Economic society’s central problems are similar to individual problems except that the problems now relate to the economy. The main problem is the scarcity of resources in the face of unlimited wants. The scarce resources have, however, alternative uses.

3 basic problems of an economic society;

- What to produce?

- How to produce?

- For whom to produce?

The problem of deciding the level of investment can be added to the above list. We discuss each of these problems systematically by turns.

Economic Problem of Allocation of Resources: What?

The term ‘what?’ refers to allocating resources to the production of commodities and services. It is a problem of determining the commodities and services which will be produced.

Related to this problem is the necessity of determining the quantities of selected commodities and services.

Had the resource been scarce, the necessity of selecting and determining the quantities of the commodities and services wouldn’t have arisen?

The concepts of opportunity cost and production possibility curve can explain the problem expressed by the word, ‘what?

Understanding Production Possibility Curve and Opportunity Cost helps to answer the economic problem of the allocation of resources.

Opportunity Cost and Production Possibility Curve

Since the concept of opportunity cost is crucial in Economics, we intend to present a detailed analysis of the concept. The opportunity cost of undertaking an activity is the forgone benefit from the next-best activity. Though a resource has alternative uses, it cannot be put into more than one user simultaneously.

If the owner of a land price decides to build a house on it, the house’s opportunity cost will be the forgone benefit from its next-best use, which is, say, growing paddy in it. The opportunity cost of reading this Economics text-book is the lost time that could be spent reading the Accounting textbook.

The idea of opportunity cost can be explained with an opportunity cost curve, alternatively known as the production possibility curve.

