The process, through which an amount of money is added or deducted from the ledger balances to make the balances up to date, is called adjustment.

Adjusting entries are journaled entries made at the end of an accounting period to change the balances of certain accounts to reflect economic activity that has taken place but not yet been recorded.

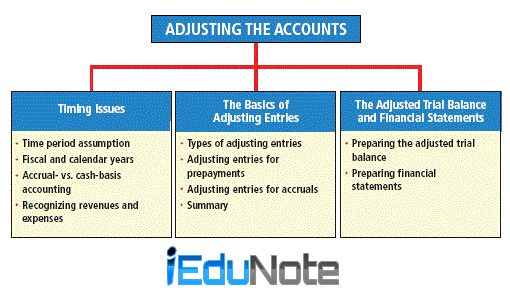

Definition of Adjusting Entries

The economic activities, incurred but not identified by the accountant as business transactions are omitted from journal entries.

Put these are adjusted by means of adjusting entries before preparation of financial statement of an accounting period.

All accrued income and expenses, incurred by an organization, are to be recorded in the income statement so that the true picture of income and expenses of a particular period is exhibited.

If all accrued income; and expenses incurred are not shown in the income statement, it becomes incomplete, incorrect and confusing.

Similarly, if all assets, liabilities and owner’s equity are not stated in the balance sheet correctly, it also becomes incorrect and confusing and does not reflect the true financial position.

Since all interested parties remain eager to know various information, financial statements i.e. income statement and balance sheet are to be prepared in every accounting period.

For all these financial statements the accountant classifies the life of a business into several small periods.

Thereafter all economic activities are fixed for each period.

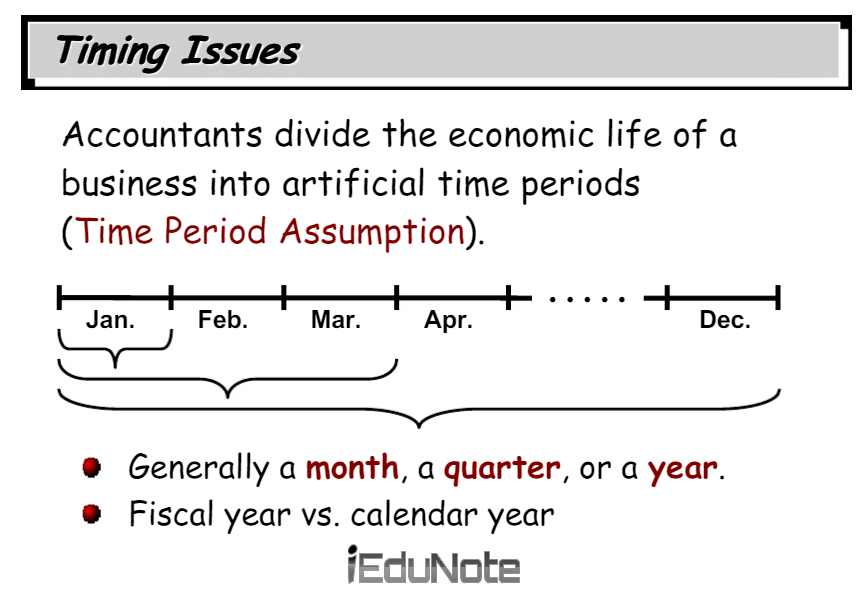

These periods are of short duration and are called accounting period. Generally, an accounting period is of one year, but sometimes it may also be of six or three months period.

As one year accounting period is called one accounting year or one financial year any period of successive twelve months is called one financial year.

But it may not be the same as one calendar year. For preparing annual statements correctly adjusting entries are needed.

Related: Types of Accounts in Accounting

Before preparation of financial statements the balances of accounts concerned are corrected and updated by giving adjusting entries.

At the end of every accounting period, income statement and balance sheet are prepared for ascertaining profit or loss and financial position of an organization.

