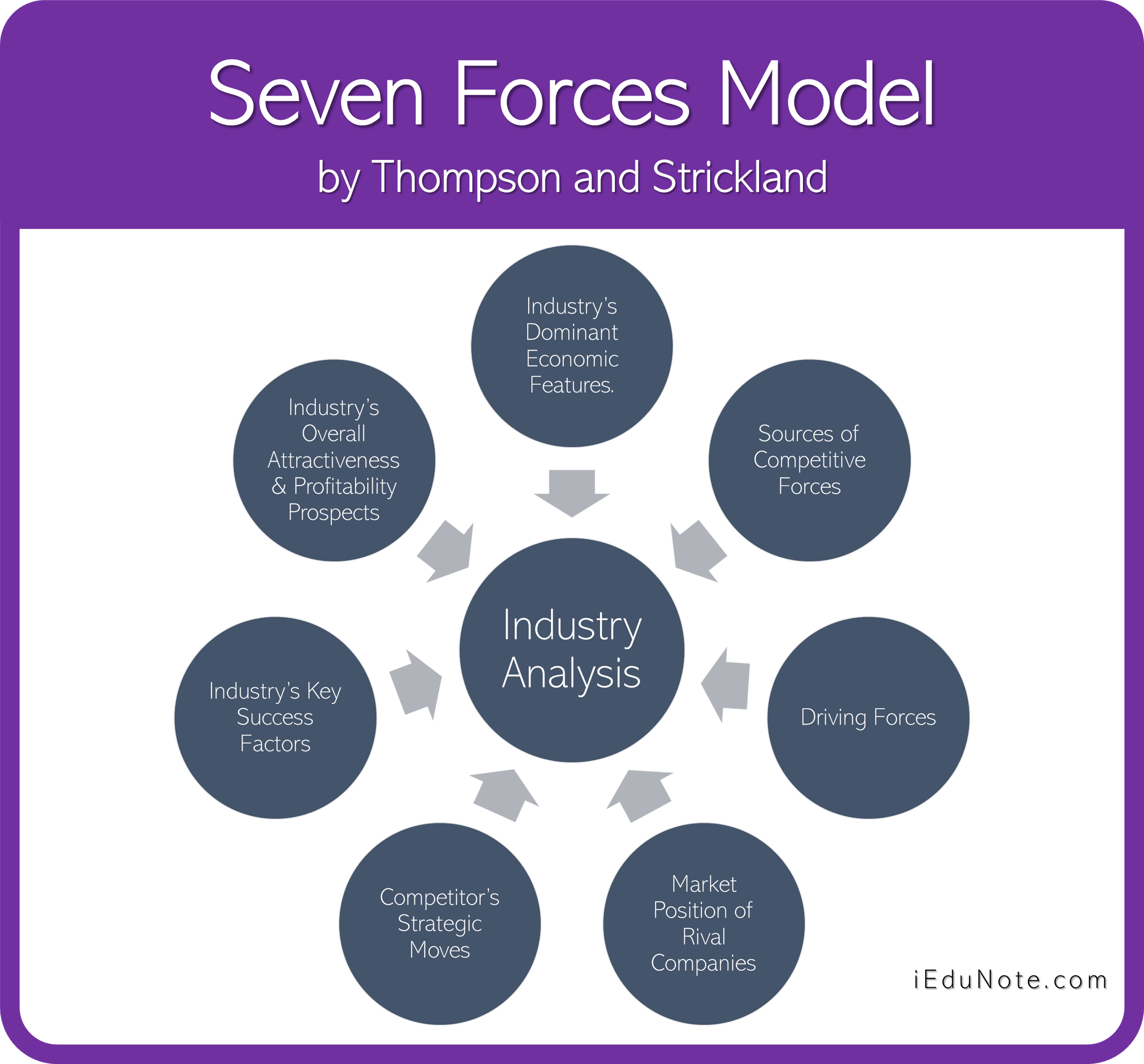

Explore Thompson and Strickland’s Seven Forces Model to assess industry dynamics, competitive forces, driving factors, market position and strategic moves.

Seven Forces Model by Thompson and Strickland, focuses on dominant economic characteristics of industry, sources of competitive pressures, strengths of the competitive forces in the industry, driving forces, market position of the competitors, strategic moves (actions) undertaken by competitors, the key success factors in the industry, and the overall attractiveness of the industry.