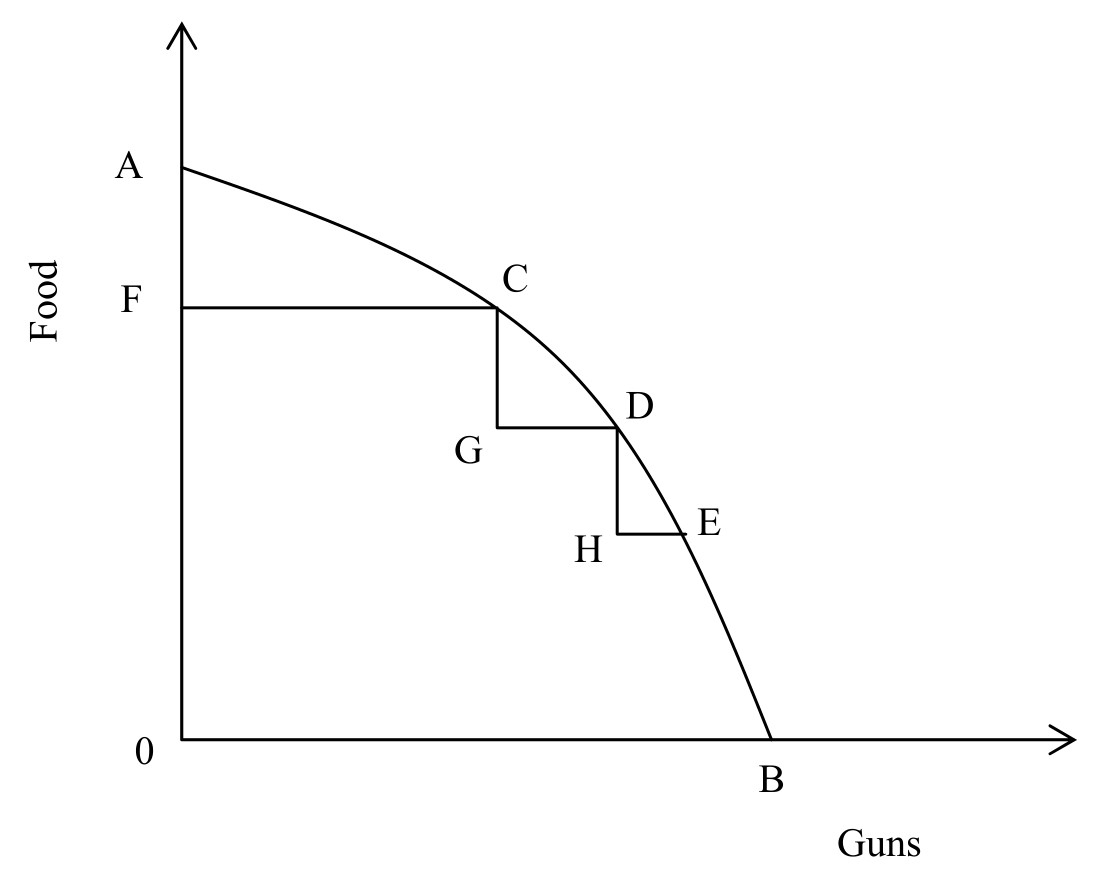

Suppose a hypothetical economy can produce only two commodities, guns, and paddy, by using all its resources. The production possibilities of the economy are shown in the Figure below.

We measure the quantity of food in a million metric tons along the vertical axis and the number of guns in millions along the horizontal axis. Initially, the economy is at point A, producing OA quantity of food and no guns.

Perhaps both the people and the government of the economy express dissatisfaction with having no guns and would like to produce FC guns by sacrificing the AF quantity of food.

In other words, the opportunity cost of FC guns is an AF quantity of food. Some resources previously used in producing food were released and shifted to the production of guns. Consequently, the production of food fell when the economy stands to produce a small number of guns.

Suppose the new military ruler of the country wants more guns. The economy moves to D from C, gaining GD guns at the cost of GC tons of food.

Similarly, to obtain HE additional units of guns, the economy has to sacrifice DH units of food. It can be easily seen that the amount of sacrifice of food for each extra unit of the gun is rising gradually.

In economic terminology, this phenomenon is known as increasing marginal opportunity cost or increasing marginal cost in brief. There is, of course, an economic explanation for increasing marginal cost.

When the economy produced a large amount of food and a small number of guns initially, some of the food production resources were indeed more suitable for gun production. The resources with a comparative advantage in gun production were released for gun production when the economy started producing more guns.

As a result, the opportunity cost of producing guns was initially low. As the economy increased the production level of guns further, some of the resources having a comparative advantage in food production had to be shifted to gun production. Consequently, the opportunity cost of producing guns increased with increasing levels of gun production.

Needless to say, the phenomenon of increasing marginal cost makes the production possibility curve concave to the origin.

It should be noted that the production possibility curve shows efficient production levels. At each point on the production possibility curve, the economy produces the two commodities as much as possible with given resources.

For example, the production level shown by H in Figure above is clearly inefficient. Using the given resources, the production level can be pushed to D, which shows an increased quantity of food with no change in guns’ production level.

It can also be shifted to E, where gun production increases, whereas food production remains fixed. Production of both commodities will increase if the production shifts to any point between D and E.

