Certified Public Accountants (CPAs) are innovative and strategic thinkers who are well respected for their integrity and commitment to excellence. They are dedicated to each client and work to satisfy their business and financial needs.

CPAs provide several valuable and useful services to consumers, business owners, government agencies, and nonprofit organizations.

Their services range from helping an individual develop a personal financial plan to assisting a business owner with things like tax planning, financial statement analysis, and understanding complex financial transactions for business decision-making.

When one consults a CPA, it is forming a business partnership with someone who values one’s success.

The type and range of services a particular CPA firm offers will depend on the partners’ and staff’s skills, interests, and experience mix.

Types of Services Provided by CPA Firms

Types of services by CPA are divided into two main categories; Attestation Services and Non-Attestation Services. Both combined, there are nine types of services provided by CPA Firms.

Table of Contents

Attestation Services by CPA Firms

A CPA may provide three levels of attestation services when evaluating the business’s internal financial statements. Each of them is described below:

Audits

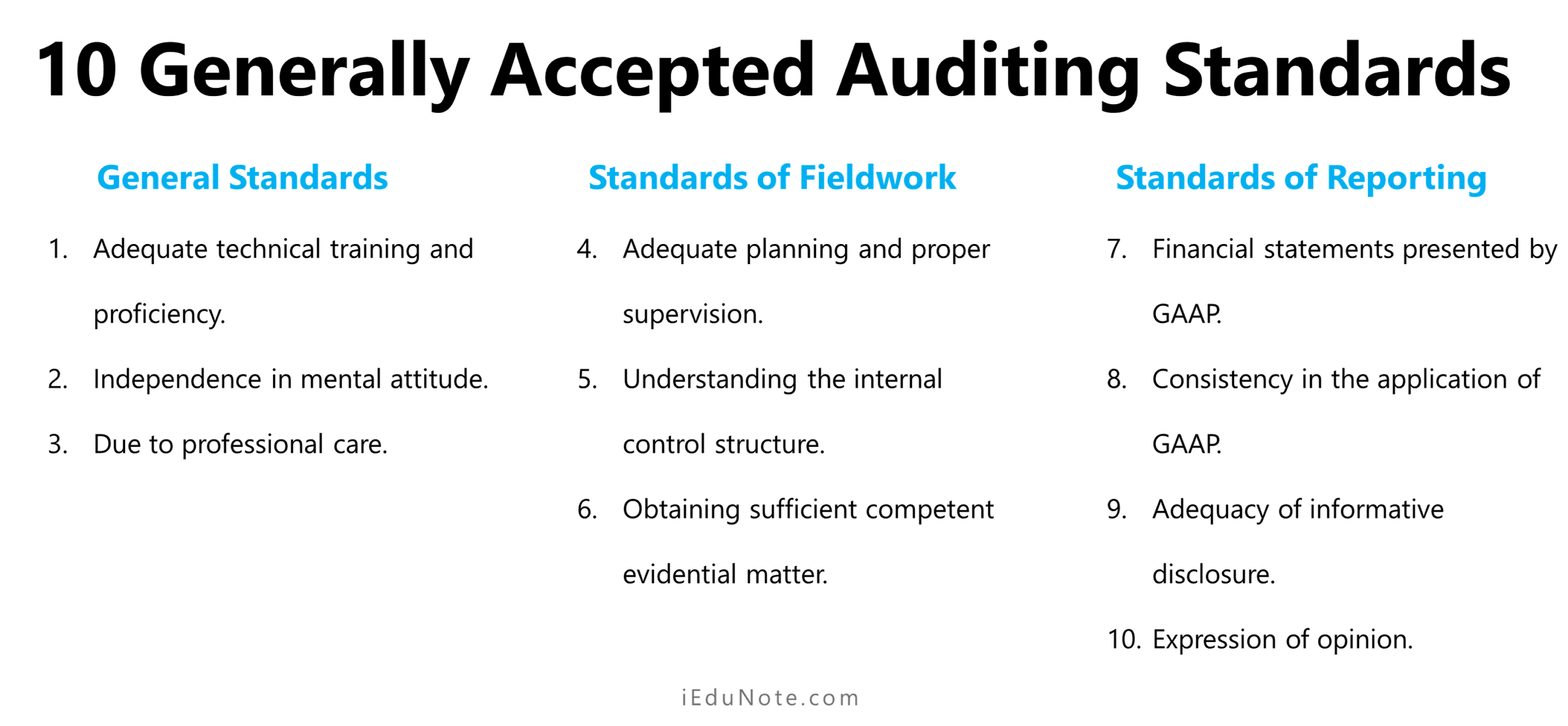

Auditing services are the highest level of independent CPA services available.

In layman’s terms, the purpose of an audit is to independently verify by sight, confirmation, discussion with management, assessment of internal controls, and analytical procedures that a company’s financial reports are substantively correct.

Audited financial statements will also include a statement of changes in financial and detailed and referenced footnotes detailing the company’s accounting methods, policies, and certain financial data.

Again, the statement of cash flows, the attached footnotes, and the procedures and reporting are governed by the AICPA, SASs, and other governing and regulatory agencies.

By nature of the work performed and the reporting standards required, Audits are substantially more expensive than any other service level.

Publicly traded/SEC companies are examples of companies required to have an annual audit. It would be prudent also to consider having an annual audit performed when someone other than the owner performs key areas of control and exposure.

Reviews

A review consists predominantly of assessing the company’s books and records by the performance of analytical tests, certain analytical procedures (such as the comparison to prior books and records), and calculation of certain financial tests and ratios.

By their very nature, these procedures are intended to give reasonable assurance to an outside reviewer rather than the detailed verification and reporting requirements required by an audit.

Reviews are frequently requested by banks or insurance companies issuing performance bonds who want a higher degree of service/verification than a compilation, which is discussed next, but not the full extent and cost of an audit.