Thompson and Strickland’s Seven Forces Model model for the analysis of the industry is based on seven forces to provide comprehensive treatment for the analysis of the issues in the industry.

It focuses on dominant economic characteristics of an industry, sources of competitive pressures, strengths of the competitive forces in the industry, driving forces, the market position of the competitors, strategic actions undertaken by competitors, the key success factors in the industry and overall attractiveness of the industry.

Why the Seven Forces Model of Industry Analysis was developed

Michael Porter’s Five Forces Model focuses only on the competitive forces surrounding buyers, suppliers, established companies, potential competitors and substitute products.

This model excludes many other industry-related factors that substantially provide inputs for the identification of the industry’s environment! opportunities and threats.

To overcome, this shortcoming of Porter’s Model, Thompson and Strickland has developed a model for the overall analysis of industry; including competition within the industry.

The model for industry and competitive analysis proposed by Thompson, and Strickland has not only been able to overcome the drawbacks of Porter’s Model, but it also seems to be comprehensive.

It touches on all the relevant issues in an industry that need to be analyzed for assessing the overall industry situations, including the degree of competition in the industry.

What are the factors or forces of 7 Forces Model

Seven factors of the Thompson and Strickland are;

The information generated through the analysis of these factors would build an understanding of a firm’s surrounding environment and form the basis for matching strategy to changing industry conditions and competitive forces.

Factor-1: Industry’s dominant economic features.

An industry’s economic features are important because their implications for strategy making are great.

Economic features of an industry generally include:

- market size,

- the scope of competitive rivalry (local, regional etc),

- market growth rate and position,

- stage in the life cycle (early development, rapid growth, and takeoff, decline and decay etc),

- number of companies in the industry,

- number of customers; the extent of backward linkage or forward linkage (i.e., degree of vertical integration in the industry),

- ease of entry into the industry,

- ease of exit from the industry,

- types of distribution channels,

- level of differentiation of competitors’ products,

- technology innovation,

- opportunities to realize economies of scale by the companies,

- capacity utilization, and

- industry profitability.

An industry’s economic features are relevant to managerial strategy making in various ways.

Here are some examples. The strategic importance of ‘market size’ is that small markets do not usually attract big competitors but big markets do it.

The strategic importance of ‘entry barriers’ is that high barriers protect market position and profits of existing firms and low barriers invite more and more potential competitors to enter into the industry.

Similarly, big capital requirements create barriers to the entry of potential competitors.

An industry’s economic features are important because their implications for strategy making are great.

An industry’s economic features are relevant to managerial strategy making in various ways. Here are some examples. The strategic importance of ‘market size’ is that small markets do not usually, attract big competitors but big markets do it.

The strategic importance of ‘entry barriers’ is that high barriers protect market position and profits of existing firms, and low barriers invite more and more potential competitors to enter into the industry.

Similarly, big capital requirements create barriers to the entry of potential competitors.

Factor-2: Sources of Competitive Forces

An important component of industry analysis is the sources of competitive pressures and the strengths of each competitive force. An understanding of the competitive character of the industry helps managers to develop successful strategies.

Thompson and his colleague suggested the use of Michael Porter’s Five Forces Model for the analysis of competitive pressures and the strength of each force of competition.

They are of the view that the state of competition in an industry is a composite of five competitive forces identified by Porter.

As already discussed, the five forces are a threat of new entrants, bargaining power of suppliers, bargaining power of buyers, the threat of substitute products, and rivalry among the existing firms.

Factor-3: Driving Forces in the Industry

Economic characteristics say very little about the ways in which the environment may be changing because of new developments in the industry.

New developments take place in the industry because important forces are always driving the competitors, customers, and suppliers to alter their actions. These forces in the industry are the major underlying causes of changing competitive conditions in the industry. These are called driving forces.

Depending on the nature of industry there may be various drivers of industry and competitive; change. The driving forces create pressure on competitors, suppliers, and customers to change their actions. They tend to change competitive conditions in the industry.

Most of them originate in the industry environment, although driving forces are not uncommon in the general environment.

