price at which it will break-even or make the target profit it wants to earn.

Target pricing is used by General Motors, which price its automobiles to achieve a 15 to 20 percent profit on its investment. This pricing method is also used by public utilities, constrained to make a fair return on their investment.

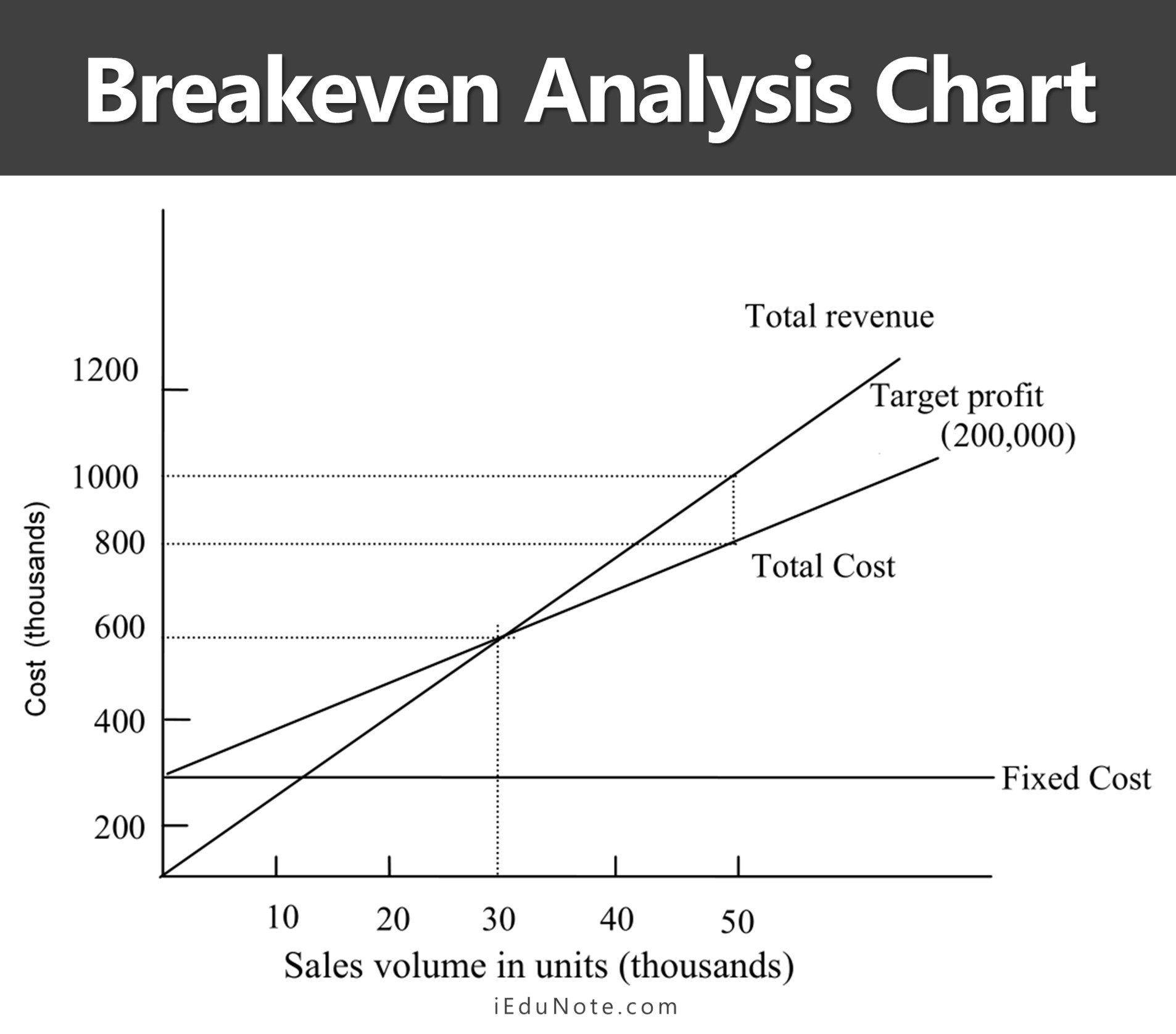

Target pricing uses the concept of break-even chart, which shows the total cost and total revenue expected at different sales volume levels.

The figure below shows a break-even chart for the toothpaste producer discussed here. Fixed costs are $3,00,000, regardless of sales volume.

Variable costs are added to fixed costs to form total costs, which rise with volume. The total revenue curve starts at zero and rises with each unit sold. The slope of the total revenue reflects the price of $20 per unit.

The total revenue and total cost curves cross at 30,000 units. This is the break-even volume. At $20, the firm must sell at least 30,000 units to break-even; that is, for total revenue to cover total costs.

Break-even volume can be calculated using the following formula;

If the firm wants to make a target profit, it must sell more than 30,000 units at $20 each.

Suppose the toothpaste producer has invested $800,000 in the business and wants to set the price to earning a 20 percent return on sales, or $200,000. In that case, it must sell at least 50,000 units at $20 each.