Reviews typically also include a statement of changes in a financial position and detailed footnotes.

Compilations

The lowest level of attestation services a CPA may provide is a compilation.

Essentially, a compilation is when a CPA compiles the books and records of a client without the performance of any substantive procedures, independent verification, or confirmation of any of a client’s balance.

Thus, a compilation solely represents a company’s management, as no verification or procedures of account balances on the balance sheet or the profit and loss statement are required.

Also, management can exclude from compiled statements the statement of changes in financial positions and all related footnotes.

Non-Attestation Services by CPA Firms

CPAs perform numerous non-attestation services. The common forms of nonattestation services provided by CPAs are as follows:

Internal Audit

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations.

It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluating and improving the effectiveness of risk management, control, and governance processes.

Internal Control Design

Internal controls are systems, policies, procedures, and practices used to detect or prevent errors of commission and omission. Internal controls should safeguard an entity’s assets, which include accurate financial records.

Internal controls also promote operational efficiency and encourage adherence to prescribed managerial policies and procedures and laws, rules, and regulations.

Effective internal control is a cornerstone of successful management.

Tax Services

Ever-changing tax laws and the growing complexity of financial and investment decisions have prompted more individuals and businesses to seek a CPA’s help.

CPAs offer tax planning strategies to minimize current and future tax liabilities; prepare federal, state, and local tax returns; help clients comply with tax laws and regulations, and represent clients during examinations by various tax authorities.

Management and Business Consulting

CPAs can assist with the formation of businesses and provide the services needed through various stages of development, such as:

- Installing accounting systems and controls.

- Developing cash flow models.

- Identifying ways to improve profitability.

- Securing or restructuring financing.

- Providing business valuations.

- Advising on mergers, acquisitions, and divestitures.

- Designing employee compensation and benefits packages.

- Ensuring compliance with government regulations.

Additional Services

As client needs emerge, so, too, do new CPA services.

More and more CPAs are being called on to use their accounting, tax, and financial skills along with investigative talents to help people resolve significant matters involving money, such as;

- Bankruptcy and insolvency reorganizations.

- Divorce settlements.

- Civil lawsuits.

- Fraud investigations.

- Professional liability claims.