The most common driving forces are changes in the long-term industry growth rate, changes in buyer demographics, product innovation, technological change, marketing innovation, entry or exit of major firms, diffusion of technical know-how, increasing globalization of the ‘industry, changes in cost and efficiency, emerging buyer preferences, government policy changes, changing attitudes and lifestyles.

Early detection of driving forces is possible through systematically and regularly scanning the industry environment as well as other external factors, known as Environmental Scanning.

This qualitative technique of investigating external factors involves itself in monitoring and studying current events, constructing scenarios and identifying the driving forces.

Many large companies such as Coca-Cola, Motorola, and Shell Oil employ environmental scanning on a continuous basis.

in any kind of industry in general, you can adopt the following steps for the analysis of the driving forces:

- Scan the environment and identify the driving forces. You need to identify the powerful driving forces that have dramatic impacts and also less strong driving forces that are specific to your industry but have moderate impacts.

- Examine the driving forces thoroughly and determine whether and how they are influencing the industry landscape, i.e, how they are making the industry attractive or unattractive or less attractive. This step is about the assessment of the impacts of the driving forces.

- Finally, develop strategy taking into account the impacts of the driving forces. At this step, you will determine the possible strategy adjustments that would be needed to deal with the impacts of the driving forces.

There may be many forces of change in an industry but in reality, all of them do not qualify as ‘driving forces’. Managers need to carefully evaluate the forces so that they can intelligently separate the major changes from the minor changes. This would help managers formulate a sound strategy.

Driving-forces analysis is in reality considered as having ‘practical value and is basic to the task of thinking strategically about where the industry is headed and how to prepare for the changes ahead.

Factor-4: Market Position of the Competitors

The market position of competitors in the industry has a bearing on the overall competition in the industry. Therefore, the strengths of competitive, forces need to be analyzed.

Such an analysis is important to discover the main sources of competitive pressures and how strong they are. An attempt is made to study the market position of rival companies.

