Normally, a company does not compete directly with all firms in an industry, so determining which firms should be considered key competitors is necessary.

If product categories from other industries can satisfy specific customer needs, the analysis should include potential competitors. Information that is obtained from a key competitor analysis often covers the following areas:

- Identifying the strategic group

- Identifying their goals

- Estimate the overall business strengths and limitations of each key competitor and have ideas of their behavior patterns.

Identifying Competitors’ Strategies

A company can consider those firms as its nearest rivals pursuing the same types of strategies and trying to reach the same market segments as the company is pursuing.

The firm can call this group a strategic group, which includes the company itself. A company needs to locate its strategic group to decide on policies and future courses of action.

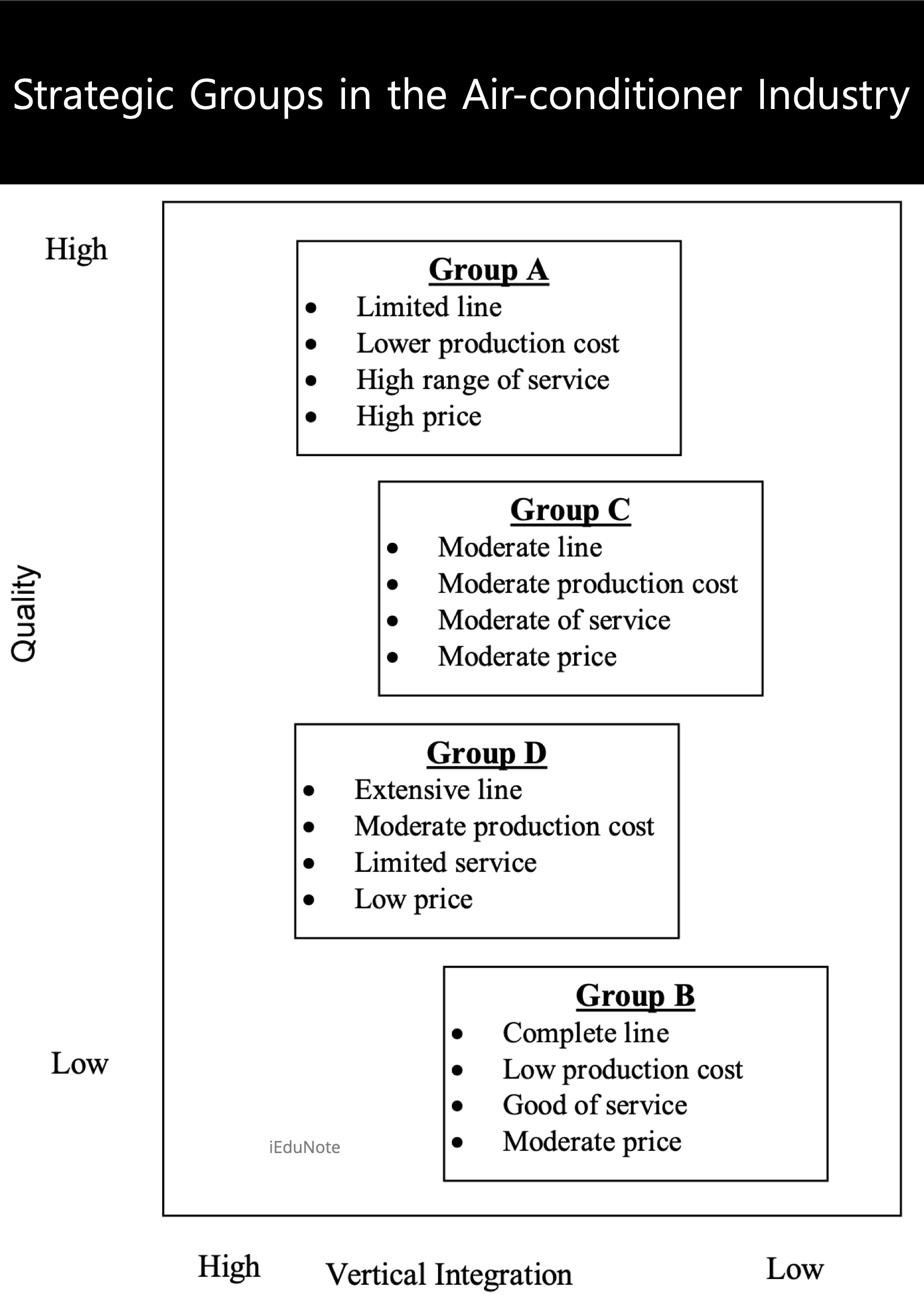

Let us assume that a company named ‘XYZ” co wants to enter the airconditioner industry. Let us also assume that quality image and vertical integration are this industry’s two important strategic dimensions.