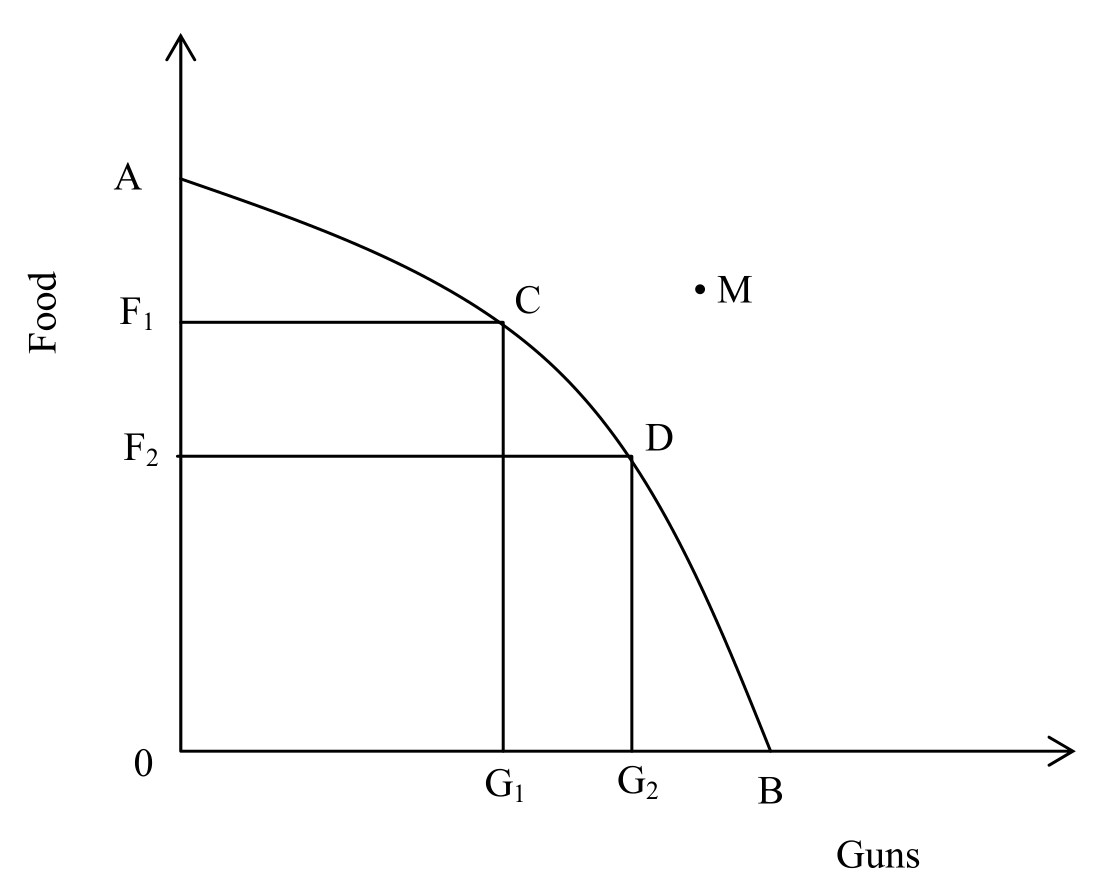

Now that we have explained the concept of opportunity cost and illustrated the derivation of the production possibility curve, which entails opportunity cost. We can use the production possibility curve for explaining the problem denoted by the word ‘what?’.

The production possibility curve shows the different bundles of two commodities, food and a gun, that can be produced utilizing all the available resources in the economy.

For example, the country can produce the combination shown by C or D‘s combination in Figure-1.2. Combination C signifies F1 tons of food and G1 units of guns. Similarly, combination D shows F2 tons of food and G2 units of guns.

Each point on the curve AB shows a specific combination of two commodities. The country chooses one and only one combination from the set of many combinations on the curve AB. It cannot choose more than one combination on the curve. Similarly, it cannot choose point M, which it cannot produce with the given resources.

It would not choose any point below the production possibility curve because production at such a point would entail inefficiency in production. The word ‘what?’ refers to the problem of choosing one specific combination of the two commodities from a large number of combinations lying on the efficient production frontier AB.

Economic Problem of Selecting Method of Production: ‘How?’

The abbreviated question ‘how?’ refers to choosing the method of producing the selected commodities. There are different methods of producing predetermined quantities of several commodities and services.

For example, there are labor-intensive and capital-intensive methods of production. Normally, the production of a commodity or service requires all inputs of production.

The quantities put in the production of a commodity may be changed because one input may be substituted another depending on the relative prices of two inputs.

Producing a commodity is labor-intensive when more labor and less capital are used in that commodity’s production process. The input intensity of a commodity can also be defined in relative terms.

Gun is said to be more capital intensive than food when the ratio of capital to labor in gun production is larger than the corresponding capital labor-ratio of food production.