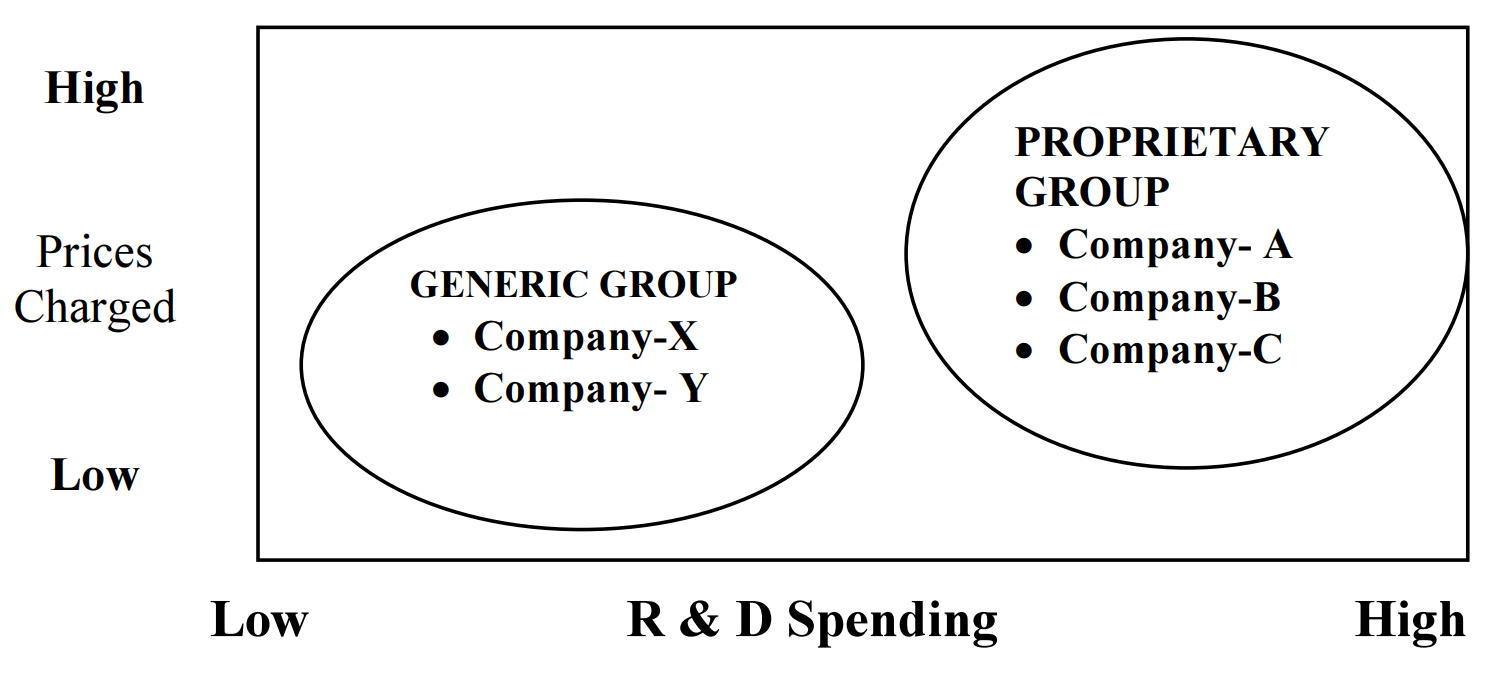

One technique for revealing the competitive (market) positions of industry participants is strategic group mapping, It is most useful when an industry has so many competitors that it is not practical to examine each one in-depth. Strategic group mapping endeavors to determine the strategic group for a product of a company.

Let’s explain the concept of the strategic group.

Strategic Group

Firms in an industry often differ with respect to several factors: distribution channels, market segments, quality of products, technological leadership, customer service, pricing policy, advertisement policy, and promotion policy, etc. These differences lead to different groups consisting of a limited number of firms in the same industry.

The firms in the same group are found, to follow the same basic strategy, and some follow a strategy different from the firms in other groups.

These groups are called strategic groups. The competitors that pursue similar strategic approaches and have similar positions in the market constitute a strategic group.

For instance, although Maruti car is in the automobile industry, it is not a competitor of Tesla. Subaru is not competing with Mercedes-Benz or BMW.

Two main strategic groups in the pharmaceutical industry – Proprietary Group and Generic Group. The companies in the proprietary group invest huge amount of money in research and development for producing a new product.

They patent the new product and produce and sell it for several years (as per patent law in the country) at high prices. This brings them high profits for many years until the patent term is expired.

These companies are high- risk/high return companies, and are included in the proprietary group.

On the other hand, the companies in the generic group are low-risk/low return companies. They produce those products (drugs) that were first invented by the proprietary group companies.

Therefore, their investment is low due to low R&D spending, and risk is also low. Their returns are low because they charge low prices for generic drugs.

You will find a resemblance in the companies in the same strategic group in terms of:

- comparable product line breadth

- using the same kind of distribution channels

- offering buyers similar services and technical assistance

- using essentially the same product attributes

- depending on identical technological approaches or

- selling in the same price/quality range.

The implications of strategic groups are:

- A company’s closest competitors are those in its strategic groups, not those in other strategic groups. A major threat to a company’s profitability can come from within its own strategic group.

- Porter’s five forces can all vary in intensity among different strategic groups within the same industry.

Procedure for Constructing A Strategic Group Map

Thompson and Strickland suggested the following procedure for the construction of a strategic group map:

- Identify the competitive characteristics that differentiate firms in the industry (variables: price, quality range, geographical coverage, degree of vertical integration, product line breadth, use of distribution channels, degree of service offered).

- Plot the firms on a two-variable map using pairs of these differentiating characteristics.

- Assign firms that fall in about the same strategy space to the same strategic group.

- Draw circles around each strategic group, making the circles proportional to the size of the group’s respective share of total industry sales revenues.

The closer the strategic groups are to each other on the map, the stronger the competition among the member companies. The next closest competitors are in the immediately adjacent groups.

Factor-5: Strategic Moves of the Competitors

Strategic moves refer to strategic steps or actions undertaken by a company.

Every company must be informed of the strategic moves of its competitors. Information about the competitors’ strategic moves can be obtained through an analysis of their moves in a systematic way.

The analysis involves;

- identifying competitors’ strategies,

- analyzing the strategies,

- watching the actions of the competitors,

- understanding their strengths and weaknesses, and

- anticipating what moves they will make next.

After scouting the competitors’ strategic moves, managers can decide about the appropriate counter-moves. They can plan their own actions to defeat their competitors. It is simply impossible to outcompete a competitor without monitoring their actions and predicting their future moves.