From the figure (shown on the next page), we can see four strategic groups in this industry.

The groups can be named ‘A,’ ‘B,’ ‘C,’ and ‘D.’ Suppose group ‘A’ consists of two competitors, group ‘B’ two, group ‘C’ five, and group five competitors.

From this strategic group identification, the new company planning to enter this industry can get some important tips to decide which group to enter.

The company knows, in the beginning, the difficulty it may face entering into a particular group. Second, it knows what competitive advantage it should have to sustain in the industry and knows which particular firm will have a neck-to-neck fight.

From the above figure, we can say that a new company will find it easier to enter group ‘D’ because it will require minimal investment in vertical integration and reputation and quality components.

But it will be very tough to enter group ‘A’ or group ‘B’ because integrating vertically and ensuring quality output will require heavy investment.

After entering a particular group, a firm must also be prepared to face competition from a group member(s) and possess the strengths to face it.

By this time, you know that a firm faces competition from other firms in the strategic group. Also, there may have competition between groups. There are several reasons for the such competition being seen between groups.

They are: offering products to the same group of customers by different strategic groups; generalization of offers by the customers – customers may consider offers of different groups similar in many aspects; the expansion plans pursued by different groups led them to attack each others’ customers; and the minimum mobility barriers.

The figure has taken into consideration only two dimensions to identify the strategic group. They are quality and vertical integration. There could be many other dimensions that may be used to identify the strategic group.

Some dimensions are technological sophistication, manufacturing methods, innovative features, geographical scope, etc. Before deciding which group to enter, a company should conduct a more detailed analysis and identify the strategic group.

To do this, it should collect detailed information on competitors

- covering their business,

- marketing,

- manufacturing,

- research & development,

- financial,

- human resource strategies,

- product quality,

- product features,

- marketing mix,

- customer services,

- pricing policies,

- distribution coverage,

- salesforce strategy,

- sales promotion,

- advertising programs.

A company should not continuously pursue its strategies based on the first analysis. It should know that competitors often change their policies, and consequently, a company should regularly monitor competitors from the above dimensions.

More so, customers’ needs change, which may require different policies to be pursued by a company. A company should, therefore, monitor changes in customers’ needs and resultant competitors’ moves. Based on this, it should revise its policies as and when necessary.

Determining Competitors’ Objectives

By this time, you are aware of your competitors and the strategies pursued by them. To move forward, you should pose yourself with several questions and try to answer those.

The usual questions that you should ask yourself are:

- What are the objectives of my competitors’ operations?

- What stimulates my competitors to behave in a particular fashion?

Answers to these two questions are very important to you. How accurately you find out the answers to these questions determines your success in the marketplace.

Concerning the objectives pursued by your competitors, you may make two assumptions. The first one is that competitors operate to maximize their profit; hence, the main objective is profit maximization.

Though companies may pursue a profit maximization objective, the relative weight put on the profit varies from company to company. Some may emphasize short-term profit, and others may emphasize long-term profit.

Again some companies may link profit with customer satisfaction. They try to maximize their profits by providing maximum satisfaction to their customers. They know they could make a quicker profit if they follow other strategies.

The second assumption on competitors’ objectives is that competitors do not pursue one objective; rather, they pursue a mix of objectives.

Some of the mix’s individual objectives are current profitability, market share growth, cash flow, technological leadership, service leadership, etc.

After identifying the objective mix, the intending company should try to determine how the competitors weigh each of the individual objectives. It will help the firm ascertain the satisfaction level of competitors of each objective.

It will also help the firm guess how competitors may react to different strategic moves of the company.

