Commercial Banks are traditionally known as lending institutions. Making loans to business houses and industrial enterprises has been their popular activity.

But recently, banks have departed considerably from their popular activity by making finances to speculators & dealers in securities, consumers, real estate businesses, and so on.

In general, the dealing in bonds & securities is not looked upon as a primary banking function but is rather relied mainly on to fill in gaps in the use of resources left by a slackening demand for loans.

Even when customers’ demands for loans are strong, most commercial banks, in the interest of safety, hold to the standard that their total lending should not exceed 50-60% of the number of their total deposits.

As stated earlier, investment in securities is a residual commitment, funded after the bank has met its reserve and loan demands.

But its use of residual funds is largely dependent on the economy’s cyclical nature characterized by the purchase & sale of security instruments. During recessionary periods when demand for commercial credit is relatively low, security investments are a good alternative source of income.

When economic recovery proceeds, loan demand increases, maturing security investment can be rolled over into loans, or shorter-term securities may be sold to enhance the volume of the funds for higher-earning loans or investments.

Experiences show that banks prefer most interest-bearing rather than dividend-yielding instruments.

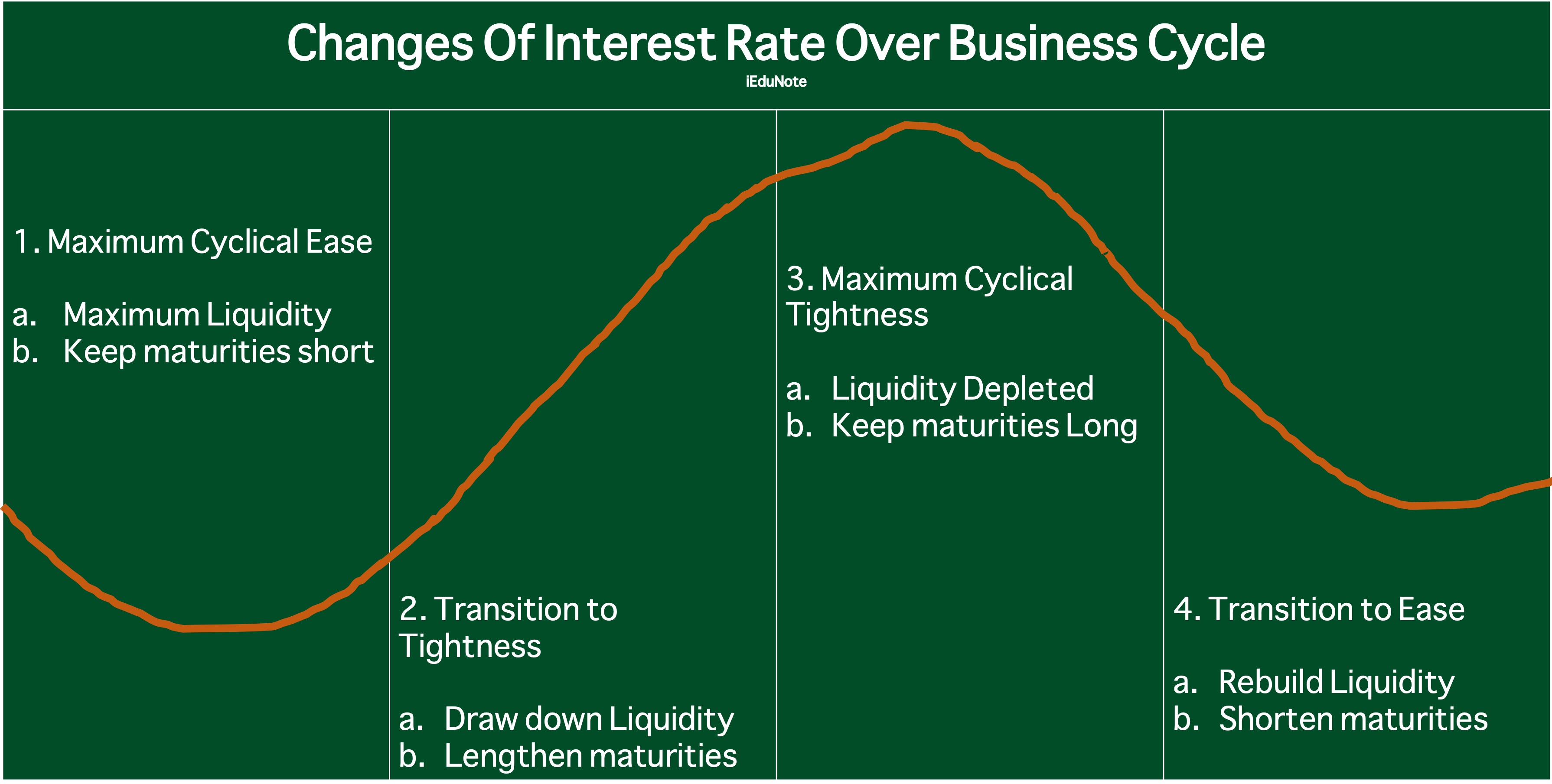

Therefore, it is logical that commercial banks’ security investments are most likely to be significantly influenced by the different phases of the interest rate cycle:

- Maximum Cyclical Ease

- Maximum Liquidity

- Keep maturities short

- Transition to Tightness

- Draw down Liquidity

- Lengthen maturities

- Maximum Cyclical Tightness

- Liquidity Depleted

- Keep maturities Long

- Transition to Ease

- Rebuild Liquidity

- Shorten maturities

This may be seen from the following figure:

The figure provided above states that.

- When interest rates are at the lowest level, demand for loans is weak, and the monetary policy is expansionary.

- When demand for loans picks up, the monetary policy usually turns less expansionary.

- When demand for loans is highest/greatest, monetary policy is probably contractionary, interest rates are high, and

- When demand for loans weakens, monetary policy becomes more expansionary.

In times of weaker loan demands, the capacity to buy securities beyond secondary reserve needs will generally be greater. Commercial banks’ officials responsible for making security investments must remain all-time alert for the time to start making capital gains and to shorten maturities.