It should be noted that the method of production depends on the technology of production and the prevailing input price.

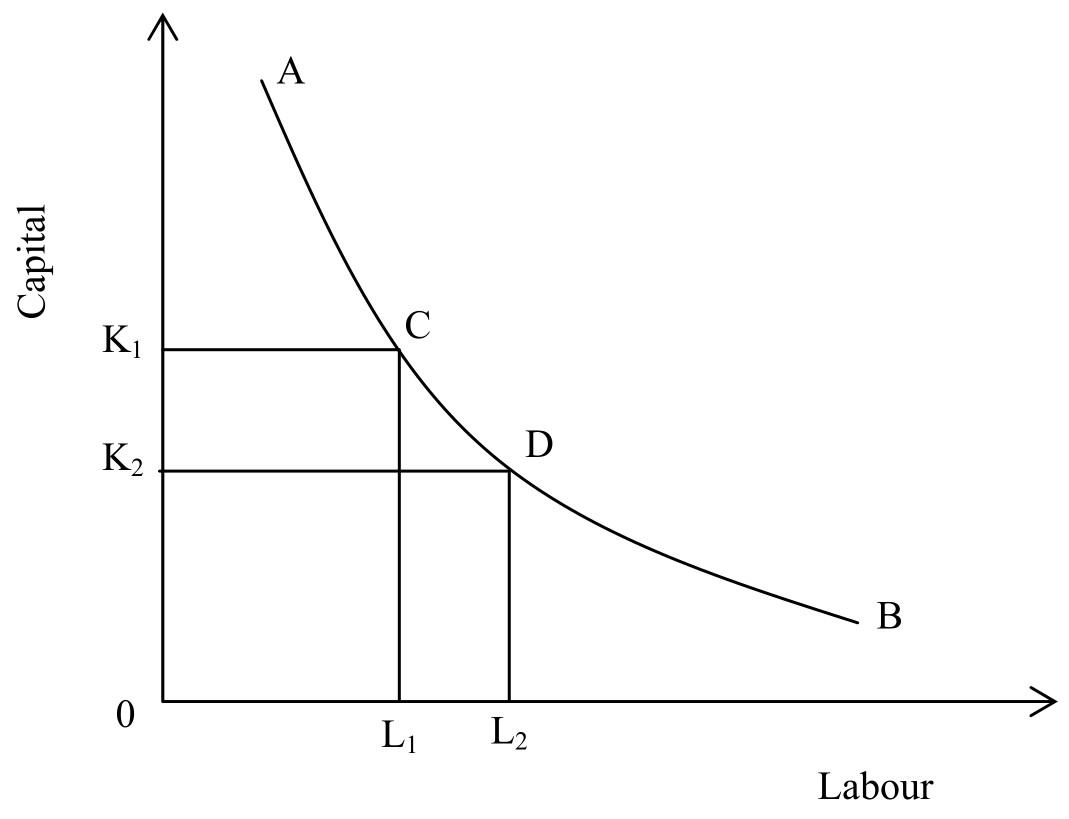

This Figure explains the nature of the second problem denoted by the term ‘how?’.

Here, we introduce the concept of an equal product curve, alternatively known as iso-quant. An equal product curve shows the different combinations of two inputs, which produce a given quantity of output.

The curve AB in Figure 1.3 is an equal product curve. The vertical axis of

Figure 1.3 measures capital, and the horizontal axis measures labor. Combination C with OK1 units of capital and OL1 units of labor can produce as much of the commodity as the combination D with OK2 amount of capital and OL2 amount of labor.

Input allocation at C, however, implies a capital-intensive production method because, at C, production of the commodity requires more capital than labor.

Similarly, combination D implies a labor-intensive method of production. Each point on the curve AB implies a distinct capital-labor ratio and a distinct production process of the commodity in question.

The choice problem indicated by the word ‘how?’ refers to choosing one of several production methods shown along with different points of an equal product curve.