Managers of a company can gather information about the strategies of competitors by:

- Examining what the competitors are doing in the marketplace;

- Monitoring what the management of the competing companies is saying about their plans;

- Considering competitors’ geographical market arena, strategic intent, market share objective and willingness to take risks.

- Trying to understand whether competitors’ recent moves are offensive or defensive;

- Directly visiting the competitors’ offices to get information about prices, wage and salary levels, the introduction of new products, etc.

- Pumping competitors’ representatives at trade shows/exhibitions/ trade fairs; and

- Searching through garbage dumpsters outside competitors’ offices (may be considered unethical, although not illegal).

Factor-6: Key Success Factors

There are certain factors in every industry that determine a product’s success in the market. These may include attributes of the product, resources of the firms, competitive capabilities, etc.

These factors are called ‘key success factors’ (KSF)/critical success factors.

A sound strategy incorporates industry key success factors. They are prerequisites for industry success. That is why all firms in the industry must pay close attention to the KSF.

For example, KSF in the juice industry; include full utilization of juice-producing capacity (to lower down costs), strong network of middlemen (to have a wider distribution of products over a region or the country), unique flavor and taste, etc.

Even packaging can be a success factor if the juice is targeted to young groups.

Key success factors usually vary from industry to industry.

The variations occur mainly because of changes in the driving forces and competitive conditions in the industry. This warrants that the managers of companies need to give careful attention to identifying the major KSF and avoid the minor ones.

Factor-7: Attractiveness of the Industry

Strategy-makers in a company must be able to give an answer to the question: “Is the industry attractive, and what are its prospects for above-average profitability?

In order to answer this question, strategists review the overall industry situation and develop reasoned conclusions about the relative attractiveness or unattractiveness of the industry.

The factors that they usually analyze for assessing industry attractiveness include:

- industry’s growth potential

- favorable or unfavorable impact by the prevailing driving forces

- the competitive position of the company in the industry

- potential entry or exit of major firms

- stability and/or dependability of demand

- possibility of competitive forces becoming stronger or weaker

- the severity of problems/issues confronting the industry as a whole

- degrees of risk and uncertainty in the industry’s future.

Industry Analysis Plan and Seven Forces Model by Thompson and Strickland

Industry analysis provides information about the industry situations that help strategy-makers concentrate on strategic thinking and predicting the future of the industry. An insight into the overall industry situations facilitates effective and pragmatic strategy making.

On the basis of the above analyses, managers can prepare a document containing all the information related to the competitive forces in the industry. We may call it ‘industry analysis plan.’

The industry analysis plan broadly includes such information as economic features, sources of competition, driving forces, market position, strategic moves of the competitors, the attractiveness of the industry in which the company is operating its businesses, and the key success factors in the industry.

Against each of these forces, detailed information is provided that portray the entire picture of the industry. The information in this plan helps, the managers develop appropriate strategies to deal with the competitive pressures prevailing in the industry.

It also serves as a database Of industry-related information.

Let’s try to understand the types of information that are usually provided in the industry analysis.

| Information about the economic features of the industry | Market size, growth potential. technology, vortical integration numbers, and sizes of buyers and sellers, and so on |

| Sources of competition | Status of competition among competitors, power of buyers and suppliers, competition from substitutes, the threat of potential entry and so on. |

| Driving forces | Changes in long-term industry growth, globalization of competition in the industry, product innovation, changing buyer preferences, etc. |

| Market position | Market leaders, runner-ups, weak companies, strategic group members. |

| Strategic moves of Rivals | Competitors’ strategic moves and intents, whom to be watched and so on |

| Key success factors | Product attributes, competencies, capabilities and so on. |

| Industries overall effectiveness | Factors making the industry attractive, factors making industry’ unattractive, j special industry problems, favorable or unfavorable profit outlook. |