If the firm charges a higher price, it will not need to sell as many toothpastes to achieve its target return. But the market may not buy even this lower volume at a higher price. It depends on the price elasticity and competitor’s price.

The firm should consider different price and estimate break-even volume, probable demand, and profit for each. This is shown in Table 81. The table shows that as price increases, break-even volume drops (column-2).

| Table 8-1: Break-Even Volume and Profits at Different Prices | |||||

| (1) Price ($) | (2) Unit demand needed to break-even ($) | (3) Expected unit demand at a given price ($) | (4) Total Revenues ($) (1) x (3) | (5) * Total costs ($) | (6) Profit ($) (4) – (5) |

| 14 | 75,000 | 71,000 | 994,000 | 1,010,000 | (16,000) |

| 16 | 50,000 | 67,000 | 1,072,000 | 970,000 | 102,000 |

| 18 | 37,500 | 60,000 | 1,080,000 | 900,000 | 180,000 |

| 20 | 30,000 | 42,000 | 840,000 | 720,000 | 120,000 |

| 22 | 25,000 | 23,000 | 506,000 | 530,000 | (24,000) |

| *Assumes fixed cost of $300,000 and constant unit variable cost of $10. | |||||

But as price increases, demand for the toothpaste also falls off (column-3). At $14 price, because the firm clears only $4 per toothpaste ($14 less $10 in variable costs), it must sell a very high volume to break-even.

Even though the low price attracts many buyers, demand still falls below the break-even-even point, and the firm loses money.

At the other extreme, with a $22 price, the firm clears $12 per toothpaste and must sell only 25,000 units to break even.

But at this high price, consumers buy too few toothpaste, and profit is negative. The table shows that a price of $18 yields the highest profits.

Note that none of the prices produce the manufacturer’s target profit of $200,000. To achieve this target return, the firm will have to look for ways to lower fixed or variable costs, thus lowering the breakeven volume.

Buyer-Based Pricing Approach

Under this approach of pricing, the following techniques can be applied in pricing the product:

Value-Based Pricing

The product’s perceived value is getting increasing acceptance as the base for pricing by many firms. Instead of the seller’s cost, value-based pricing uses buyers’ perceptions of value as the key to pricing.

Value-based pricing suggests that the marketer can not design a product and marketing program and then set the price. Price is considered along with the other elements of marketing-mix before formulating the marketing program.