Economic Problem of Distribution: ‘For Whom?’

The third problem of economic society, abbreviated by the phrase ‘for whom?’ refers to distributing the produced commodities and services among the consumers.

An economy may be endowed with many natural and non-natural resources to produce a large volume of goods and services.

The economy people might still face problems meeting their wants for daily necessities if most of the produced commodities and services go to consuming a small section.

Most LDCs face the problems of both inadequate resources and distribution of income.

In Bangladesh, a small proportion of the population is rich because their forefathers were rich, and these people have much more than they would like to have.

The majority of the people here live under the poverty line. The big question is: should we ignore it and endure with the existing distribution of income as happily as ever?

We also face the problem of physically disabled and developmentally disabled persons who are unable to work.

Should these persons be left unprovided to starve to death?

The central authority of an economy often faces these types of questions. The problem expressed by the phrase ‘for whom?’ refers to selecting a widely accepted criterion of distributing income among hundreds of millions of people living in the country.

Economic Problem of Determining the Rate of Investment

The fourth problem of an economic system refers to determining the rate of investment for the economy. Investment increases the size of capital stock by adding new capital to the previously existing stock of capital.

Capital is produced means of production. It is a kind of commodity used as input for producing more commodities in the future. The investment comes from saving, which in turn is obtained by postponing present consumption.

We need higher levels of investment to attain higher growth rates of the economy in the future. Future consumption levels of people will be higher if the economy grows at a higher rate.

In other words, there is a trade-off between present and future consumption levels. A little sacrifice at present may make our lives much more comfortable in the future.

The central authority of an economy has to determine the amount of present sacrifice in the form of investment for attaining a higher growth rate of the economy in the future.

Solutions of the Fundamental Problems Under Alternative Economic Systems

Socialist and other Centrally Planned Economies

In socialist and other centrally planned economies, the fundamental questions’ answers are dictated by the government’s central authority.

Usually, a planning commission under the Government’s close supervision considers the nature and production targets of different commodities and services.

The planning commission usually uses a vast wealth of data on consumers’ tastes, preferences, and demand and supply conditions.

In allocating resources, the central planners emphasize those commodities and services, which, they believe, are socially beneficial. The central planners choose the method of production, which is, according to them, ideally good for the country.

In distributing the produced commodities, the central planners use the criterion of ” to each according to her/his need” as determined by them. The central planners again determine the rate of investment for the economy.

Capitalist Economy

In a capitalist economic system, answers to the four fundamental questions are provided through its market mechanism.

A commodity market is collecting consumers and suppliers for that commodity, who interact among themselves for exchanges.

The participants of the market need not be concentrated in one place. They may be widely scattered all over the whole country or beyond the national geographic boundaries. The operation of the market economy presupposes the fulfillment of three conditions.

First, people are assumed to enjoy unfettered freedom in making decisions about economic activities like consumption, production, etc.

This psychological view is often referred to as individualism, which ensures that only individuals make decisions without being influenced by any authority and by any other pressure group.

Second, in a market economy, every economic agent is supposed to be a maximizer.

For example, a consumer tries to maximize her/her satisfaction by consuming commodities and services.

The producer tries to maximize her/his net profit, which is equal to total revenue minus total cost.

In a capitalist economy, everybody is motivated by her/his self-interest. The attempt to augment self-interest by everybody in the economy leads to discipline and integration among the diversified economic activities of different economic agents in society.

Third, the market economy can work properly only when private property rights are well defined and defended by the government.

Private property rights include unfettered control over an asset or the right to do something without encroaching on others’ rights.

Let’s now explain how a market economy provides answers to the four fundamental questions. In a market economy, price is determined at the point where aggregate demand equals aggregate supply.

Price acts as a signal in the market economy. It is said that consumers are sovereign in a market economy. It is the consumer who determines the allocation of resources to different commodities and services.

They decide which commodities and services will be produced in the economy. Their preferences are expressed through prices.

