The cash conversion cycle is the days a company requires to convert resources to cash flows. This measure calculates the period during which each input dollar is committed to production and sales processes before it is converted to cash through the accounts receivable process.

The cash conversion process gives insight into the financial stability of a company because it reflects the period during which assets are committed to business processes and therefore are not available to invest to achieve even greater returns. As a result, the shorter the cash conversion cycle, the better.

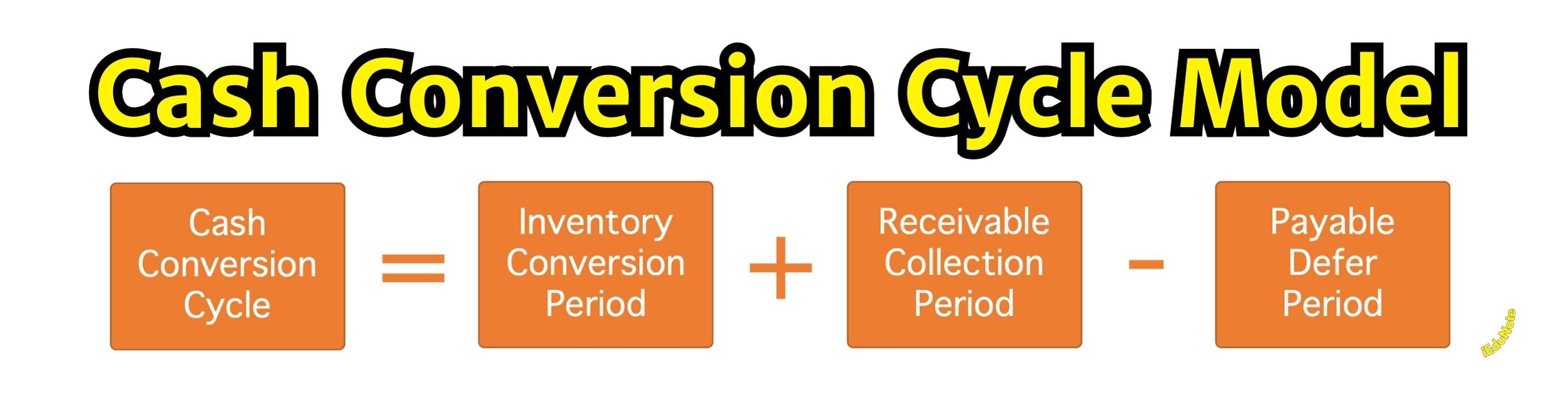

Calculating the Cash Conversion Cycle or Net Operating Cycle

The cash conversion cycle calculation uses. Elements of the operating cycle equation include raw materials, work-inprocess, finished goods, bills receivable, and the outstanding days’ payables. The days’ outstanding payables are the average time the company requires to pay its vendors.

First, calculate the accounts payable turnover by dividing the cost of goods sold by accounts payable. Next, divide 365 days by the accounts payable turnover to determine the days’ payables outstanding.

To determine the cash conversion cycle, add the days’ sales outstanding and the days’ sales in inventory and then subtract the days’ payables outstanding.

The resulting cash conversion cycle measures the period between the cash outflow for materials required to produce a product or service and the cash inflow from sales.

A decrease in the cash conversion cycle can lead to an increase in the operating profit margin.

For example, Queens Corporation makes Luxurious Furniture, where the Inventory Conversion Period is 20 days and the Account Receivable Collection period is 15 days. It takes 15 days to pay invoices to the Company’s vendors.

Using the formula above, Company’s Cash Conversion Cycle is Cash Conversion Cycle = 20 + 15 -15 = 20 days. This means that Queens Corporation generates cash from its assets within 20 days.