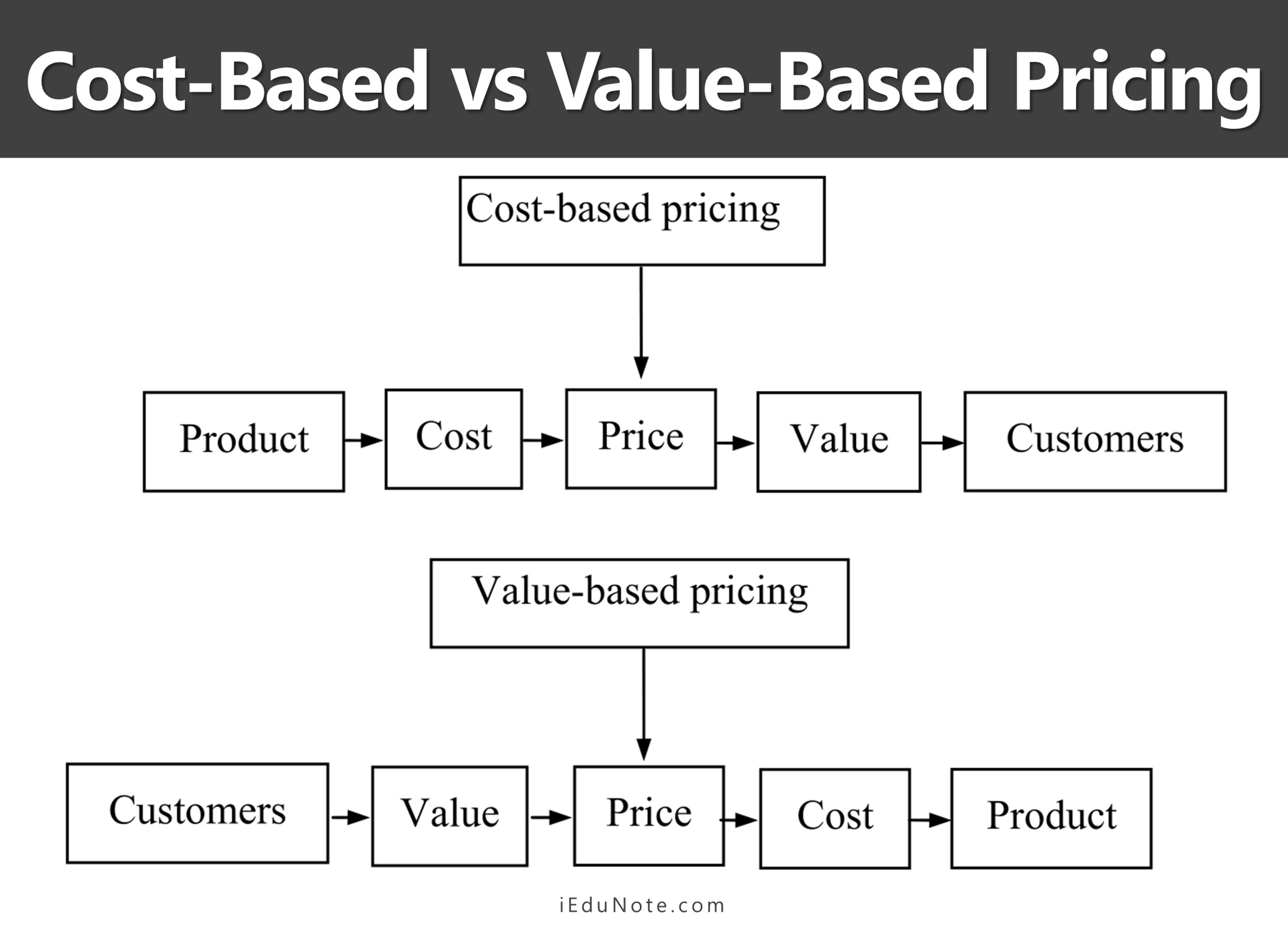

The figure below illustrates the distinction between cost-based pricing and value-based pricing.

Cost-based pricing is guided by the product. The firm starts with what it considers to be a good product, estimates the costs of making the product, and sets a price that covers costs plus a target profit.

The firm must then convince buyers that the product’s value at that pricing justifies its buying. If the price turns out to be too high, the firm must settle for lower markups or lower sales, resulting in low profits.

Value-based pricing operates oppositely. The firm sets its target price based on customer perceptions of the product value.

They targeted value and price, then guide decisions regarding product design and probable costs. Thus, pricing begins with analyzing consumer needs and value perceptions. Price is set to match consumers’ perceived value.

A firm adopting value-based pricing must assess what value buyers assign to different competitive offers.

However, it may be not easy to measure the perceived value.

Consumers may be asked how much they are ready to pay for a basic product and benefit added to the offer.

A firm might conduct experiments to test the perceived value of different product offers. If the sellers’ price is more than the buyer’s perceived value, the firm’s sales will be affected adversely.

Many firms overprice their products leading to poor sales.

Other firms under the price which bring higher sales, but they produce less revenue than they would if the price were raised to the perceived-value level.

Competition-Based Pricing Approach

Competition prevailing in the market is also an important consideration factor in pricing products. In a competitive environment, a firm needs to analyze the competitor’s price and offer and then set price for its product. According to this approach, the following techniques are used:

Going-Rate Pricing

In going-rate pricing, the firm bases its price mainly on competitors’ prices. The firm’s costs or demands are given less importance.

The firm might set prices near to its major competitors. In a situation of oligopoly, firms normally charge the same price. The smaller firms follow the market leader. They change their prices when the market leader does so rather than when their demand or costs change.

Going-rate pricing is quite popular. When demand elasticity is difficult to measure, firms feel that the going price represents collective prudence of the industry regarding the price that will fetch a reasonable return.

They also think that following the going rate pricing will prevent harmful price competition.

Sealed-Bid Pricing

In sealed-bid pricing, the price set by a firm is based on competitors’ price rather than its costs or the demand. The firm is serious in getting a contract that requires pricing less than other firms.

Still, the firm can not set its price below a certain level.

Because pricing below cost will be damaging for the firm. In contrast, the chance of getting a contract decreases with the increase in the price set by a firm.

The net result of the interaction between two opposite variables ( profit and probability of getting a contract ) can be described in terms of the expected profit of the particular bid.

Suppose a bid of $5,000 would yield a high chance (0.81) of getting the contract, but only a low profit ($100). The expected profit with this bid is, therefore, $81.

If the firm bid $6,500, its profit would be $1,600, but its chance of getting the contract might be reduced to 0.01. The expected profit would be only $16.

Therefore, the firm might bid the price that would maximize the expected profit. According to table 8-2, the best bid would be $5,500, for which the expected profit is $216.

| Effect of Different Bids on Expected Profit | |||

| Firm’s Bid ($) | (1) Firm’s Profit ($) | (2) Probability of Getting this Bid (Assumed) | (1) x (2) Expected Profit ($) |

| 5,000 | 100 | 0.81 | 81 |

| 5,500 | 600 | 0.36 | 216 |

| 6,000 | 1,100 | 0.09 | 99 |

| 6,500 | 1,600 | 0.01 | 16 |

Expected profit as a basis for setting the price is particularly useful for the large firm that makes many bids. The firm will make maximum profit in the long- run. But a firm that bids only occasionally or disparately needs a contract will not consider the expected profit approach suitable.

The approach, for example, does not distinguish between a $10,000 profit with a 0.10 probability and a $1,250 profit with a 0.80 probability. In such a situation, the firm that wants to keep production going would prefer the second contract.