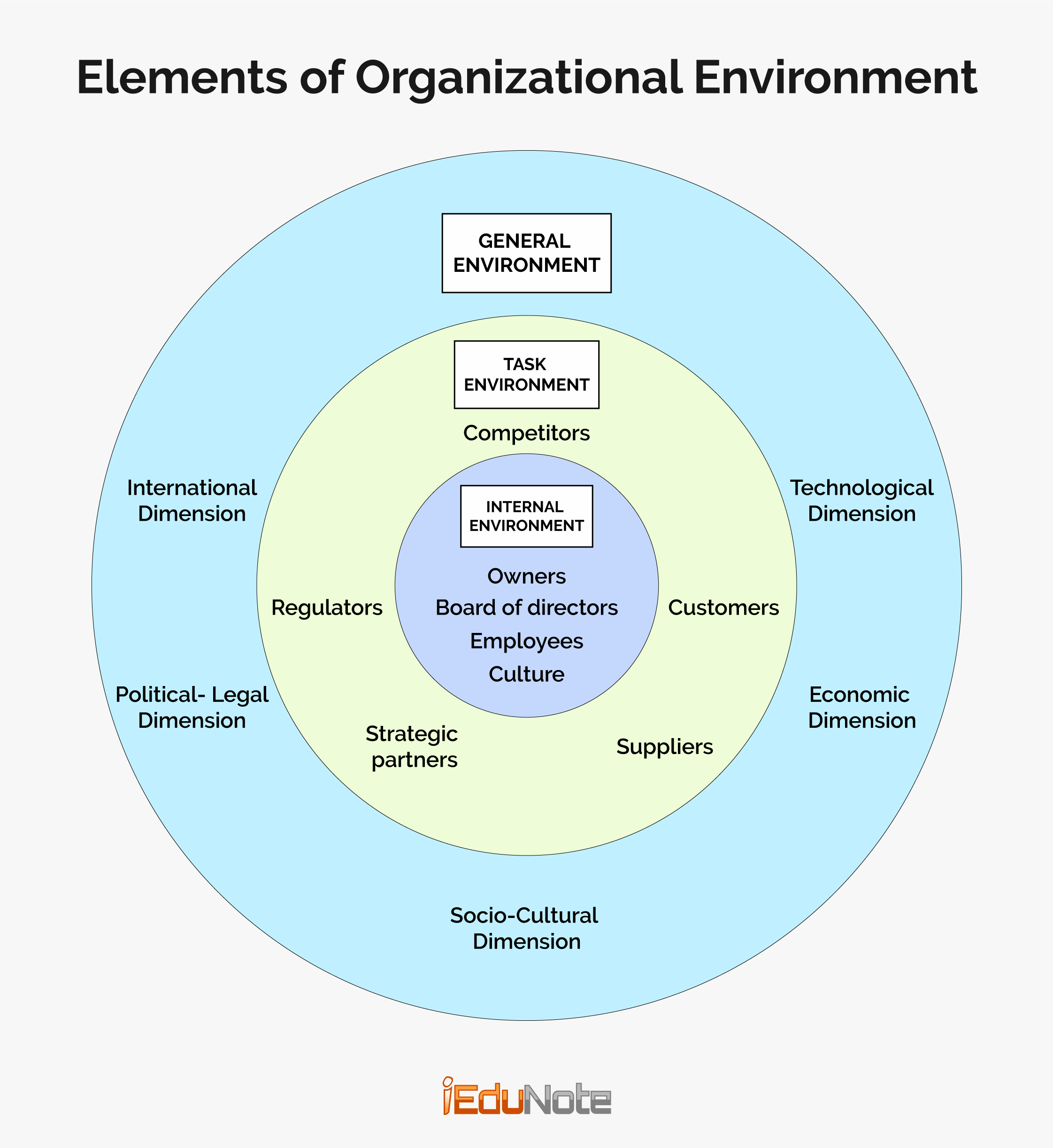

After making an analysis of the industry environment, managers have no reason to suffer from complacency. They cannot really make a winning strategy unless they gather information regarding the company’s internal situations and the general external environmental factors.

In the industry analysis, managers look at Industry-specific external environmental factors only. This analysis provides only industry-related external opportunities and threats.

But they cannot know about the general opportunities and threats that arise from the general, economic environment, political and legal environment, social and cultural environment, natural environment and demographic environment.

Against this backdrop, we devote the next chapter to making SWOT analysis that helps in identifying internal strengths and weaknesses and external opportunities and threats of an organization.

Conclusion

Seven Forces Model provides comprehensive treatment for the analysis of the issues in the industry. An analysis of 7 factors reveals the competitive structure of the industry.

The information generated through the analysis of these factors would build an understanding of a firm’s surrounding environment and form the basis for matching strategy to changing industry conditions and competitive forces.