The correctness of such profit or loss and financial position depends on the proper adjustment of income and expenditure.

Types of Adjusting Entries

Types of adjusting entries are discussed below:

1. Advances, and

2. Accruals.

Each of them is again of two types as stated below:

1. Advances

- Advance payment of expenses: Cash payment of expenses and recording them property until used or expiry of the period.

- Unearned Income: Unearned income received for cash and recorded as cash received and liability till income accrued.

2. Accruals

- Accrued Income: Revenue accrued but not yet received for cash or accounted for.

- Outstanding Expenses: Expenses incurred but not yet paid or accounted for.

What to post as Adjusting Entries?

All Financial transactions, relating to a particular accounting period but

- not recorded as accrued income,

- outstanding expenses,

- transactions of capital items of a particular accounting period such as the portion of properties,

- liabilities converted into revenue,

- income expenditure,

- depreciation,

- amortization,

- depletion of unearned income.

Timing Issues with Adjusting Entries

Accountants divide the economic life of a business into artificial time periods. That makes figuring out when to post the adjusting entries challenging.

Time period assumption states;

- Revenue should be recognized in the accounting period in which it is earned.

- Expenses should be matched with revenues.

- The economic life of a business can be divided into artificial time periods.

- The fiscal year should correspond to the calendar year.

Let’s look at how timing issues with adjusting entries are dealt with.

Cash Basis Accounting versus Accrual Basis Accounting

Comparatively small organizations, educational institutions, and professionals such as physicians, lawyers, and accountants keep accounts of all their income and expenditures on a cash basis.

Under cash basis accounting process income is recognized when it is received in cash and expenses are also recognized when these are paid in cash.

For example,

A service was offered in 2002 but the cash for it was received in 2003.

Under cash basis accounting process, it will be treated as income of 2003. Similarly under this system the expenditure of 2002 if paid in 2003, will be treated as an expenditure of 2003.

For this sort of faulty accounting of income and expenditure, the cash basis accounting process is generally not accepted as a proper accounting system.

Under accrual basis accounting sales or services, rendered in a particular accounting period, are recognized as income for that period whether cash received or not.

Similarly, under this system expenditure, incurred in a particular accounting period, are recognized as expenditure whether cash paid for these or not in that particular period.

Therefore, under accrual accounting system the economic transactions, which have taken place but not accounted for, are adjusted with balances of accounts concerned to get them updated by means of adjusting entries.

By adjusting entries financial statements can be prepared accurately.

Related: GAAP for Accounting Rules, Principles, Assumptions

Recognition of Revenue and Expenses

Determining the amount of income and expenses, as shown in the financial statements of a particular accounting period, is a Very complicated task.

For that reason the accountants follow two generally accepted accounting principles viz – revenue recognition principles and matching principles.

According to the revenue recognition principle the revenues, earned in a particular accounting period, are revenue of that period.

For example, sale price realized or receivable on account of a particular accounting period is the revenue of that period.

Whether sale or service rendered in an accounting period is treated as income on the occurrence or on cash received depends on accounting principle.

Generally, merchandise or service is treated as income when it is transferred.

For example,

Both cash sale of $ 10,000 and sale of $15,000 on the account are sale income. In this case, cash $10,000 and accounts receivable $ 15,000 will be shown in the balance sheet and sales $25,000 will be shown as income in the income statement.

The accountants recognize expense following the principle – expense follows income.

Therefore expense recognition is closely related to revenue.

For example

If the expenditure is incurred for the purchase of merchandise, sales revenue is generated.

There is no revenue without expenditure. Profit is determined after deduction of expenditure from revenue.

Time of Preparation of Adjusting Entries

While preparing financial statements necessary adjusting entries are to be passed.

Therefore if the financial statements are prepared at the end of six months period in that case also necessary adjusting entries are to be passed.

As per convention and some laws, business organizations report the results and financial position of the business to the owners at least once in a year.

That is why adjusting entries are required at least once in a year for preparing financial statement correctly.