For example, suppose a competitor pursues the service leadership objective. In that case, it will react more strongly to a competitor that offers innovative and improved services than to one announcing a price reduction.

After having an idea of competitors’ objectives, the next question that may come to your mind is what shape(s) their objectives are.

There are a lot of things that shape competitors’ objectives. Some of the important ones are the firm’s size, history, current management, financial situation, position in the larger organization, and so on.

A competitor, for example, is part of a larger company. You should know whether the parent company runs it for milking or growth. This will help you to decide on an attack strategy. If you know your competitor is not considered critical by the parent company, you can easily attack it.

Besides analyzing things that shape your competitors’ objectives, you must monitor your competitors’ expansion plans, if they have any.

The product/market battlefield discussed before will help you identify your competitors’ expansion plans. If you can ascertain this in advance, you may create mobility barriers, making it difficult for them to expand. By doing this, you may solidify your position in the industry.

Assessing Competitors’ Strengths and Weaknesses

Assessing competitors’ strengths and weaknesses help a company decide on its strategies more appropriately.

Competitors’ success depends, to a great extent, on their abilities and resources. In identifying its competitors’ strengths and weaknesses, a company should gather information on its competitors along different lines.

Areas on which information is usually collected include sales data, market share, profit figure, ROI, cash flow, new investment, utilization of capacity, product improvement, etc.

If your competitor is a publicly held company, you can receive its annual report by buying one stock share and have a fair idea of where it stands financially. Is it cash-rich and able to move quickly to take advantage of opportunities, or is it deeply in debt and vulnerable to threats?

But, all information about competitors cannot be collected so easily and requires a lot of effort. One of the commonly used sources of information is secondary data. In some instances, firms use primary sources to gather information on competitors’ strengths and weaknesses.

They may conduct consumer, dealer, and supplier surveys to collect competitor data. Competitors’ strengths and weaknesses may be identified by getting consumer responses on five dimensions about competitors.

The following table shows the hypothetical results of a customer survey of four competitors along five dimensions :

| Customers’ Ratings of Four Competing Company | |||||

| Company | Customer awareness | Product quality | Product availability | Technical assistance | Selling staff |

| Company ‘A’ | VG | E | VB | G | E |

| Company ‘B’ | E | VG | VG | E | G |

| Company ‘C’ | G | VB | E | VG | VG |

| Company ‘D’ | G | G | G | G | G |

The table above shows that company ‘A’ produces excellent quality products, sells through excellent salesforce, and provides good technical assistance to customers.

But, its product is not widely available. Competitor ‘B,’ on the other hand, is found superior to the company ‘A’ in almost every respect, except the quality of the product.

Company ‘C’ is found to be better in every respect except the quality of the product, and company ‘D’ is good in all respect.

This picture can help a company identify its competitors’ strengths and weaknesses and decide whom to attack from which respect.

In analyzing its competitors, a company should monitor three variables: viz., the share of the market, the share of mind, and heart share. Share of the market means the percentage of the target market occupied by the competitors.

On the other hand, the share of mind means the percentage of customers who named the company in response to a statement, for example, ‘name the first company that comes to mind in this industry.’ Share of heart indicates customers’ biases toward a particular company’s product or preference for certain brands.

These three shares have got a relationship with them. The market share is very much dependent on mind share and heart share.

If mind shares increase, it will positively impact heart share, and ultimately the increased heart share will contribute to increasing market share.

Note that increasing market share will lead to increased profit; hence, a company should try to increase mind and heart share for increased profitability.

In identifying your competitor’s weaknesses, you should look for their assumptions about their business and market.

By studying their assumptions, you will know whether they are working on any such assumption which is not true. This will show you the gap between your competitors, which you can easily exploit.

One of the assumptions, for example, which one of your competitors is pursuing is, ‘customers are influenced more by the dashing salesperson.’ If you know this, you can work based on it to exploit your competitor and reap the benefit of it.

While assessing your competitors’ strengths, you should bear in mind that strength evaluation goes well beyond mere lists of competitors’ physical, financial, and human assets. An assessment must include how well the firm has used – and is likely to use – its strengths.