If consumers’ demand for a commodity increases, the market price of that commodity goes up. Since producers are profit maximizers, a commodity’s increased price acts as a signal to the producers to increase that commodity.

Thus, the message of consumers’ preferences is conveyed to the producers through the price system.

The quantity of the selected commodity is also determined through the price system. Producers must produce the level of output at which demand is equal to supply.

If the producers produce more than the equilibrium quantity, they will not sell all output. If they produce less than the equilibrium quantity, they will not meet all the consumers’ demands.

We now illustrate how the market mechanism determines the method of production. Since a producer’s ultimate objective is to maximize her/his profit, she/he will always use the cheapest method of production.

A production method will be the least expensive method if it uses cheap inputs more than the dear inputs. An input is cheaper when its relative abundance in a country makes its price lower.

Thus, the market determines how commodities and services should be produced.

Distribution of the produced goods and services also takes place through the market mechanism. Every economic agent has a dual role in a market economy: she/he is a consumer and a supplier of productive input at the same time.

By supplying the inputs, she/he earns income, which she/he spends on consumption.

A person’s purchasing power will be higher if the price of the input supplied by her/him increases due to increased demand for that input. A person’s income will be lower if there is less demand for her/his input.

Therefore, a person’s income is dependent on the price and quantity of input sold by her/him. Market forces determine the price and quantity of input sold.

A person’s income will also be higher if she/he inherits a large volume of wealth and income from her/his forefathers. A higher-income person will consume more commodities and services than another person with a lower income.

Thus, the question of who consumes the produced commodities is also determined by the market mechanism because market forces also determine the input price.

Finally, the rate of investment in a capitalist economic system is also determined by the market.

People’s attitude toward investment depends on the rate of interest and a host of other factors. The rate of interest and other determinants of investment are determined by forces of demand and supply prevailing in the capital market.

The capital market integrates the demand for and supply of loanable funds in an economy through different financial institutions like banks, stock markets, etc.

Thus, the market mechanism also determines the rate of investment in the economy.

Mixed Economy

It should be noted that pure capitalism is rare in the real world. In most of the world’s capitalist countries, governments control the markets, though answers to the fundamental question are sought through the market mechanism.

Private ownership of some key sectors of the economy is replaced by state ownership.

In the USA, anti-trust laws are in vogue to check and curb the emergence of monopoly powers. Market economies having both private and public ownerships may be called mixed economic systems.

We have a mixed economic system in Bangladesh where some enterprises are owned and managed by the state.

The Role of Government

The government’s role in the state’s economic affairs is pervasive in socialist and other centrally planned economies.

As mentioned earlier, a planning commission under the government’s close supervision determines the answers to an economy’s four fundamental problems. The proponents of the market economy discourage any intervention in the free functioning of the market mechanism.

They would like to restrict the state’s role in maintaining law and order in society so that economic forces and agents can work undisturbed. The non-interventionist view of the role of the state is now held in abeyance.

The theory of demand management put forward by the great economist John Maynard Keynes brought the government to the forefront as the most important economic institution for devising and implementing different economic policies. The intervention of government in the economic affairs of the state is sought from another perspective also.

It has been theoretically and empirically proved that the market economy performs better than any other economic system in providing answers to three fundamental questions except distribution.

The superior performance of the market economy is contingent on the fulfillment of some conditions.

Moreover, the market economy can achieve the desired goal of efficiency if the market structure is competitive. There are a few cases where the market economy cannot work. The major problem is that the market structure is not competitive for most of the commodities and services.

In such a dismal situation about the efficiency of the market economy, the government has a significant role in facilitating and encouraging the market economy’s unhindered functioning. The government can use different kinds of policy tools to correct market failures.

Only then the market economy can function properly. Despite the importance of government interventions, theoretical controversies about the government’s role in economic affairs are still on.

However, most governments of capitalist economic systems frame and implement economic policies to achieve economic goals.